Future trends and innovation in real estate investment

Investors must be primed for the sixth innovation wave. From data centres to flexible working spaces, opportunities abound.

2 minutes to read

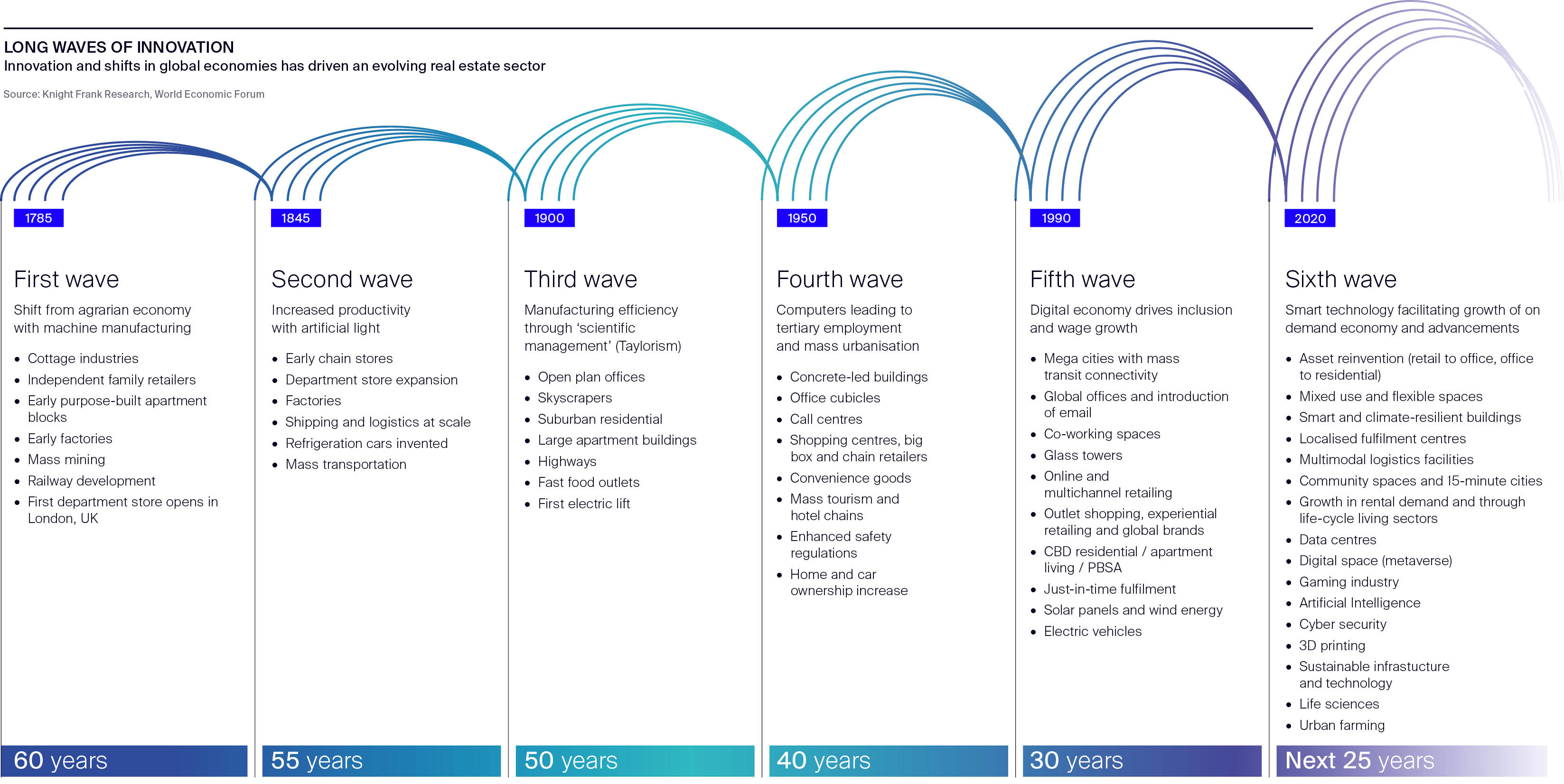

Creative destruction, first identified by Austrian economist Joseph Schumpeter, promotes the idea that new waves of innovation disrupt and shape the business cycle, making previous systems obsolete. Real estate is certainly not immune to these waves of innovation, in many cases, it has been shaped by them.

The sixth innovation wave, digitalisation, should bring rapid change, potentially through only a few real estate cycles. While many investors may go back to basics in search of liquidity and risk-off investing over the next 18 months, it is worthwhile not just examining the past but also to look forward to the cycles that lie ahead.

The rapid growth of new technologies and key challenges around issues, including energy and food security, as well as climate change, means we are already seeing change and will continue to do so at a rapid pace going forwards. Investors need to be primed to react to these changes.

Demand for data centres is expected to continue to grow, with an increased focus on energy procurement, considering increased ‘off-grid’ green energy sources, for example. As energy becomes increasingly scarce, planners may become more discerning about granting permissions for new data centre development, which will present new opportunities and challenges. The rapid evolution of technology and infrastructure also means investors must be conscious of changing trends and obsolescence risks as well.

Demand for electric vehicles will also continue to grow, bringing opportunities for charging stations and repurposing. In a lower long-term growth environment, investors may look for ways to make existing assets work harder.

A more flexible use of space, as we are seeing with, for example, hotels offering office space is likely to grow. Working assets harder through external space used for energy generation or communications towers, particularly with the continuing rollout of 5G is also likely to occur.

While well established in some locations, the potential densification and commercialisation of residential space may also lead to increased demand and growth in self-storage solutions.

Long-income focused investors may turn increasingly to infrastructure. Investment is often incentivised by governments in waning macroeconomic environments to drive forward long-term growth and recovery. We will likely see rapid innovation in ‘clean technology’ and environmental solutions, creating opportunities from carbon capture for land-based investments to alternative methods of generating and storing energy.

Lastly, while still nascent, urban and aeroponic farming has seen growth worldwide, from Singapore to the US sites spearheaded by Kimbal Musk, offering additional uses for warehouses and other urban real estate locations in the future.

Click to enlarge chart