Active Capital in 60 seconds

This time last year, we introduced Active Capital through the lens of immense uncertainty and unprecedented shock. Now, thanks to the rollout of a global vaccination programme, markets are cautiously optimistic. Indeed, our forecasts show that cross-border investment is back with a bang.

2 minutes to read

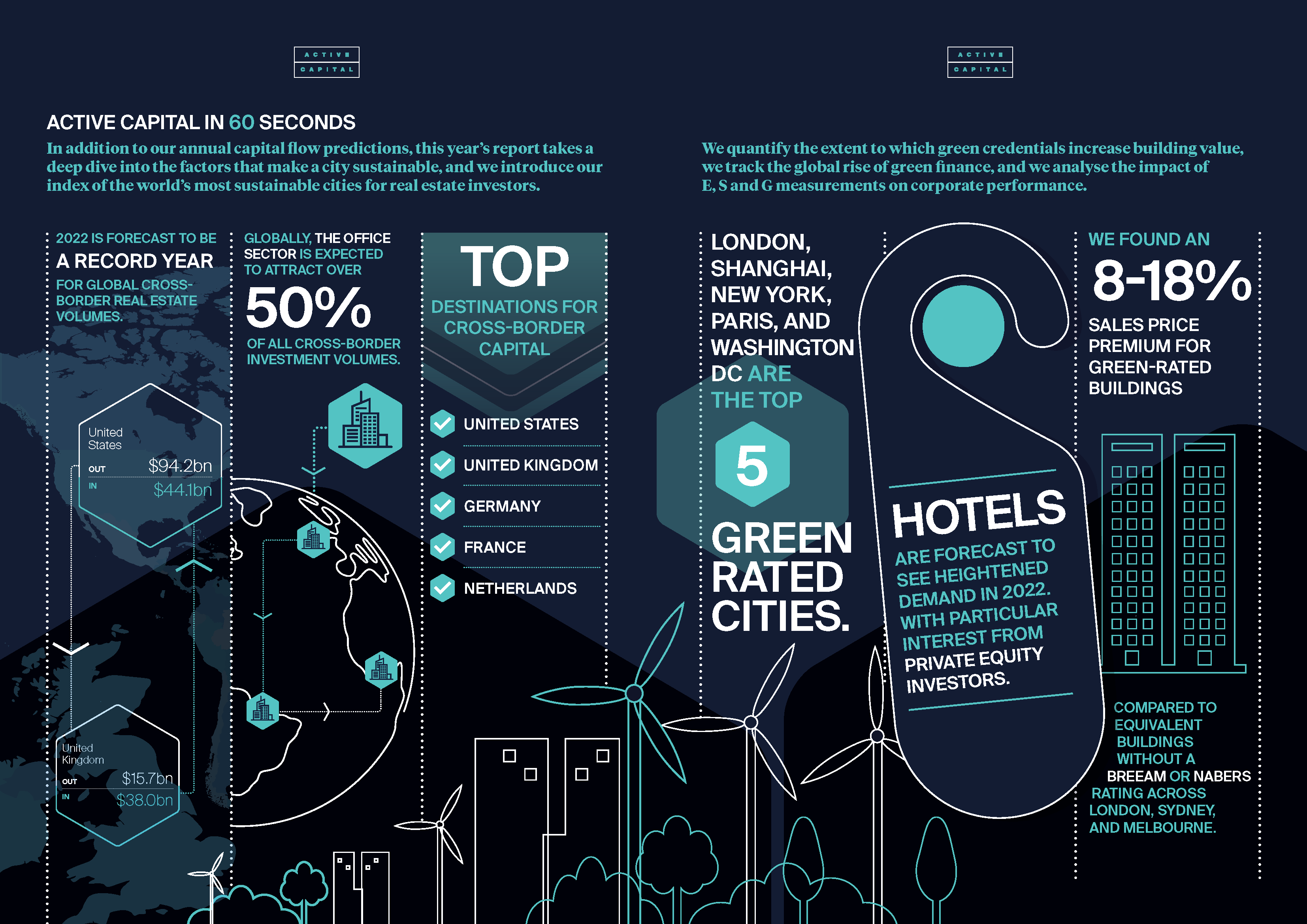

Through the latest machine learning techniques, unique datasets, and ‘on-the-ground’ insights from our brokers and advisors around the world, we predict a record year for cross-border real estate investment in 2022.

Our Capital Gravity model, which forms a cornerstone of the report, has highlighted that the top destinations for real estate investment capital in 2022 will be the US, the UK, Germany, France, and the Netherlands.

For the first time, we have been able to distil our Capital Gravity forecasts into investor types and sectors. Notably, the global office sector is expected to welcome over 50% of all cross-border investment volumes, driven by income-focused strategies, while the hotel sector is likely to see a strong year in 2022, with particular interest from private equity investors.

In this year’s report, we have also used cutting-edge techniques to quantify the accelerating ESG movement – at the city level, corporate level, building level, and finance level. At the city level, we have created an index of the world’s most sustainable cities, and when looking exclusively at the greenest cities, London, Shanghai, New York, Paris, and Washington DC hold the top five places.

At the building level, we have found that green certifications in both hemispheres of the world (i.e. the UK and Australia) can lead to an 8-18% sales price premium, proving that the race for sustainable assets should not solely be driven by risk mitigation attempts and occupier demand, but investment value, too.

As we look out over our forecast period, we predict both a more active and a more responsible global real estate investment market: one in which leading decision makers have the data and tools to correctly balance the imperatives of sustainability with the ambition of growth.

Below is just a snapshot of this year’s findings. Click here to enlarge the image.

Download Active Capital 2021