New York rising, EV chargers in all new homes and the Bank of England's worsening festive headache

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Will they, won't they, continued....

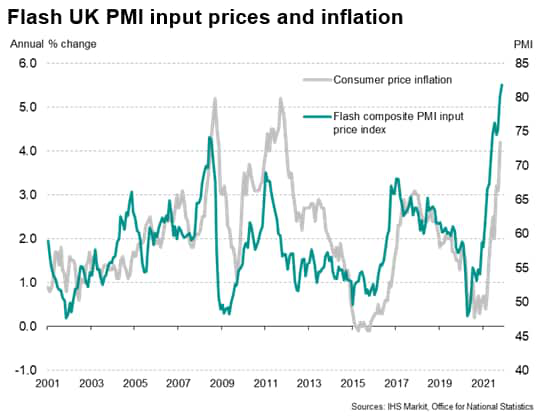

A new Purchasing Managing Index from IHS Markit, a leading indicator for the path of inflation, showed another record increase in firms' input costs during November. That suggests inflation will soon breach 5% (see chart).

The flash reading comes after data published last week revealed that the jobs market had shrugged off the wind down of the furlough scheme and that consumer price inflation had hit 4.2% in October - the fastest rate in a decade and more than double the BoE's 2% target. The jobs data was thought to be the final hurdle standing in the way of the BoE raising interest rates.

The case for a rate hike in December is now so compelling that it's worth considering why it might not happen. Growth of manufacturing is weakening, according to the PMI. Meanwhile Bloomberg notes that the timing is awkward, with Christmas a little over a week after the December 16th decision. Officials may wait to see how Christmas pans out before making their move.

New York, New York

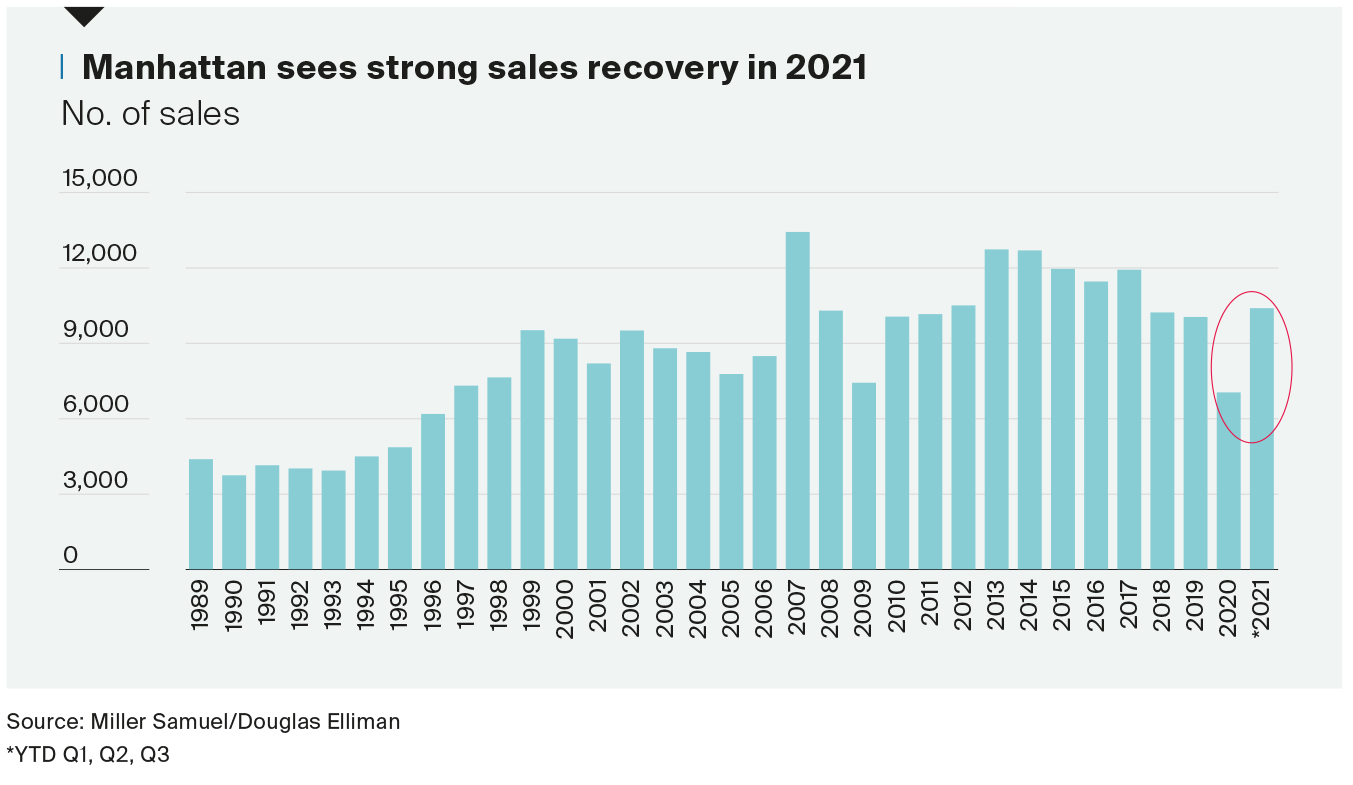

The recovery in New York's prime housing market is strengthening. By September, the number of completed sales in Manhattan was up 47% compared to the 2020 calendar year and had already surpassed the total sold during 2019. Prices in the borough are largely steady - see here for the full update from Kate Everett-Allen.

I made the case for the recovery back in June. At the time, restaurants were crowded, domestic flights were packed and corporate America was calling its workers back. These themes have strengthened during the intervening months, though like much of Europe, infections of Covid-19 are on the rise once again and whether or not new restrictions are required will depend on how the holidays pan out.

The relaxation of international travel restrictions will strengthen the recovery further, with vaccinated overseas buyers once again able to explore the city and view properties in person for the first time in 20 months. As Kate notes, prices at the prime end of the market have been falling for nearly four years, but a return to growth is imminent, with annual prime price growth likely to hit 5% in 2022.

EVs

New homes in England will have to have electric vehicle charging points installed by law from next year. The government hopes the regulations will result in the installation of as many as 145,000 new charging points annually.

Groups representing the housebuilders aren't happy. The main concern is the lack of existing capacity on the grid, and the National Federation of Builders suggests the housebuilders will be left to foot the bill for substations needed to provide enough load capacity. Costs are considerable – upward of £50,000 for a handful of homes.

The move is one of several sustainability challenges faced by the housebuilders. New homes are already more efficient than existing stock, but with the Future Homes Standard requiring a 75-80% reduction of carbon emissions in new homes from 2025 compared with current standards, there is still a way to go – particularly given the skills shortage and current prevailing pressure on global supply chains.

Transactions

UK property transactions fell 52% between September and October, according to the latest data from HMRC.

Stamp Duty holidays have a history of distorting the market. Transactions fell 62% in July from June after the main SDLT holiday came to an end. They fell 35% in April from March, due to an SDLT deadline that never materialised.

A better barometer for the health of the market is to look over the longer term - the annual figure represents the strongest 12 months to Oct in more than a decade.

In other news...

The Alps: The ultimate location for remote workers?

For our latest Sentiment Survey, we're canvassing your views on where the market is heading next. Are you looking to buy or sell and when; what are your expectations around price; and what's your motivation after a remarkable year? Click here to take part. We'll be giving away a magnum of Louis Roederer champagne to one lucky participant.

Elsewhere - Pret sales hit pre-pandemic levels (Bloomberg), Blackstone and KKR are among suitors weighing bids for Global Switch (Bloomoberg), tight supply in Barcelona's prime housing market (FT), Eurozone business activity picks up despite surging inflation (FT), anf finally, UK Fintech switches to four day work week (Bloomberg).

Photo by CHUTTERSNAP on Unsplash