London's shrinking pipeline of tall buildings

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

London's pipeline of tall buildings

Build costs, planning risk, competition for land, regulation and Covid-19 are among the factors weighing on London's pipeline of tall buildings, according to new research from Knight Frank and New London Architecture.

Developers submitted applications for 72 buildings of 20 storeys or more last year, 13% fewer than in 2020, according to a preview of the data shared with the FT. The number of applications has been falling since 2018.

There were 98 full permissions granted during the year, the highest on record, reflecting a general willingness among boroughs to accept proposals in order to meet their housing targets, but roughly half of those applications were from before 2019. The pipeline shrank 1% to 583 buildings.

Stay tuned for a deeper dive into the data over the course of the week.

Asking prices

Asking prices for UK homes climbed 1.6% in April, slowing slightly from a 1.7% rise in March, according to Rightmove. Both readings are big jumps and more than half of homes are currently selling at or above asking price.

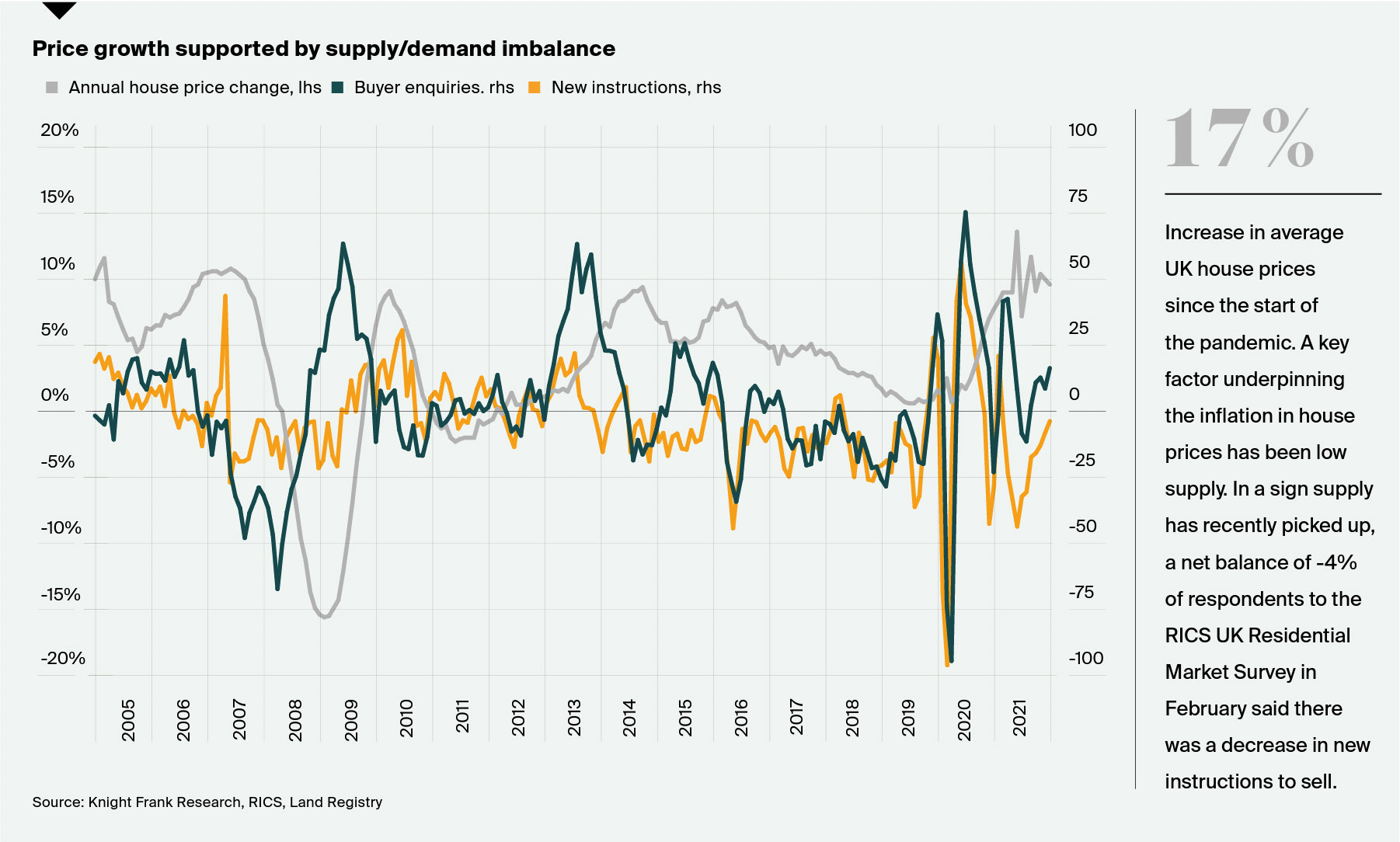

Pricing momentum is being underpinned by the shortage of supply. We expect that to correct as the distortive effects of the pandemic continue to fade and there are already some signs that supply will soon improve (see chart).

We forecast that UK price growth will slow to 5% this year. The squeeze on incomes will peg that back to 1% next year before things start to pick up again. In the five years to 2026, this will produce 13.6% cumulative growth in the UK. We believe some regions will outperform as they benefit from the UK’s changing economy after Covid. The Midlands, for example, will benefit from the growth of the logistics sector and life sciences.

Edinburgh

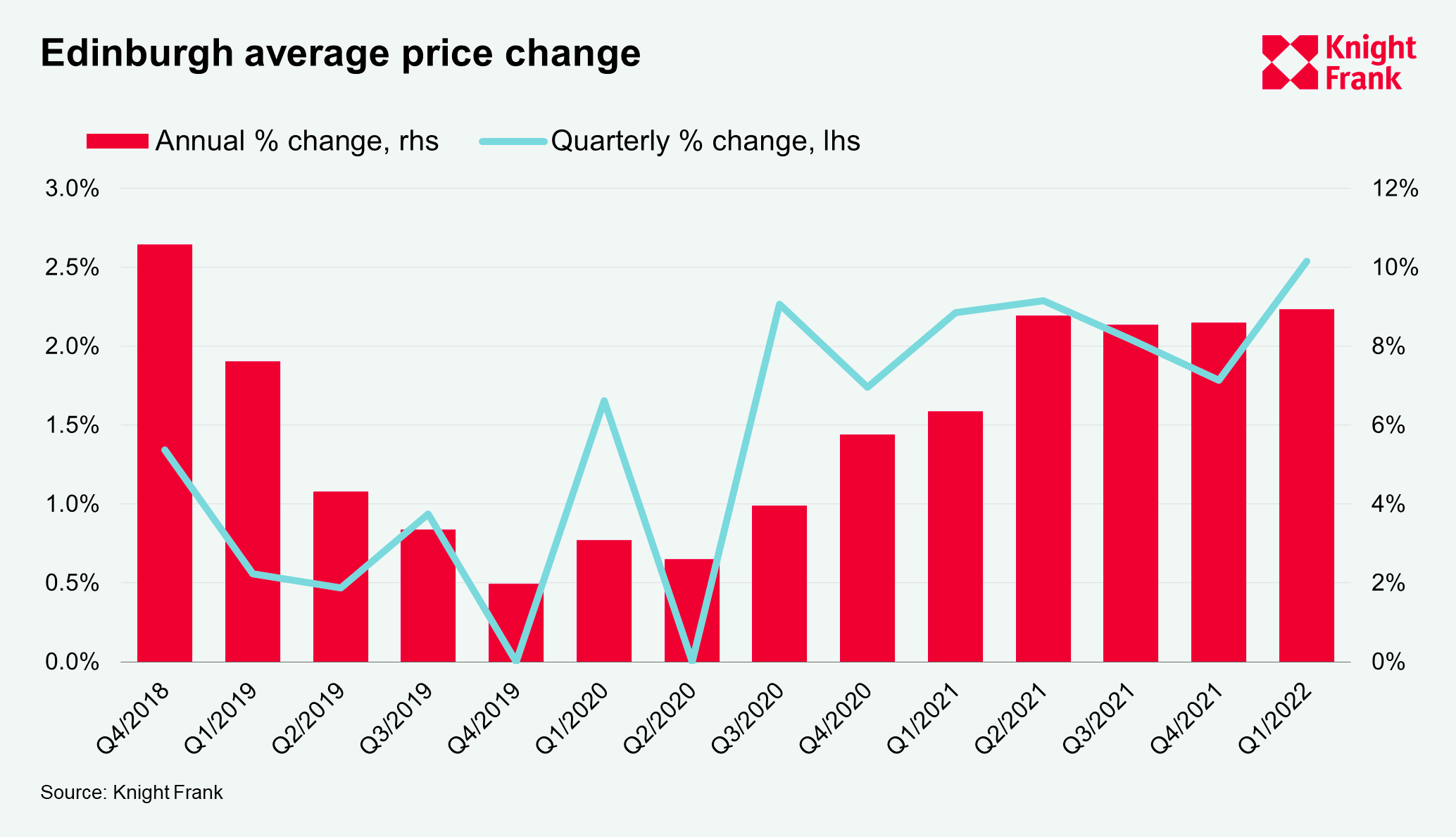

Annual house price growth in Edinburgh hit 8.9% in March, the strongest rate since the end of 2018, according to the latest data from Chris Druce.

New prospective buyers, in the city and area around Edinburgh, were up 33% in the first quarter versus the five-year average. New instructions increased by 4% in the same period, underlining the supply/demand imbalance that has kept upwards pressure on prices.

Consistent with other city markets, flats are back in fashion as part of a trend that has seen the reopening of economies and return to offices rebalance demand between rural and urban markets.

Office first

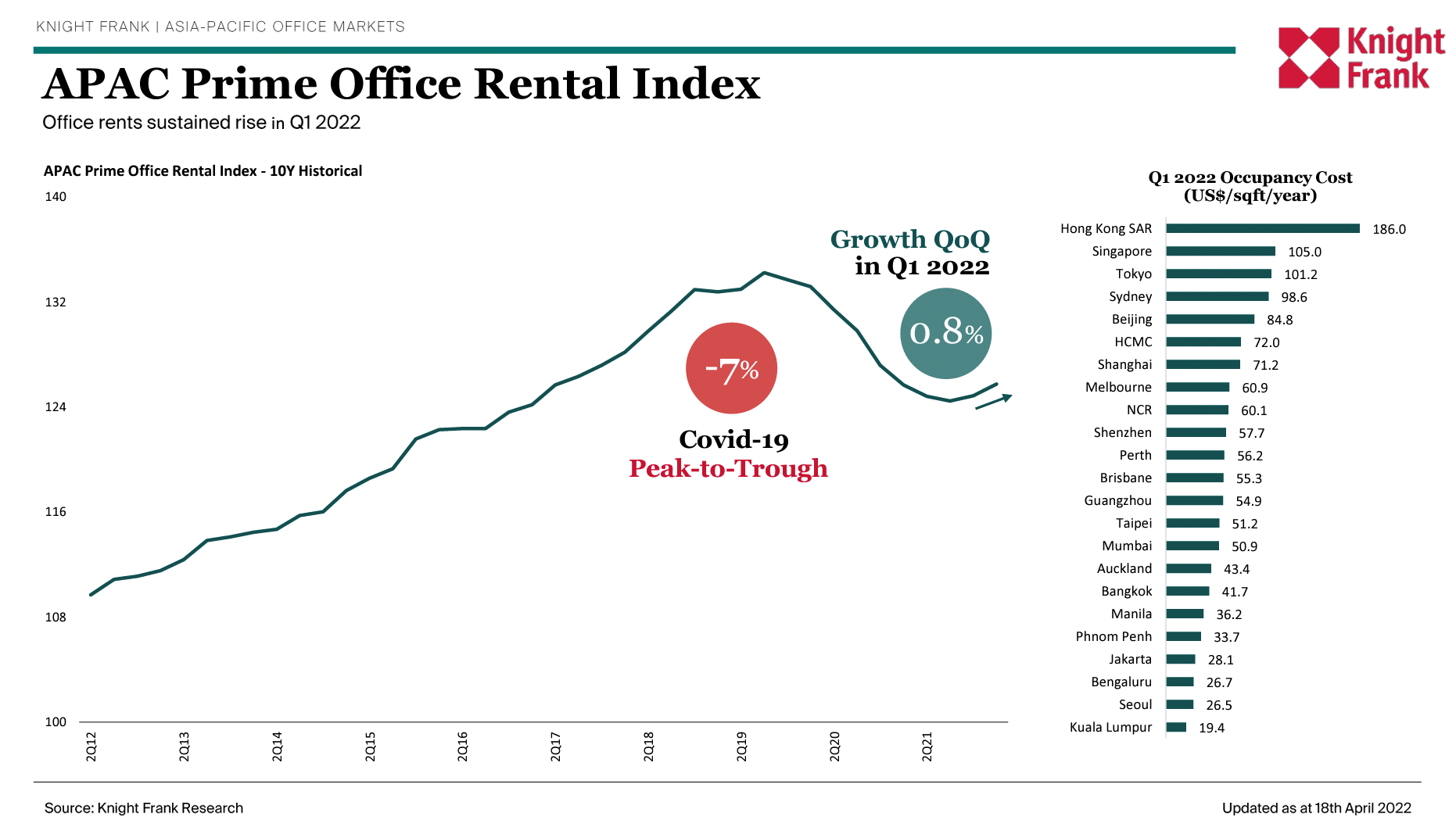

Leasing demand for offices across Asia Pacific is fast improving. Some 21 cities tracked by our index recorded stable or rising rents in the first quarter, up from 13 in the previous quarter.

As Christine Li notes this morning, the mass adoption of remote working doesn't appear to be a permanent feature in the region. Large parts of North Asia, including Greater China, South Korea and Japan, have little or no intention of embracing hybrid working due to an entrenched 'office-first' work culture.

As we're seeing in office markets globally, there is a clamour underway for the highest quality buildings. Vacancy remains tight in the prime segment and should reduce further as more markets further open their economies.

In other news...

In a new Rural Market Update, Andrew Shirley at the inflationary squeeze in farming and the difficult questions it poses for food security.

Elsewhere - the UK private sector suffers a sharp slowdown (Reuters), Sterling falls to the lowest versus the dollar since 2020 (Reuters), Covid-19 outbreak in Beijing prompts panic buying (NYT), Amex says business travel rebound is gaining momentum (FT), China’s Covid strictures scupper hopes of property revival (FT), Houston gets green light for the nation's largest urban solar farm (Bloomberg), and finally, ECB's Largarde on why inflation is a "different beast" in Europe (Bloomberg).