How will rising online sales volumes impact on demand for distribution and logistics space?

What does the shift towards online retail mean for the logistics market and how will rising online sales volumes impact on demand for distribution and logistics space?

6 minutes to read

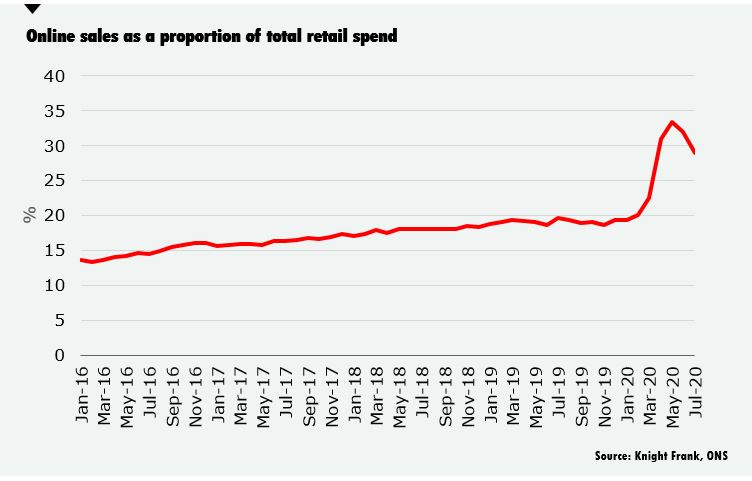

The Covid-19 pandemic forced the temporary closure of non-essential retail stores in March 2020 and encouraged many shoppers to look at options for home delivery for both essential and non-essential items. There was a sharp uptick in online retail demand, particularly in the grocery sector as many shoppers turned to home delivery options. The online segment accounted for 19.2% of UK retail sales in 2019, this jumped to 33.4% in May 2020.

Will shoppers return to the high street?

In June and July 2020, as more retail stores began to trade once again, online retail sales volumes decreased, slightly, but remain significantly higher than pre-Covid levels. Online sales as a proportion of all retailing was 28.9% in July, down from 33.4% in May; when non-essential shops were closed, but much higher than the 19.2% in 2019.

Shoppers may be returning to the high street but in-store restrictions remain in place. Customers may be prevented from handling goods or trying on clothes, or they may not wish to. Many shoppers are looking to limit the amount of time they spend in-store and this is likely to keep many shopping online for the short to medium term. Longer term, consumers may be more willing to return to the high street but the internet will play a larger role in the retail market than it did before the pandemic. Retailers that have not yet embraced omni-channel retail will need to do so and this will lead to structural changes in their supply chains.

A recent survey of British consumers found that 38% of respondents were planning on buying more online after Covid-19 compared to before the lockdown measures came into place. The shift in retail activity from in-store to online is impacting the amount of warehouse space required by retailers. We are already seeing rising demand for space from online retailers (both pure-play and multi-channel retailers), seeking to expand their networks and capture share in a growing market.

Online sales are projected to account for up to 32% of total retail sales by 2024 (Source: eMarketer) and this will have significant implications for the logistics market. The growth in e-commerce is helping drive demand for space, business to consumer (B2C) retail requires more intensive picking and packing operations compared to regular retail and thus additional warehouse space is needed.

What does this mean for logistics demand?

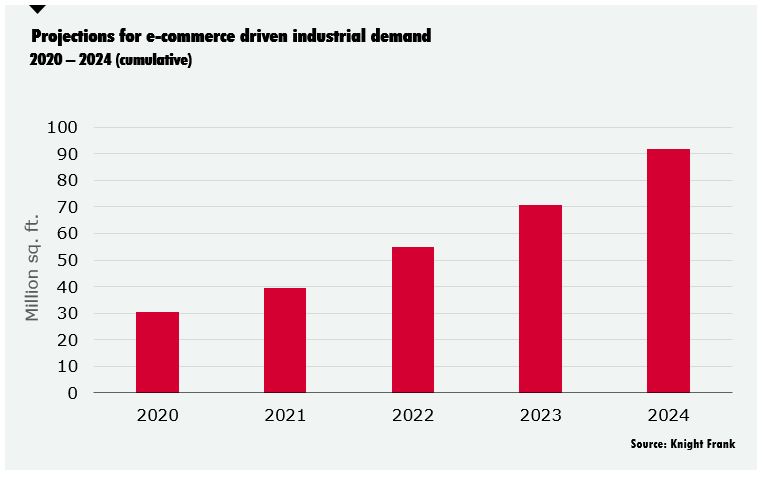

Knight Frank analysis shows that for every £ billion of online sales requires approximately 1.36million sq ft of warehouse space. With UK online sales forecast to rise by up to £67 billion over the next five years, we could see e-commerce drive additional requirements of 92 million sq ft.

The analysis has been conducted using historic data on the network of warehousing space and financial data for online retailers / distributers over the past five years. So, is this a reasonable indicator of space requirements over the next five years?

The firms within the study have been expanding their networks over the past five years and sacrificing profit and asset utilization in order to facilitate rapid expansion and capture market share. Prior to 2020, we were seeing a slowing in acquisition of warehousing space (by pure-play online retailers) accompanied by rapid sales growth and rising capacity utilisation rates. However, 2020 saw acquisition rates increasing again, with companies seeking to increase their capacity to meet the surge in current, and expected future demand.

At present, safe working practices necessitate social distancing and this is constraining capacity for logistics, both within warehouse facilities and across the wider supply chain. Operations across the supply chain are impacted from production to picking and packing and delivery of goods. Allocating more floor area per person means less productivity per square footage. While these measures remain in place, requirements of 1.36million sq ft of warehousing space per £ billion of sales, may not be sufficient. However, highly automated elements of the supply chain are proving more resilient.

Maintaining productivity or expanding capacity at this time is proving a challenge, designing a distribution centre or warehouse for future use may have to take some of these issues into account. We may see the need for social distancing accelerating the use of technology and automation within warehouses. Over time, through improving efficiencies and automation technologies, we are likely to see an increase in capacity utilization of warehousing assets and we may find the figure of 1.36million sq ft per £ billion shrinking.

Omni-channel retailers are likely to switch existing space currently supplying their store network, to servicing e-commerce B2C demand. They may also seek to make better use of their store networks to distribute internet retail sales and ensure that their online and physical sales platforms are as seamless and mutually-supportive as possible.

Even if utilization rates improve and the space to sales ratio reduces over the next five years, the robust forecast for online retail and competition, particularly for well-located assets, is likely to drive positive momentum for the logistics market.

Which segments of the retail market are forecast to see the largest growth?

The pandemic has altered not just the way we shop, but also what we buy and where we buy it. The recession has impacted spending patterns, with a fall in overall retail spend, and the combination of economic uncertainty along with pandemic-induced social changes have led to an increased focus on essentials such as food and electronics, with less spend on clothing and luxury goods.

The grocery retail sector has seen online sales more than double since last year. Grocery retail sales (both in-store and online) totalled £13.3 billion in July, with 10.8% of this spend online (£1.44 billion) compared with just 5.2%, or £681 million in July 2019. Despite huge demand for online food orders early in the pandemic, many retailers were unable to capitalize on this due to capacity constraints.

30% of UK consumers say they will shop more for groceries online after the pandemic. Mintel estimate that the online grocery sector will grow by 33% this year, to reach £16.8 billion. Further growth over the next few years will see the sector worth £17.9 billion by 2024, representing an additional spend of £5.2 billion compared with 2019 (Source: Mintel). Based on our analysis, this growth could lead to additional requirements of 7.1 million sq ft of warehousing and logistics space (2020 – 2024).

Grocery retailers are now looking to seize the opportunity of accelerated growth in the online grocery market and expand their network capacity. Ocado are planning to add c.40% more capacity over the next 18 months, with new fulfilment centres planned in Bristol, Andover and Purfleet. Recipe box company Gousto have taken over 500,000 sq ft of space in Warrington and Essex, they intend to triple capacity over the next two years. HelloFresh is also expanding, taking a lease on a 230,000 sq ft high-quality logistics space at Goodman’s Nuneaton development.

The rise in online retail and home delivery will drive demand for parcel carrier services. DPD are reporting volumes up 40-50% on pre-Covid levels and are actively recruiting and seeking more warehousing space. With £60m to be invested this year on 15 new regional depots (10 more than originally planned in 2020) and a further £40m to be invested on technology.

As retailers and delivery firms expand and enhance their networks, questions remain, what will their future supply chains look like and where will see the rise in demand for space materialise? Will it be mega fulfilment centres, smaller urban logistics depots, or micro-fulfilment centres perhaps?