Growth in global house prices falls to an 8-year low

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

The inflation squeeze

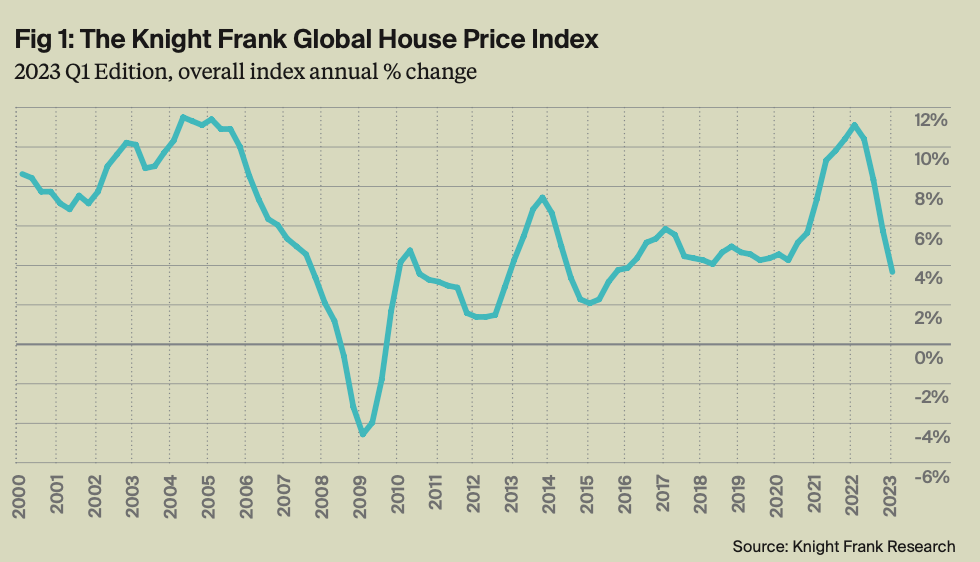

House prices across the world are under pressure as central banks attempt to rein in inflation. Average annual price growth across the 56 markets covered by the Knight Frank Global House Price Index slowed to 3.6% in the twelve months to Q1 2023, down from 5.7% in the previous quarter (see chart).

The index is rising at the slowest annual rate since the third quarter of 2015 and is down from a recent peak of 11.1% growth in the year to Q1 2022, when global markets were booming in the aftermath of the pandemic.

While the latest data reveals a substantial slowdown in annual price growth, quarterly growth improved. Global house prices contracted 0.6% in the final three months of 2022 yet saw a 1.5% rise in the first three months of 2023. This reversal in isolation doesn’t suggest that global markets are set to improve – rather, it does highlight that tight supply, limited new housing construction and strong household formation are acting to underpin prices in many markets.

The top performers

Turkey led our ranking again last quarter, but its phenomenal growth of 132.8% is largely a consequence of rampant inflation. The recent move to a more orthodox approach to monetary policy is unlikely to lead to a rapid downward shift in inflationary pressures. A 22% quarterly rise in house prices there in Q1 suggests there is more to come this year.

Eastern and south-eastern European countries dominate the top of the rankings, with North Macedonia (18.8%), Croatia (17.3%) and Hungary (16.6%) all showing strong annual growth. Singapore is the standout performer in the Asia-Pacific region, with 11.3% annual growth. Recent changes to tax policy have mainly targeted overseas buyers in an attempt to cool rising prices, though there were enough domestic buyers to push prices to new highs. The Urban Redevelopment Authority is releasing new sites for development as it seeks to increase housing supply.

US prices ticked up 1% during the period. Supply is tight, which is underpinning price growth despite worsening affordability, particularly in the growth markets across the southeast and southwest states. See the index for more.

Reining in a runaway

Inflation and the path of interest rates will be the key determinants of global house price growth during the next 18 months.

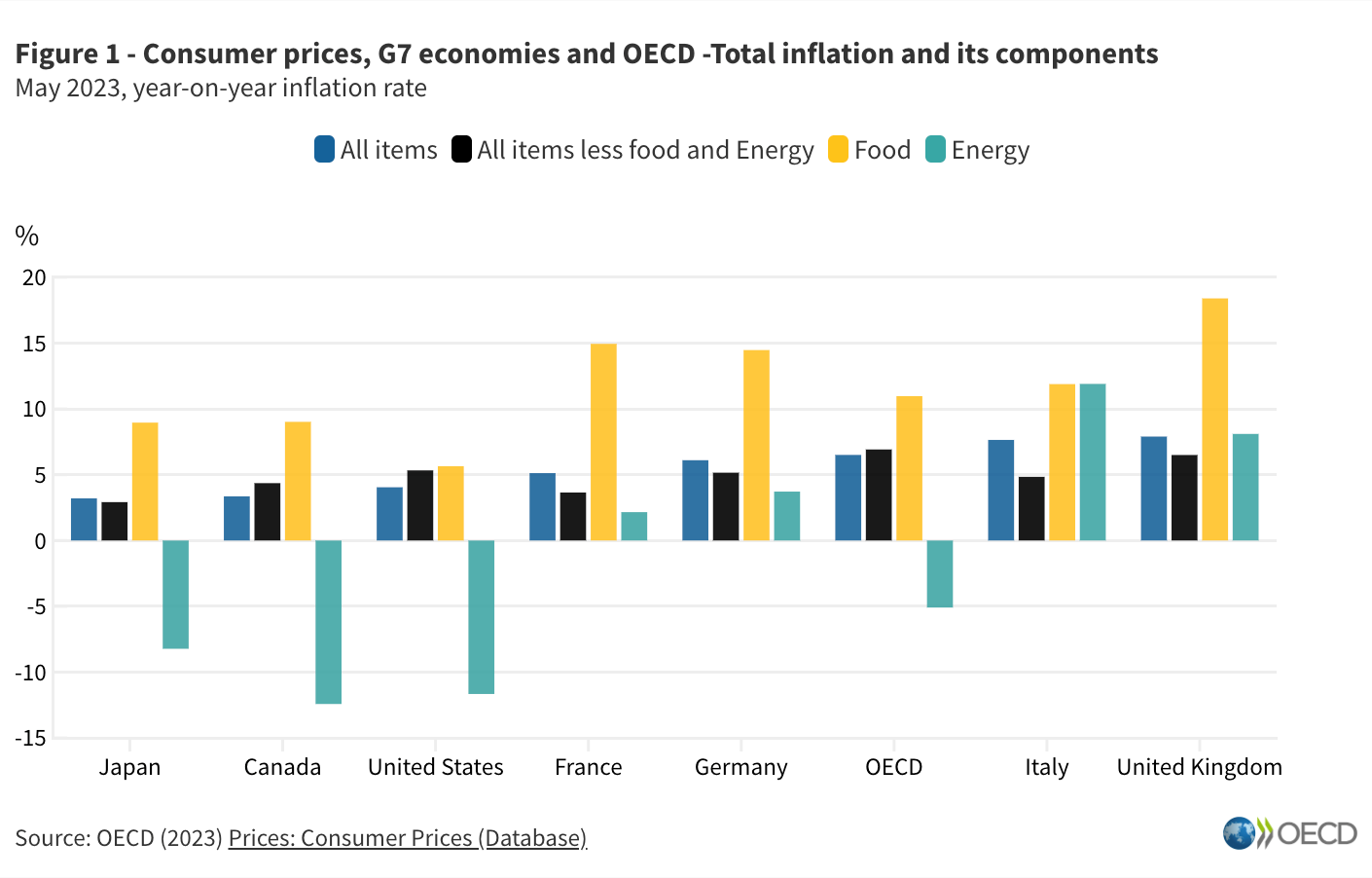

UK readers could be forgiven for feeling bearish on that front given the past two inflation prints, but the global trend is increasingly positive. Annual inflation in the 38 OECD member states dropped to 6.5% in May 2023, down from 7.4% in April 2023. That's the lowest level since December 2021. Energy inflation plunged to -5.1%, from 0.7% in April.

Core inflation, and particularly services prices, are proving sticky in most nations, as we explored last month. Still, both are trending in the right direction, albeit very slowly. Core inflation in the OECD edged down to an annual rate of 6.9% in May, from 7.1% the previous month. Services inflation dipped to 5.7%, from 6.0% in April. Easing spread to 18 countries during the month, compared to 13 countries in April.

The UK is now the only G7 member state in which inflation is still rising. The Bank of England has done little to push back on expectations that it will need to tighten monetary policy further in the months ahead. That's likely to mean the base rate hit a peak of "at least" 5.25% this year, with cuts unlikely until the second half of 2024, according to forecaster Capital Economics.

Rising rates

The average rate for a five-year fixed mortgage stood at 6.01% on Tuesday, according to Moneyfacts. It's the first time five year fixed rates have surpassed 6% since last year's mini budget.

Fewer homeowners are being enticed to fix at these levels. The percentage of homeowners opting for five-year fixes fell below 50% during the three months to April, according to UK Finance figures covered by the Times. That's the lowest level since November 2021, when mortgage rates began rising rapidly. The proportion opting for variable rates, meanwhile, hit 13%, the highest share in any three month period since 2013.

Mortgage rates are unlikely to ease for the time being, given the likely trajectory of the Bank rate and the fact that markets will want to see two or three decent inflation readings before swap rates ease meaningfully.

The three Ps

Last year’s edition of The Rural Report introduced the concept of the three Ps – People, Planet and Prosperity – a trio of words that editor Andrew Shirley believed summed up the key opportunities and challenges facing our clients. In this year’s report, Andrew and the team set out to explore one of those Ps in more detail: Planet.

There is no escaping the fact that, like it or not, government policy is increasingly being driven by an environmental agenda anchored to ambitious targets to decarbonise the food chain, boost biodiversity and cut pollution.

This has led to the creation of markets for natural capital and nature-based solutions in the guise of carbon credits, biodiversity net gain and nutrient neutrality, to name but three. These markets could deliver valuable new income streams and are already helping to boost the value of farmland, but they can be confusing and are often unregulated.

We try to answer the key questions in this year's report by utilising a mixture of expert insight, analysis and client case studies. You can download your copy here.

In other news...

Paris embarks on a radical overhaul of city planning. David Bourla explores the implications.

Elsewhere - UK year-ahead inflation expectations rise to 5%: Citi/YouGov (Reuters), and finally, global temperatures hit a record on Monday (Bloomberg).