Housing market activity slows

Making sense of the latest trends in property and economics from around the globe

2 minutes to read

Activity slows

Housing metrics spanning new buyer demand, agreed sales and new instructions contracted during November as the market adjusted to higher interest rates, according to the latest RICS Residential Market Survey. Although there are signs the negativity that accompanied the mini-budget has eased.

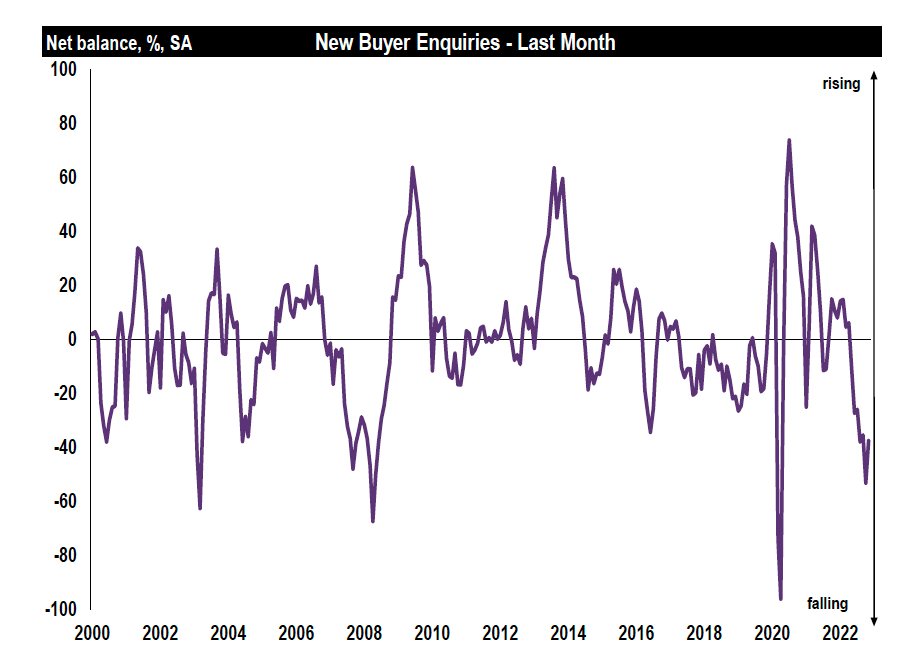

The -38% net balance for new buyer enquiries is the seventh consecutive contraction (see chart) although is notably better than last month's -53%. Supply remains tight, which will put a floor under price falls for now. New sales instructions registered a net balance of -9% and the measure of new market appraisals remains weak.

The cost of fixed rate mortgages continues to ease, as do expectations of where the Bank of England base rate will peak. The latest Reuters poll of economists suggests the Bank will opt for a 50bps hike next week on the route to a peak of 4.25% during Spring 2023.

30-year mortgage terms

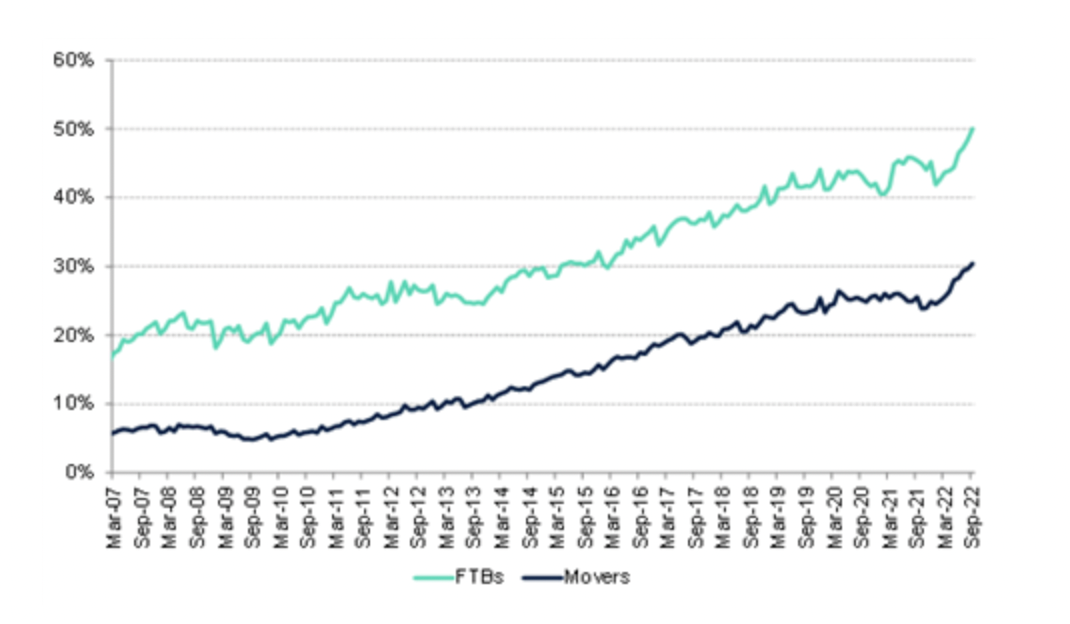

More than a decade of strong house price growth and more recent rises in mortgage rates have left first-time buyers with few choices but to take on mortgages with longer terms.

Half of all first-time buyers that took mortgages during the third quarter opted for terms of more than 30 years, according to new data from UK Finance. That's up from a quarter just ten years ago (see chart).

The average household income of a first-time-buyer mortgage application in Q3 2022 stood at just under £60,000, an increase of 17% compared to the same quarter a year ago. That indicates a shift towards higher income householders entering the market as lower income households get locked out.

In other news...

Bank of Canada says future rate decisions more data-dependent (Reuters), UK labour market loses more momentum in November (Reuters), big cities drive half of global economic growth (FT), one-bed city flats make a comeback (Times), U.S. mortgage rates fall for a fourth week (Bloomberg), and finally, James Dyson condemns UK plan to extend WFH rights (Bloomberg).