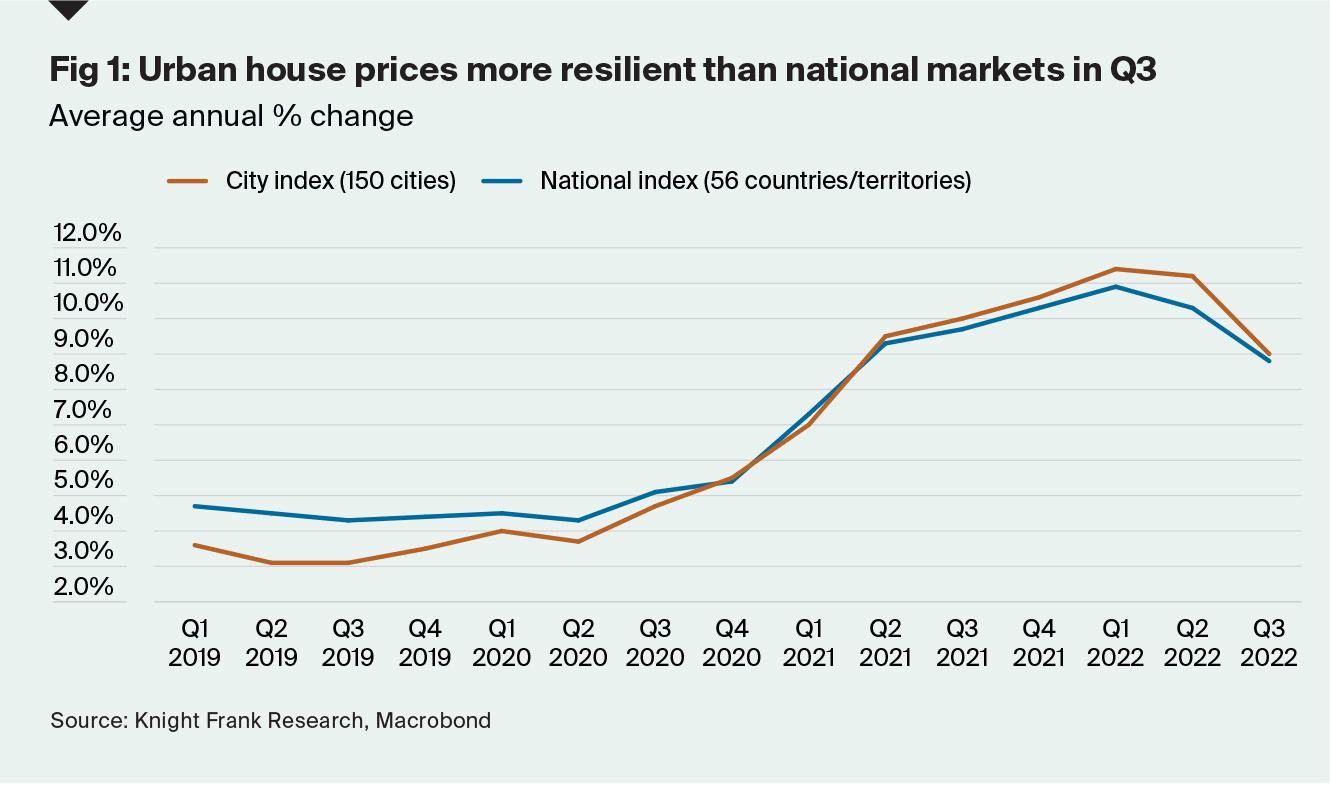

Urban house prices fall below 10% for the first time since Q1 2021

The annual increase in urban house prices has fallen below 10% for the first time since Q3 2021 as the higher interest rate environment starts to dampen demand and sales activity.

1 minute to read

Nonetheless, some 133 of the 150 cities tracked by the index recorded positive annual price growth in the year to Q3 2022, down only marginally from 138 last quarter.

Although city house prices are averaging stronger growth (9%) than national markets (8.8%), the gap in performance has narrowed in the last quarter (Fig 1).

Interest rates, inflation and the cost of debt have continued to rise, leading price growth in more cities to move into negative territory. Sixteen cities recorded a fall in prices year-on-year, up from 12 in the previous quarter, with cities in New Zealand, China and Australia well represented amongst them. Central banks in New Zealand and Australia have now implemented nine and eight rate rises respectively since the pandemic.

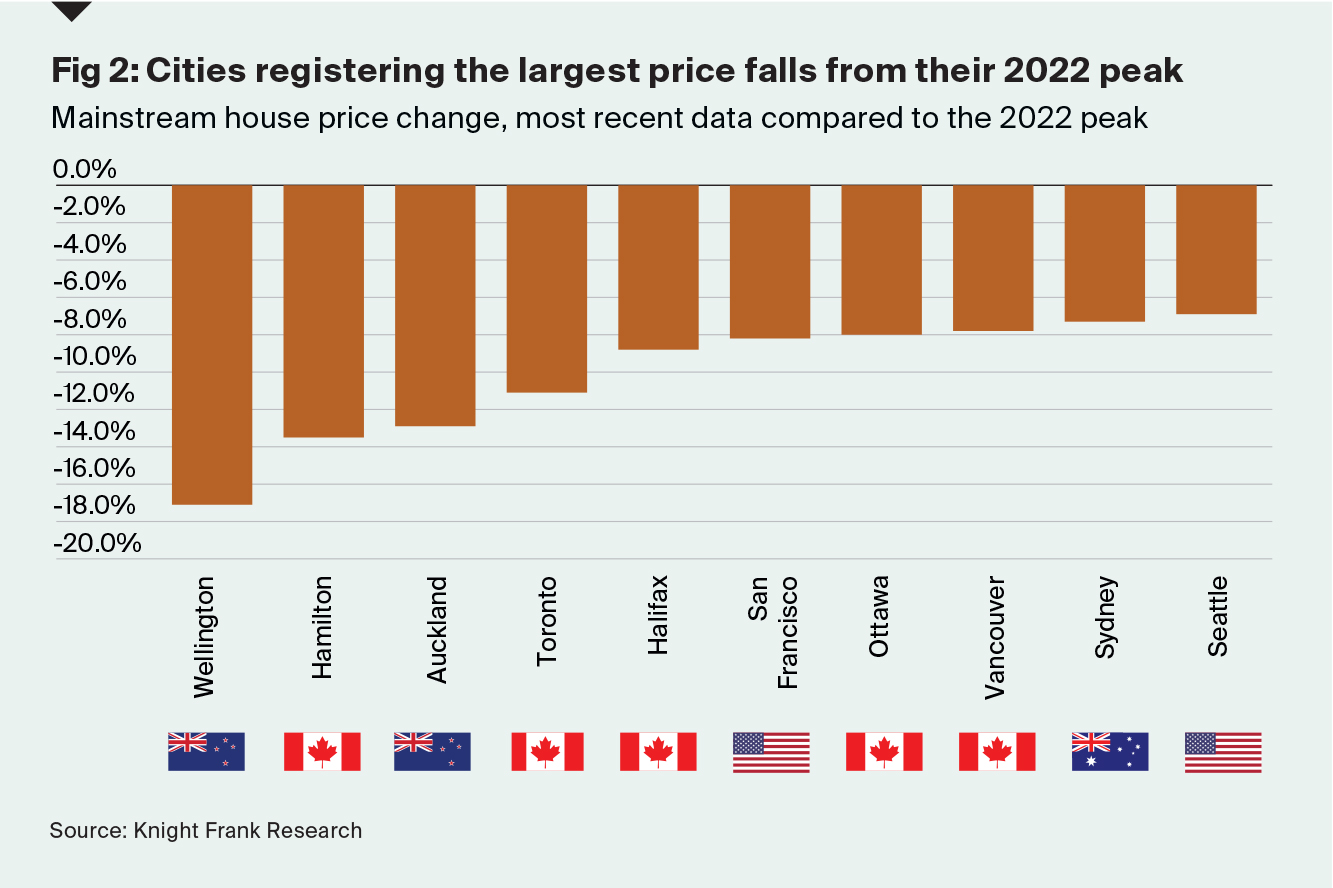

Wellington (-17%), Hamilton (-14%), Auckland (-13%) and Toronto (-11%) have seen the largest decline in house prices since their 2022 peak, with Canadian cities occupying five of the ten rankings (Fig 2).

The gap between the strongest and weakest-performing city within some countries is also widening. In the US and Australia, for example, the gap between the highest-ranking city, Miami (28%) and Adelaide (21%) and each market’s lowest ranking city, San Francisco (6%) and Sydney (-4%) now extends beyond 22 and 25 percentage points respectively.