Pulse on the global economy - Long-term consequences of a pandemic what are the biggest risks?

To help cut through the noise we bring you a roundup of the latest news, emerging trends and forecasts across the global economy and asset classes and how this is impacting residential markets.

4 minutes to read

The growing trend of deglobalisation and regionalisation is something we have spoken about in The Wealth Report and on recent podcasts. Announcements and musings from the US and New Zealand are hinting towards a further deglobalisation in the movement of people creating a barrier in cross-border property transactions.

US President Donald Trump extended a pause on some green cards and suspended visas for other foreign workers until the end of 2020, this could be an indication of the border policy for the rest of 2020. New Zealand’s deputy prime minister, Winston Peters, who is also the country’s foreign minister, said that the country should tighten its liberal immigration policies and concentrate on improving the skills of its own workforce following the Covid-19 pandemic. In Germany the update to the Außenwirtschaftsgesetz or Foreign Trade Act looks to be increasingly protectionist ad limit foreign investment into critical infrastructure.

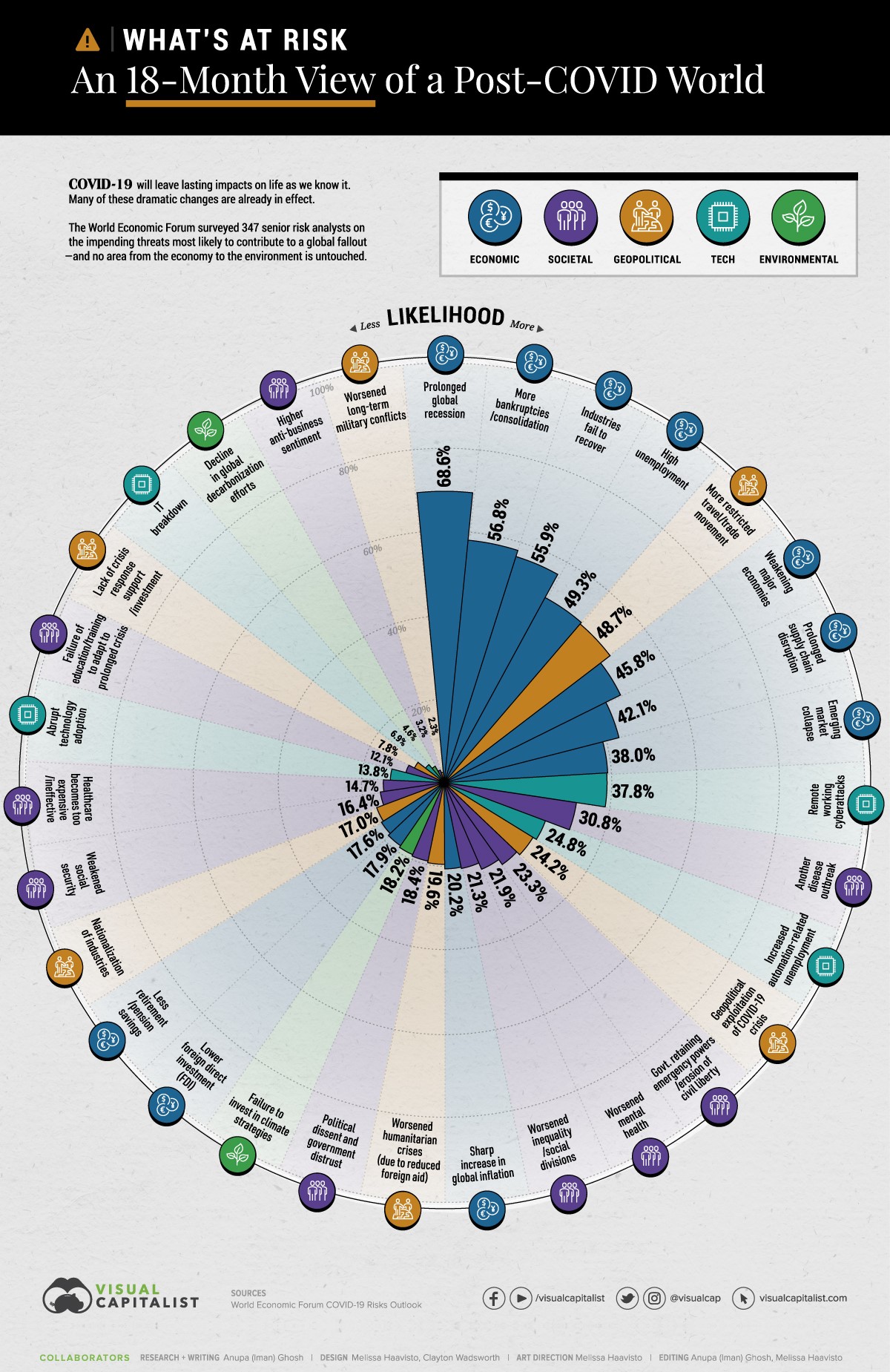

The risk of a less connected world was highlighted in survey of 347 risk analysts by the World Economic Forum, which saw half of the respondents concerned over the more restricted travel and trade movement. In the same survey almost 70% ranked a prolonged global recession as the most likely risk to materialise, 59% cited it as the biggest concern. This comes in the same week that the IMF painted a bleaker picture by downgrading their world GDP growth expectations for 2020 to -4.9% from -3% in April.

However, as we reported last week there is an optimism among some that we are in for more of a “V-shaped” sharp recovery. This is being supported by positive improvements in sentiment and the release of IHS Markit's Purchasing Managers' Indices.

The latest PMI data shows UK manufacturers led the largest rebound in economic activity on record in June with the measure rising from 40.7 in May to 50.1 – anything above 50 signals expansion. The services PMI rebounded from 29 to 47 with the composite measure rising from 30 in May to 47.6. The European economy is also staging a comeback, with the eurozone PMI climbing from 31.9 to 47.5.

This is supplemented with the latest flash business survey by Oxford Economics which saw pessimism easing for the first time during the pandemic, with two-thirds of businesses now expecting the global economy to emerge from recession in Q4 2020 at the latest, compared with around half of businesses in May. A quicker recovery will boost optimism amongst consumers which can be a positive for housing markets globally – the markets which maintain lower unemployment and a pick up in activity are likely to benefit.

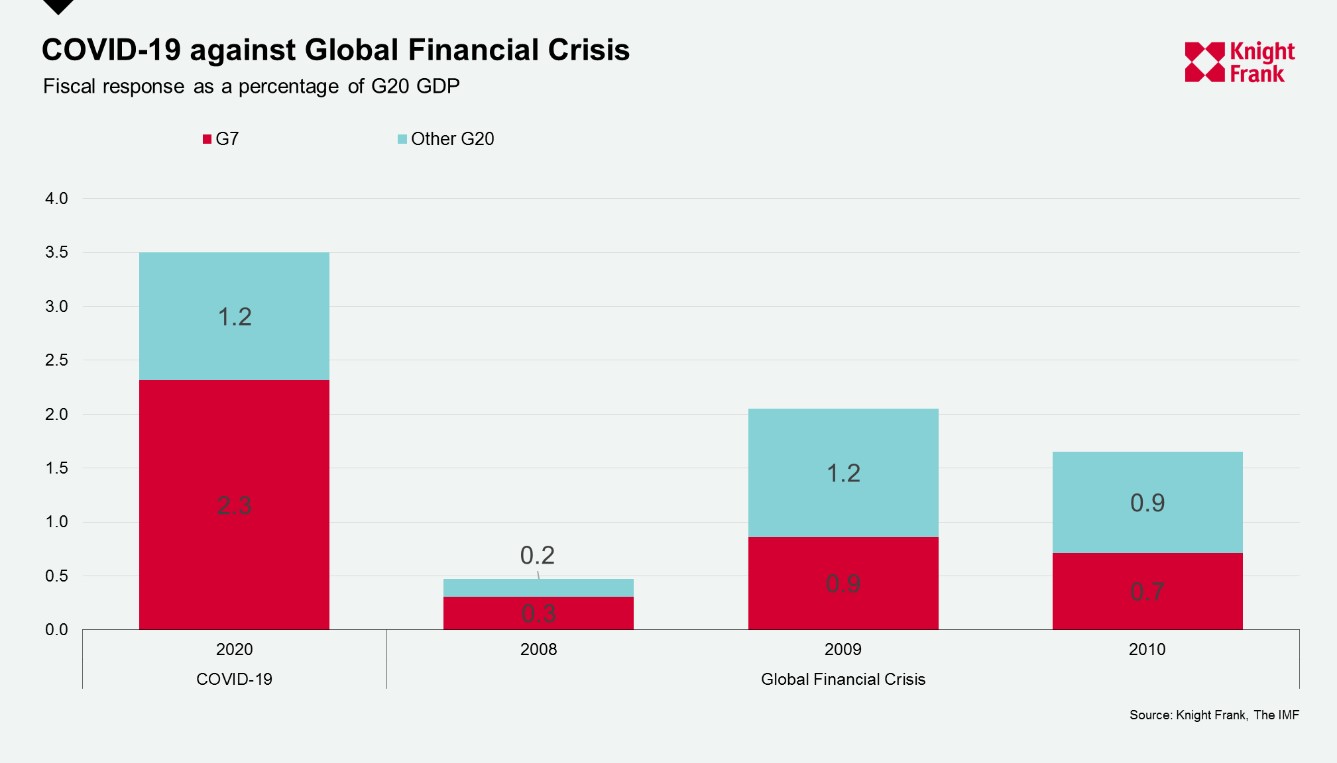

The bounce in activity and sentiment has been supported through record levels of government support. The chart below shows the levels of intervention this year, as at April 2020, compared to the three years after the Global Financial Crisis (GFC). The proportion of GDP committed in a fiscal response already exceeds the amount committed three-years post-GFC, with more allocated since April.

This level of spending will support lower interest rates for several years. As we stated last week, The Federal Reserve has committed to keeping rates low until at least the end of 2022 and a recent UK survey indicates the Bank of England Base Rate is unlikely to make changes until 2023 at the earliest. With record low rates here to stay many will be able to secure cheap finance for the long-term.

The risks however are still skewed to the downside with a resurgent number of cases starting to emerge in some countries. Last week's outbreak of the virus in Beijing has now eased. Meanwhile, Germany’s coronavirus reproduction rate jumped to 2.88 on Sunday, up from 1.79 a day earlier, health authorities said. The US is also facing record increases in seven states causing some political and business leaders to pump the brakes – prompting the governors of New York, New Jersey and Connecticut to impose a two-week quarantine on visitors from nine states.

On the positive side there are tentative signs that France has a working model. Social distancing measures remain in place and masks are compulsory on public transport. Since easing the lockdown, the weekly number of Covid-19 patients sent to hospital has more than halved.

Next week we will look more closely at whether the threat of these resurgences is likely to be quelled quickly along with an update from the latest movements.