Female artists artwork continues to rise in value

A new generation of buyers acquiring art in different ways is helping bring greater equity to the market. Sebastian Duthy from Art Market Research examines the figures.

5 minutes to read

This update comes from the Luxury Investments report from The Wealth Report Series, giving high-net-worth-individuals a guide to investments of passion.

Despite a growing number of female artists creating highly distinctive works from the beginning of the 20th century, a recent report by Julia Halperin & Charlotte Burns reveals that just 3.3% of all auction sales between 2008 and mid-2022 were by women.

However, costs are continuing to rise. Art Market Research’s (AMR) index of 100 women artists reveals that the greatest period of growth was between May 2016 and May 2019.

Rising 70% over the three years, the shift coincided with the powerful social change movements, #MeToo and #BLM. Following the Covid-19 lockdown, average values accelerated once again with a rise of 30% in just one year.

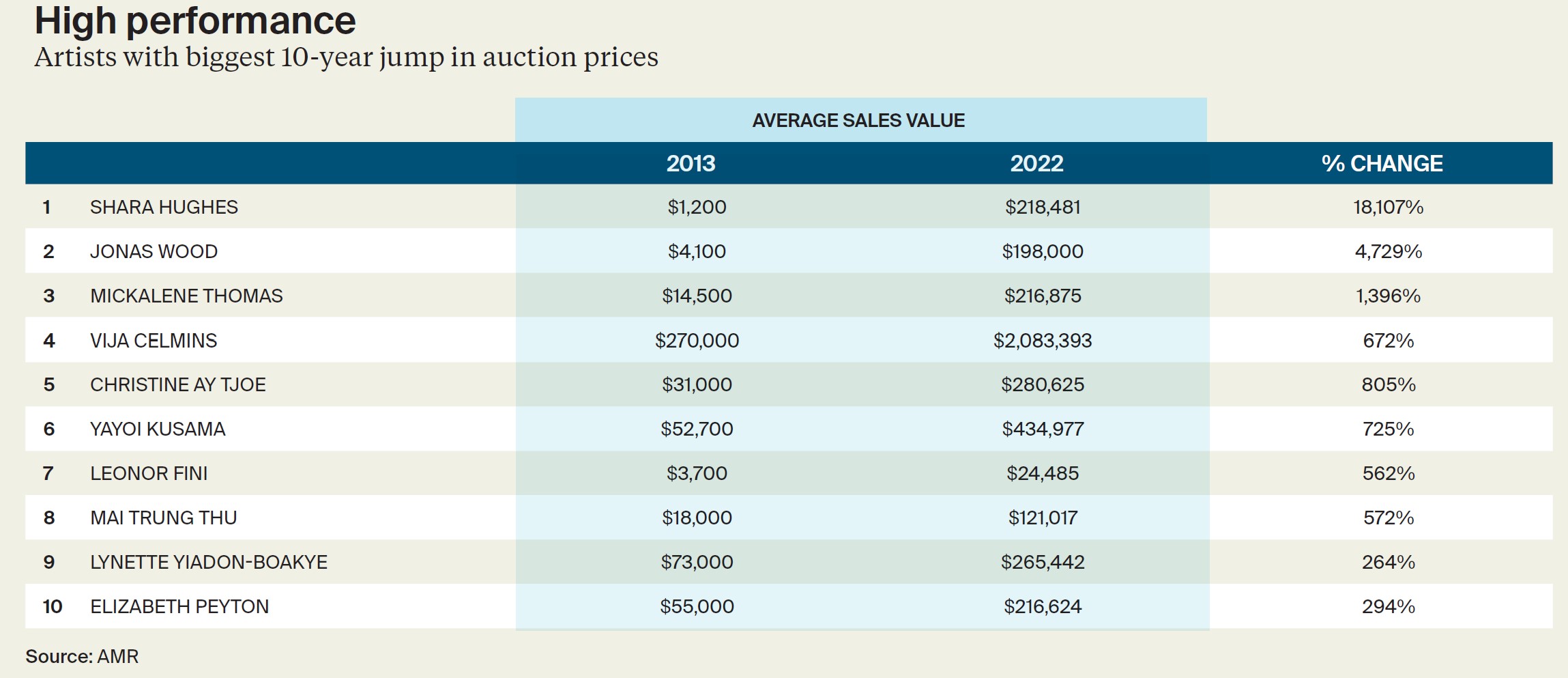

In a leader board of individual artists whose works have grown in value the quickest over the past 10 years, eight were women, of which seven were living artists.

Hey you – Portrait of Jessica by Mickalene Thomas. Sold at auction by Phillips New York in 2021 for US$1,542,000

The American artist Mickalene Thomas sits near the top of our leader board and her works such as Racquel Reclining Wearing Purple Jumpsuit, which was sold by Christie’s in 2021 for US$1.8 million, and Portrait of Jessica (above) address race and gender issues. Works by the artist can now be found in world-leading institutions such as MOMA and The Guggenheim.

Olivia Thornton, Head of 20th Century & Contemporary Art for Europe at Phillips, which has handled three of the artist’s five most expensive auction sales, explains Mickalene’s growing popularity.

“She is an influential artist known for her distinct aesthetic languages in contemporary visual culture. Her mixed media works explore the complexities of black and female identity and experiences, and she is a source of inspiration across art, culture, and fashion, including collaborating with Dior earlier this year.”

Gender gap

Looking forwards, we analysed the number of younger male and female artists coming to auction in 2022 and found:

- Around one third (32%) were women

- Living artists whose works broke an auction record in 2022 – 40% were by women

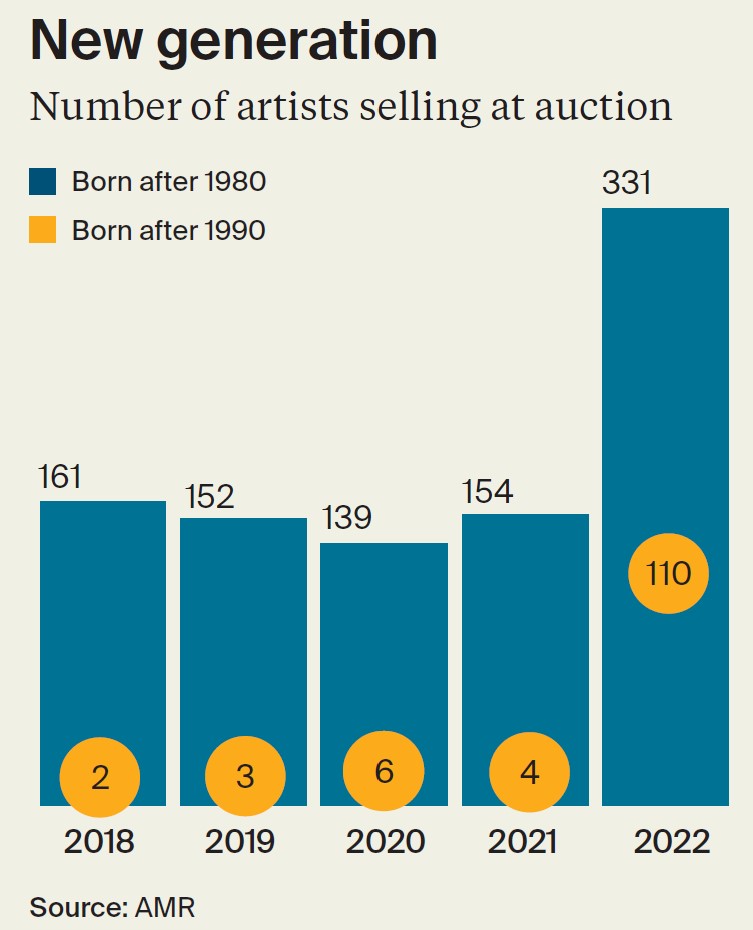

In the past few years, the number of living artists whose work appears at auction has continued to rise as gallerists and auction houses respond to increasing demand.

A survey of the ages of artists at major auction house sales reveals that the number of artists born after 1980 has increased dramatically.

Buying art online

The appearance of so many young artists at auction comes at a time when younger and younger collectors are participating in auctions through online channels. It makes sense that collectors should want to invest in pieces that speak directly to them, but it’s also evidence of a shift in the way artworks are consigned to auction.

" AMR’s index of 100 women artists reveals that the greatest period of growth was between May 2016 and May 2019 (+70%), which coincided with the #MeToo and #BLM movements."

Traditionally gallerists ‘placed’ artworks with collectors who could be relied on not to flip them within months. As the collecting landscape changes, however, mega galleries like Hauser & Wirth, Gagosian and Almine Rech, have become more pragmatic in their approach to selling.

Today, these vendors are adapting to a market where traditional relationships built over years are being replaced with remote sales to buyers who appear to prefer the anonymity of buying online.

In July, the Antiques Trade Gazette highlighted a report measuring bidders’ attitude to sales with and without an auctioneer revealing online buyers preferred ‘predictable end times’, ‘convenience’ and ‘less pressure’ when choosing timed sales.

The findings of the 5,000 people surveyed indicates these online-only auctions are much more likely to convert new registrants to new bidders than live sales. As marketplace innovations continue to invade the traditional auction market model, we can expect digital behaviour to continue to shape the way art is bought and sold.

But it’s also worth noting that gallerists' practice of catering to current demand instead of acting as arbiters of taste, is encouraging exactly the results many have long feared – that copycat styles will proliferate.

If you go online to see what’s selling now, you will find a higher than usual number of works displaying remarkably similar traits.

Asia-Pacific art market

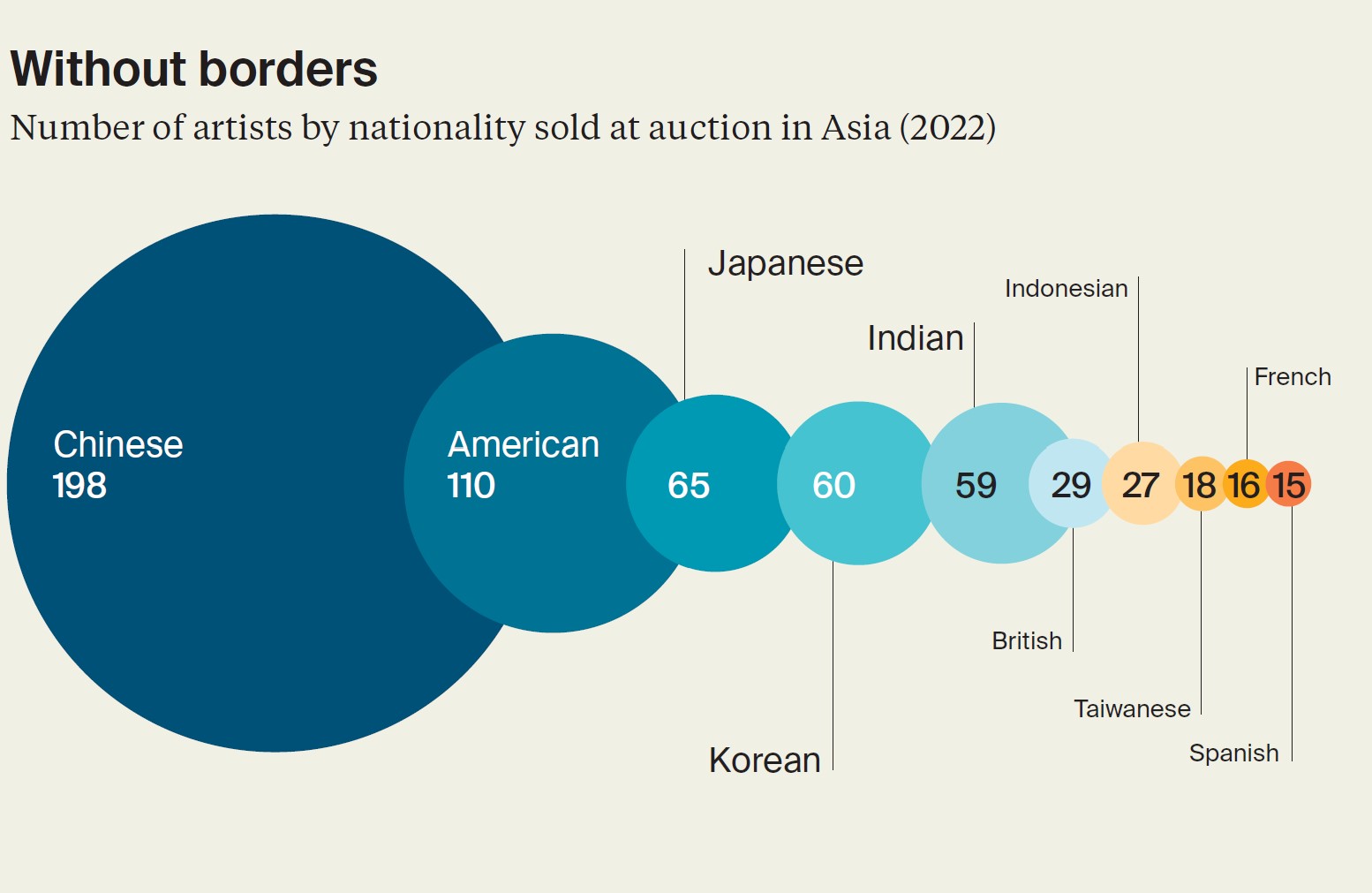

The Asia-Pacific market has been another focus of growth for collectors who have demonstrated their increasing appetite for art following the 2008 financial crisis. As a result, international art businesses have been committed to growing their presence in Hong Kong and are now looking beyond the confines of China.

Frieze, the international art fair, held its first Asian edition in Seoul last year following the recent arrival of a clutch of international galleries in the South Korean capital.

Sotheby’s held its first major auction in Singapore in 2022 and toured some of its works in Vietnam.

Much of the clamour is for the attention of younger bidders made rich by successes in the entertainment, fashion, gaming, fintech and crypto sectors.

When collectors in the Asia-Pacific region first started piling into art 15 years ago, it was almost exclusively for works produced by homegrown talent. A 2022 chart of sales divided into artists’ nationality shows that this appetite has grown to include works by artists from all over the world.

The commitment to growth in Asia is evidenced by the real estate top auction houses are investing in.

Thumbnail image courtesy Christie's

Discover more

Download

Download the full report for a unique guide to the investments of passion collected by high-net-worth-individuals.

Download the report

Subscribe

Subscribe for all the latest insights and additional content from The Wealth Report.

Subscribe