Covid-19 Daily Dashboard - 17 September 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 17 September 2020.

COVID-19: The total number of recorded cases globally is approaching 30 million, with 941k reported deaths according to Johns Hopkins University & Medicine.

Equities: Global equity markets are lower this morning. In Europe, the STOXX 600 and the CAC 40 are both down -0.5%, while the DAX and the FTSE 250 have both contracted -0.6%. In Asia, declines were led by the Hang Seng which was down -1.6%, followed by both the Kospi and the S&P / ASX 200, which were -1.2% lower on close. The CSI 300 (-0.5%) and the Topix (-0.4%) also recorded losses. In the US, futures for the S&P 500 are down -1.4%.

VIX: After increasing +1.8% yesterday, the CBOE market volatility index is up a further +5.9% this morning to 27.6, which remains elevated compared to its long term average (LTA) of 19.8. The Euro Stoxx 50 vix is up +4.8% to 23.1, albeit, still below its LTA of 23.9.

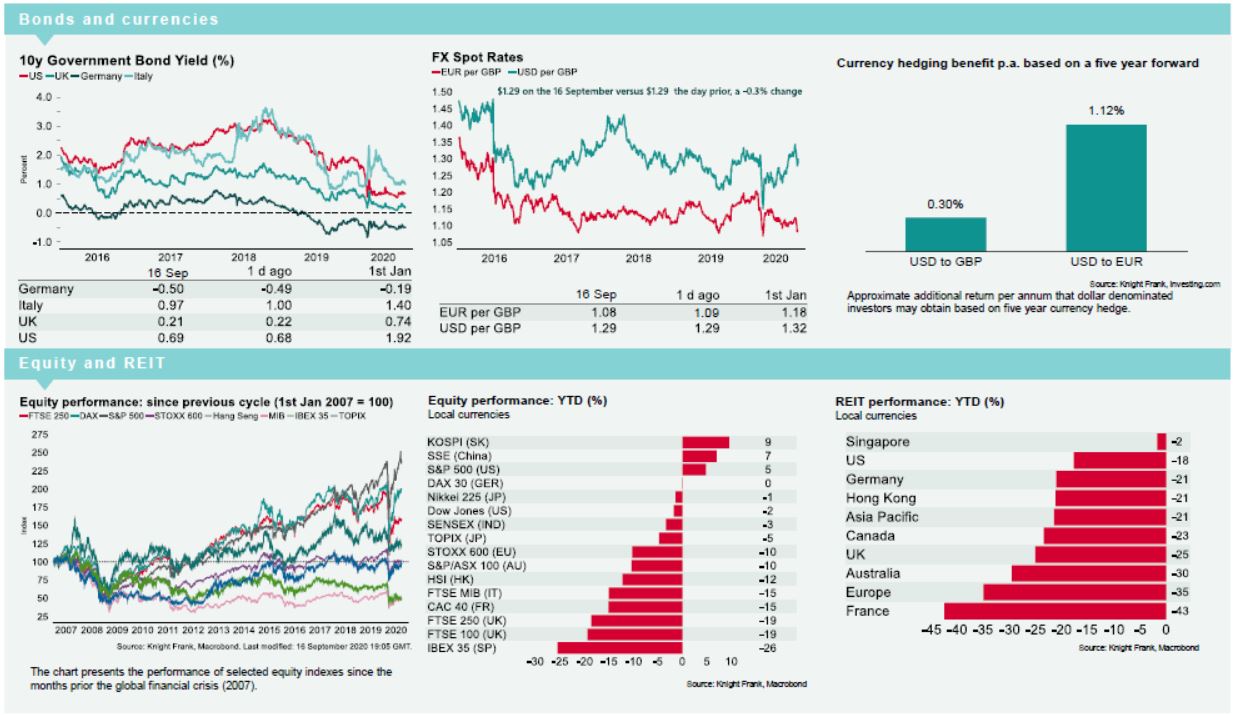

Bonds: The UK 10-year gilt yield and the Italian 10-year bond yield have both softened +1bp to 0.22% and 0.98%, while the US 10-year treasury yield is down -1bp to 0.69%. The German 10-year bund yield is flat at -0.48%.

Currency: Sterling has appreciated to $1.30, while the euro has depreciated to $1.18. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.30% and 1.12% per annum on a five-year basis.

Oil: Both Brent Crude and the West Texas Intermediate (WTI) are above $40 per barrel for the first time since the end of August, currently at $42.10 and $40.04, respectively.

Baltic Dry: The Baltic Dry decreased yesterday after two sessions of growth, down -0.6% to 1,281. The index remains +18% higher than it was in January, while -35% down from the peak in July.

US Economy: The Federal Reserve announced yesterday that interest rates will likely be kept close to zero until at least 2023, with rates only rising once the country reaches full employment and inflation is on track to ‘moderately exceed’ the 2% target ‘for some time’. The Federal Reserve also updated its 2020 economic forecasts. GDP growth has been revised upwards to -3.7% from -6.5% last forecast in June, while the unemployment rate is now forecast to be 7.6%, an improvement from 9.3%.