Friday property news update - 10 September

Vaccine mandates, free ice cream for office returners and central London shrugs off the taper

3 minutes to read

Vaccine mandates

US President Joe Biden yesterday announced plans to mandate Covid-19 vaccines for more than 100 million Americans - a move that will be welcomed by much of corporate America.

The Occupational Safety and Health Administration is drafting a rule mandating that all businesses with 100 or more workers require their employees to either get vaccinated against the coronavirus or face mandatory weekly testing, effectively taking the onus off companies wrestling with what has become an ultra sensitive issue.

There have been a few first movers - Goldman Sachs said all staff would need to be vaccinated in order to attend its US offices last month, but it's clear that many have been waiting to see how public sentiment moves or whether governments take the lead. The FT gets hold of a leaked memo from Shell weighing up whether to mandate vaccines among staff. The document warns that the company should avoid becoming a “pioneer” and should move “in step with governments and society on this controversial issue."

The office

Sentiment among City of London corporate leaders is largely moving in one direction. John Neal, chief executive of Lloyd's of London, said companies have a duty to get staff back into the office so that younger employees can develop their careers and learn from senior colleagues.

Footfall at the Lloyd's underwriting room, which has capacity for 7,000 people, is currently running at less than 45% of pre-pandemic levels, which Mr Neal expects to double in coming weeks.

Meanwhile Goldman Sachs goes further by scrapping social distancing and returning its European HQ in London to full capacity. The firm is offering free ice cream to returning workers as a sweetener.

Green homes

The UK government yesterday confirmed that it will introduce legislation requiring the installation of electric vehicle charging points on all new-build properties in England.

The move comes amid mounting concern that the government's plans to phase out petrol cars by 2030 are under threat due to a lack of charging points, but are also moving in line with evolving demand from homeseekers.

The energy efficiency of a future home is either important or very important to 84% of respondents to Knight Frank's Global Buyers Survey, according to the latest analysis from Kate Everett-Allen. Some 28% of respondents say they would be more likely to buy an energy efficient home if future environmental regulations had a direct impact on its value.

Meanwhile, around 27% would prefer a greener home and would be willing to pay a premium for it, whilst 22% consider the prospect of cheaper mortgages a motivating factor.

Prime central London

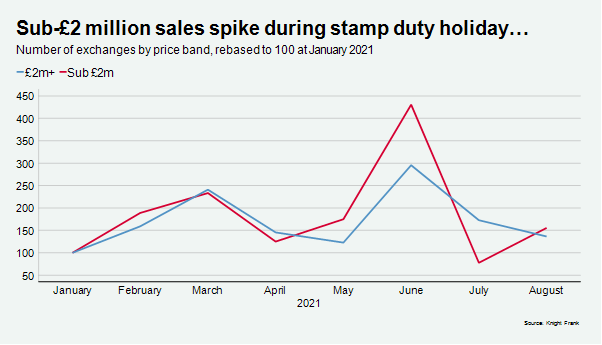

New analysis from Tom Bill suggests Prime central London has largely shrugged off the beginning of the stamp duty holiday taper.

Following the substantial winding down of the holiday in June, the number of sub-£2 million exchanges in July was 30% below the same month in 2019. By August, the equivalent decline had narrowed to 5%, Knight Frank data shows.

Above £2 million, a section of the market where activity was less affected by the maximum £15,000 saving, exchanges were down by 5% versus July 2019 and 3% compared to August 2019. For higher-value properties, the stamp duty holiday was an opportunity to save £15,000 but the urgency around the deadline was less acute, as the below chart demonstrates.

In other news...

Accountancy giant KPMG to recruit more working class staff, starting salaries rise at the fastest pace in 24 years, the ECB to cut back on bond buying, holiday industry on path to recovery as tourists return to southern Europe, Microsoft scraps return to office date, how one developer spurred the reinvention of New York after 9/11, Ikea comes to Oxford St, the booster jabs work really well, this village is already using hydrogen to heat homes, Biden calls Xi, and finally, Reuters poll puts a Bank of England rate hike to 0.25% in late 2022.

Photo by Robert Stump on Unsplash