Navigating CRE debt markets in 2024

3 minutes to read

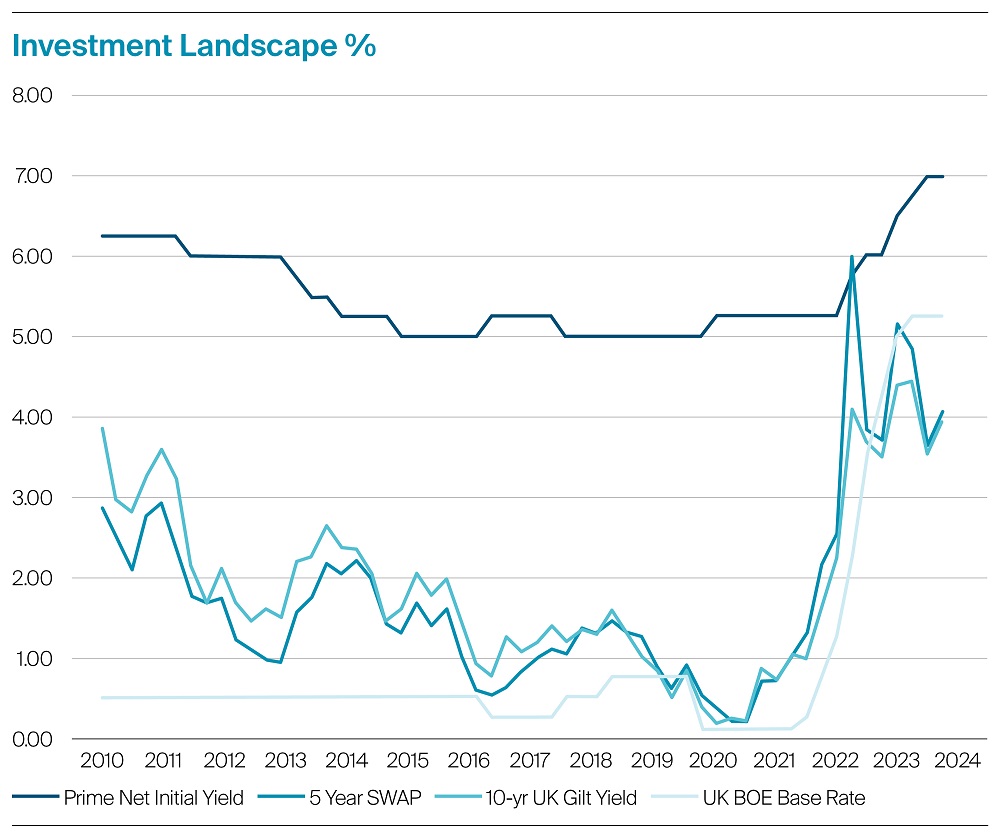

Integrating leverage into today’s real estate transactions has become increasingly complex as the pendulum of debt costs has swung from historic lows to recent peaks. Yet, amidst these challenges, a newfound (but welcome) appreciation for the pivotal role of debt in investment decisions has emerged.

Discerning risk and return has become paramount in this era of fluctuating interest rates. With interest rates now peaking, the stage is set for investors to analyse potential returns with greater conviction. Consequently, we’ve witnessed greater investor activity since the start of the year.

As the UK navigates its path to recovery, we anticipate five key themes unfolding in debt markets this year:

1. Distress, disguised? – Some contend that the market lacks signs of distress – but we disagree with this sentiment. While comparisons to the post-GFC era might be tempting, it’s crucial to acknowledge that today’s distress wears a different mask.

Instead of widespread Non-Performing Loan (‘NPL’) portfolios flooding the market, we’re now seeing subtle tremors in single-asset loans (i.e., where the original loan was primarily secured by the underlying real estate rather than by the strength of the sponsor relationship) – particularly in sectors where collaboration from defaulting borrowers is lacking. Why is this happening?

The landscape in 2024 is significantly different from the post-GFC period. Banks have embraced a more conservative approach to commercial real estate (CRE) lending over the past decade. Their focus on financing ventures led by well-capitalised sponsors has nurtured stronger relationships and reduced the likelihood of loan defaults.

2. Collaboration among lenders – Over the past 12 months, there has been a notable trend of lenders collaborating more effectively. Breached loans no longer evoke harsh default interest penalties. Instead, lenders are adopting a more flexible approach – granting sponsors time to effect a sale or refinance. This shift is significant, especially considering the perhaps unjust stigma of ‘loan to own’ often associated with debt funds of the past decade. The current period of dislocation and revaluation has proved that, for the most part, credit strategies from private equity (PE) houses are not primarily aimed at acquiring assets via the loan route.

3. Blurring the lines between Debt and Equity – The traditional boundaries between debt and equity are becoming increasingly blurred. Transactions often defy traditionality and embrace hybrid solutions that address refinancing challenges and safeguard sponsors while offering enticing upside potential. This hybrid approach is fuelled by the prevalence of debt funds, offering mezzanine and preferred equity solutions as a comprehensive ‘one-stop shop’ package. This creates an interesting and evolving market, uniquely supporting the current dislocation in a way we haven’t previously seen.

4. Pricing opportunities – With high-interest rates reaching their peak and anticipated to decrease, the outlook for the coming months is optimistic. As margins stabilise, dynamics continue to shift, which is evident in the emerging bifurcation among sectors. The Living and Logistics sectors are already benefitting from cheaper finance, while margins for commercial offices have increased. Nonetheless, our team has secured competitive senior debt for various assets across the UK, underscoring that sensibly priced debt is still accessible.

5. Gap to yield – Following a period of dislocation in Q3 2022, the delta between 5Y SWAPs and prime net initial yields has returned. If rates continue downward, debt will become more accretive, potentially unlocking capital markets trades.

The depth and complexity of today’s debt market constantly evolve to adapt to new market conditions. The wide-ranging platform of capital sources offers investors a multitude of capital structures, which are much needed in today’s challenging but optimistic environment.