Game of thrones

A new crop of emerging wealth hubs is challenging the old world order. Patrick Gower reports

34 minutes to read

In October 2022, a reporter tweeted that a major international investment bank was “on the brink”. It was enough to prompt many wealthy clients to begin pulling their funds out of Credit Suisse. The Zurich-based investment bank would collapse just five months later.

Two themes repeatedly cropped up during our investigation into the long-term prospects for the world’s wealth hubs: this generation of HNWIs is both better connected, and more mobile, than ever.

Both themes are encapsulated by the Credit Suisse saga. In that particular case, wealthy individuals were primarily moving money, but the principle applies equally to physical movement, too.

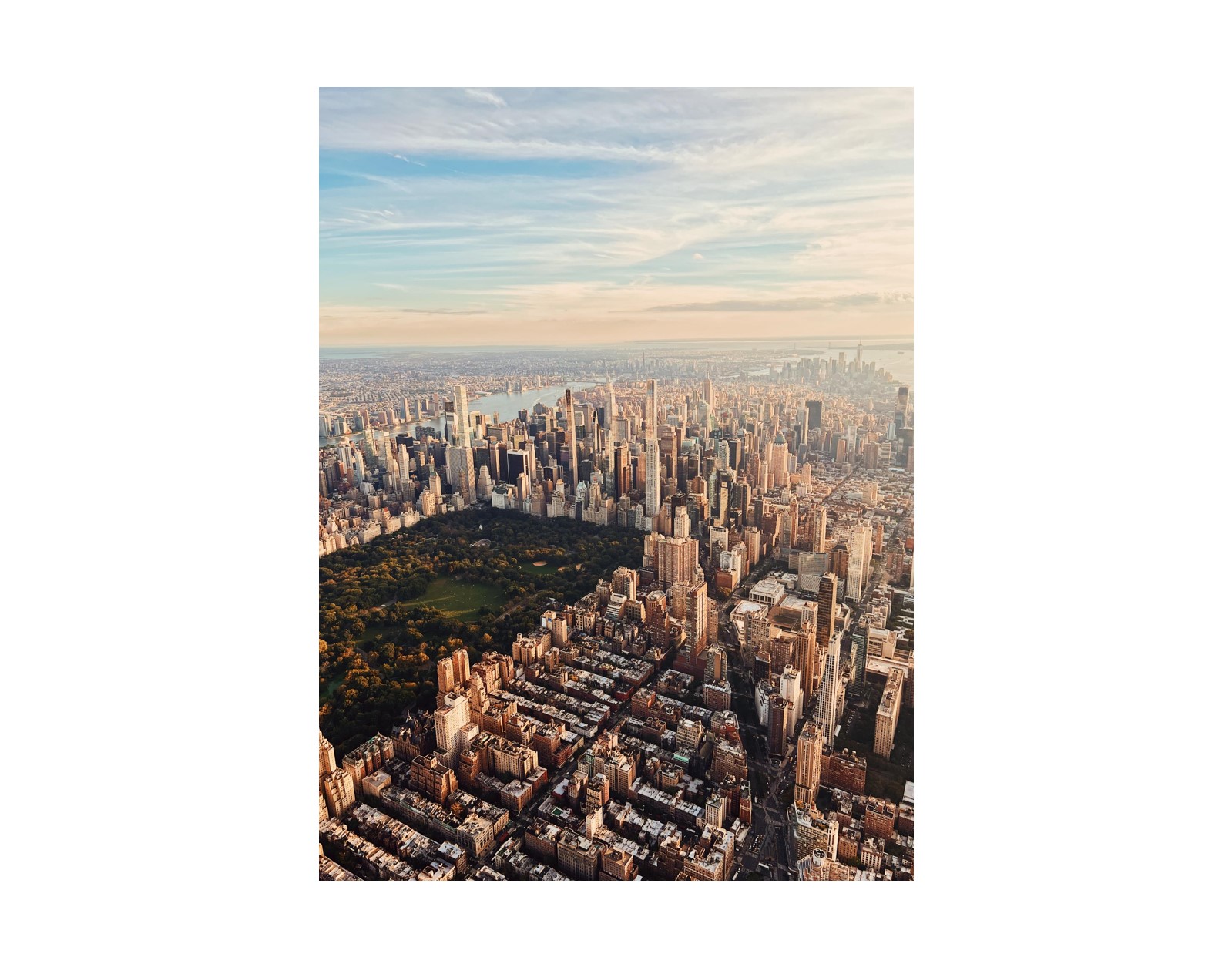

From Miami to Milan, relative upstarts among the world’s wealth hubs are challenging the supremacy of incumbents such as New York and London. An increasingly nomadic group of HNWIs appears happy to respond to incentives to move, whether these span tax, safety or simply a change of lifestyle.

This is a story of carrots and sticks. In London, a combination of taxation and political rhetoric have prompted some investors to wonder whether they are still welcome. Equally, perceptions of a fall in living standards in major US cities, particularly when it comes to safety, have increased the allure of alternatives.

The challengers have problems of their own, of course. Milan suffers from a dearth of prime homes. New Yorkers might fancy a slice of Miami but are reluctant to move amid a scarcity of places in schools that can charge as much as US$50,000 a term. Singapore has seen great success in building its ultra-wealthy population but is realising that coaxing them to invest locally presents another challenge altogether.

Credit Suisse is just one bank, but Swiss regulators are now questioning whether the banking system’s reliance on wealthy – and flighty – individuals poses as many risks as opportunities. It must be careful how it addresses the problem: for the world’s 1%, leaving has never been easier.

Paris. Race to the top

A package of reforms aims to make Paris the number one choice for the international banking elite

Ten days before Christmas, French Finance Minister Bruno Le Maire flew to New York to try to establish how he might coax more bankers and hedge fund managers to move to Paris.

Le Maire wanted to “take the pulse” of senior leaders at Wall Street giants including Goldman Sachs, Morgan Stanley, BlackRock and Global Infrastructure Partners, a government official told the website Politico at the time. Those meetings will inform a new package of legislative and regulatory reforms, due in 2024, aimed at building on post-Brexit relocations to the French capital.

Le Maire’s government has been locked in a race – alongside the administrations of Ireland and Germany – to topple London as Europe’s dominant financial hub since Britain voted to leave the European Union in 2016. They are being assisted by the European Central Bank (ECB), which insists that banks must move more senior staff to within its remit if they are to manage risks appropriately. Neither Paris, Dublin nor Frankfurt has managed to strike a notable blow so far, but Paris has the best momentum.

A bigger buzz

“Global finance institutions are bringing top level management in [to Paris] to demonstrate to the regulators that they are taking this seriously,” says Florence Carr, a Paris-based partner in EY’s Financial Services Office. “It’s the build up of lots of little things that are attractive to the high-end executive that has given Paris a bigger buzz than other places, like the fantastic international schools or the fact you can hop on a train and be on the French Riviera in about five hours.”

By some measures, Paris appears to be in the ascendency. A series of business-friendly reforms has enabled France to attract more foreign direct investment than any European nation for the past four years, driven largely by industry and innovation but supported by the flourishing Parisian financial sector, according to EY. Regional unemployment is close to a 15-year low.

The 2023 Rugby World Cup was a success, bringing an estimated €1 billion into the French economy. The Olympics will arrive in July, and large swathes of the city are being regenerated, including a 52-hectare site 7km north of the centre that is being developed into 2,800 new homes. Meanwhile, the Grand Paris Project, Europe’s largest urban infra-structure scheme, will deliver 68 new stations and four new rail lines when it is completed in 2030.

The financial sector is swelling. As of 2022, Paris had lured 2,800 financial services jobs from London, compared with 1,800 that had left for Frankfurt and 1,200 that moved to Dublin, accord-ing to EY. The number of French bankers earning at least €1 million surged 63% between 2020 and 2021, according to the latest available figures from the European Banking Authority.

A flourishing industry

While those figures leave little doubt that the industry is flourishing, it remains true that relocations have been far rarer than initial estimates suggested: a 2017 report by PwC for the lobby group TheCityUK warned that Brexit had put as many as 75,000 UK financial sector jobs at risk, for example. Certainly, the UK government has not been resting on its laurels. In December, Chancellor Jeremy Hunt signed a financial services deal with Switzerland – made possible by Brexit – that should make it easier for financial firms and wealthy individuals to do business. In-deed, many investors say they are sanguine about the long-term risks to London, which has a deeply embedded financial services ecosystem that makes leaving more trouble than it’s worth.

“There are enough workarounds to be able to have staff in London and operations in the EU,” says Jérôme Legras, Managing Partner and Head of Research at Paris-based Axiom Alternative Investments. “It’s more complicated and there have been a lot of administrative headaches, but ultimately the impact has been managed. We’ve seen more people going to Frankfurt and Paris but it’s not massive.”

That could change if the ECB and the French government get their way. The reforms being considered by Le Maire could be inspired by a December report by Charles Rodwell, a lawmaker from Macron’s party, that suggested it should be easier and cheaper to fire high-income employees, ac-cording to Politico. Measures could include tweaks to labour laws or moves to facilitate easier stock market listings of small and medium-sized enterprises, according to a December report by Bloomberg. Any incentives are likely to fit with Le Maire’s plan to attract institutions beyond the global banks, such as hedge funds and sovereign wealth funds.

The kingmaker

While those reforms would be attractive to investors, the ECB is the real kingmaker. A desk map-ping review conducted by its officials in 2020 found that many of the post-Brexit European hubs opened by financial institutions were in fact “empty shells” still reliant on London-based services.

“A lot of the business was being booked in the EU but sent through financial means outside of the EU and particularly to London,” Carr says. Officials have “been pushing and pushing and the pressure is mounting almost every day on this.”

More than a fifth of the 264 trading desks initially reviewed “warranted targeted supervisory action,” Andrea Enria, head of the ECB’s supervisory board said in 2022. Further reviews are likely to be expanded to cover services beyond the scope of the initial review, including mergers and acquisitions and stock and bond issuance, the ECB said in December. The reviews are likely to form the core of a strategy to draw more capital to the bloc, which in turn must be overseen by increasing numbers of senior executives.

The banks “are getting their reports from the ECB that are very much saying ‘if you want to trade here, you need to have the capital to back up your business here’,” Carr says. “That means if you trade, you need the capital to protect that trade, and when you move capital you have to move people. This is definitely happening.”

“As of 2022, Paris had lured 2,800 financial services jobs from London, compared with 1,800 that had left for Frankfurt and 1,200 that moved to Dublin, according to EY”

London. Shift to the left

A change of government in the UK could have significant implications for London’s future as a wealth hub.

Tony Blair had been prime minister for about a year when his Trade and Industry Secretary Peter Mandelson said the Labour Party was “intensely relaxed about people getting filthy rich.”

It was 1998, and Blair was at the beginning of a decade-long rule that would be era-defining in its approach to economic liberalisation. But while real incomes surged, so did wealth inequality.

The party’s attitudes to wealth have become increasingly varied ever since. Neither billionaires nor poverty would exist in a fair society, party leader Jeremy Corbyn said in 2019.

The UK is again on the cusp of a Labour government and, if some polls are to be believed, it’s only the size of the majority that is yet to be decided. As is customary at this stage in the election cycle, current leader Sir Keir Starmer has been reluctant to reveal too much, but experts tell The Wealth Report that he’s likely to preside over the most radical Labour government in decades.

What that looks like in practice will be crucial for London. Following a period of post-Brexit uncertainty, the capital’s reputation as Europe’s dominant hub for wealth and finance is looking more secure. Labour risks upsetting that progress if it is too heavy-handed in its attempts to raise taxes on the wealthy, says Paddy Dring, Global Head of Prime Sales at Knight Frank.

“People are concerned about the government and in particular about any changes that might make big overseas investors feel unwelcome,” he says. “Feeling welcome is important. Clients use those words and I think it’s important that a new government conveys that Britain still values international investment.”

Comparisons with Blairites

Starmer and his shadow chancellor Rachel Reeves have so far courted business and ruled out many of the more radical policies favoured by left-leaning sections of the party. These include introducing rent controls, imposing a mansion tax on higher-priced properties, raising capital gains tax and increasing the top rate of income tax. While Reeves does want to reform the UK’s non-dom tax regime, which allows UK residents with a permanent home overseas to avoid pay-ing UK tax on foreign income, anything substantial risks “shooting themselves in the foot for political gain with very little in the form of economic benefit,” says James McBride, a veteran of the Labour Party Policy Unit that worked on both the 2016 Brexit referendum and 2017 general election campaigns.

Despite the moderate rhetoric, comparisons with Blairites would be wide of the mark. “They aren’t Corbynites either, but they are much more centre left in their proposition than either the Financial Times or the liberal consensus would have us believe,” says McBride, now managing director at political consultancy ForeFront Partners. “If that’s correct, then we’re headed for a Labour government that will be more left-wing and more radical than any we’ve had since the 1970s.”

For a glimpse of what that might look like, turn overseas. From North America to New Zealand, left-wing political parties in advanced economies are beginning to reckon with flaws in the typical “tax and spend” economic model. A key pillar in US president Joe Biden’s fiscal policy is known as “modern supply- side economics”, an overhauled version of the credo made famous by former president Ronald Reagan and his British counterpart Margaret Thatcher. Both sought growth via tax cutting and deregulation.

Modern supply-side economics, by contrast, incentivises labour force participation, research and development, infrastructure and climate change mitigation, with an eye on longer-term structural problems such as inequality, US Treasury Secretary Janet Yellen said in the 2022 speech in which she coined the term.

Progressive governments in other advanced economies would like to follow suit, including Labour, according to McBride. While their plans “aren’t yet codified”, he says, their application of modern supply-side economics could mean anything from a universal offer for childcare to drive up labour market participation at the less contentious end of the spectrum, right up to something as ambitious as Biden’s Inflation Re-duction Act.

“It would represent a much more activist, interventionist industrial strategy,” he says. “This is bread and butter European socialism, but it would be a break with the neoliberal consensus that we’ve had.”

Levelling up

Their ambition will be limited by what’s popular and what’s possible when it comes to public finances. Tackling wealth inequality will remain a priority, but Labour’s methods are likely to focus more on curtailing runaway asset prices by increasing housing supply, for example, rather than raising taxes on the wealthy. Curtailing the dominance of London by levelling up the rest of the country will retain cross-party support, and McBride suggests we will see greater levels of devolution, though this is a multi-generational project.

So are Starmer and Reeves also “intensely relaxed about people getting filthy rich”? Probably not, but the pair are realists and have a good grasp of what’s possible, according to McBride.

“In an ideal world they would want to tax more, particularly the rich, but they’re smart enough to know that would cost them the election, and despite the instinctive politics, the world is a complicated place,” he concludes. “The UK is in a pretty tough position for lots of reasons, and it would be too risky both politically and economically to go down that route.”

Geneva. Back to basics

The Swiss banking industry, so long a byword for security and stability, must work to regain momentum and restore its reputation

On Saturday October 1 2022, an ABC news reporter tweeted that a major international investment bank was “on the brink”.

It was the beginning of the end for Zurich-based Credit Suisse. Buffeted by repeated scandals, shares in the bank were already down 60% over the course of the year. By Monday lunchtime there had been more than 6,400 retweets and 28,000 likes, according to the Australian Financial Review. Customers began pulling their funds.

Six months later and almost 6,000 miles away, chat groups packed with well-connected venture capitalists began speculating that Silicon Valley Bank, headquartered in Santa Clara, California, might be insolvent. The subsequent contagion reverberated back to Zurich, where Credit Suisse depositors had already pulled SFr67 billion during the first three months of the year. Both institutions would collapse within the month.

Money on the move

“In both cases, we realised how quickly people can decide to move their money,” says Angela Gallo, a senior lecturer in finance at Bayes Business School. “A critical factor in the failure of Credit Suisse was the fact that a lot of their deposits were with very wealthy clients, and wealthy clients tend to be quite dynamic, so they leave very quickly.”

This poses a challenge for key wealth hubs such as Geneva and Zurich, which rely disproportionately on highly mobile wealthy individuals. Switzerland commands more than a fifth of the world’s cross-border wealth management, making it a larger overseas wealth hub than Singapore or Hong Kong. Switzerland’s deep pool of financial talent, its proximity to the rest of Europe and the diversification provided by the Swiss franc have long been a draw for investors. However, those factors are dwarfed by a reputation for secrecy, security and stability that has been centuries in the making.

“People come from all over the world to put down roots in a place perceived as safe and stable from an economic, political and personal perspective,” says Alex Koch de Gooreynd, Knight Frank’s Head of Residential Sales in Switzerland. “If you’re from a place where life is a little less secure and the rule of law is less of a factor for political leaders, the Swiss offer is hugely attractive.”

Slowing growth

That reputation has already been shaken by scandals and a steady erosion of secrecy rules as both US and EU authorities seek to clamp down on tax evasion and money laundering.

The Swiss wealth management industry has grown at a slower rate than rival Asian centres for several years, and Hong Kong is likely to overtake Switzerland as the leading centre of cross-border wealth management in 2027, according to a 2023 forecast by Boston Consulting Group (BCG).

Granted, this is partly a consequence of economic pressures impacting the wealth management industry across western Europe and the rapid growth of private wealth in Asia. But Swiss regulators know they must repair reputational damage and prevent further bank runs if the industry is to regain momentum.

The subsequent takeover of Credit Suisse by UBS in March “changed the perception of the Swiss banking industry,” says Gallo, who believes the reliance on wealthy depositors, once considered among its greatest strengths, is now seen by regulators as a weakness.

“We would normally think that banks’ deposit base is made up of retail investors like you and me, but it’s not true anymore,” she says. “For many, super-rich individuals or corporations with big accounts play a much bigger role. The growing importance of wealth management has real implications for bank stability.”

Safety in the long run

The Swiss National Bank and the Swiss Finance Ministry are now conducting a review of the country’s banking rules, part of which will seek to address the flighty nature of wealthy investors who played a role in the demise of Credit Suisse. Measures being discussed include an option to stagger a greater portion of withdrawals over longer periods of time, imposing fees on exits, or rewarding clients who tie up their savings for longer with higher interest rates, Reuters reported in November. A report is due out in spring 2024.

By paying SFr3 billion for Credit Suisse and assuming up to US$5.4 billion in losses, UBS CEO Ralph Hamers told reporters that his bank was “defending the reputation” of the Swiss banking industry. Initially, investors gave the takeover a lukewarm reception for creating what was perceived as “a weaker giant”, Gallo says, but if the deal manages to assuage fears among over-seas investors about the safety of their funds in the long run, it is likely to be regarded as a major success.

“Overseas clients with funds in Switzerland must fall back on the history of the banking industry and the fact that it’s dominated by very large players, because that gives them the reputation they need,” Gallo says. “With secrecy comes some uncertainty about what will happen to your funds, so the reputation of the banks is everything.”

Milan. Filling the gap

A new tax regime is drawing UHNWIs to Italy: now its main wealth hub needs the prime housing stock to keep them there

For decades, the world’s billionaires have snapped up mansions overlooking Lake Como and secluded Tuscan farmhouses to use as getaways from their lives in London, Geneva and New York.

But while most are used to packing weekend bags, increasing numbers of UHNWIs are purchasing handsome Milanese penthouses to use as primary residences, lured by generous tax incentives.

A tax regime allowing non-domiciled Italian residents to pay an annual flat tax of €100,000 on foreign income lies at the core of the surge. Family members can take part for an additional an-nual €25,000 fee. Just 98 people took advantage of the scheme when it was introduced in 2017, a figure that rose steadily to 549 by 2020 before more than doubling to 1,339 in 2021, according to official figures analysed by The Guardian.

The system “has been a great success and it’s still very much in its growth phase,” says Roberta Crivellaro, partner and head of the Italian practice at law firm Withersworldwide. “More and more clients are asking about Milan because they’ve seen that this measure has been kept in place since 2017, so the initial scepticism has now passed away.”

Public support

Indeed, the scheme has survived five prime ministers and enjoys broad public support in a country reliant on tourism, Crivellaro says. That stands in contrast to so-called non-dom schemes elsewhere, most notably in London, which have attracted the ire of residents fed up with public displays of wealth inequality. The UK’s Labour Party has pledged to reform that scheme if it wins power in an election likely to take place this year (see page 21).

Italian prime minister Giorgia Meloni views the scheme as part of a broader plan to cut taxes in order to boost investment. In October, Meloni announced €24 billion in tax cuts and pledged to raise public sector pay throughout 2024 despite rising pressure on public finances. State interest payments have ballooned as rates have risen.

Italy has long had the culture and weather to attract the world’s wealthy. Milan is the country’s main wealth hub, connected by two airports and within easy reach of the Alps, Lake Como and the beaches of the Ligurian coast. High taxes were once viewed as a key barrier preventing overseas investors settling over the long term, but as the scheme has grown more successful a new challenge has emerged: a lack of suitable prime housing.

“Milan just doesn’t have the assets that these clients are looking for,” Crivellaro says. “Milan would be their first destination if they could find houses like those you might see in London, but they can’t, so they go to Como or Florence.”

“There are certain industries, such as fashion, furniture and finance, where being in Milan really makes sense, but it has got some way to go before it can offer the lifestyle of other hubs”

Pressure on housing

Milan’s population has climbed 10% during the past decade, putting pressure on both ends of the housing ladder. Average house prices have climbed from €3,883 per sq m five years ago to a November 2023 high of €5,345. In central Milan, prices can typically run as high as €10,466 per sq m.

“The vast majority of prime properties lie in existing structures, so unlike a lot of markets in the world Milan’s property market isn’t driven by new build,” says Bill Thomson, Italian Network Chairman at Knight Frank. “Supply comes through via the redevelopment of existing buildings, and those that do come available are often purchased by local developers who have spent tens of millions buying apartments for the rental market.”

Without the stock, billionaire purchasers tend to opt for an apartment in Milan and a trophy property to live in within easy reach of the city, Thomson and Crivellaro agree. That will limit Milan’s potential as a regional wealth hub as property purchasers spend time in more secluded locations rather than splashing out in the city as the government would like.

“Sometimes these billionaires do not live the idea of communities,” Mayor Giuseppe Sala said in an interview with Bloomberg TV in October. “They are happy here. They live in a very vibrant city and in an easy city because it’s not so big. But we would like to have a sort of give-back from them.”

Some of these issues will be solved in time. The supply of prime homes is picking up, though they are still not of a calibre to compete with the great wealth hubs of Europe, Crivellaro says. Upmarket restaurants and private members’ clubs are also proliferating.

A branch of restaurant SUSHISAMBA will open during 2024 as part of the redevelopment of the historic Torre Velasca by Hines, for example.

“There are certain industries, such as fashion, furniture and finance, where being in Milan really makes sense, but it has got some way to go before it can offer the lifestyle of other hubs, and particularly other parts of Italy,” says Thomson. “People want to enjoy their lives as well as save money, and for that, the rest of Italy has the best the world has to offer.”

Hong Kong and Singapore. Rich pickings

Over the five years to 2028, Asia’s wealthy population is set to grow faster than any other region in the world

The rate of growth – equivalent to around 35 new UHNWIs each day – will bring the total to about 230,000, almost 40% larger than it was in 2023. At that point, only North America will boast a larger community of ultra-wealthy people, but at current rates of growth, it won’t be long before Asia takes the crown.

Competition to host Asia’s newly minted wealthy is hotting up, with Hong Kong and Singapore leading the charge. Singapore has utilised tax incentives and a business-friendly regulatory regime to encourage 1,100 family offices managing more than US$4 trillion to move to the city-state, up from about 100 less than a decade ago.

Dominant player

Hong Kong has long been the region’s dominant wealth hub. The city’s wealth management industry posted the fastest growth in assets under management in the five years to 2022 until “the winds changed” and some wealthy individuals began moving funds to Singapore, BCG said in a 2023 report. The authorities responded with a set of incentives aimed at family offices and residency for people investing at least HK$30 million into the city.

“Hong Kong is very good at reinventing itself, and it has obviously seen what it perceives as the success of Singapore’s family office regime,” says Jeffrey Lee, partner and head of the Singapore office at law firm Charles Russell Speechlys.

Though family office numbers have risen in Singapore, the link to direct spending and investing is not clear cut. Last summer, the Monetary Authority of Singapore (MAS) tweaked the incentives on offer to encourage family offices to invest in the country’s equity markets, including those aimed at encouraging investment in local climate-related projects, for example.

“Singapore is seeing success in attracting emerging wealth from Indonesia, Thailand, Malaysia and Vietnam, while Hong Kong will always be the dominant hub for wealth created in the Chinese mainland”

Family office arrivals have had little impact on the residential property market either, according to MAS officials. The challenge for the city is to encourage these private institutions to put down deeper roots – which should lead to more widespread investment.

Despite these challenges, the wealth management industry is likely to swell rapidly. Financial wealth booked in Singapore is expected to grow at a rate of 9% through to 2027, according to BCG.

That will place it in the top three wealth management hubs globally, behind Hong Kong and Switzerland.

Hong Kong’s family office community is about 400-strong, and the city has ambitious plans for growth, with targets for a further 200 by 2025. In October last year, a policy announcement con-firmed an investment migration programme that will encourage wealthy individuals to invest at least HK$30 million in local stocks or other assets. The Capital Investment Entrant Scheme is likely to be open from the middle of this year onwards, and will have a central role in bolstering Hong Kong’s wealth management industry.

Experts are generally bullish on Hong Kong’s prospects. Indeed, the rate of regional wealth creation is so significant that Hong Kong and Singapore are each strengthened by the success of the other, according to Charles Russell Speechlys’ Lee. Singapore is seeing success in attracting emerging wealth from Indonesia, Thailand, Malaysia and Vietnam, while Hong Kong will always be the dominant hub for wealth created in the Chinese mainland.

Inviting investment

Indeed, the success of Hong Kong as a wealth management hub hinges less on the performance of Singapore than it does on the expansion of the Chinese economy and its ability to at-tract wealthy individuals from the mainland. China’s economic growth is likely to slow to 4.5% in 2025, down from 8.4% in 2020, according to World Bank forecasts. Those growth rates are still likely to be enough to help propel Hong Kong to becoming the world’s dominant wealth management hub by 2027, taking Switzerland’s crown, according to BCG.

The key question for both Singapore and Hong Kong will be the degree to which either manages to implement a regulatory structure that encourages real investment in the local economy, ac-cording to Lee.

“Most governments would want these sorts of regimes to be created with one key focus in mind, which is to invite investment into the country,” he says. “Will either be able to attract the ‘real’ family offices as we know it – families that need some sort of infrastructure around their wealth? I think the jury is still out on that.”

Miami. Going up – and up

Even billionaires struggle to get a slice of the South Florida waterfront

Fresh from selling his fashion brand to Estée Lauder for US$2.8 billion, Tom Ford spent US$51 million for a Palm Beach estate in December 2022, a record for a so-called “dry” property on the island.

The South Florida property market “was already on an upward trajectory in 2020, but the pandemic took us to outer space,” says Bill Hernandez, a real estate agent at Douglas Elliman in Miami.

“If people have to spend that kind of money to not be on the ocean, then good gracious, what does that tell you about where we’re headed? ”Wealthy individuals have long flocked to Florida for its weather, lifestyle and political and economic stability. Miami is known as the “capital of Latin America” and is arguably the region’s most dominant financial hub, despite not being part of it. Seven in ten residents identify as Hispanic or Latino, according to the US Census Bureau.

On the move

A new dynamic has emerged since the Covid-19 pandemic. Large companies and wealthy individuals who were once tethered to dominant US economic centres such as New York or Los Angeles have moved to Florida in increasing numbers, citing attractive tax rates, perceptions of higher crime in their former bases and the success of remote working.

In South Florida, foreign driver licence exchanges increased 78% in the first nine months of 2023 compared with the same period in 2022. Of the out-of-state applicants arriving in south-east Florida during the first half of the year, 24% were from New York, 10% from New Jersey and 8% from California, according to the Miami Association of Realtors. Feeder states such as Texas, Georgia, Virginia, Maryland and Ohio are also increasing their market share.

Financial institutions such as Citadel, Elliott Management and Point72 Asset Management have all either moved their headquarters to or expanded in Florida. Citadel founder Ken Griffin cited Chicago’s crime rate as key to its move, suggesting safety risks had made it difficult to recruit into the firm’s Windy City office. In 2023, Amazon founder Jeff Bezos purchased a US$79 million seven-bedroom mansion along with the neighbouring US$68 million plot of land in Miami’s Indi-an Creek, an island known as the “Billionaire Bunker”.

“Miami has come on strong as a corporate destination and the culture has become dramatically more sophisticated, which is attracting decision-makers from all over the world,” says Peter Bazeli, Principal and Managing Director at real estate consultancy Weitzman. “It still has a long way to go if it’s ever going to truly compete with the likes of New York, because of the sheer numbers. You still don’t have that critical mass of employment – but it has momentum.”

“In South Florida, foreign driver licence exchanges increased 78% in the first nine months of 2023 compared with the same period a year ago”

Getting real

Annual house price growth in Miami has cooled from a peak of 37.2% in May 2022 to 6.5% in the year to December, according to the Knight Frank Prime International Residential Index (see page 32). The market calmed as buyers began to resist the lofty demands of sellers, says Doug-las Elliman’s Hernandez. “Some sellers were still at crazy elevated prices, but these buyers can respond by staying in New York or Beverly Hills,” he says. “Now sellers are starting to get real and we saw some really big sales occur through 2023.”

Elevated house prices aren’t the only headwind. Florida, like many emerging wealth hubs including Milan, have enjoyed rapid growth since the onset of the pandemic. However, their success is putting strain on resources and infrastructure, whether it’s a lack of available land, or a shortage of schools that perform at levels that wealthy families expect if they are to move from cities such as London or New York.

Gulliver Preparatory School in Miami has seen record applications for each of the past four years, the school told Forbes last year. Pine Crest School said a surge in interest began in March 2020, which it put down to “the rise in corporate remote work arrangements, and the attractive cost of living and quality of life in South Florida.” Avenues, one of New York City’s most elite schools, is set to open in Miami from 2025. Places are likely to cost US$50,000 a term.

“Some people hesitate to transition down here because we simply can’t match the level of education on offer in New York,” Hernandez says. “When they do make the move, there’s a big competitive market to get their kids in to the handful of private schools that we have.”

Competition for land is almost as fierce, particularly on the waterfront, according to Bazeli. That’s impacting the feasibility of new residential projects. “Anywhere on the ocean in Miami Beach, even up all the way to Bal Harbour, you can underwrite residential projects at as high as US$5,000 or more per sq ft,” he adds. “It just depends on the scale and the massing of what you can build.”

Trading up

Tom Ford has traded up since his December 2022 purchase. Last year, the designer upsized by swapping houses with Brian Kosoy, CEO of private equity real estate firm Sterling Organization, the Palm Beach Daily News reported at the time. Ford now resides in a 17,424 sq ft, five-bedroom mansion at 195 Via Del Mar in Palm Beach – a two-minute walk to the water.

Demand may have cooled in the broader market, but billionaires such as Ford will continue to fight for the best spots because many of the trends that have supported Florida’s post-pandemic growth are firmly entrenched, Hernandez says. “I think by the end of 2025 and through 2026, South Florida real estate from Palm Beach all the way down to Coconut Grove will be one of, if not the most expensive real estate market in North America,” he concludes. “I’m convinced of it.”

New York City and Los Angeles. On brand

From the east coast to the west, long-held perceptions of luxury are being challenged by a new breed of branded developments

From “The Fresh Prince of Bel Air” to “MTV Cribs” and “Selling Sunset”, the film and TV industry has long promoted the Los Angeles mansion as a global symbol of American wealth.

But for a small and growing number of wealthy residents moving to the city in search of the California dream, these opulent homes, at times reaching in excess of 100,000 sq ft, are no longer the only option. Indeed, across major US cities including New York and Miami, an increasing focus on security and convenience is bringing full-service buildings and branded residences to the fore. In Los Angeles, city authorities are seeking to promote higher-density, mixed-use developments to lock in what it sees as more sustainable growth.

“Los Angeles has always been about the mansion, but the city has so much potential precisely because of the fact that it’s still really very much in the early stages of higher-density, mixed-use types of development,” says Peter Bazeli, Principal and Managing Director at Weitzman.

“I think that there are some really exciting things to come from an urban planning perspective if the city does begin to diversify away from the mansion housing stock that makes up the luxury market there.”

The prime housing market is recovering from a downturn sparked by the sharp increase in borrowing costs and the implementation of the so-called “mansion tax” in 2023. The 4% levy on property sales above US$5 million rises to 5.5% for US$10 million-plus sales. While authorities expect almost 40% of revenue to come from sales of single-family homes, the levy also applies to apartments and commercial buildings. Prime residential values in Los Angeles climbed 2.5% in 2023, according to our Prime International Residential Index (page 32). Knight Frank expects growth to cool to 1% over the course of 2024 with rising supply as lower mortgage rates encourage owners to sell.

Safety first

A set of Aman Branded Residences in Beverly Hills, due to open in 2026, provides a glimpse of the competition. The homes will sit alongside an Aman hotel and club, within eight acres of botanical gardens on the 17.5-acre One Beverly Hills development, less than a mile from Rodeo Drive.

The Aman residences are part of a rapidly expanding global market of branded residences that cater to wealthy individuals seeking the benefits of ownership while wanting the services of five- and six-star hotels. There are now 186 operational schemes globally and another 138 are in the pipeline, according to Knight Frank Research. North America accounts for nearly 40% of total projects and 60% of the pipeline.

Meals cooked by Michelin-starred chefs are a big part of the appeal, but safety is now among the primary draws, brokers say. Though official statistics show incidents of violent crime are at or close to historic lows in both New York City and Los Angeles, perceptions don’t always match reality. Three-quarters of New Yorkers said crime was a “very serious” problem in a February

Quinnipiac University poll, for example, the highest number since researchers first asked the question in 1999.

Experts put the disconnect down to social media and high-profile campaigns on crime from political leaders. Wealthy buyers – including those coming from overseas – are well-connected enough to pick up on the concerns.

“Safety and property taxes are generally among the first questions from purchasers, but both tend to be outstripped by the degree to which people want to come here, do business and enjoy everything else that New York has to offer,” says Hugh Dixon, Head of the US Private Office at Knight Frank.

“Los Angeles has always been about the mansion, but the city has so much potential precisely because of the fact that it’s still really very much in the early stages of higher-density, mixed-use types of development”

“The challenge for developers with schemes in the pipeline will be to ensure what’s on offer matches local definitions of luxury and provides a strong enough connection between the brand and the physical space to justify the prices charged”

Growing pains

Nevertheless, there appears to be a swelling group of wealthy buyers – particularly the newly minted younger generation – who want to be in downtown locations while enjoying the best services and security available.

“The trend in Los Angeles is into full-service buildings,” says Cory Weiss, a broker at Douglas Elliman’s Los Angeles office. “I’m seeing buildings that used to predominantly have older people in, and a lot of the younger people are moving in for the safety and convenience. I’ve had two clients buy second homes here in the past year and they bought in full-service buildings be-cause of the safety and security. I’m just seeing more activity from people considering these building that generally wouldn’t have in the past.”

To be sure, some experts say luxury multi-family homes and branded residences pose little threat to the dominance of the mansion, whether in Los Angeles or elsewhere. The branded residences market is tiny by comparison, and there will always be a large slice of the expanding wealthy community that favours the space and seclusion offered by single-family properties on the outskirts of cities.

Indeed, the branded residence market has experienced growing pains. The premiums are so attractive to developers that poorly conceived schemes have been introduced, resulting in sluggish sales, says Bazeli, whose firm consults on about 80 branded residence developments each year. The challenge for developers with schemes in the pipeline will be to ensure what’s on offer matches local definitions of luxury and provides a strong enough connection between the brand and the physical space to justify the prices charged.

“As the sector evolves, buyers will become even more demanding and better educated, and they will need clear answers as to what each development is really offering to back up the premium prices being marketed,” he concludes.

Download the full report here