Rising interest rates make their mark on global luxury house prices

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Under pressure

Rising interest rates are now weighing on prime property values across key global cities.

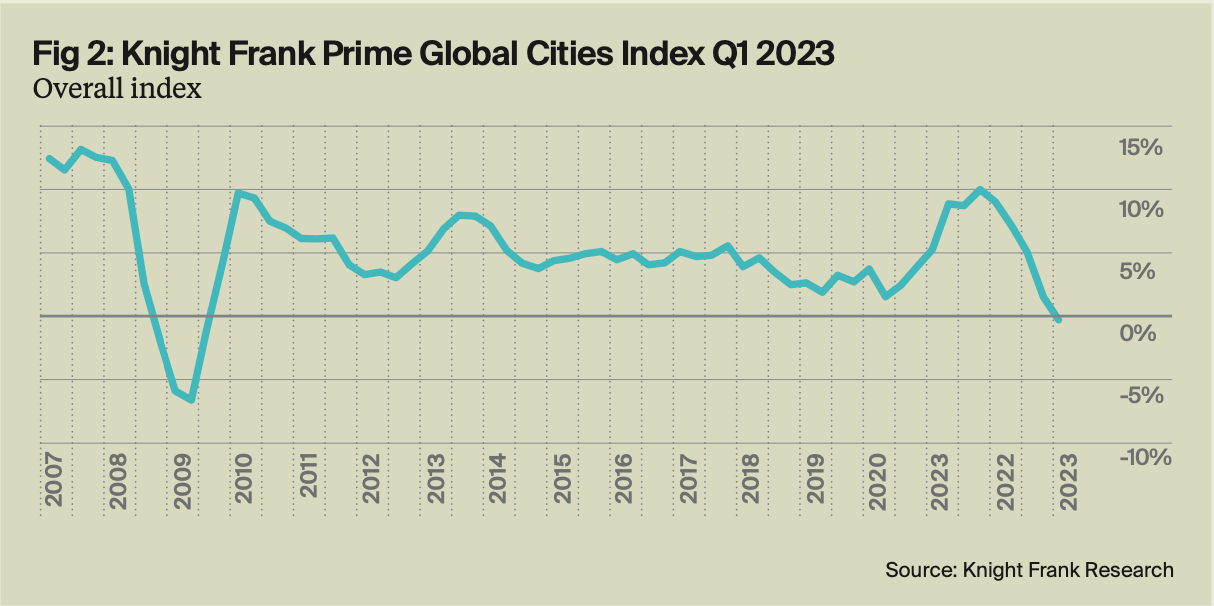

Knight Frank’s Prime Global Cities Index (PGCI), which tracks prices in 46 leading prime markets, fell by 0.4% during the 12 months through March. That's the first annual contraction since the Global Financial Crisis.

The turnaround has been sharp. Annual growth rose to a peak of 10.1% during 2021 before central banks stepped up their fight against inflation. Prices are now falling in 16 of our 46 markets. Indeed, the scale of declines in the weakest markets has pulled down the overall index.

With 44% annual growth, Dubai tops the table and remains a substantial outlier. Second place Miami is the only other city to reach double digit growth (11%). Berlin (5.7%) and Singapore (5.5%) complete the top five markets - pointing to the resilience of wealth and, in Berlin’s case, investment hubs. New Zealand dominates the lower ranks of the index with Wellington seeing prices fall more than 27% over the past year, followed by Auckland (-17%), and Christchurch (-15.3%). Other weak performers include Stockholm (-11%) and Vancouver (-9.4%), reflecting weakness in their broader national markets.

What next?

Prime values are likely to experience further pressure for the next few quarters, regardless of whether or not the Federal Reserve and other central banks opt to pause their cycle of rate hikes.

That said, green shoots are already appearing, so we're unlikely to see a correction akin to the 8.2% drop we saw during the Global Financial Crisis. Only 28% of markets saw prices fall in the first quarter of this year, down from 46% in the second half of 2022.

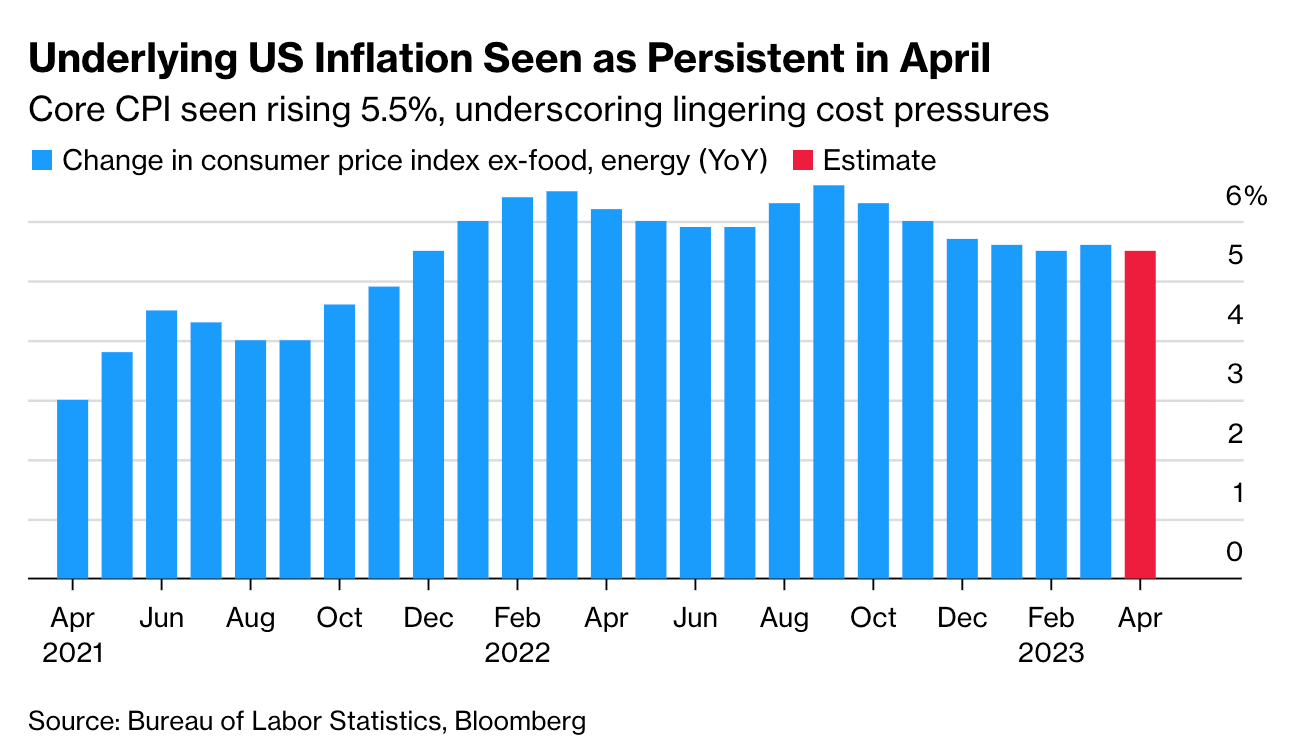

Whether or not the Fed will pause in June is still subject to considerable uncertainty. Later today, the US Bureau of Labor Statistics will release inflation data for the year to April and few are expecting any surprises. The core rate is likely to measure an increase of approximately 5.5%, roughly where it has remained for the past four readings, according to a Bloomberg tally of economists (see chart).

Tomorrow's hike

The Bank of England will make its latest interest rate decision tomorrow.

The annual rate of inflation is still in double digits, wages are rising and stronger-than-expected economic data has given the Bank plenty of leeway to keep tightening. The expected 25bps move to 4.5% will bring the base rate to its highest level since 2008.

Despite that, the housing market continues to show signs of resilience. Average house prices decreased by -0.3% in April following a 0.8% rise in March, Halifax said yesterday. That comes after Nationwide said house prices rose 0.5% in April following seven consecutive monthly declines.

"You can quibble about whether prices are up or down but the big picture is that annual growth is broadly flat and transactions clearly hit their low-point in January," said Tom Bill, Knight Frank's head of UK residential research.

New-build house prices continue to provide some support to the wider market, rising by +3.5% year-on-year, Halifax said. The first-time buyer market is also proving to be more resilient, with average property prices up +0.7% over the last year, due in part to surging rents.

Housebuilding

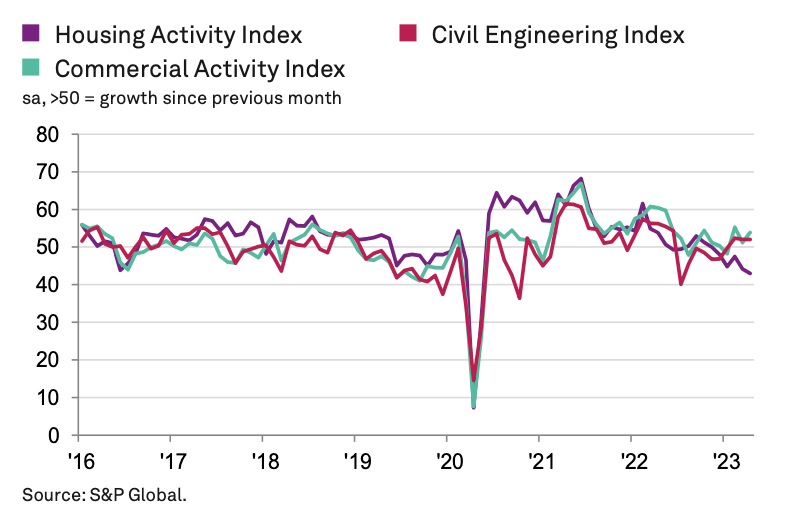

We've talked a lot in recent notes about the potential for a sizable drop in housebuilding. Pricing and sales rates in the new homes market are improving, but developers are shifting to defensive positions, in part due to heightened planning risk.

The S&P Global / CIPS UK Construction PMI, out on Friday, registered the steepest drop in housebuilding since May 2020. Survey respondents commented on delays to new house building projects, alongside constraints on demand from softer market conditions and higher borrowing costs. That stands in contrast to the wider construction sector, which has now expanded for three consecutive months.

The prevailing focus on housing policy has prompted a flurry of competing pledges, from Labour's proposal to reintroduce mandatory housing targets to the Conservatives' tentative suggestion that we may see a new buyer support scheme akin to Help to Buy in the autumn. The latest came from Labour over the weekend. Their officials told the FT that a Labour government would increase stamp duty paid by foreign buyers of UK property and restrict the sale of new-build properties to overseas investors for certain periods.

In other news...

Andrew Shirley takes a closer look at rural initiatives announced by the government to celebrate the Coronation. Stephen Springham continues his search for the widely-predicted outbreak of retailer distress.

Elsewhere - UK mortgage lender to offer first 100% loans since 2008 crisis (Guardian), US lenders warned that commercial property is ‘next shoe to drop’ (FT), and finally, New York's empty office buildings lure rich families hunting for bargains (Bloomberg).