London’s hotel market shows resilience with Q1-24 profits up, despite a softening in the ADR

1 minute to read

Download the latest hotels dashboard here

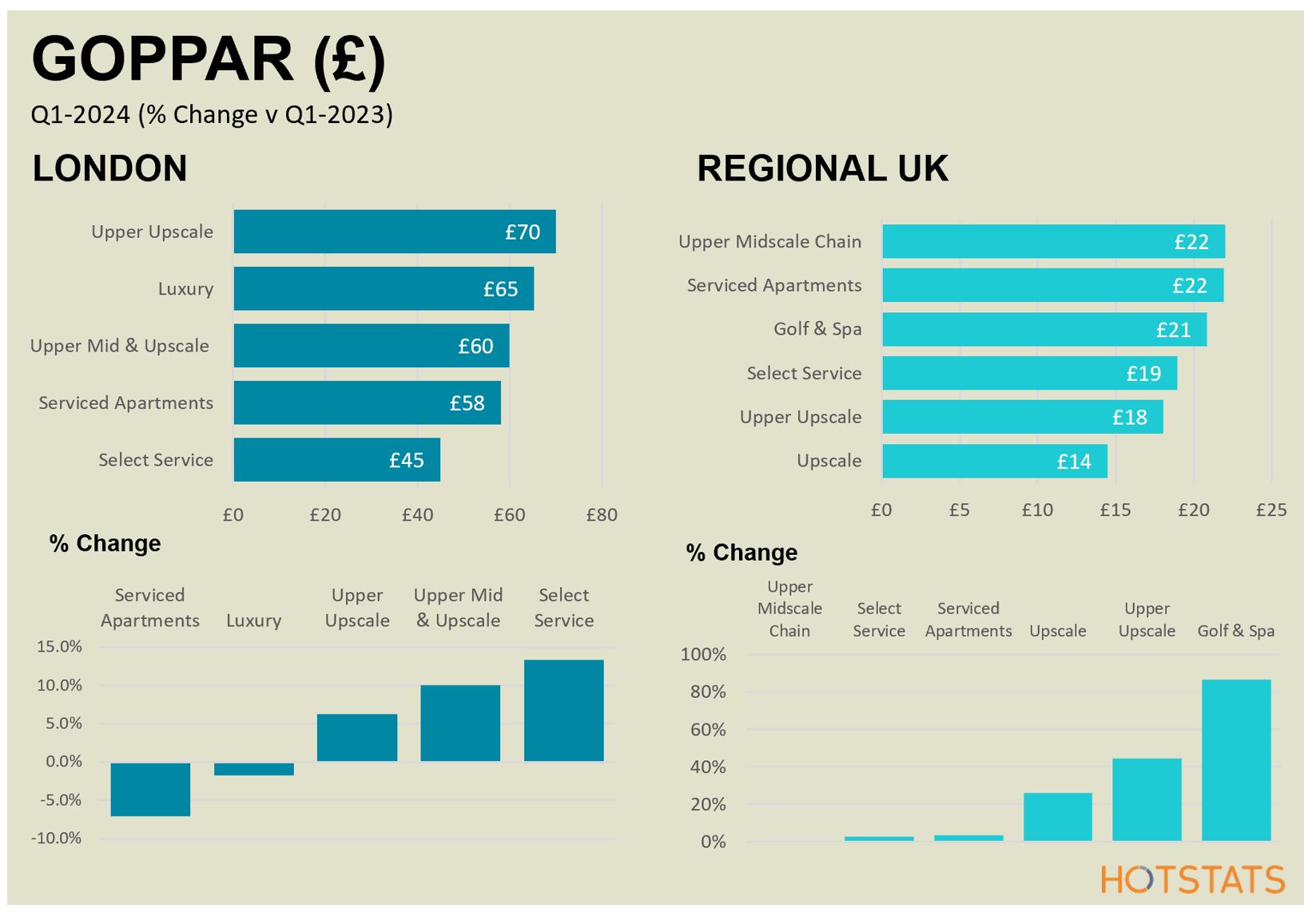

London’s Q1 occupancy of 73% narrowed to just 1.3 percentage points below Q1-19 levels. The shift in strategy towards growing occupancy levels facilitated RevPAR growth despite a marginal softening in the average room rate (ADR), whilst a rise in ancillary revenues led to improved efficiencies and supported the rising costs. Yet it was a tale of mixed fortunes, with London’s Select Service hotels turning in by far the strongest performance with double-digit growth in revenues and profitability. By contrast, London’s Luxury hotel market saw revenues held level and profits declining by 1.7% versus Q1 the previous year.

Meanwhile, it was a positive first quarter for the Regional UK hotel market, with respectable RevPAR growth, achieved from both an uplift in occupancy and ADR. Increased demand for meetings and events, and strong growth in corporate and negotiated rates contributed to the respectable growth in revenues. Golf & Spa hotels and full-service Upscale and Upper-Upscale outperformed the regional market in terms of revenue growth and profitability.

An uplift in department operating income has been a key driver behind the growth in Q1 profits year-on-year. London recorded respectable GOPPAR growth of almost 6%, whilst Regional UK saw Q1 GOPPAR rise by 10%, whilst Regional UK saw Q1 profits rise by 10%. GOP margins have held steady over the same period, albeit the winners in TRevPAR growth (total revenue per available room) were certainly outperformers in terms of improved levels of profitability.

For further detailed analysis of the UK Hotel Market Trading Performance, including a visual overview of Q1 hotel investment volumes, take a look at Knight Frank’s new look UK Hotel Dashboard.