UK growth, (yet more) inflation, and geopolitical tensions

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

The UK economy outperforms

UK GDP grew 7.5% over 2021, the strongest level of growth in the G7 and its fastest rate of expansion since 1941. Next year, the IMF expects more of the same, forecasting GDP to grow by 4.7% and outpace other G7 countries for the second year running.

Inflation: How high can it go?

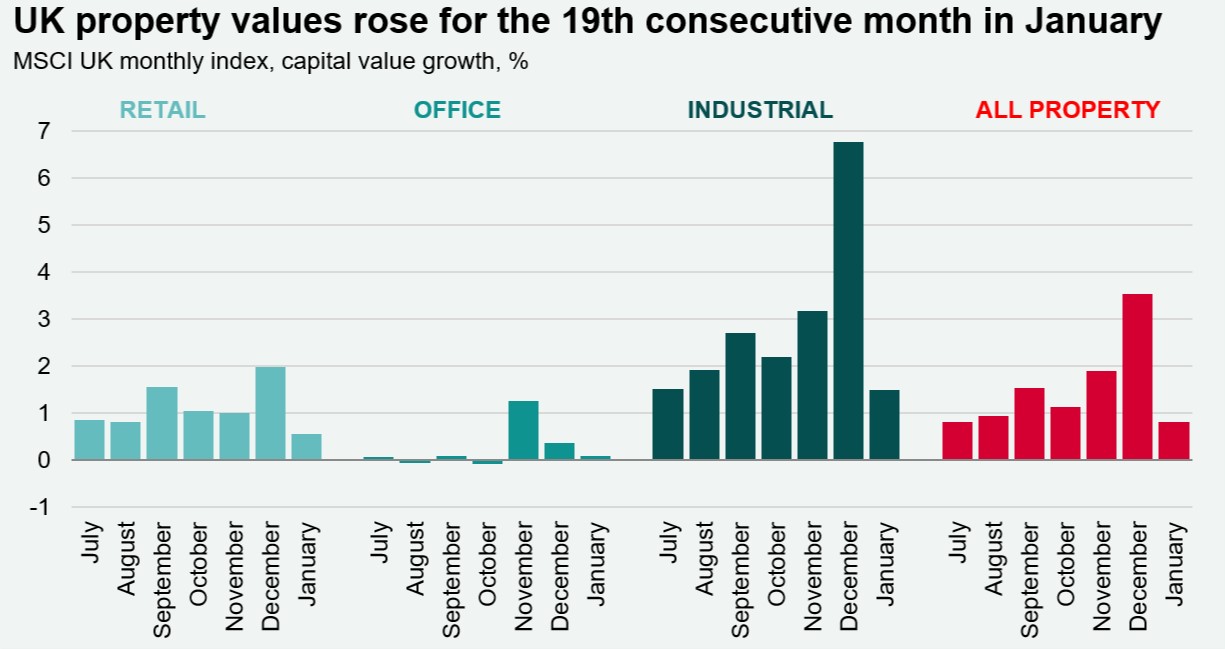

US inflation reached 7.5% in January, its fastest pace in four decades, and US 10-year treasury yields have since surpassed 2.0% for the first time since August 2019. With inflation fears driving weak or even negative bond returns in some countries, investors will be looking to other assets, such as real estate, to mitigate risks.

Geo-political headwinds stoke price pressures

The escalation of political tension on Ukraine’s border has spooked global markets. Brent crude increased to $96 per barrel on Monday, its highest level since September 2014, while European natural gas prices jumped by 12% yesterday to €83.4 per megawatt hour. Russia is a major exporter of key raw materials and commodities, and ongoing uncertainty will exacerbate existing supply chain shortages, add to inflationary pressures and potentially restrict cross border capital flows.

Download the latest dashboard