Planning key to accelerating seniors housing delivery

The UK population is ageing rapidly and there is an urgent need to accelerate the delivery of age-appropriate housing stock.

3 minutes to read

By 2037, it is forecast that one in four people in the country will be over 65.

Local authorities are responding to this, but they are moving at a slow pace. Our latest research, produced in partnership with law firm Irwin Mitchell, found that three-quarters of councils across England are yet to adopt specific planning policies and site allocations addressing seniors housing.

In fact, out of the 326 local authorities in England, just 76 (23.3%) have clear policies indicating details of the required number of dwellings/care home beds and how this will be achieved together with specific site allocations for such development.

While this is an improvement on the first time the survey was carried out in 2017, when just 9.7% of local authorities achieved an A grade, the rate of change is out of step with the immediacy of the challenge that the country faces in providing enough age-appropriate accommodation.

The figures also reveal several regressions in the data, with 13 local authorities having moved backwards since the survey was last conducted in 2020. Of these, six (Basildon, Castlepoint, Slough, Welwyn, Hatfield, Wealden, Horsham) have regressed because of issues with their local plans.

Nationally, it seems like the mood is shifting. In February, the UK announced a new taskforce to speed up the development of retirement communities in the levelling up white paper. The NPPF and NPPG also acknowledge seniors housing and say there is a need to increase this in local plan requirements, but it isn’t prescriptive.

Where to develop seniors housing

With all this in mind, which are the best UK local authorities to develop seniors housing in, where strong demographic fundamentals intersect with a supportive planning environment?

By overlaying key demographic and economic indicators onto the planning policy data, we can identify areas of the country where the data suggests there are the greatest prospects for seniors housing to develop.

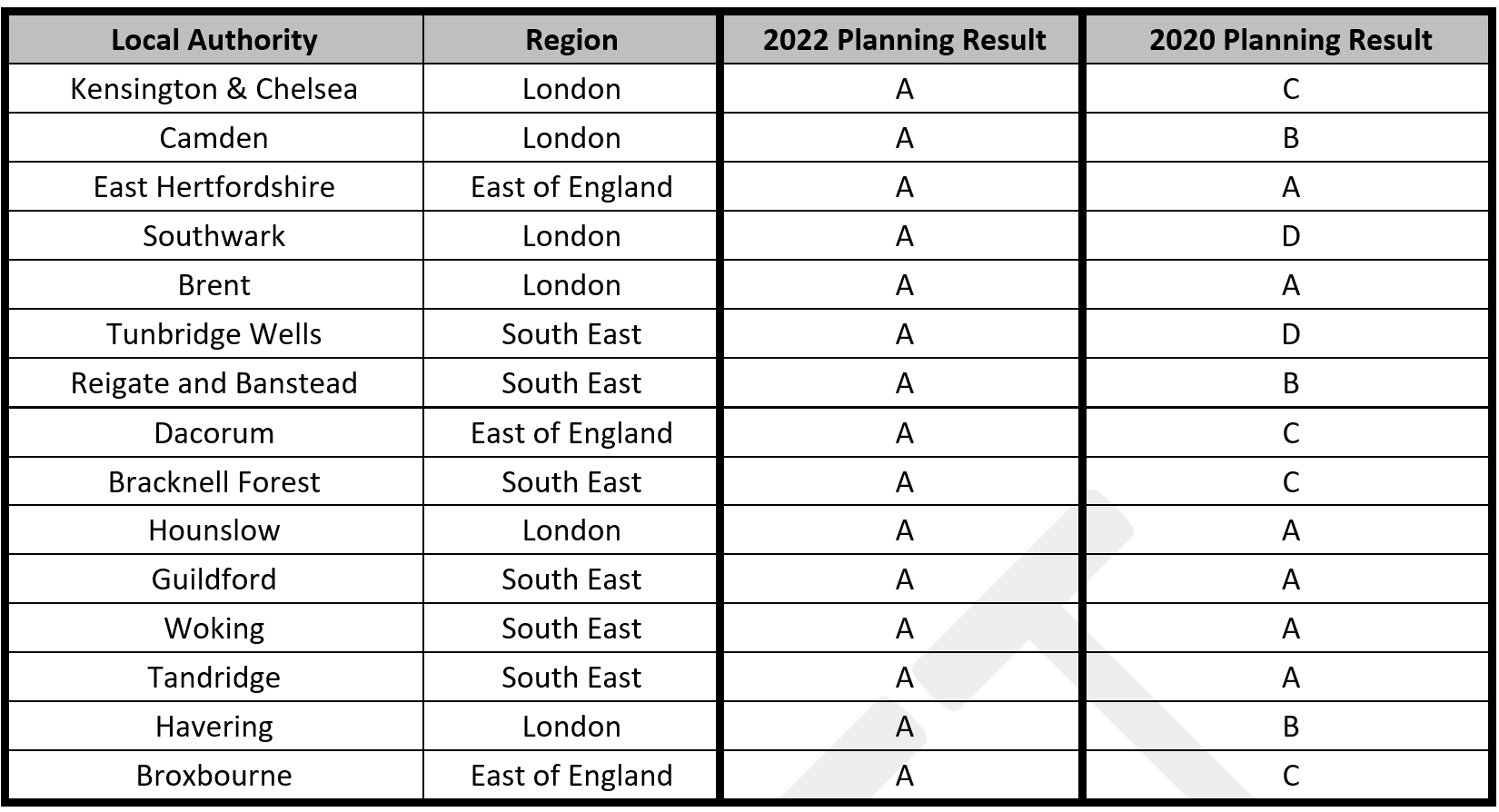

Our top tier local authorities for private seniors housing development include Kensington & Chelsea, Tunbridge Wells and Guildford, which have all seen a combination of strong seniors population growth, high levels of housing wealth and have a healthy future pipeline.

Private Seniors Housing Opportunity Rankings – Top 15

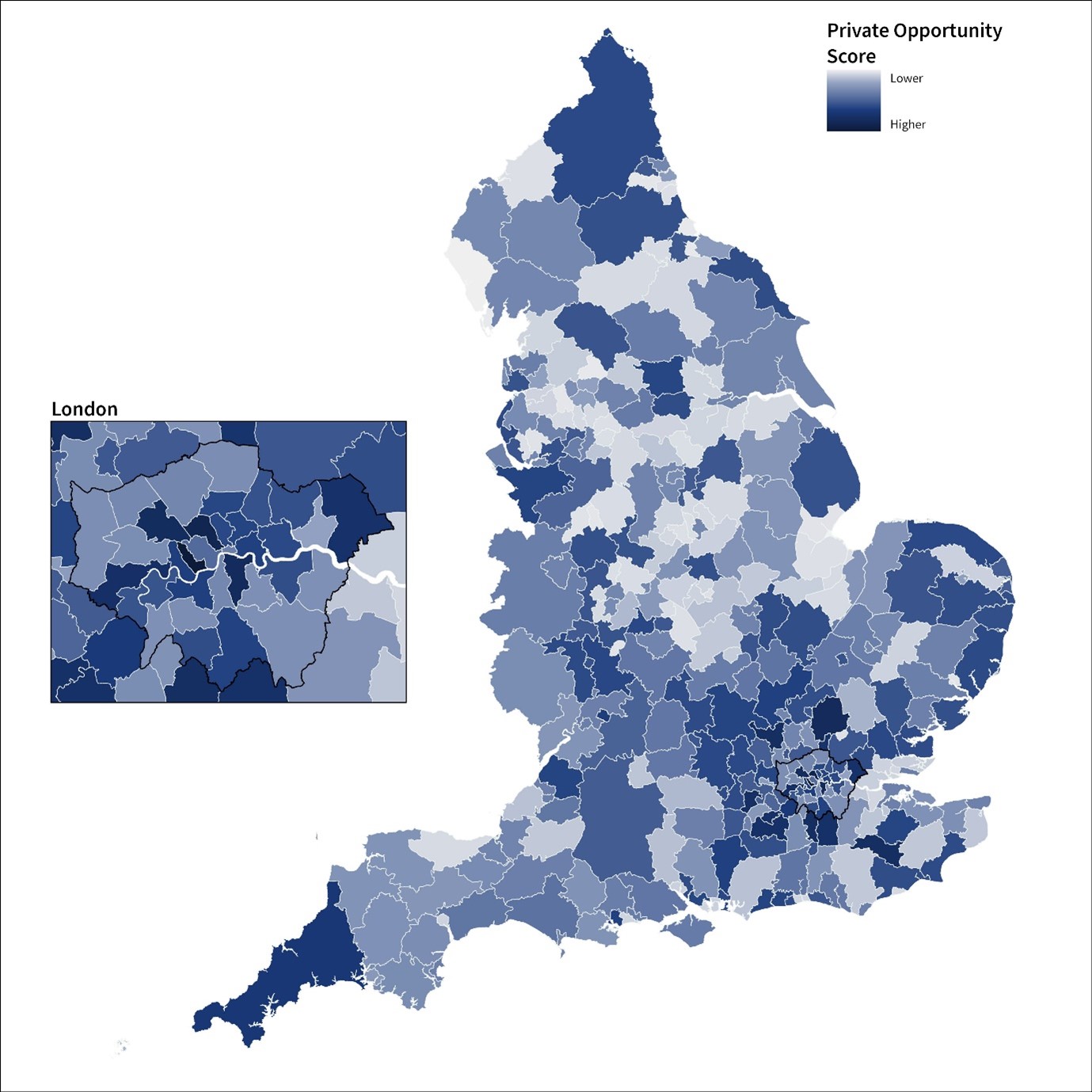

Private Seniors Housing Opportunity Score

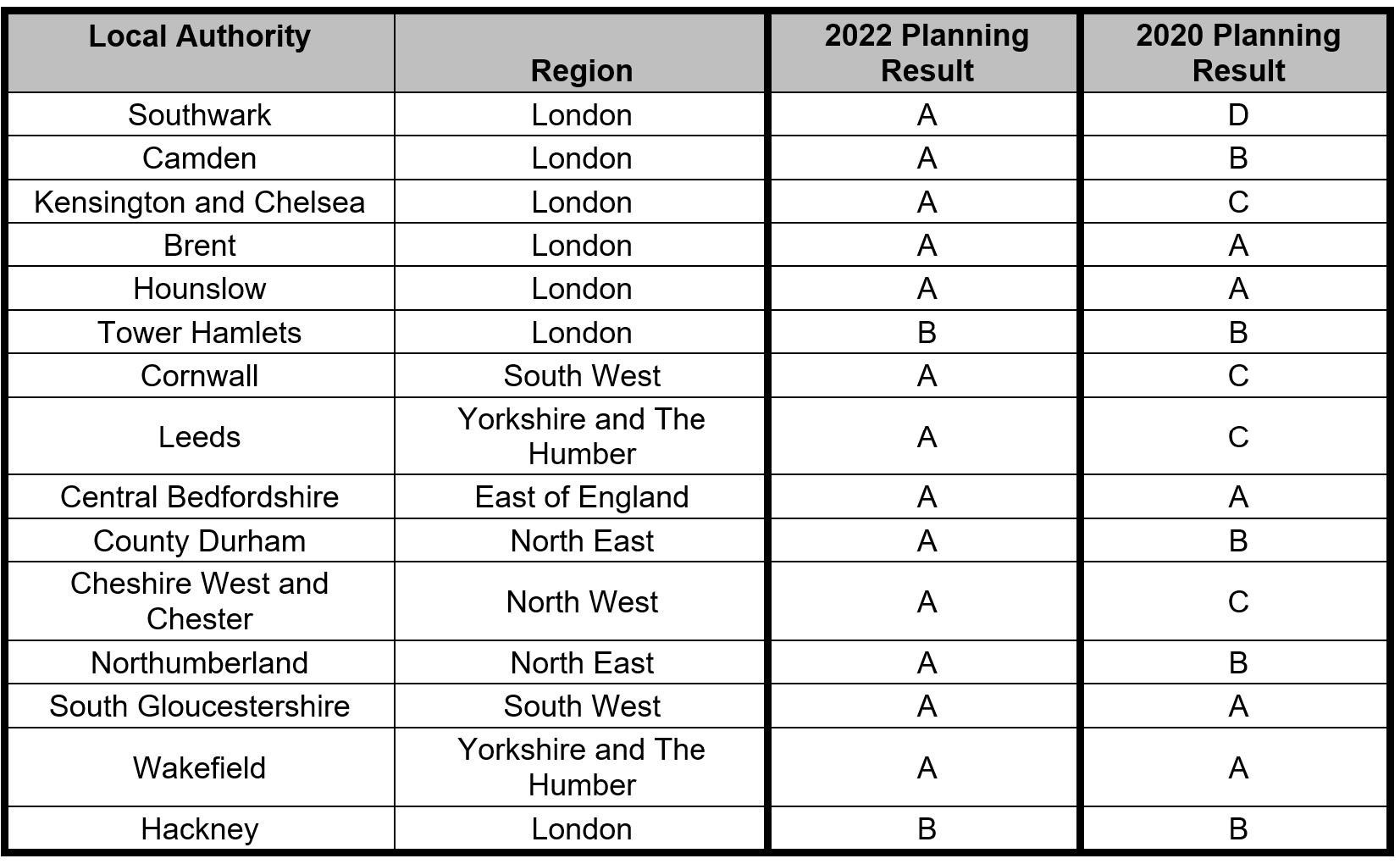

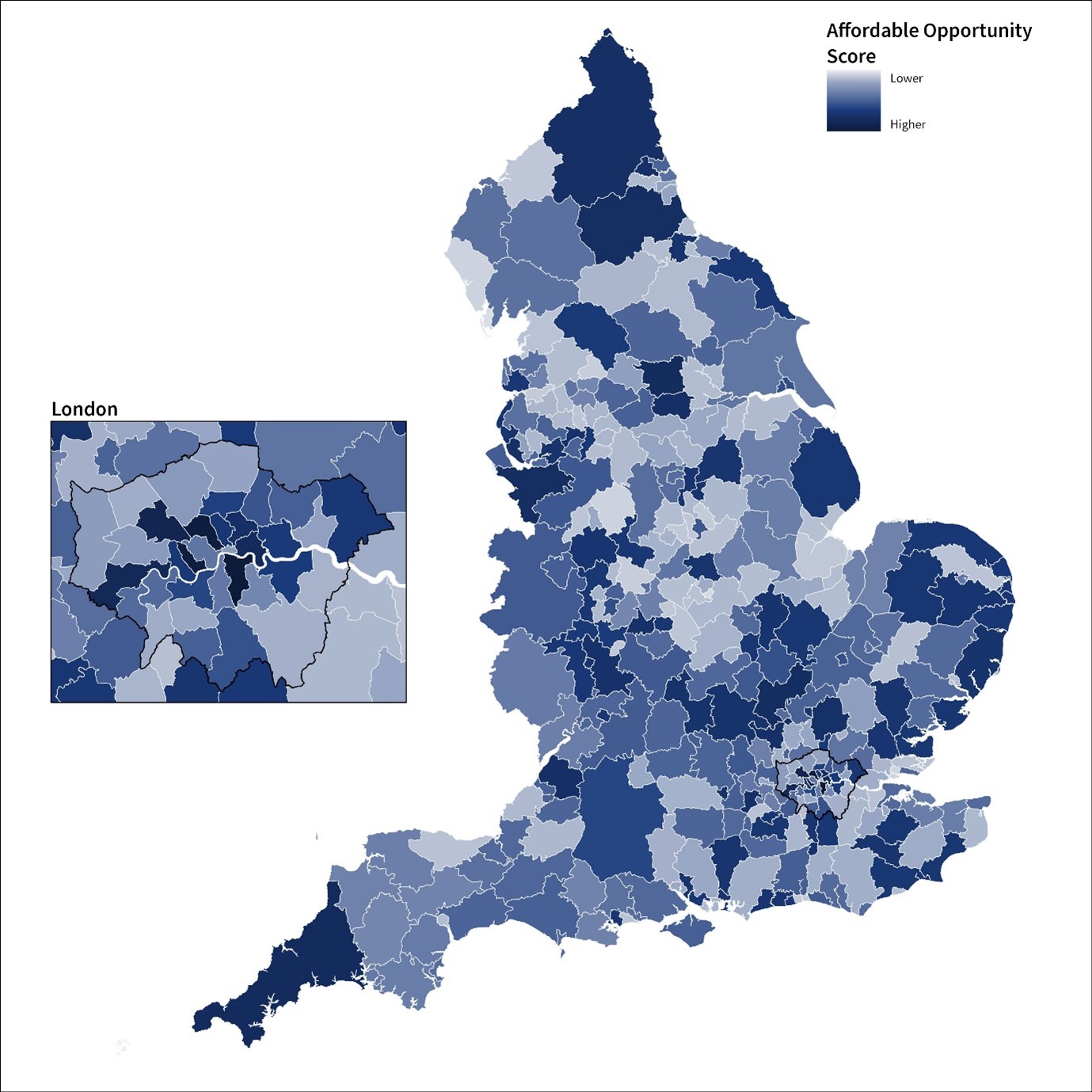

In our affordable rankings, the top 15 is dominated by local authorities in London, driven by the huge demographic change expected in the capital in the coming years and the high proportion of seniors living in social housing. Tower Hamlets, for example, is expected to see a 79% increase in its 65+ population by 2035, the highest growth projection of any local authority in the country. This is one reason why it comes 6th in our rankings, despite receiving a B planning grade.

Affordable Seniors Housing Opportunity Rankings – Top 15

There is a correlation between the local authority planning score identified by the survey and its overall opportunity score, though it is by no means a clear-cut relationship. Planning authorities with low planning rankings can still perform strongly on other metrics, and vice versa, as with Tower Hamlets.

It is clear, however, that in some parts of the country, adjustments to a council’s policy approach to the sector are needed to unlock the true potential for growth revealed by the demographic data.

In these areas, the planning position is still acting as a brake on the sectors’ ability to develop and meet the needs of the local population.

Whilst these metrics provide an accurate reflection of the demand and supply landscape in each local authority, there are other key indicators that a seniors housing operator should consider on a more granular and site-specific basis.

Affordable Seniors Housing Opportunity Score

Find out more

Download the report