UK country market sees surge of interest at start of the year

Buyer caution increases but appetite to purchase remains.

2 minutes to read

After a volatile end to 2022 in the regional UK property market, the new year has started with a relative bounce.

The spike in mortgage rates after the tax-cutting mini-Budget in September spooked the financial markets and saw many buyers pause their plans, as well as reassess budgets.

However, while the cost of borrowing was a concern for more than two-thirds (67%) of respondents in our latest sentiment survey, there are signs that the turmoil that marked the end of last year is relenting, as we explore here, with buyers reactivating their plans.

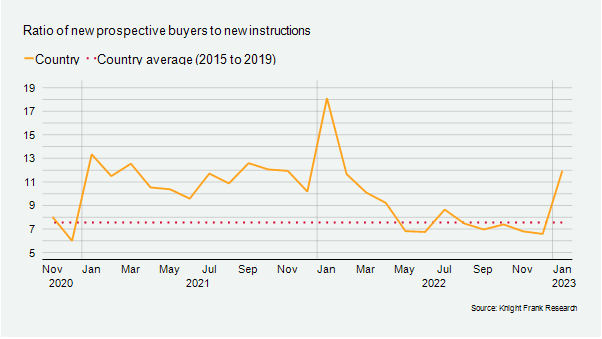

The ratio of new buyers (demand) to new instructions (supply) in the UK (excluding London) reached 12 in January, the highest it has been in the past year (see chart).

The number of offers accepted was up 34% in January in the UK (excluding London) versus the five-year average.

“It was a typical January for us, with plenty of buyers registering their interest and a good selection of stock on its way. While buyers are more cautious now, demand remains and activity will increase as supply improves in the coming months,” said Nick Chivers, office head at Knight Frank Cheltenham.

Supply building for the spring market

Market valuation appraisals, a leading indicator of future supply, were at their highest level in January since September, and up 2.3% versus the five-year average. It suggests sellers have not abandoned their plans despite a run of downbeat data.

“There is no lack of appetite but there is a gap in some cases between vendor and buyer expectations over pricing, which requires careful management,” said Edward Shaw, office head at Knight Frank Ascot & Virginia Water.

Although some five-year fixed-rate mortgages are back below 4%, the reality is that the same product (at a 75% LTV) was available at 1.79% a year ago, and borrowers’ spending power has been hit. It is one of the main reasons we expect house prices to fall 5% this year.

However, it also means equity rich and cash buyers will be in a strong position this year as a consequence.

Downsizers continue to be active too, as we explored previously, with the relatively high cost of heating proving a spur for some empty-nesters in large properties, as highlighted in our latest sentiment survey.

The momentum that has been generated in the early weeks of the year will be more fully put to the test when the spring selling season gets underway later this year.