New York’s prime price growth hit an eight-year high in 2022

Economic uncertainty and a strong US dollar put New York real estate back in the spotlight.

2 minutes to read

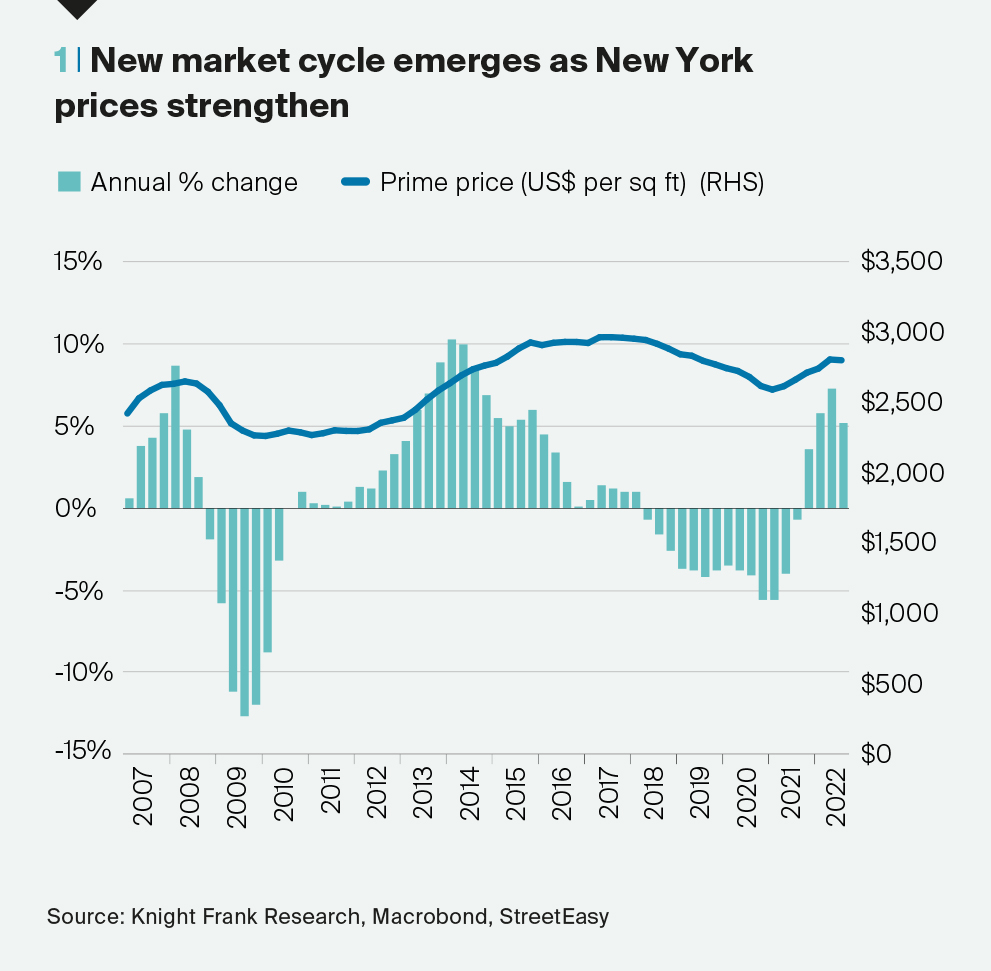

In June 2022, prime prices across Manhattan increased by 7.1%, the strongest rate of growth recorded for eight years.

Although the rate of annual price growth had slowed to 5.2% by September 2022, it remains significantly higher than a year earlier when luxury prices were falling 0.4% year-on-year.

Unlike other US cities double-digit price growth eluded New York during the pandemic.

As we enter a period of uncertainty New York is back in the spotlight as buyers seek a mature, secure, liquid and highly transparent market.

USD appeal

Despite its strength, overseas investors are seeking more, not less, exposure to the greenback in an effort to spread risk and diversify their assets.

The appeal is heightened further for those Asian and Middle Eastern buyers whose currency is pegged to the dollar, meaning they’ll incur no penalty due to the strength of the dollar.

Sales

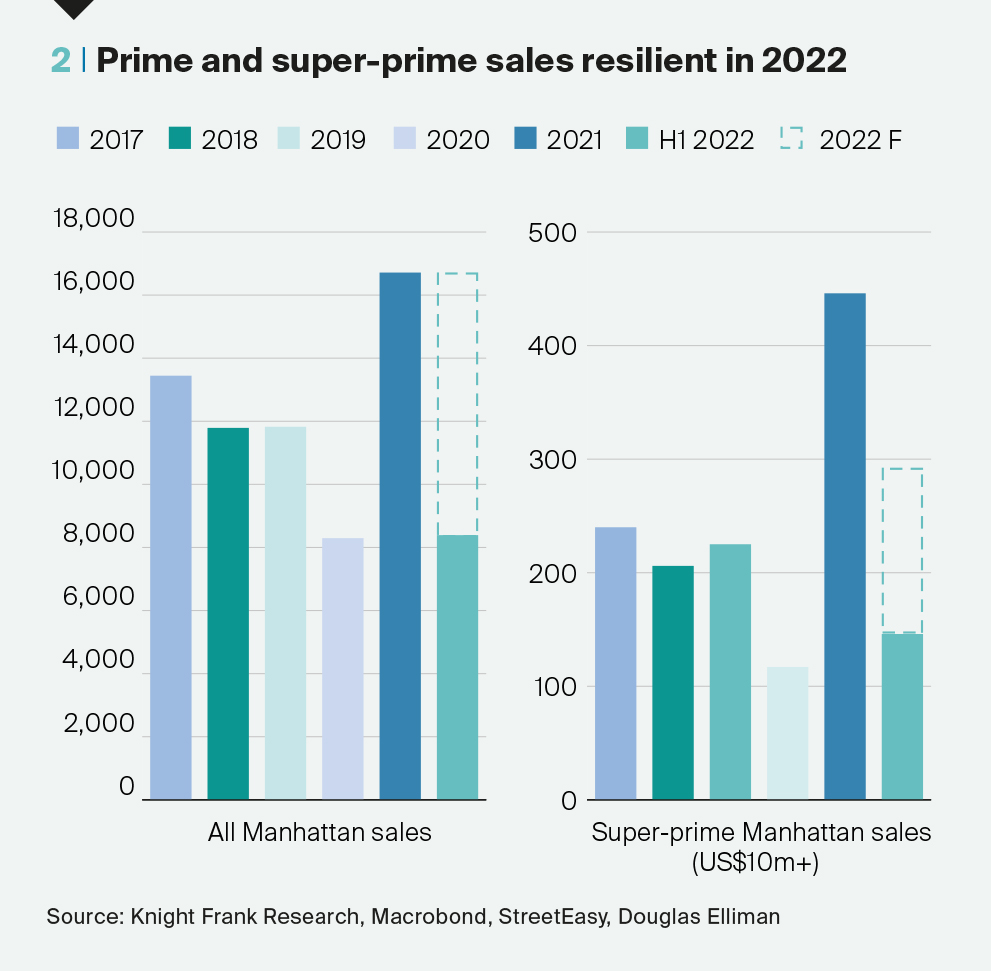

New York recorded strong sales in the first half of 2022. Over 8,300 sales were registered across Manhattan, up from 7,373 in the same period a year earlier.

The super-prime market (US$10 million) displayed similar strength. Some 146 super-prime sales were agreed in the first six months of 2022.

Of the 10 super-prime markets Knight Frank tracks globally, New York’s tally was the highest. Furthermore, 20 of these sales exceeded US$25 million.

Investment

Investors are active too. Boosted by strong demand for rental accommodation from returning office workers and corporate relocations from overseas.

Data tracking subway journeys reveals New York’s ridership reached 70% of pre-pandemic levels in September 2022, compared to just 37% in San Francisco.

Outlook

Nonetheless, rising mortgage costs and inflationary pressures are expected to temper sales volumes in the next 12 months. However, we expect New York’s annual prime price growth to remain in positive territory, boosted by rising global interest and a resilient labour market.

Download the report below to learn more.