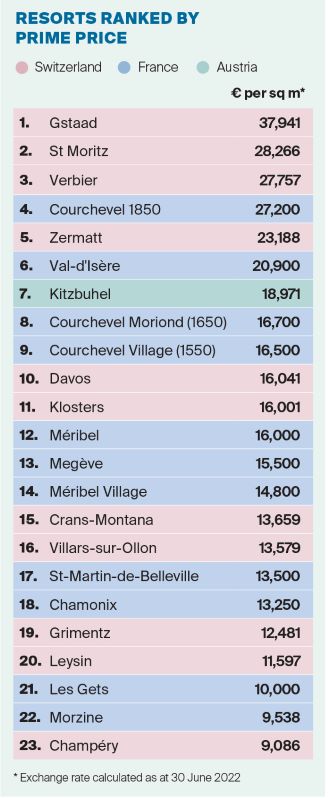

Which Alpine resorts lead our annual rankings for prime property price growth?

The price of a ski home is rising at its fastest rate for eight years, avoiding the long-term effects of the pandemic.

1 minute to read

In 2022, the price of a ski home increased at its fastest annual rate since 2014.

The average price of a four-bedroom chalet across the 23 Alpine markets tracked by the index increased by 5.8% in the year to June 2022, up from 4.6% a year earlier. In total, prime prices in the French and Swiss Alps rose on average by 13.9% during the pandemic.

The Swiss resorts of Crans-Montana and St Moritz lead with the highest levels of growth, both registering an annual increase of 14% in the year to June 2022.

Both resorts offer year-round appeal, long ski seasons and good transport links.

Verbier (8%) has seen a large volume of sales in the last 12 months, due to increased global demand. US and UK buyers were notably active last season.

French Alps

The performance of the French resorts has been largely split by region in the past year. Resorts in the Haute-Savoie region (Chamonix, Megéve, Morzine, Lets Gets), have performed well due to their proximity to Geneva Airport, as well as their year-round appeal and affordability.

The Savoie resorts, by comparison (Val d’Isére, Courchevel, Méribel), display higher market entry levels, meaning they naturally appeal to a smaller cohort of wealthy buyers, seeking the best skiing conditions.

Annual price growth to slow

Over the next 12 months, we expect the rate of annual prime price growth to slow. However, the appeal and affordability of the French resorts will support demand, whilst the safe haven attributes of the Swiss Franc will also appeal. Nevertheless, global economic turbulence will inevitably weigh on buyer sentiment in the Alps, and globally.

To learn more about current alpine market conditions, download the Ski Property Report here.