Enquiry levels jump among buyers and sellers

Recent stock market rebound also provides more confidence and the financial ability to act

2 minutes to read

Buyers and sellers are planning for life after the lockdown in greater numbers, an analysis of data collected from property portals, social media and the internet shows.

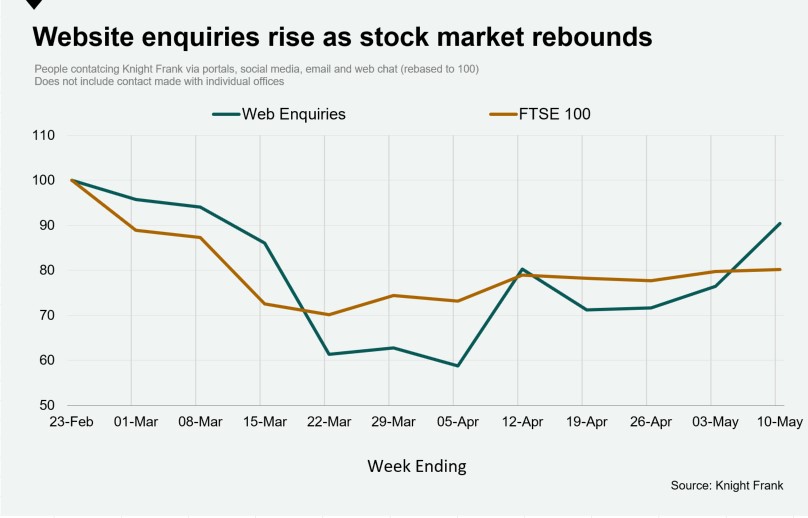

In the week ending 10 May, the level of enquiries to Knight Frank from these combined sources was higher than in either of the two weeks before lockdown measures were introduced. The figure was also 10% below that recorded in the last week of February, as recent stock market increases also spurred on decision-making.

The data includes enquiries received via listings portals such as Rightmove and OnTheMarket, all social media channels, emails sent via the Knight Frank website and enquiries made via its chat function. It does not include enquiries made to individual Knight Frank offices.

“You can see quite clearly from the numbers how people’s thinking has shifted” said Andrew Groocock, regional head of sales for Knight Frank’s City and East region. “People have gone from freezing to gearing up to do something because they realise we are going to come out of this.”

While four out of five sales underway when the pandemic struck have held together, Knight Frank forecasts there will be 526,000 lost sales in 2020, with fewer than half of those returning in 2021, with prices across UK markets expected to fall by 7% this year, according to Knight Frank’s revised forecast.

The government is expected to clarify its position this week on how and when physical viewings can take place and how the property market may function as restrictions are relaxed.

The enquiry data is split approximately 70/30 between buyers and sellers, said Andrew, who also attributes the recent pick-up to the fact stock markets have rebounded.

The FTSE 100 had risen 20% from its recent low point, having broken through the 6,000 barrier in trading on Tuesday afternoon. “As stock markets have risen so has the desire and ability of people to take property-related decisions,” said Andrew.

“I had a buyer attempt to renegotiate the price on a property he was buying with us as he was using cash from the sale of stocks to fund his purchase,” said Josh Marks from Knight Frank’s St John’s Wood office. “Since the stock market has improved he has been able to raise his offer and we have re-agreed the deal with an exchange intended for this week.”