The road to net zero

Interest in ESG (environmental, social and governance) has rocketed in the past 24 months. ESG processes and procedures focus on non-financial performance indicators. These address a company’s approach towards responsible investment, sustainability, its impact on society and the environment, as well as other ethical and corporate governance considerations.

3 minutes to read

Photo credit: The Nicholson Quarter, Maidenhead

These interest levels will only grow in the lead up to the UK’s hosting of the 26th UN Climate Change Conference of the Parties (COP26) in Glasgow on 1-12 November 2021. The COP26 summit will bring parties together to accelerate action towards the goals of the Paris Agreement and the UN Framework Convention on Climate Change.

Although the focus is on anthropogenic carbon emissions demanding global climate change mitigation and adaptation solutions, the themes of biodiversity loss, population growth, social injustice and global inequality are intrinsically linked to the climate emergency.

The real estate sector has responded by rapidly developing framework definitions, guidance literature and best practice guidelines. Definitions of what constitutes a net zero carbon building, both in terms of embodied emissions as a result of materials used in its construction, refurbishment and renovation, and operational emissions associated with day-to-day activities within the building itself, over the course of its lifespan have emerged.

"In order to be net zero carbon by 2050 there is a need to reduce the energy use intensity of buildings in operation by more than 60%."

Net Zero Carbon Buildings: A Framework Definition was published by the UK Green Building Council in 2019 and has evolved since that time. Net zero carbon is defined as a reduction in the demand for energy and materials to a level that can be met solely by sources that do not emit greenhouse gases. Current scientific consensus is that in order to be net zero carbon by 2050, there is a need to reduce the energy use intensity of buildings in operation by more than 60%. This will have major implications for both landlords and occupiers alike.

Lease clauses that facilitate the net zero pathway, together with frank discussions about investment in technologies, will undoubtedly exercise the sector going forwards. There is a renewed interest in the quantification of embodied carbon in the goods and services employed throughout the property life cycle. As operational energy efficiency improvements reduce this component of the whole life cycle carbon footprint, this interest in embodied carbon emissions will only grow.

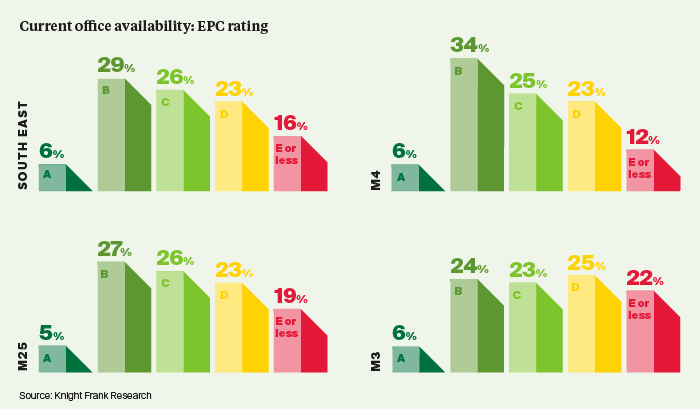

The regulatory framework to decarbonise the sector is already tightening. A greater proportion of companies are being encouraged to assess and then disclose their carbon emissions through policy vehicles such as Streamlined Energy and Carbon Reporting (SECR), the Energy Savings Opportunity Scheme (ESOS) and the Task Force on Climaterelated Financial Disclosures (TCFD), among others. At the time of writing, the reworking of energy efficiency regulations is likely to see the mandatory requirement for Energy Performance Certificates (irrespective of a trigger event) and the minimum level of performance rising to a B rating by 2030.

"The stipulation of a minimum EPC rating could move the market from relative equilibrium to under supply."

The stipulation of a minimum EPC rating could dramatically alter the dynamics of the south east office market. If imposed today, market balance would shift from relative equilibrium to under supply. To contextualise, of the 11.3m sq ft of vacant space listed in the south east at the end of Q1 2021, only 6.4% had an EPC of A. If the B category were to be included, this reaches just 34.5%. With the remainder stripped out to align to the desired EPC catagorisation, the market vacancy rate falls to just 2.3%, a level that has never been recorded.

All of these initiatives have the desired outcome to reduce the overall impact of the real estate sector. It is only by encouraging landlords and occupiers to make the measurement and management of this impact part of their core business activities that our national climate reduction aspirations will be met, and climate resilience will be embedded in the sector.

Hold on to your hats, it’s going to be a rollercoaster ESG ride through 2021 and beyond.

Click to enlarge image

David Goatman

Partner, Head of Energy, Sustainability & Natural Resources

david.goatman@knightfrank.com

Andy Nixon

National Offices Green Ambassador

andy.nixon@knightfrank.com