1 minute to read

Covid-19 has fast-tracked a lot of emerging trends across the south east, including the need to offer increased on-site amenities/facilities to occupiers. This has been increasingly evident in the Uxbridge market. Stock levels are continuing to reduce following the conversion of secondary offices into residential with further anticipated development being touted across the town. This has left a limited amount of core good-quality office stock.

Nonetheless, with the reduced levels of occupier demand, landlords with stock in the core are having to be competitive on terms to secure lettings with both headline rents marginally reducing and rent-free incentives moving out. Meanwhile, on The Business Park headline rents are holding at a mid £30's level as occupiers see the value of the improved park amenity and wellness offer.

A number of occupiers have cemented their future in the town with recent regear activity including Mondelez in Uxbridge Business Park and even a few occupiers expanding their office footprint including Regeneron at The Charter Building. This illustrates the value existing occupiers are placing on the town.

Rental levels will continue to show disparity in and out of town with the core remaining above £30 per sq ft, down from a mid-£30s rent at its peak, but the edge of town is up to £5 higher. There is no expectation that headline rents will dip any further - however, the market terms being offered are attracting occupiers to consider Uxbridge as a location.

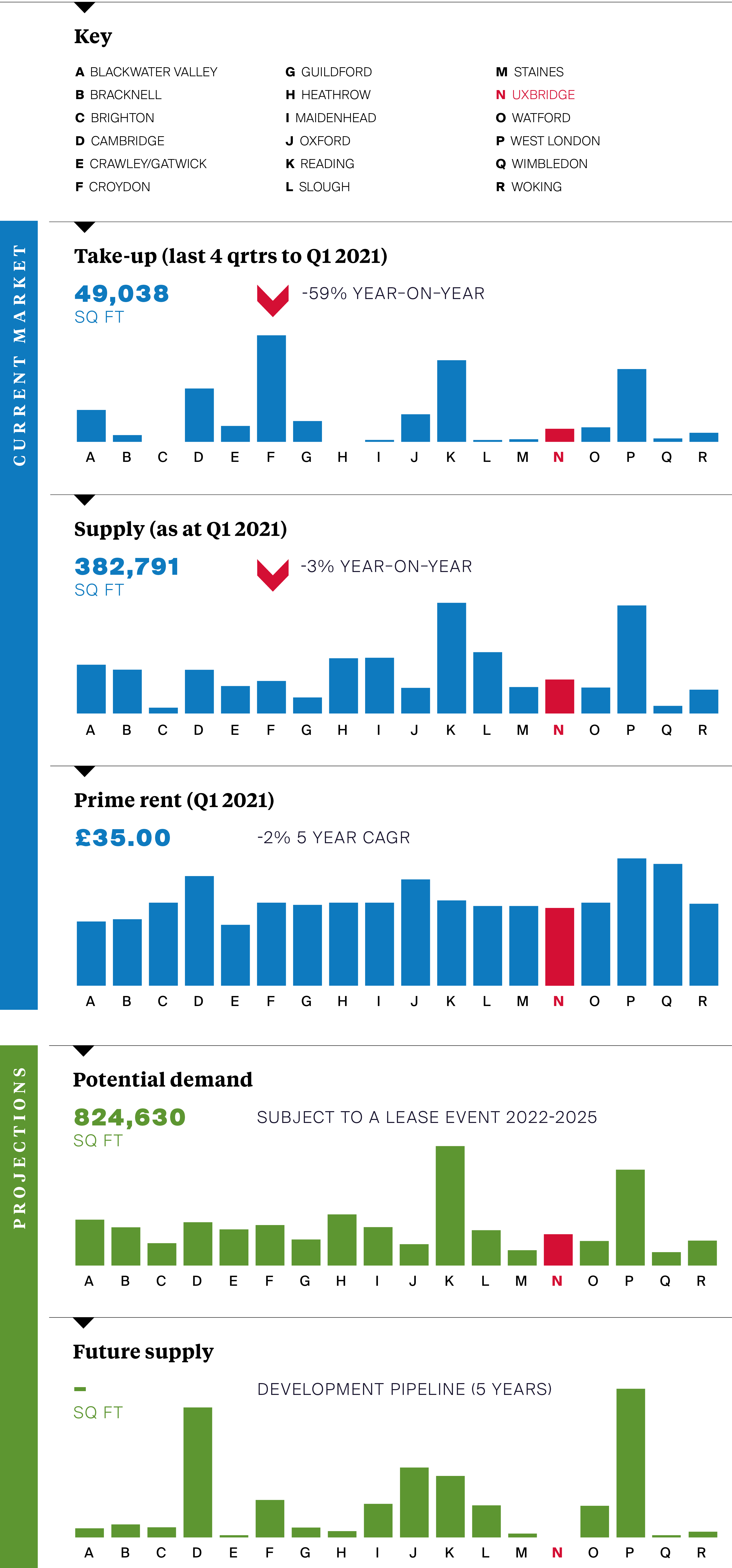

Market Data