UK Hotel Trading Performance Review and outlook for 2025

The resilience of the UK hotel market delivered another strong and profitable year of trading in 2024, with the sector having profited from a more tolerant macro-economic environment, at least in the short-term.

4 minutes to read

2024 – How did the UK hotel market fare?

Despite costs continuing to rise, the impact of lower rates of inflation, increased inbound visitor arrivals and the continued return of the conference and meeting segment, all facilitated the respectable growth in profits.

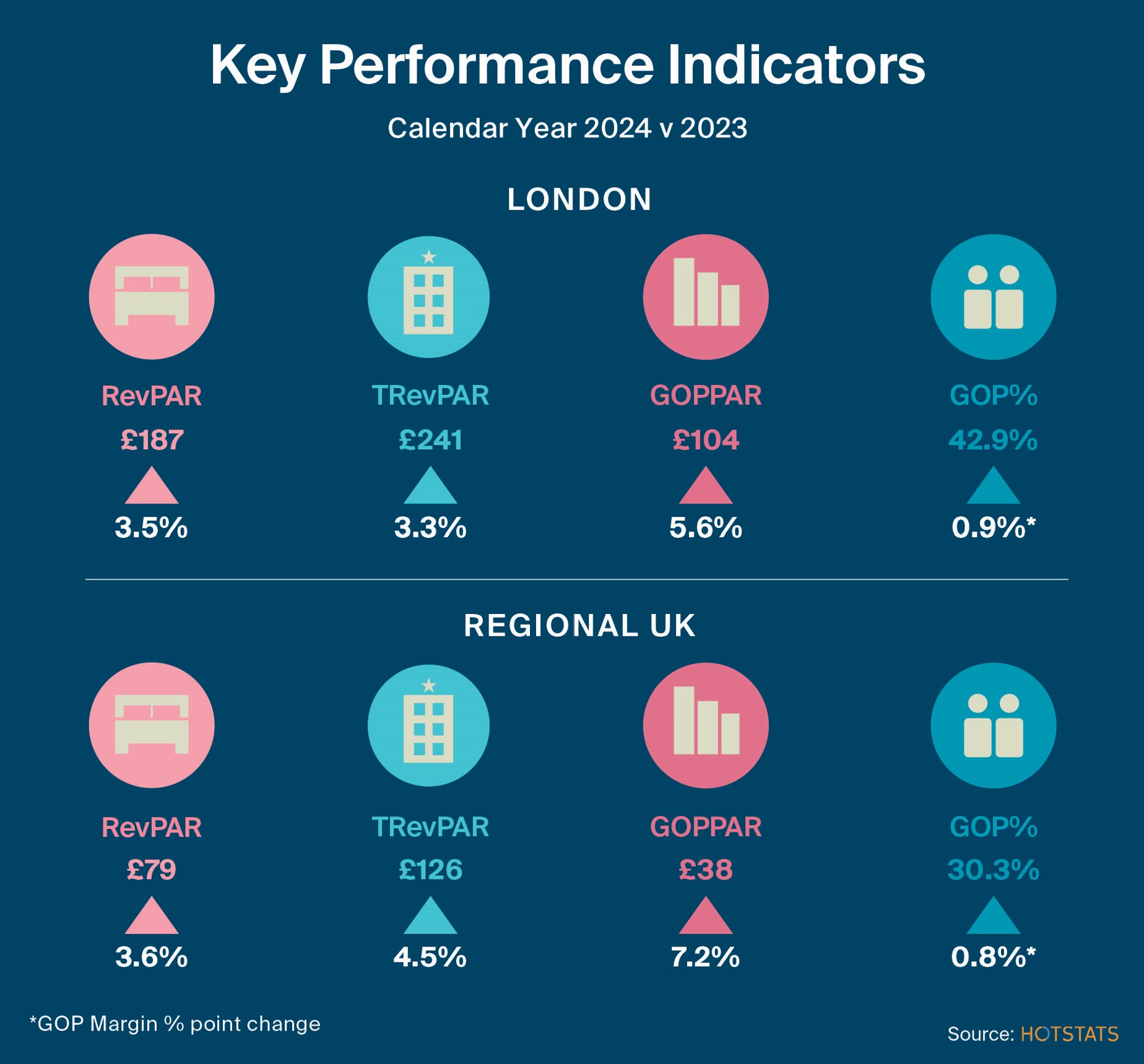

For the full year 2024, London achieved an average occupancy of 82%, equalling its pre-pandemic performance, and year-on-year an uplift of 3.4 percentage points of occupancy was recorded, whilst ADR declined by almost one percent to £228.

Overall, the London hotel market achieved a respectable performance for the year. Annual growth in occupancy of 4.5 percentage points was achieved during Q1-2024, but slowed to 2.2% growth in Q4. This was countered, however, with the decline in ADR restricted to the first six months of the year, albeit with the rate being held level during the second half of the year.

Across regional UK, another robust year of trading performance delivered a one percentage point uplift in occupancy to 76%, moving closer towards a stabilised level of performance. Meanwhile, annual ADR growth of 2.3% was recorded, to average £105 for the full year, which in real terms was on par with 2019 pricing. This performance led to respectable rooms revenue growth, but also of significance was the notably stronger TRevPAR growth, indicating a recovery in non-Rooms departmental revenue. This strong growth is evident in the region’s select service and upper midscale chain hotels, which have proven to show the greatest hedge against inflation, with 2024 TrevPAR exceeding 2019 levels in real terms.

Leveraging the use of AI has without doubt played a strong part in supporting trading performance. Whilst music concerts such as Taylor Swift’s The Eras Tour, as well as sporting events and city-wide conferences have all served to boost hotel demand in 2024, advancements in digital insight, with more hotels adopting dynamic pricing strategies, have provided hoteliers with the tools required to maximise revenue growth at peak times, and to help remain competitive at slower times.

Download the full report now

Recovery of Meetings & Events induces growth in profits

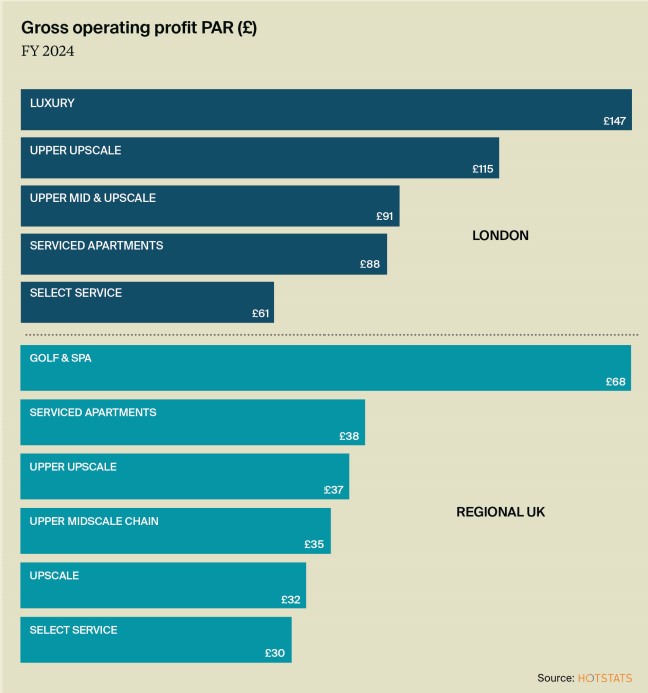

Over the six-year period under review, it was the first time that GOPPAR growth was stronger in regional UK than compared to London. It was, however, a year of mixed fortunes, with strong variation in performance between the different datasets.

The winners were those hotels which penetrated strongly in the meetings, conference and events segment, with full-service hotels attaining much higher revenue and GOPPAR growth than compared to the select service and midscale sectors.

Across all London segments, average GOPPAR growth of more than 5% was achieved in 2024, to reach £103.50 and was ahead of its 2019 performance by 7%. London improved its annual profit conversion by almost one percentage point to reach 43%, but with the GOP margin (gross operating profit as a percentage of turnover) some three percentage points lower than compared to 2019, this is an indication of the cost pressures that operators are facing.

Meanwhile, across regional UK, GOPPAR growth of more than 7% was achieved, to reach over £38, whilst the GOP margin increased by almost one percentage point year-on-year, to equal 30% of turnover. Compared to 2019, the margin has declined by less than one percentage point, with the strong revenue growth cushioning the drop in the GOP margin.

The outlook for 2025

The year ahead is set to be far more challenging with the forthcoming increases to the cost of labour and increased expenses, coming at a time when the sector is reaching a much more stabilised level of revenue performance.

Very severe payroll challenges are soon to hit the sector, which if not managed are very likely to impact on a hotel’s profitability in the short-term. This forthcoming storm of continued heightened payroll costs is already having a profound impact on how hotel owners are preparing for the year ahead.

Whilst utility costs were on a downward trajectory in 2024, and have supported cost pressures elsewhere in the business, there no guarantee that the current direction of travel will continue throughout 2025, with the energy price cap in the residential market set to rise by 6% in April.

Adding further to the cost pressures is the likely forthcoming rise in business rates, with 2025 seeing the multiplier increase and with the relief reduced. From April 2026, there is a strong possibility that the current relief will be removed entirely, and valuations rebased on 2024 trading.

Hotels face constant pressure to boost efficiency, cut operational costs, and exceed guest expectations. Optimising resources will become more crucial than ever. The upward pressure on labour cost may, however, serve to be a force for change. Embracing and adapting to the pace of change and understanding the role that technology can play, will serve to drive efficiency through streamlining operations, operating more sustainably, thereby reducing operational expenses, as well as keeping competitive by closely monitoring market trends and maximising revenue growth.

Whilst acknowledging the significant challenges surrounding the current macro-economic environment, we consider that by focusing on both revenue generation and having astute awareness and proactive management of costs, the UK hotel sector can face the challenges, whilst maintaining the momentum of ongoing growth. Realistic but cautiously optimistic, is our stance for 2025.

Download the full report now