Prime London Market Faces Prospect of Falling Mortgage Rates but Rising Taxes

July 2024 PCL sales index: 5,294.4 / July 2024 POL sales index: 274.0

3 minutes to read

Buyers in prime London postcodes were understandably more focussed on their summer holidays than moving house in June and July.

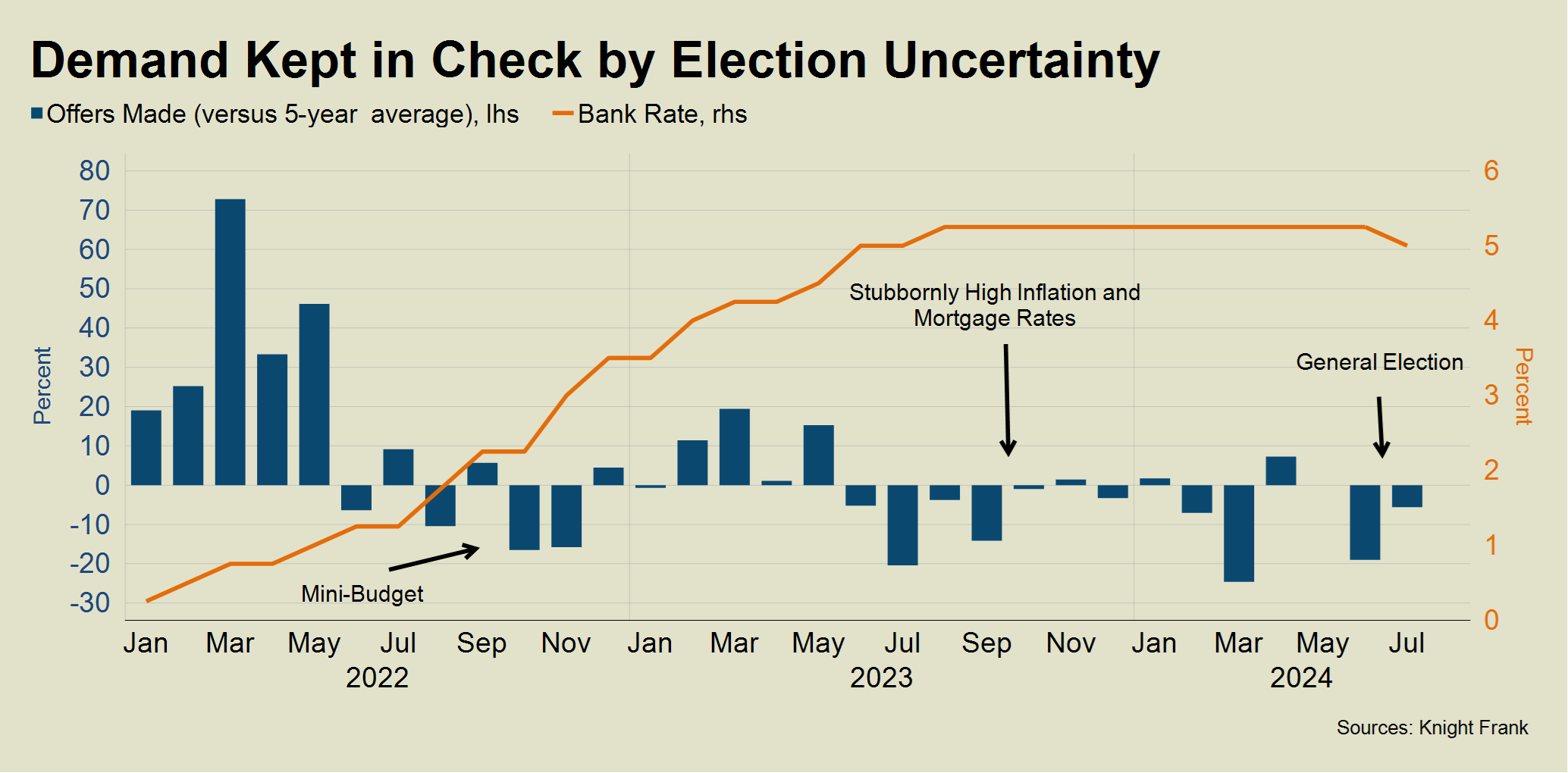

The property market in the capital is less seasonal than other parts of the country, but the number of offers made declined over the last two months, as the chart shows.

The figure was 19% below the five-year average in June and 6% down in July.

The prolonged wait for a rate cut and the distraction of a general election called on 22 May was clearly not a conducive backdrop for buyers.

Demand should rise in the autumn following this month’s rate cut, which increased the likelihood of more mortgages falling below 4%.

Last week, financial markets were pricing in a further cut of 0.25% in November and between four and five over the next year.

Despite the pre-holiday mood of hesitation, many transactions already in the pipeline were completed, largely driven by buyers needing to move.

The number of exchanges in London in June and July was 8.4% above the five-year average.

It was a release of pent-up demand following 12 months of frustratingly-high inflation and was replicated in the wider UK market. The RICS noted an improvement in the number of agreed sales in July, while Nationwide and Halifax both reported rising prices last month.

After the initial shock of the mini-Budget in October 2022, stubborn inflation kept mortgage rates high and demand in check in the final half of last year and the first six months of 2024, as the chart shows.

The improving economic backdrop will boost activity in mainstream property markets this autumn but the Budget on 30 October provides an extra obstacle for prime markets.

For example, the decision to impose VAT on private schools from January could curb demand in some higher-value areas when people return from their summer break.

Buyers could be squeezed further if changes are made to pension tax relief, inheritance tax or capital gains tax.

However, there is now a little more clarity on how the government intends to change the rules for non doms, the 74,000 individuals living in the UK who do not pay tax on their non-UK income.

Labour had previously adopted the position that under the new system, all overseas trusts would be subject to inheritance tax irrespective of when they were set up, which was potentially a trigger for a number of non doms to leave the UK.

It has now changed position slightly by acknowledging that an “appropriate adjustment of existing trust arrangements” is needed, which is a tentative step in the right direction.

Average prices in prime central London fell 2.4% in the year to July, which was the same annual reading for the third successive month. Prices are 4.5% down on their pre-Covid levels and 17.6% below their last peak in August 2015.

Recent declines in prime outer London (POL) have been smaller thanks to an active market during Covid and the fact demand has been underpinned by buyers needing to move for reasons that include employment and schools.

There was a 0.4% decline in the year to July in POL, while prices are 3% higher than their pre-Covid level and 7.6% below their last peak.