Top five wealth trends for 2023

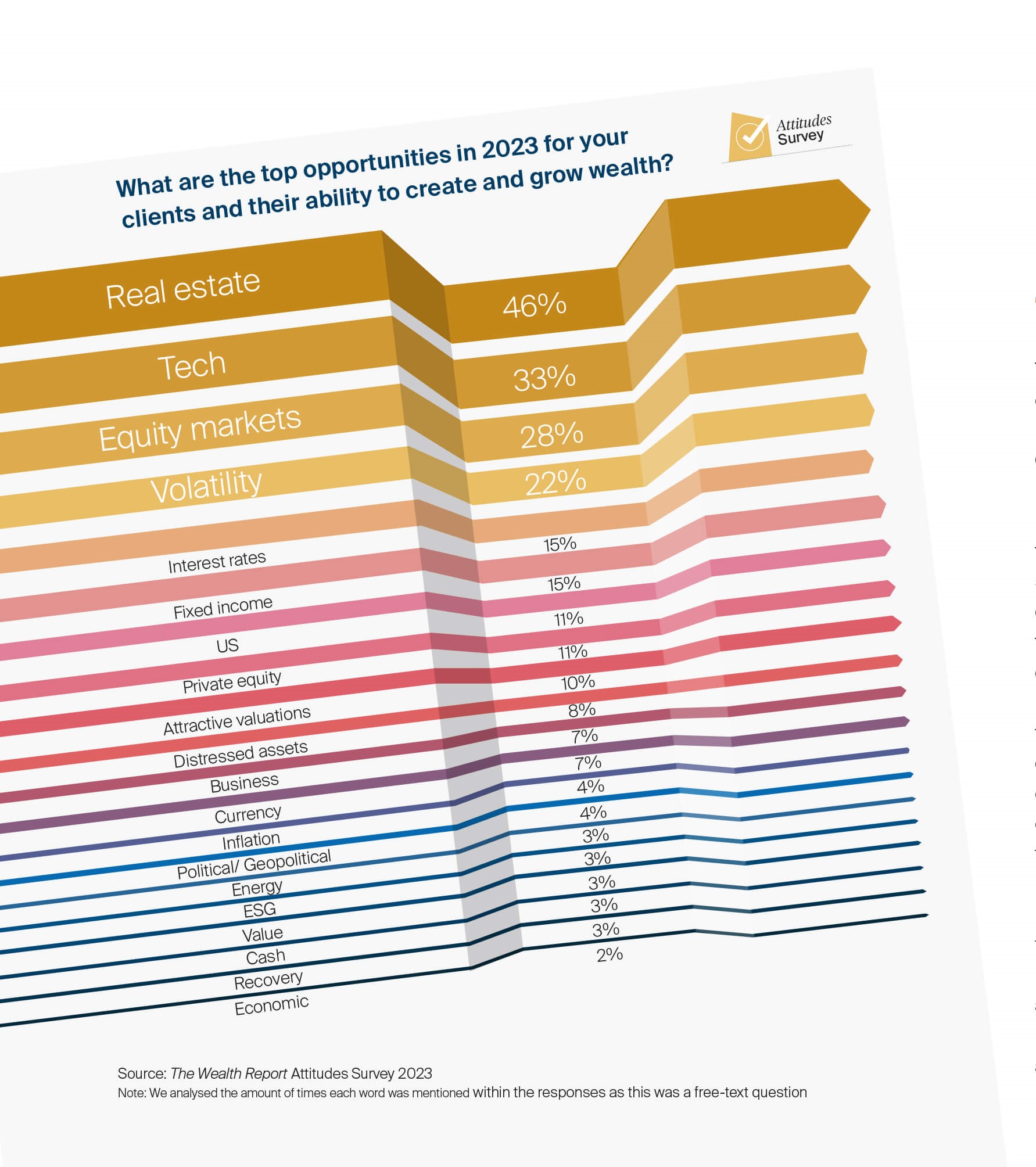

To understand what is driving this optimism and what might throw it off course, we asked survey respondents for their top three risks and opportunities for the year ahead.

5 minutes to read

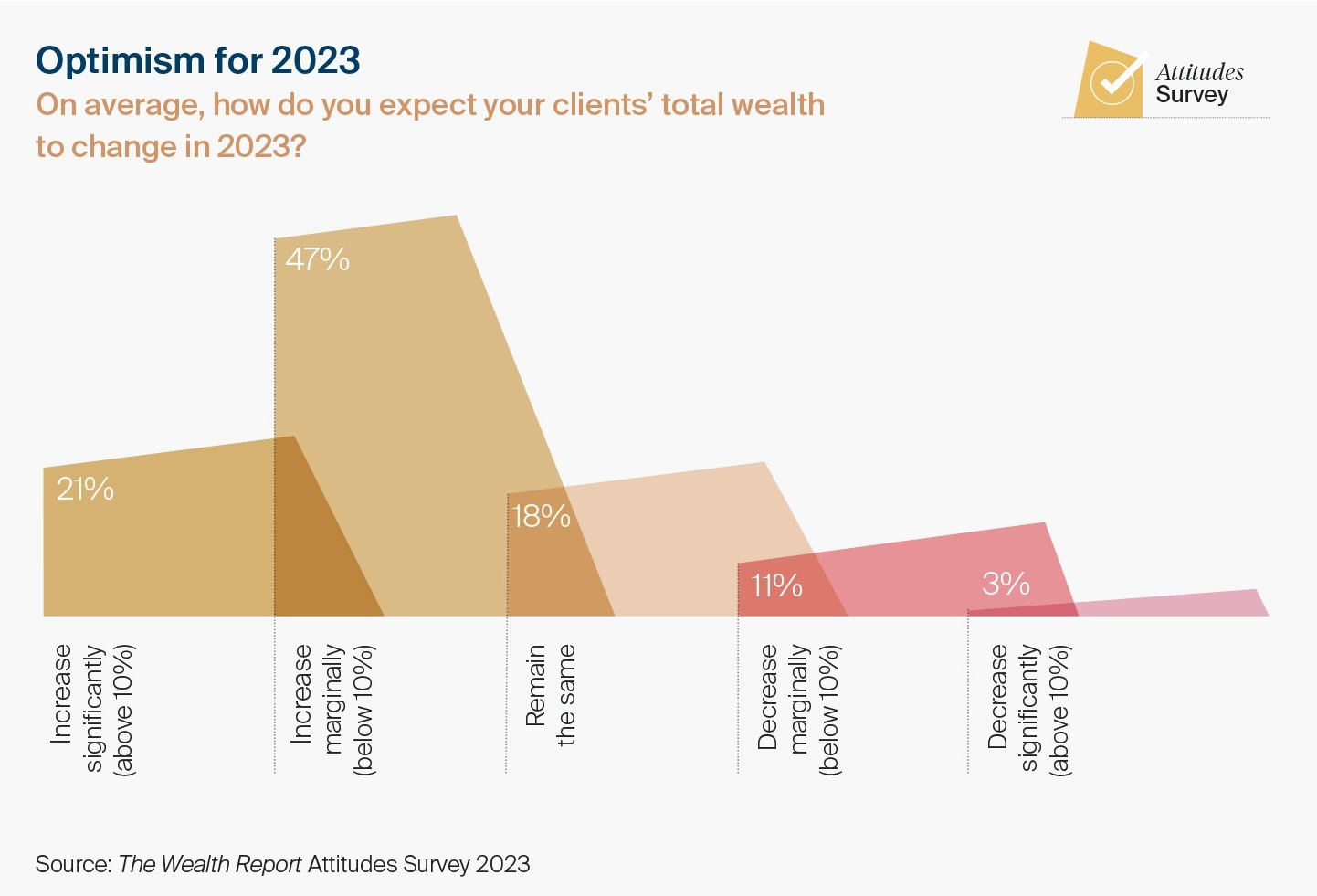

Our survey respondents and panellists are positive but realistic on the outlook for 2023, despite a backdrop of high inflation and low growth.

With disruption comes opportunity. More than two-thirds of our survey respondents expect their clients’ wealth to increase either marginally (47%) or significantly (21%) in 2023.

With that in mind, what are the top five trends to look out for in 2023? Here we summarise the five big themes for 2023 - inflation, the interest rate reset, real estate, geopolitical tensions and 'the big three.'

1. The inflation question

The path of inflation will determine the course for interest rates and the results will reverberate through global asset prices.

Central bankers, particularly the Federal Reserve’s Jerome Powell, were humbled by their error in assuming inflation would be transitory and most are now erring on the side of caution. Two thirds of our respondents cited inflation as one of the biggest threats to wealth in 2023, while almost 60% singled out interest rates.

At the time of writing, inflation looked to be turning a corner. By way of example, oil had retreated to around US$80 at the end of 2022, from a high of near US$120 earlier in the year. Should we continue to see headline rates of inflation fall, it is likely that central banks will pause and potentially end their hiking cycles during the first half of 2023. Economic downturns are now highly likely, and many forecasters see a pivot to looser monetary policy beginning in 2024 – 15% of our respondents cite that as an opportunity.

2. The interest rate reset

The saying “a rising tide lifts all boats” aptly described the post financial crisis environment of low cost and readily available debt. The new “higher for longer” rate environment will prompt a psychological shift and an adjustment in expectations.

Interest rates may ease from their 2023 peaks, but not by much – particularly when coupled with the potential for structurally higher inflation.

The message from our panel is clear: take it back to fundamentals. Some economies have already entered a recession so the accurate assessment of long-term fundamentals will be critical. Our panel also highlight the opportunity to generate income via fixed income and cash as interest rates move higher.

3. Real assets in the spotlight

Real estate was the top cited opportunity among 46% of our survey respondents, whether for its attributes as an inflation hedge or due to the benefits of diversification. Many panellists highlighted the opportunity to secure enhanced return profiles a key advantage. Plus, when investing directly, real estate enables greater control and value-add opportunities.

One in ten respondents specifically cited looking for attractive valuations and distressed opportunities. That trend isn’t limited to real estate either: equities and the technology sector were tipped by around a third of our respondents.

4. Geopolitical tensions at the fore

More than half of our respondents identified politics or geopolitics as a top risk for 2023. Brexit followed by the US/China trade war followed by the war in Ukraine – geopolitical cracks that emerged in the middle of the last decade have developed into an energy crisis and global food inflation. Just one interviewee last year highlighted the developing situation in Ukraine as a potential threat, but it’s impact on the world has been seismic. How the war unfolds will have an impact on many of the themes discussed here.

There are “little fires everywhere,” our panellist David Bailin said, referring to the global picture. While investors can position for the knowns, there will likely be shocks both on the upside and downside during 2023. Investing based on fundamentals will remain vital to cut out the noise.

“Real estate was the top cited opportunity among 46% of our survey respondents, whether for its attributes as an inflation hedge or due to the benefits of diversification”

5. The big three - China, India and the US

After two years of strict zero-Covid policies there are clear attempts by the government to reopen the Chinese economy. That should offer a boost to the world economy, though a large, coordinated reopening could prove inflationary.

The outlook will remain uncertain while policy is driven by politics rather than economics, as noted by our panellist Jonathan Fenby, Author and China analyst.

China’s policy challenges have fuelled the trend of businesses ‘regionalising’, ‘localising’, or more simply diversifying supply chains away from the Chinese mainland. There are opportunities here for real estate investors as new destinations emerge, particularly in distribution and industrial.

Longer term demographic shifts will continue to reshape global economics. In the first half of the year, India’s population will overtake that of the Chinese mainland, where the population is declining. The Indian economy will continue to rank among the world’s fastest growing economies, with 6.1% growth forecast in 2023, according to the IMF, up from stellar growth of 6.8% in 2022. India now has the world’s fifth largest economy after displacing the UK in 2022.

While the US will have its resilience tested, investors remain bullish. Some 11% of our survey respondents cited the US as an opportunity to grow wealth, as did many interviewees. While political divisions remain entrenched and the country has witnessed one of the fastest rate hiking cycles in history, the US has confirmed the fundamental strength of its economy and depth of its markets.

It is still too early to know exactly how these rate cycles will impact the global economy and the time lag between hikes and their real-world effects suggests that we’ll see more volatility during the first half of 2023. However, with dislocation and disruption come opportunities, particularly for the well informed.

Download the full report

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report