Pulse on the global economy – Positivity is building but will savings reserves be spent?

To help cut through the noise we bring you a roundup of the latest news, emerging trends and forecasts across the global economy and asset classes and how this may impact residential markets.

4 minutes to read

Some of the most fundamental movers of housing markets globally come down to economic conditions. Improved sentiment and economic stability are likely to see housing markets respond positively, although other factors may influence. The good news this week is that many commentators are increasingly calling a faster than expected recovery.

The R word and D word – recession and depression – have been thrown around a lot in recent months with the headlines stating we are in the midst of a deep recession. Technically we are but it will be short lived. A recession is defined as two quarters of contraction in GDP which will happen in most economies as there was a contraction in Q1 which will be followed by a sharp contraction in Q2.

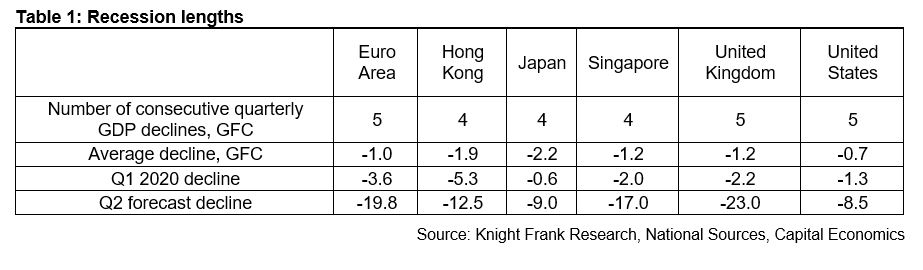

However, with lockdowns being eased many economies are starting to rebound and therefore Q3 will offer positive growth and technically end the recession. In the table below, we outline the number of consecutive quarterly GDP declines for six economies during the Global Financial Crisis (GFC) and the average decline. For some countries in the Eurozone the debt crisis of 2011-13 saw more disruption with Spain registering 11 consecutive quarters of decline and Italy seven, although the respective average declines were of 0.5 and 0.8 over the period.

We also demonstrate the declines seen in the first quarter and forecasts for the second quarter of this year, whilst they show it will be a much steeper decline it will, dependent on a number of factors and risks, be much shorter.

There are more signs pointing to a speedy recovery, but the biggest factor will be if consumers begin to spend the reserves they have been saving over the past few months. With lockdowns in force discretionary spending, from the morning coffee to dining out and leisure activities, has tumbled. In the UK, data from the Bank of England this week showed that household bank deposits increased by a record £25.6bn in May, following increases of £16.7bn in April and £14.3bn in March – that’s a total of over £56bn of extra cash in bank accounts.

This pattern will have been replicated across the world. Over the coming months, as more restrictions are lifted and consumers begin to release some of this spending, we could see a swift recovery. The way in which consumption patterns may change will also impact the speed. Surveys have been demonstrating a mixed bag, some showing that consumers on balance will spend more on dining out post-lockdown whilst others show more will adopt more digital and online experiences – only time will tell.

The major risks are of second waves and subsequent lockdowns and continued uncertainty around employment as job support schemes unwind, if consumers fear they will lose their jobs little amounts of their savings will be spent.

We have seen unprecedented government action to support the economy, how this continues and unwinds will be key, but also government action to kickstart the economy will play a big part, such as targeted spending that creates jobs will help the recovery. For example, the UK Government announced a multi-billion pound "new deal" for infrastructure projects to stimulate the UK economy and the EU has planned for a €750 billion recovery fund.

Many real-time and more responsive data points suggest that this speedier than expected recovery is underway. China’s latest official manufacturing purchasing managers’ index (PMI) for June was 50.9 (a reading above 50 indicates expansion), higher than expectations of 50.5, and up from 50.6 in May.

The idea of a swift ‘V’-shaped recovery is gaining traction among Central Banks. The Bank of England’s chief economist Andy Haldane said this week that Britain is on track for a V-shaped recovery already two months into the recovery. The Federal Reserve Chair Jerome Powell said that the US has entered a new phase of economic recovery "sooner than expected" but still faces challenges, namely in the labour market and in curbing the latest resurgence in coronavirus numbers.

The positivity coming from economic news keeps rolling. Whilst the Q2 GDP figures are expected to be bleak when released they are backwards looking and show the depths of the pandemic in April, the real-time and high frequency indicators will offer more insight into how swift the recovery may be.