The Wealth Report 2023: top trends and key highlights

This year’s report points to real estate opportunities despite changing investment strategies and economic uncertainty.

3 minutes to read

Inflation and interest rates have never been far from the headlines across the globe as economies reeled from the Ukraine crisis and subsequent energy crunch.

Described as a “permacrisis” global events events lead to a 10% fall globally in wealth in US dollar terms. Despite this, high-net-worth-individuals are still looking to increase their portfolio and a healthy 69% of Attitude Survey respondents expect their clients’ wealth to increase this year.

Here we highlight some of the key findings from The Wealth Report 2023 and delve into the latest wealth trends across the globe.

New investment strategies

As mentioned, 2022 saw a number of shocks that rocked global economies including the Ukraine Crisis, the energy crunch and geopolitical turmoil.

Flora Harley examines why total wealth held by ultra-high-net-worth-individuals shrank by 13.6% during 2022, a drop of some US$13.8 trillion and how investor strategy is shifting.

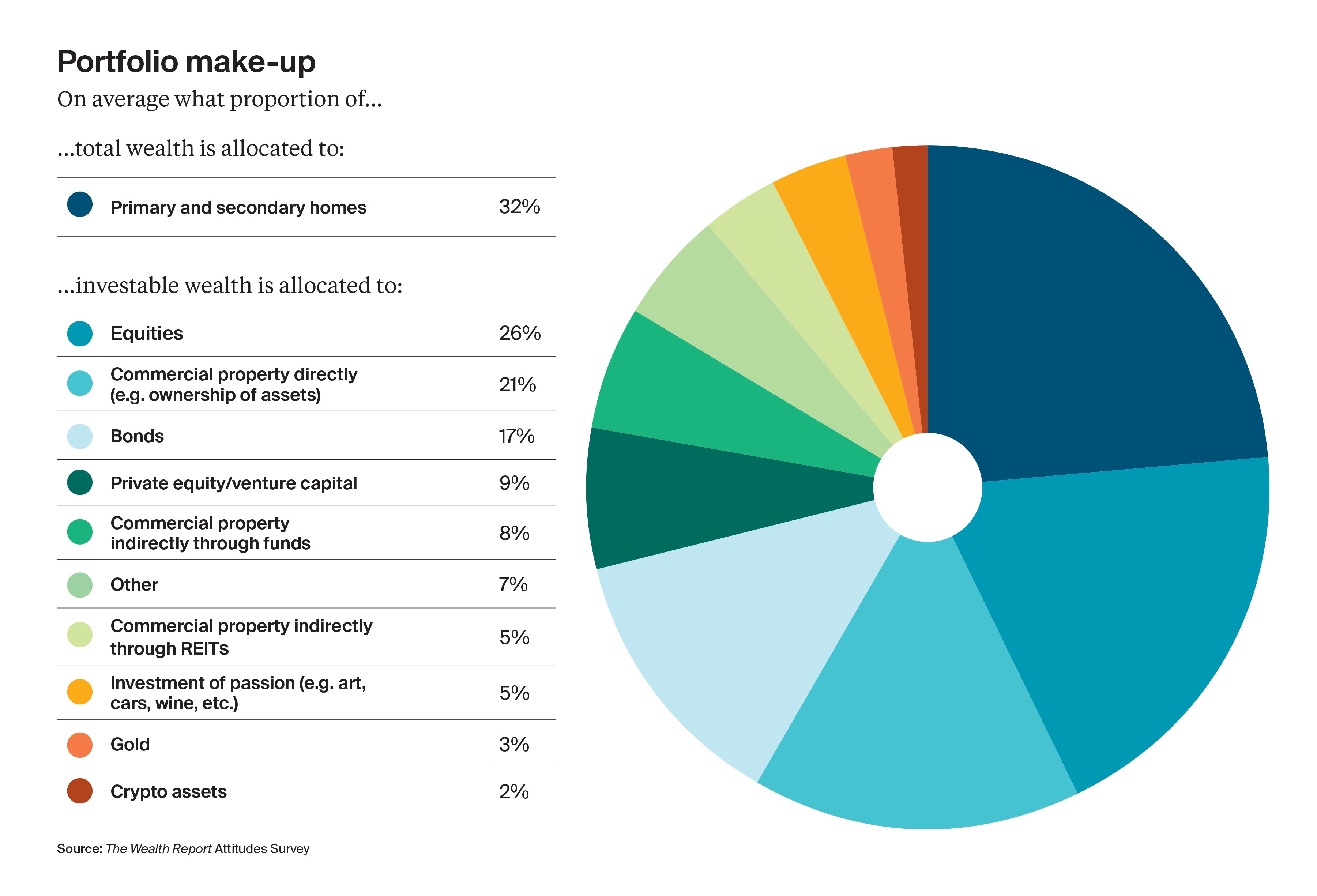

Data from the Wealth Sizing Model allowing the charting of aggregate wealth levels and the Attitudes Survey reveals portfolio allocations with a third of total wealth in residential property, just over a quarter in equities and 21% in commercial property.

Read more

Rise in private capital into CRE

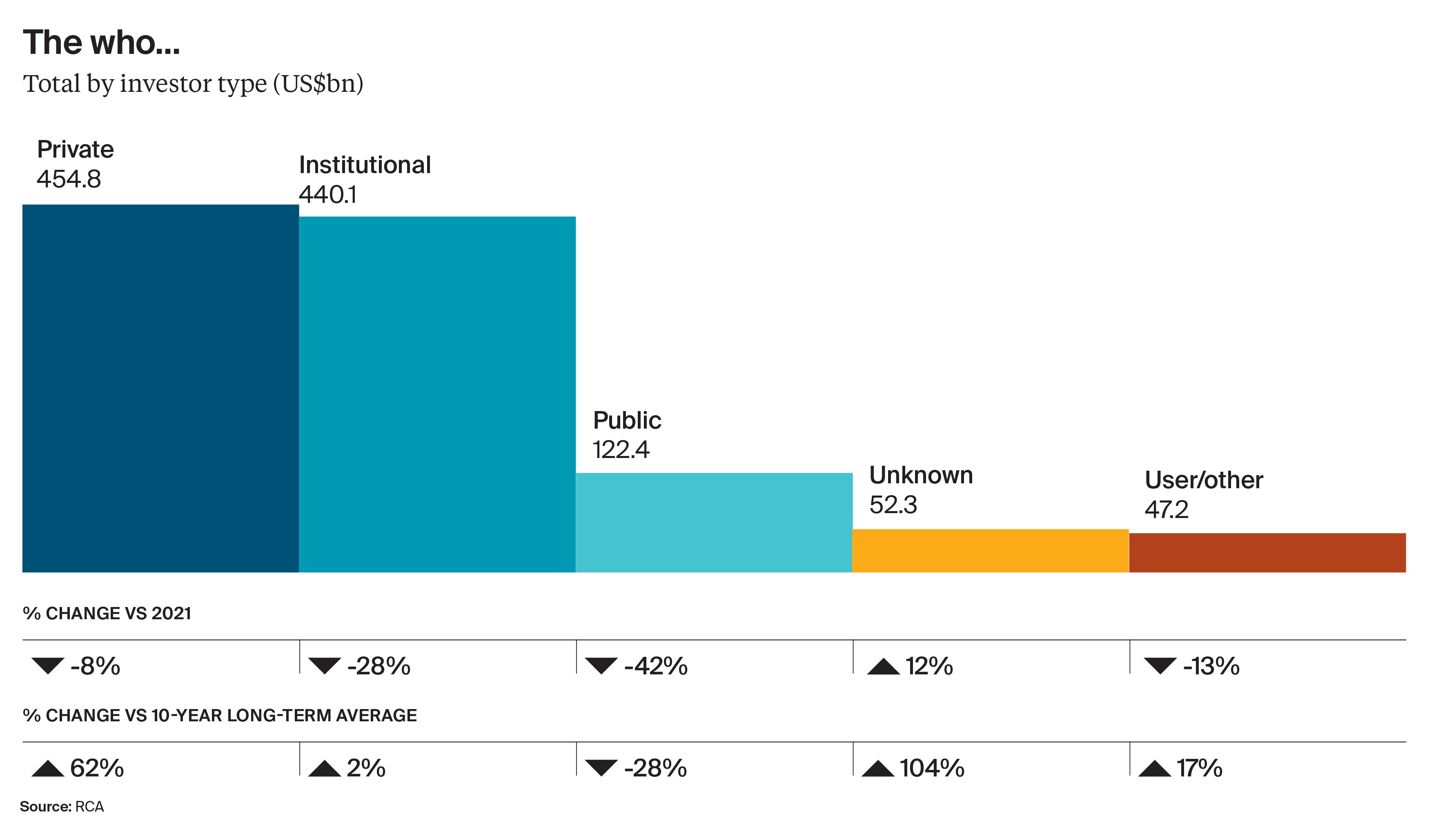

Research from Antonia Haralambous shows that Private investors were most active buyers in commercial real estate (CRE) investment in 2022.

Private investors were the most active buyers in global commercial real estate markets in 2022 with US$455 billion invested, accounting for 41% of the total, according to RCA.

For the first time, private investment surpassed institutional investment in 2022.

Antonia looks further into investment sectors of choice and the top destinations for capital across the globe as inflation begins to bite.

Read more

Prime International Residential Index

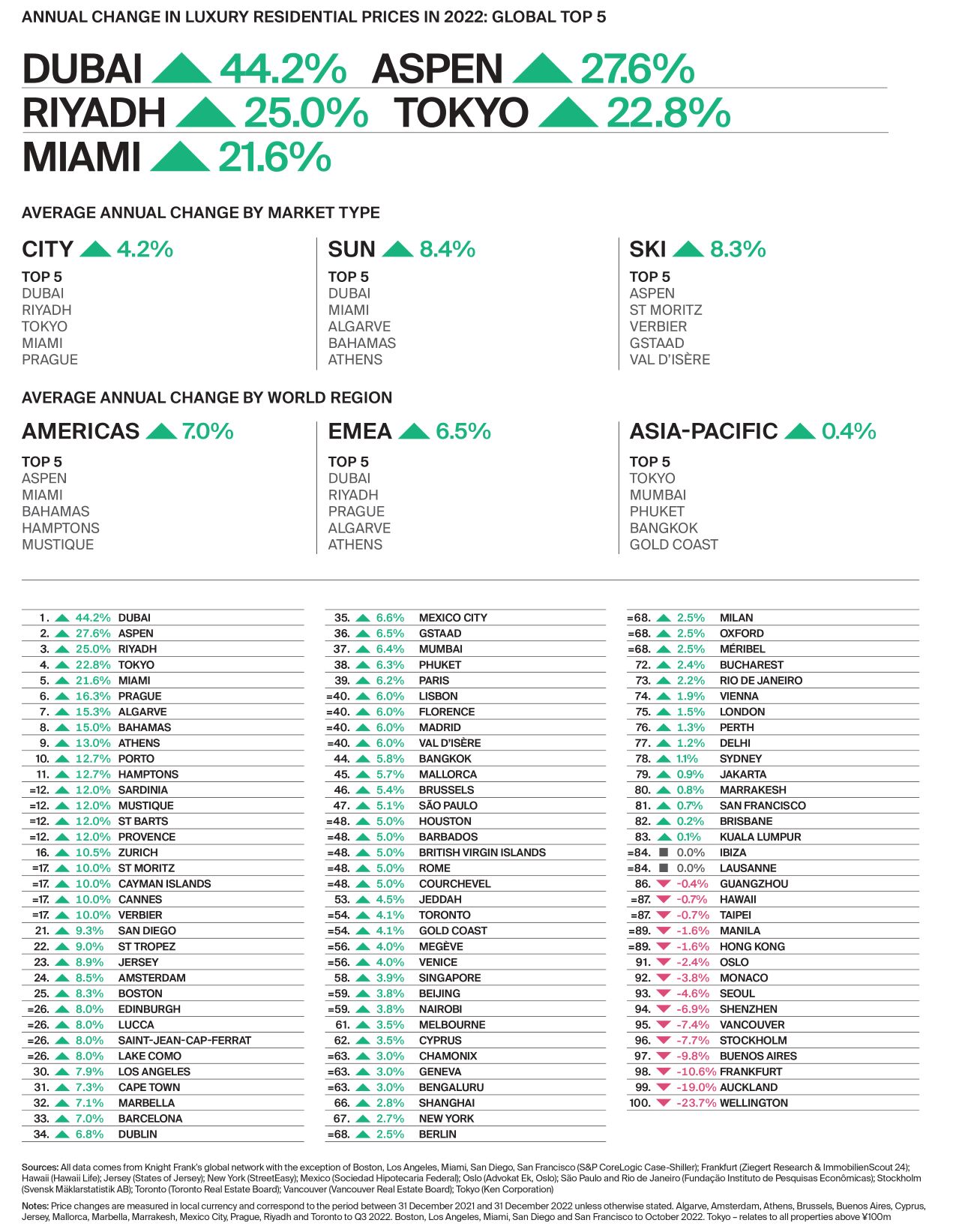

Prime real estate prices continued to rise in 2022 across different regions and markets.

Kate Everett-Allen took the pulse of our unique Prime International Residential Index (PIRI 100), which tracks price performance across 100 key city, sun and ski locations.

With prime prices declining in only 15 of 100 prime markets, the post-pandemic spending boom has continued.

You can download the table and see who the big winners were in 2022.

(Click image below to download and explore in detail)

Read more

Investments of passion

Investments of passion are still riding high despite economic reports, Andrew Shirley details.

The Knight Frank Luxury Investment Index (KFLII), which tracks the value of 10 investments of passion, rose by a healthy 16% during 2022, comfortably beating inflation and outperforming the majority of mainstream investment classes, including equities and even gold.

Art was the top performer in 2022, rising by 29%. Cars and watches also saw a rise of 25% and 18%, respectively.

Whisky had a week performance in 2022, despite being a 10-year leader by +373%, it only saw growth of 3% in 12 months.

Andrew also looks at some of the highest selling assets at auction in 2022 including a US$195m Andy Warhol, Shot Sage Blue Marilyn, 1964 at Christie’s auction house.

(Click image below to download and explore in detail)

Read more

Subscribe for updates

Subscribe for the latest insights from The Wealth Report.