5 minutes to read

Watford has experienced recent regeneration and development. The area’s connectivity and amenities are attractive to companies looking to establish or expand a presence near London. The introduction of further new developments, such as a mixed-use scheme on Clarendon Road by Regal London, suggests strong confidence in the market and is aimed at meeting the growing demand for highquality office space. Rents in Watford are relatively affordable compared to other South East office markets, which has been a major attraction for businesses. Watford hosts a range of prominent office occupiers, reflecting its status as a key business hub. Notable companies with a significant presence include TK Maxx, which has established its new European headquarters there. Other significant tenants include KPMG and PwC, which underline Watford’s appeal to professional services firms. Additionally, the area has attracted tech companies like ACI and other prominent names like Ralph Lauren, FIS Global, Wunderman Thompson Commerce, Ricoh, and BioRad.

What is the shape of the office market?

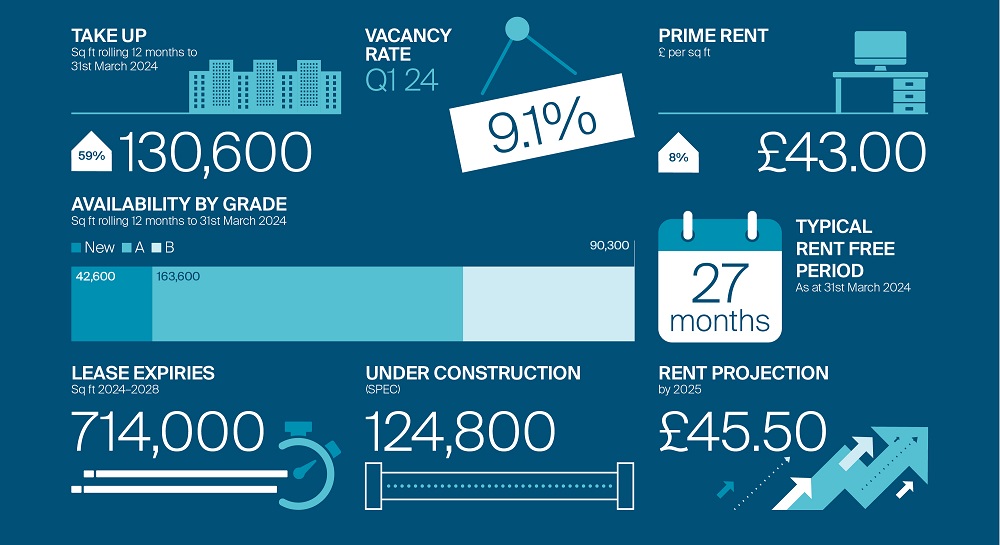

Annual take-up in 2023 reached just short of 120,000 sq ft, almost double the total of 2022. Notably, three transactions over 20,000 sq ft were completed during the year, the highest number since 2018. The first quarter of 2024 has seen momentum sustained, with Epson UK, part of the Japanese multinational global technology company Epson Group, one of the world’s largest manufacturers of printers and imaging technologies, taking 30,530 sq ft across the third and fourth floors of The Clarendon Works. The Regal London scheme will be completed in the second half of 2024.

Who is taking space?

Over the past 5 years, occupiers from Financial and Business Services have accounted for 31% of take-up. Notable deals from this sector include PWC consolidating its teams from Uxbridge and St Albans to a new 28,500 sq ft base at 40 Clarendon Road. Over 600 employees are based in the Watford office, which forms part of PwC’s firmwide strategy to deliver a broader range of services outside London. In Q4 2023, Regal London leased 16,795 sq ft to flexible office provider YoooServ at Clarendon Works. In addition to providing flexible workspace on the ground and first floors of the 140,774 sq ft building, YooServ will also manage all the amenity space and services throughout the building. Retail firms also have a strong presence in Watford, accounting for 28% of take-up over the past 5 years. Notable deals include Signet Jewellers taking 20,000 sq ft at 1 Croxley Park and, most recently, Poetic Gem taking 29,000 sq ft at 54 Clarendon Road. However, the largest deal in recent years was when construction firm Skanska moved its headquarters to Leavesden Park in 2021, taking 64,000 sq ft.

What does future demand look like?

From the immediate numbers, the scale of potential demand looks positive. Knight Frank is tracking 137,000 sq ft of active requirements in the Watford market. Further analysis shows that 714,000 sq ft of space is subject to a lease event over the next 4 years.

More fundamentally, office-based employment drives future job creation in Watford. The latest forecasts indicate that office-based employment will rise 21% over the next ten years. Professional services, Science and Technology are the principal growth areas, increasing by 26%. Administrative roles are also forecast to rise by 23%. The Watford local plan recognises this. The South West Herts Economic Study Update has identified a need for 400,000 sq ft of office floor space.

What is challenging the market?

Although supply levels have risen in Watford since Covid, recent strong letting activity has meant availability has begun to decline. When writing, 296,000 sq ft was available to let, equating to a vacancy rate of 9.1%. Notably, 30% of this total is grade B space, with the new space down to just 42,000 sq ft, the lowest level for 3 years.

A growing gap is developing between secondary and prime office space in Watford and many Hertfordshire markets. Occupiers based in secondary locations or office space are settled, paying rents closer to £30.00 per sq ft. With prime rents rising by a further 8% over the past 12 months to £43.00 per sq ft, improvement in workspaces is coming at a significant cost.

Additionally, despite the recent uplift in prime rents, it has not yet reached a high enough level to justify the current build costs for new projects. Pipeline projects that are not already under construction have, in some cases, been delayed. This means supply is low and likely to remain so for at least the short term.

Is office supply to grow?

As of Q1 2024, 124,800 sq ft of space was under construction. This space is scheduled to be completed in 2024, with no developments underway with delivery dates beyond this.

What will underpin longer-term growth?

Watford has several significant regeneration initiatives to revitalise the town and enhance its economic and environmental sustainability.

One major regeneration initiative is the Watford Riverwell project. This £450 million joint venture with Kier Group involves transforming 70 acres of land into residential, commercial, and recreational spaces. The project focuses on creating 750 residential units, office spaces, and a hotel while addressing environmental challenges and promoting ecological restoration.

The town is involved in a £1.6 billion regeneration masterplan for Watford Junction, which includes developing nearly 3,000 homes, commercial spaces, shops, and community facilities. This plan represents a comprehensive approach to urban development in Watford.

Watford’s Town Hall Quarter is undergoing a £200 million regeneration project to revitalise the area around the historic Town Hall and Colosseum. The project encompasses new homes, public spaces, and community facilities, contributing to Watford’s urban revitalisation.