Rental options for seniors housing set to more than double in five years

UK rental seniors housing to increase by 160% in next 5 years with Covid-19 pandemic accelerating the demand for rental housing with care.

5 minutes to read

UK rental seniors housing to increase by 160% in next 5 years with Covid-19 pandemic accelerating the demand for rental housing with care.

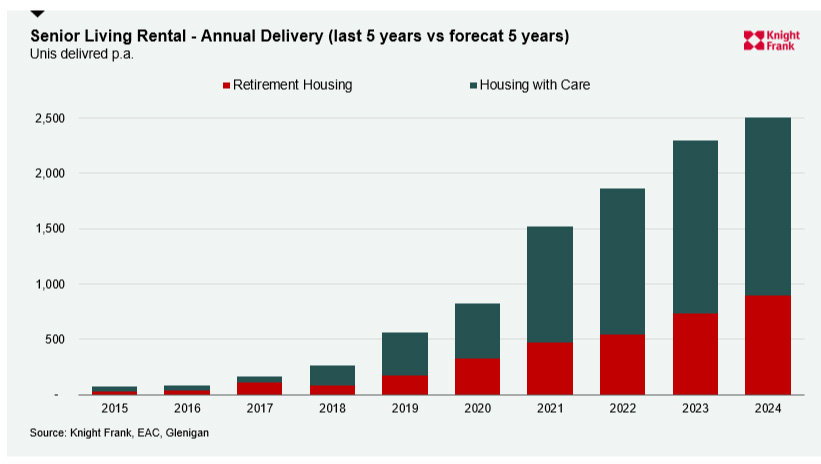

The number of private senior living rental properties in the UK is forecast to increase by 160% in the next five years, from almost 5,000 currently to more than 13,000 by 2024.

Analysis of planning pipeline data suggests that an additional 8,500 specialist senior living rental units will be built over this timeframe, driven by a number of housing with care operators allocating a proportion of their pipeline to this market.

Such schemes will provide high levels of services, care and support as an integral part of their proposition.

Even accounting for such rapid growth, senior housing rental stock will only account for 1% of the total number of specialist senior housing options, which is currently dominated by ‘for sale’ stock. However we forecast this dynamic to change in coming years as the sector matures. Looking to the mature North American sector helps which is dominated with rental stock (90% of total) with 80% of tenants selling a former family home before moving and becoming a tenant

Our forecasts for the how the total number of senior housing units across the UK will change over the next five years can be found here.

However, the case underpinning an increase in provision of rental stock is a compelling one.

The Covid-19 pandemic is expected to speed up existing trends in the sector including a more rapid take-up of the ‘one move solution’ with increasing service and care being delivered into rental propositions. A rental apartment or care suite can also provide increased tenant choice best suited to their financial profile and preference – with square footage being traded for increased services and care.

We forecast the UK market will have a range of rental propositions catering for residents that live independent lives well into their 90’s and those that require higher levels of assistance with daily activities. And continuing care retirement communities will be more prevalent in the market – with schemes adding dementia care to independent and assisted living. There will likely be a range of propositions including varying levels of service and care on offer providing different sized apartments and suites (and hence charges/rents) – all maximising the amount of choice on offer to tenants and widening the market for the proposition

Jamie Bunce, CEO of Inspired Villages, explains: “Covid-19 has acted as a catalyst for many things and accelerated certain pre-existing trends; a move towards digital and social media, a move towards flexible office space and working from home, attitudes towards the elderly and their central role in society, a better understanding of the fundamental difference between retirement villages and care homes, and a general move towards rental in later living communities; to name but a few. What was predicted as a five-year change may just become a one-year change.”

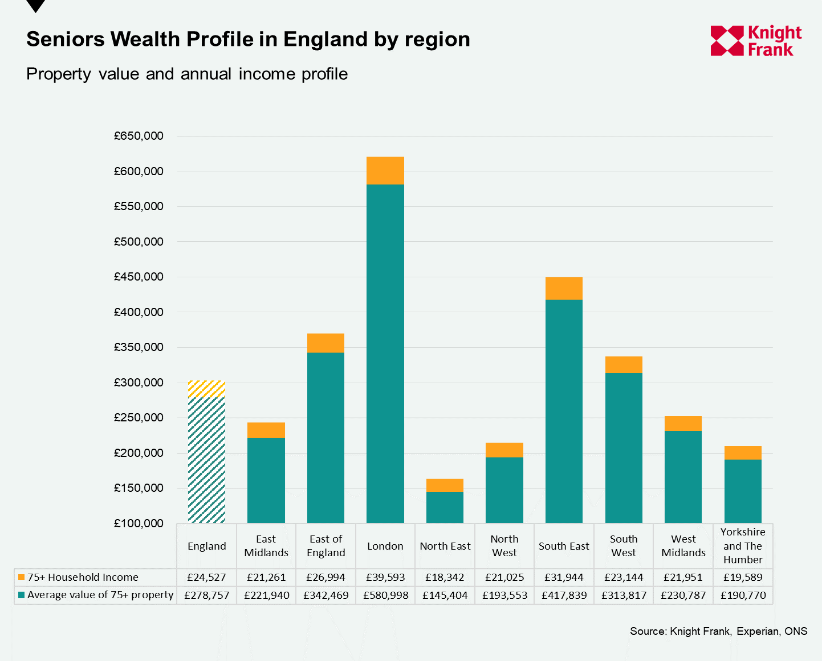

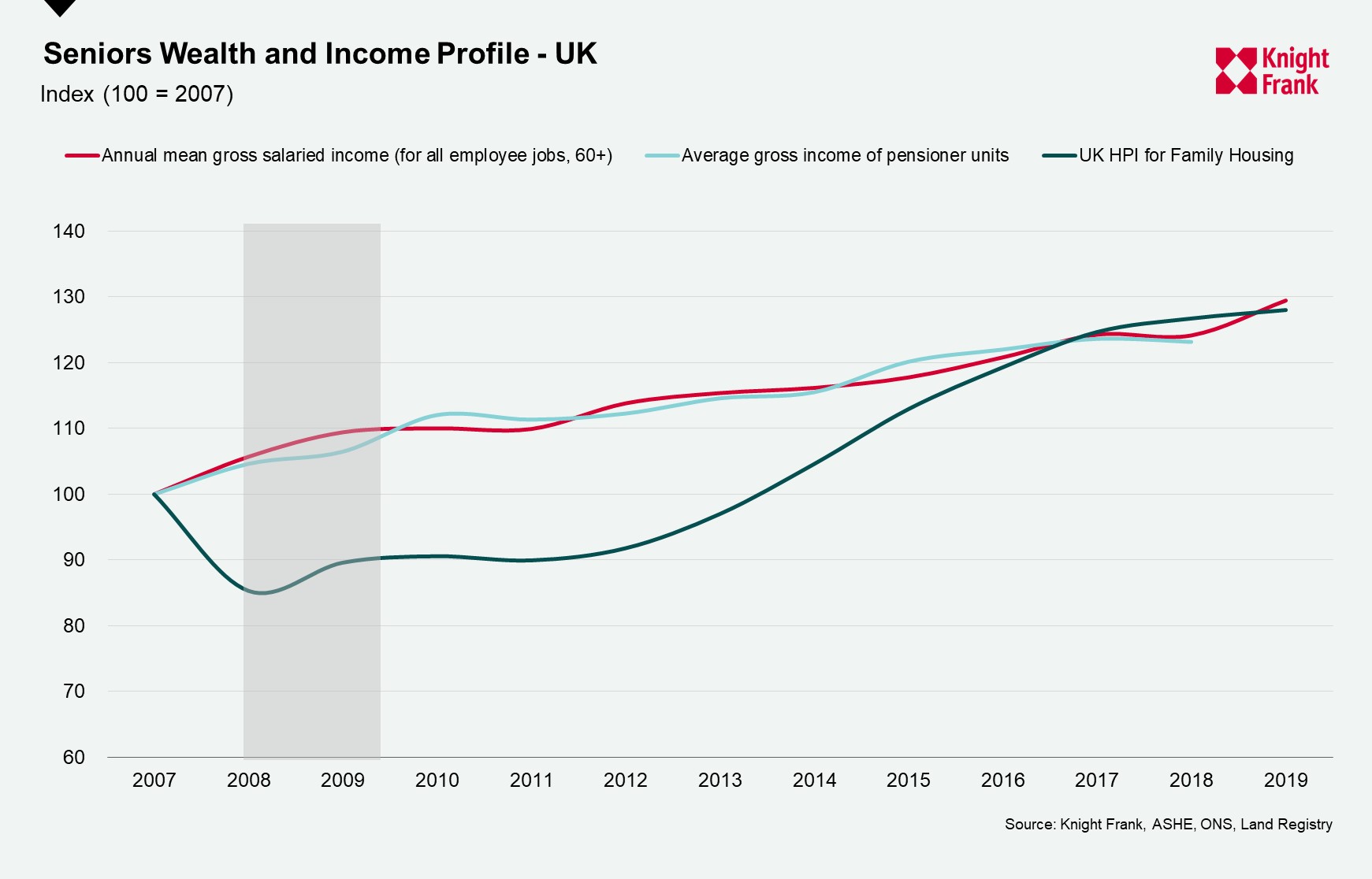

Seniors are able to fund a move to rental in numerous ways; unlocking capital from the sale of the family home or using pension and income to fund.

Case for rental – the tenant

- Flexibility – The option to rent offers customers a chance to move quickly and experience the benefits of village life – which they can continue to do permanently or as a precursor to buying.

- The former home does not necessarily need to be sold first.

- Choice - the individual or couple has a number of options with the former home – letting to generate rental income; release of equity with financial products; pass to other members of the family; retain the option of moving back should they wish; sell at a time of their choosing (possibly when market conditions have improved or after the property has been refurbished)

- Income tax benefits - using pension income to pay rent and using final salary pensions

- Reduced relocation costs with no SDLT payable.

- Much lower event fee charges compared to leasehold units

- Potential inheritance tax benefits for owners of more expensive properties (over £1m)

Mr Bunce, adds: “Rental is an increasingly important part of our business model. We are currently renting 15% of our stock and demand for our rental apartments is increasingly month-on-month. There has been a marked rise in interest over this time and a third of all enquiries are now for a rental offering.”

Case for rental - the investor

- Demand supply imbalance

- Demographic driver of increasing age

- Income and property wealth of seniors underpin demand

- Yield compression for early entrants

- Trend towards large-scale residential rental market in low interest rate / yield environment

- Opportunity to attach senior housing lease to inflation

- Low level of default / non-payment – based on professional managed residential

Challenges

- Nascent market and lack of proof of concept and hence access to large volumes of data.

- Lack of operators – experience is required to manage income and operate the retirement community. However, in the last few years we have seen significant institutional investment into the senior housing sector backing a number of operators

- In the UK we are not very familiar with “professionally managed” residential properties but that is changing already with BTR growing and rental is a much more common option internationally (for example, it is the main tenure for senior housing in the United States)

- Valuation challenges around lack of a large volume of existing UK – not insurmountable though and early entrants will likely benefit from largest yield compression

- Consideration needs to be given to regulation including CQC Registration for higher care propositions

For more information, please contact Tom Scaife or Lauren Harwood