The takeaway for real estate from the UK's Seventh Carbon Budget

The Climate Change Committee has released its Seventh Carbon Budget, which could shape long-term policy direction, we highlight key takeaways for the real estate sector below

7 minutes to read

The Seventh Carbon Budget, covering the period 2038 to 2042, from the Climate Change Committee, makes for an interesting read. While we’ll have to wait a few months to see whether the government adopts its recommendations, here are a few takeaways from the real estate sector:

Buildings are expected to play a central role in decarbonising the UK – contributing almost 16% of emissions reductions in the 2023-37 budget period, rising to 25% during the 2038-42 timeframe covered by the Seventh Carbon Budget. "The largest share of emissions reduction in our pathway comes from switching to low-carbon electric technologies across sectors including transport, buildings, and industry."

Costs of decarbonising the built stock

On the residential side, the installation of heat pumps is expected to grow significantly. By 2040, half of UK homes will need to have a heat pump, compared to just 1% in 2023, according to the balanced pathway estimate. Achieving this requires rapid acceleration in annual installations – from 60,000 in 2023 to nearly 450,000 by 2030 and c.1.5 million per year by 2035.

The report stresses that installation rates of these technologies should align with natural replacement cycles – meaning heating systems are only replaced at the end of their useful life. From 2035, however, all new and replacement heating systems will need to be low-carbon to ensure the housing stock is fully decarbonised by 2050.

The latest net costs for residential decarbonisation are expected to average £5.1 billion per annum between 2025 and 2030. This breaks down to £6.8 billion in capital expenditure, partially offset by almost £1.7 billion in operational expenditure savings. When extending out to 2050, the average net cost rises to nearly £10 billion per annum. The resultant reduction in emissions from the 2025 level is 41%.

The report highlights what this looks like for the typical household, with energy costs forecast to reduce by 43%. They note that home energy use by 2050, would see a typical household energy bill (excluding driving) of c.£940 per year, compared to around £1,650 in 2025. They go on to explain that “installing heat pumps and improving home energy efficiency will require additional investment – equivalent to £730 per year when annualising £15,000 additional spend over the technology lifetime – which policy will need to address. Depending on the level of policy support, a typical household will experience somewhere between £100 in savings to £150 in additional costs per year, on average, from 2025 to 2050.”

This is beyond simply EPC measures where our own analysis of the average cost for reaching an EPC C-rating for the private rented-sector stands at £5,841, and £9,275 for owner-occupied homes. The greater level of cost is due to more interventions – also highlighted by a larger reduction in emissions.

In the commercial sector, low-carbon heating technology is also expected to see significant uptake. The Committee’s pathway "includes limited early scrappage in the non-residential buildings and industry sectors. Many of these premises are significant energy users, so replacing high-carbon systems early can deliver large emissions savings."

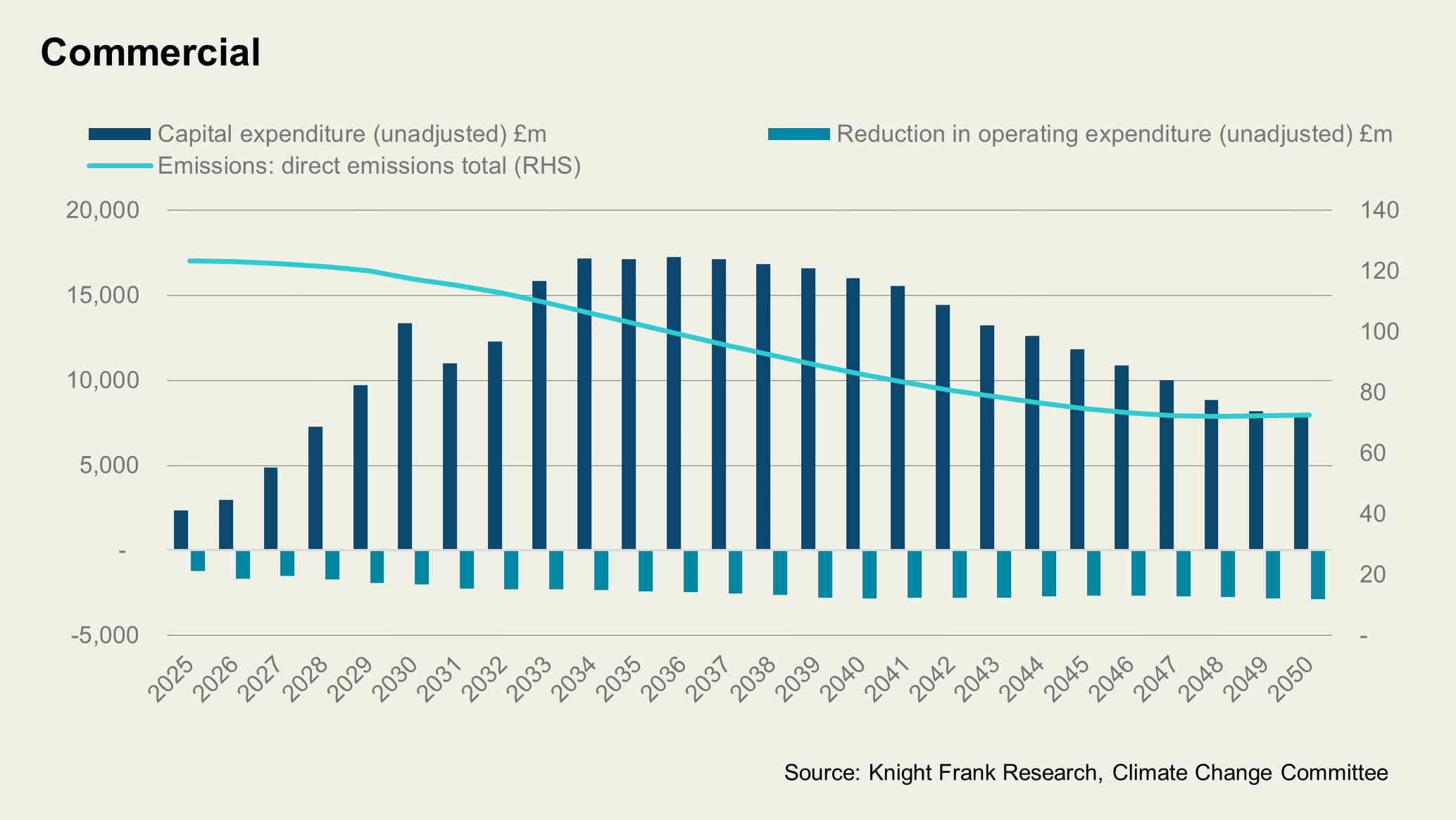

Between 2025 and 2030, the average annual net cost for the commercial sector is forecast at £1.3 billion, made up of £1.8 billion in capex, offset by £526 million in savings. Extending this to 2050 yields a net cost of £436 million as savings grow to £1.2 billion and costs fall to £1.6 billion – overall emissions are forecast to fall by 44% by 2050 from a 2025 baseline.

Although those costs may seem daunting, the Seventh Carbon Budget reflects significant downward revisions—partly due to falling technology costs. The latest projections estimate the average annual net cost of decarbonisation between 2025 and 2050 at around 0.2% of UK GDP - a 75% reduction compared to the Sixth Carbon Budget.

For both sectors, understanding that upgrades will likely need to be made to lower-carbon heating systems, either at the natural end of their useful life (for residential) or even earlier (for some commercial properties), is essential. However, this should not be viewed as just a cost-saving exercise, as the statistics show that payoffs extend over time.

The broader benefits need to be considered. We explore rental and value uplifts and reduced vacancy periods for the commercial sector and highlight potential financing implications in Meeting the Commercial Retrofit Challenge. Similarly, with residential, boosting efficiency can lift the value of a home.

But the overall economic boost from investment could be sizeable.

In 2024, the net-zero economy grew by 10% in Gross Value Added (GVA), according to research by the Energy and Climate Intelligence Unit (ECIU) and CBI Economics, three times faster than the broader economy.

This shift has implications for real estate, influencing occupier demand and space requirements – a trend that could continue at pace. Research from Oxford Economics and The Tony Blair Institute highlights both the opportunities and challenges of this green economy transition. Their best-case scenario projects that the green economy—albeit defined more narrowly than the net-zero economy—could grow from 0.8% of GDP today to nearly 6% by 2050, supporting 1.2 million jobs.

Green finance and green insurance are identified as top-value sectors, with the UK already highly competitive in these areas. Maintaining this edge will be crucial. In February, the City of London Corporation and HM Government jointly launched the Transition Finance Council to further solidify the UK's leadership in green finance. Other high-potential sectors include carbon capture, utilisation and storage (CCUS), fixed offshore wind, and green infrastructure services such as civil engineering, operations, and maintenance.

These economic shifts and emerging sectors are vital in UK Cities' DNA, to ensure that the right type of real estate in the right quantum is provided.

Other takeaways for real estate owners and investor

Electric vehicle (EV) growth will continue, and charging infrastructure must be deployed to support it. The Balanced Pathway scenario sees three-quarters of cars and vans being electric by 2040 (up from just 3% of cars and 1.4% of vans in 2023), and nearly two-thirds of heavy goods vehicles (HGVs). We explore the opportunities for charging and real estate here.

On costs of transport, the report notes a typical £550 in savings per year, on average depending on policy support, from 2025 to 2050. This is due to typical driving fuel costs falling to c£220 per year, from c.£790 in 2025 (excluding fuel duty). In tandem, the cost of new electric cars is to be cheaper than petrol alternatives by 2026 to 2028.

Nature is at the forefront of strategy. Measures such as woodland creation and peatland restoration will be inherent in reaching goals for carbon sequestration opportunities. They state, "land-based actions to increase natural carbon sequestration and reduce emissions from land deliver 2% of the required emissions reduction by 2040, although this share grows quickly to over 5% by 2050".

By 2040, woodland coverage will increase to more than 16% of the UK’s land area, up from 13% today. That equates to tree planting rates more than doubling to 37,000 hectares per year by 2030. At the same time, the proportion of UK peatlands in natural or rewetted condition will need to rise from 26% in 2023 to 55%, with much of this work frontloaded within this decade.

Renewable energy is central to decarbonisation. By 2040, offshore wind capacity is forecast to grow to 88 GW from 15 GW in 2023 while solar capacity is expected to grow from 16 GW to 82 GW. This will be coupled with falling costs, and adoption continues to decrease, with solar being estimated to see a 50% reduction in cost, offshore wind to fall by 39%, and onshore by 15%. The report notes, "These technologies need to be accompanied by investment in network infrastructure, including rapidly building out the transmission grid and speeding up the grid connection process, which currently poses a barrier to electrifying industry and HGV depots." We wrote about the current grid connection reform proposals here.