Has China's property slump bottomed out?

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Home sales climbed 26% in May from the previous month, the first rise this year. Government attempts to stimulate demand, from slashing the benchmark rate for mortgages to easing some buyer restrictions, are to some extent working.

Still, May's monthly sales rise puts activity down more than 40% compared to last year, but it's a start. Yu Liang, chairman of Vanke, China's second-largest developer, believes May's reading shows the market is through the worst period, though "the recovery is a slow and gentle process and will take time.”

The latest outbreak of Covid now appears to be under control and much will depend on how long that holds. We talked on Monday about the residential market's growing influence on China's economy, and why officials are so keen to avert a protracted downturn.

Inflation expectations

Has the Bank of England got it right on inflation?

By sticking with incremental interest rate hikes in the face of inflation running at a 40-year high, the Bank stands in stark contrast to peers at the Federal Reserve and Bank of Canada. The Bank for International Settlements this week delivered a warning (see also Monday's note) that so-called soft landings are generally engineered by those "that tighten in a timely and decisive fashion.”

Yet the public's expectations of inflation over five to ten years fell to the lowest level since January this month, according to polling from Citi and YouGov. Over the twelve month time horizon, expectations held steady after worsening rapidly over the course of this year.

It's one data point and there are plenty of counter points - see evidence that retailers are passing on inflated costs - but it will certainly feed the Bank's narrative that a more aggressive approach to monetary policy is unnecessary.

Engineering recessions

The risks for central banks run both ways. The Fed was slow to tighten because it was slow in realising inflation wasn't transitory. Will it be slow to ease off from its aggressive approach when the data turns?

The risk, argues Allianz chief economic adviser Mohamed El-Erian, is that the Fed is forced to reverse before the end of the year under threat of recession, or worse, returns to "a world in which policy measures are whipsawed, seemingly alternating between targeting lower inflation and higher growth, but with little success on either."

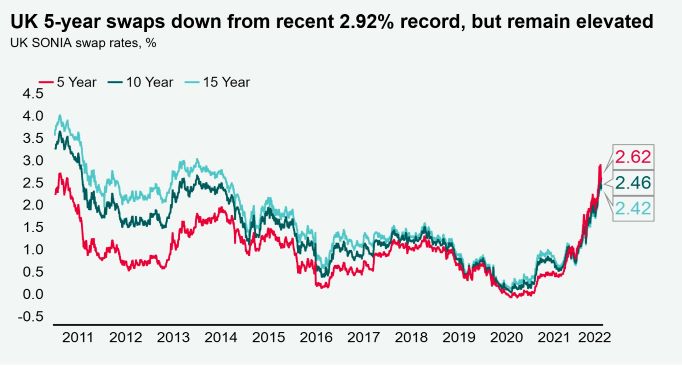

Inflation expectations are showing signs of easing in the US and my colleague Will Matthews points out that money markets now expect the US interest rate to rise to 3.5% by 2023, down from 3.8% in the week prior. Swap rates have since fallen from recent peaks.

Help to Buy

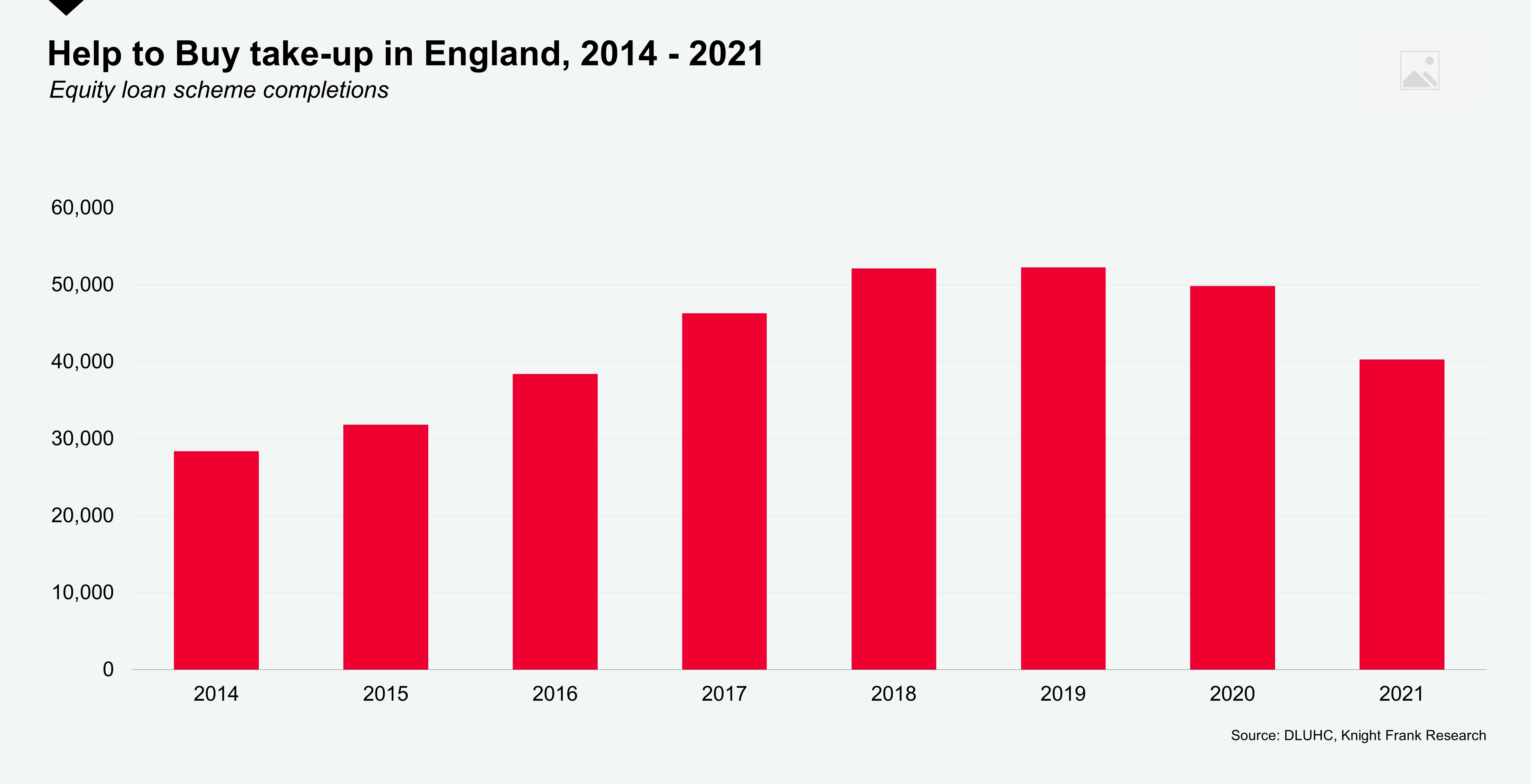

Help to Buy has grown to support about 50,000 new build sales per year in England since its inception in 2013, . That eased to just over 40,000 last year after the scheme narrowed to include only first time buyers in April 2021 (see chart).

What is going to plug that sales gap from next March onwards? Anna Ward weighs up the various options, including First Homes and Deposit Unlock.

Ultimately the fast-growing Built-to-Rent (BTR) market will play a key role. An increasing number of housebuilders are looking to do bulk deals with build-to-rent operators to help de-risk their schemes. There are currently nearly 70,000 complete and operational BTR units across the UK, a figure which has more than doubled over the last five years alone. Analysis of the future pipeline suggests delivery of new BTR units will continue to rise at a similar rate.

In other news...

Graduate ‘gold rush’ as firms fight to fill vacancies (Telegraph), short-term lets face stricter rules as review gauges impact on tourist hotspots (FT), Christine Lagarde hardens ECB’s message on fighting inflation (FT), and finally EU countries uphold phaseout of new cars emissions by 2035 (Bloomberg).