Hotel Dashboard - UK Hotel Market Recovery, January 2021

The emergence of a highly transmissible variant of the virus during Q4-2020, has resulted in continuing anguish for the UK hotel sector. The impact of the tightened localised restrictions and subsequent lockdowns have been harsh and unyielding on UK hotel trading performance.

2 minutes to read

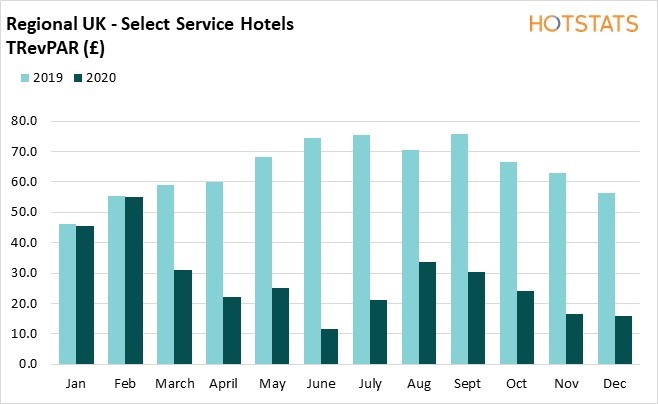

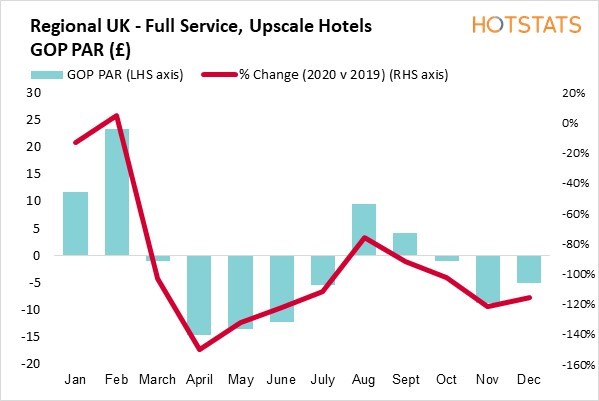

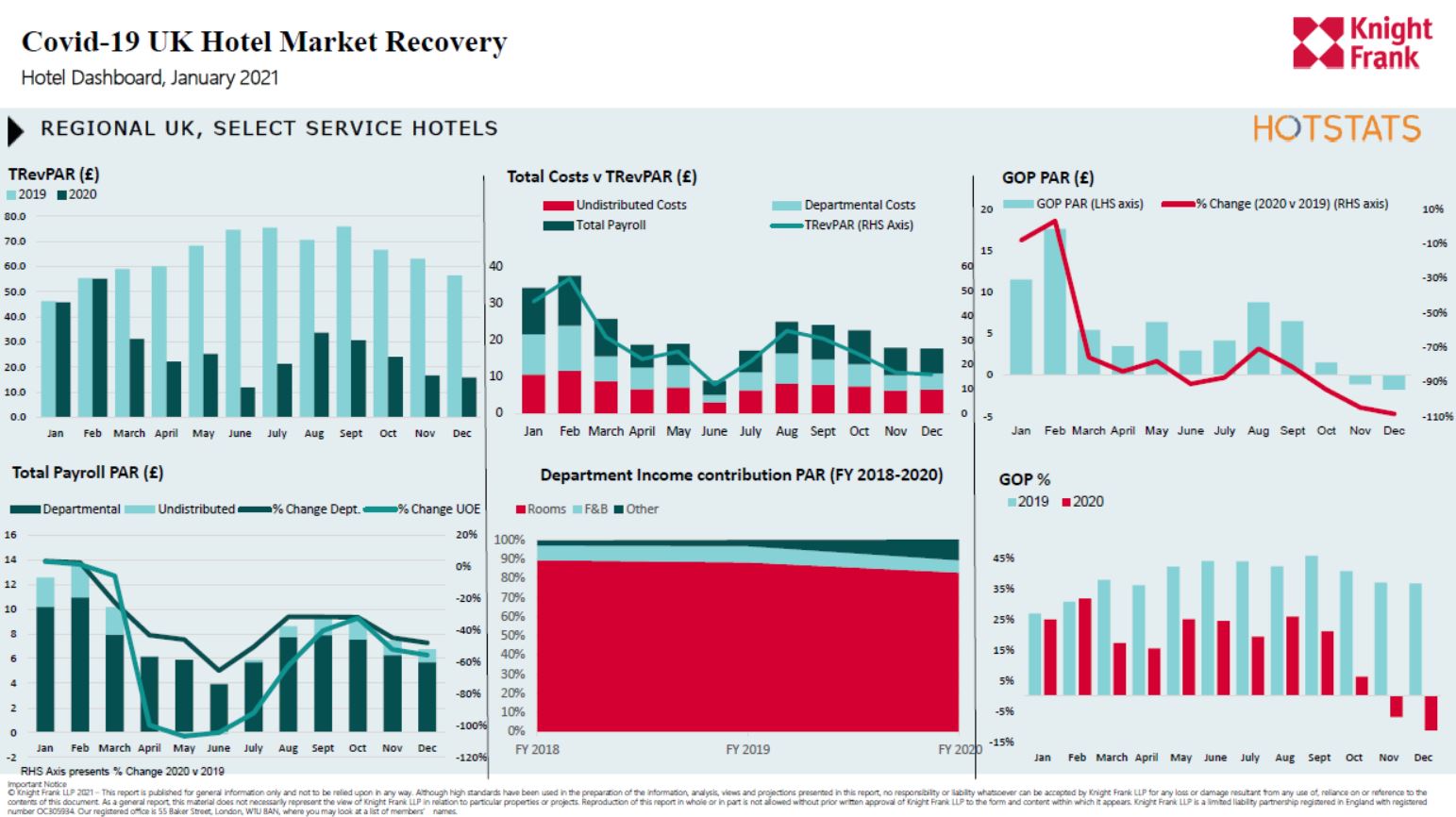

In our January edition of the Hotel Dashboard, we provide our latest opinions and outlook for the UK Hotel sector, together with a more detailed review of regional UK trading performance. Specifically, we review in greater detail the performance of two hotel datasets - Regional UK, Full Service, Upscale Hotels and Regional UK, Select Service Hotels.

Download the Knight Frank Hotel Dashboard

- Government cautiousness over the easing of lockdown restrictions is growing. The reopening of the hospitality sector is likely to be shifted further towards the end of Q2-2021.

- Covid-19 mutations from overseas have the potential to derail the recovery of the UK hotel sector. Concerns over whether the vaccines will continue to work have already led to the suspension of all travel corridors. Tighter border controls are to be expected, with hotels likely to be commissioned for use as 10-day quarantine centres.

- Optimism for a strengthening second half of 2021 remains, with strong pent up leisure demand. With increasing uncertainty around international travel and quarantine rules, the UK hotel market is set to benefit from strong demand for staycation, with the trend towards a longer average length of stay.

- The November lockdown resulted in month-on-month occupancy across regional UK declining by over twelve percentage points and ADR by over 14%, contributing to a 46% decline in RevPAR. In December, with the lockdown continuing in all but name, the severely restrictive trading conditions resulted in a further 6% decline in RevPAR.

- With the national guidance to “Stay at Home”, the severely restrictive trading conditions have resulted in the UK hotel market to become loss making during November and December 2020, for all hotel datasets analysed, with the exception of the Serviced Apartment dataset.

"The devastating ongoing impact of Covid-19 on the UK hotel market is stark, when appreciating the significant level of cost savings made for the full year 2020.

Whilst some of these reduced costs are a direct result of certain hotels being closed and hotel owners benefitting from the Coronavirus Job Retention Scheme, these cost savings were not sufficient to mitigate the trading losses endured by the ongoing debilitating trading restrictions of Q4-2020.

Given the continuing lockdown at the start of 2021, the current focus for the sector continues to be one of survival, with cash conservation and liquidity of immediate concern.

Pressure is mounting for the Chancellor to announce a bold package of financial support for the UK hospitality industry, ahead of the Budget on the 3rd March 2021. The level of support must compensate for the ongoing imposed restrictions - this is a critical time to support these viable hospitality businesses, which in turn will spearhead the UK’s economic recovery."

Philippa Goldstein, Knight Frank, Senior Analyst – Head of Hotel Research

Download the Knight Frank Hotel Dashboard