Monthly UK Residential Property Market Update: September 2020

Property market transactions and prices up as recovery continues.

5 minutes to read

The UK property market continued its recovery last month, maintaining a momentum that has surprised many since it reopened, initially in England in May.

The high volume of deals struck since then has begun to convert into transactions, and the UK property market saw the highest number of exchanges since the end of 2019 in the week ending 29 August, Knight Frank data shows.

With so many working from home for an extended period, there has been time to reassess and consider requirements such as proximity to work, and with the potential for further lockdowns, there is a determination to act.

RICS said that buyer interest, instructions, agreed sales and house prices were all up in August, according to the latest UK Residential Market Survey.

A key driver throughout this period of activity has been the pursuit of more space and greenery, something that looks increasingly like it will become an established trend. Indeed, 83% of respondents to the RICS survey see demand for homes with gardens increasing during the next two years.

September was the first month since March that current house price expectations moved back into positive territory (50+) according to the latest IHS Markit UK House Price Index, with a reading of 52.7. Future expectations for house price growth continued to strengthen too, with a reading of 54.4.

Publishing figures for September, Nationwide said that year-on-year house prices are now 5% higher, which is the highest level of growth since September 2016. However, house price growth slowed on a month-on-month basis, rising 0.9% in September compared with 2% growth in August. It came after Halifax said prices had increased by 1.6% from July to August, up 5.2% on an annual basis, but also stated that with government support measures about to end, it was highly unlikely that this level of price inflation will be sustained.

Underlining how active the market has become since the stamp duty holiday was introduced, the Bank of England said that mortgage approvals were 66% higher in July than June, close to pre-pandemic levels. At a meeting on the 17 September, members of the Bank of England's Monetary Policy Committee voted to keep the base rate at its historic low of 0.1%.

Property transactions in August were up 15.6% on July on a seasonally adjusted basis. The 81,280 residential transactions recorded by HMRC in August were 16.3% lower than in August 2019. However, the decline is narrower than in July, which was 27.4% lower than the figure recorded in 2019.

The number of mortgage approvals for house purchase increased in August, to 84,700 from 66,300 in July. This was the highest number of approvals since October 2007.

On this basis, Knight Frank has updated its UK property market forecast with a central scenario that double-digit price falls will not take place despite an assumption of a rise in unemployment and second wave of Covid-19. UK property transactions will fall by 15% this year compared to 2019, and prices will be broadly flat, with slight upwards movement in areas with more outdoor space and greenery.

Prime London sales

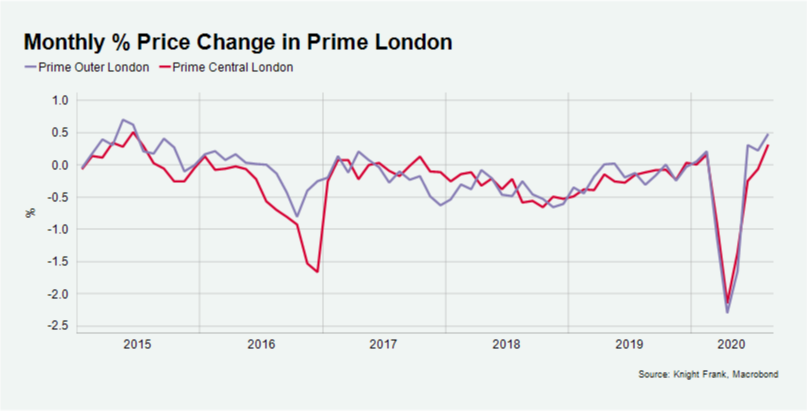

The London market, which bounced back more strongly at the start of the year, has lagged the rest of the UK since lockdown. However, it is now building momentum of its own and average prices in prime London property markets grew by the most in five years in the month to August.

Prices were up by 0.3% in prime central London in August, and in prime outer London average prices rose 0.5%, which was the highest rise since June 2015.

London set a new record for offers accepted in August, with the highest monthly total in 20 years.

Despite this rally, our revised forecast predicts a 3% fall in prices in both PCL and POL in 2020, before recovery next year.

Areas such as Knightsbridge and Mayfair, popular with international buyers, remain subdued at present due to Covid-19 travel restrictions.

Prime London lettings

Meanwhile, average rental values in prime central London fell 1% in August, taking the annual decline to 6.9%, the largest decrease since Q4 2009. In prime outer London rental values fell by 0.4%, producing an annual decline of 5.9%.

Lettings market activity has been robust since the market re-opened, and the number of tenancies started in August was 9% above the five-year average. However, higher levels of supply and weaker levels of demand has had an impact on rental values.

Between April and August the number of market valuations carried out by Knight Frank for the lettings market was 37% higher than last year, as more owners initially decided to let rather than sell. Over the same time period, the number of new prospective tenants fell 26%, and this imbalance has produced downwards pressure on rents.

This imbalance now shows signs of reversing as more students decide to act and as other tenants take advantage of falling rents. Viewings reached a ten-year high towards the end of August, and this resurgence may begin to lessen some of the downwards pressure on rents.

Country market

The number of offers accepted in the country business in the month of August was the second highest on record, surpassed only by July’s record total in the last two decades. The record run, which began in June, underlines that the traditional seasonality seen in the property market outside London has not materialised in 2020.

This run of activity is converting into transactions, with exchanges in the country business were 60% higher than the five-year average in the week ending 29 August, and the weekly total was the biggest since December 2018.

Instructions were at a 20-year high outside London in July, reinforcing our belief that the market will remain busy into autumn. To this end, our revised UK property market forecast predicts prices for Prime Regional properties will end 2020 1% higher, with growth of 4% in 2021.

For our revised forecast in full see UK Property Market Outlook: Week Beginning 7 September 2020.