A rate cut arrives, but not from the Bank of England

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Sweden's Riksbank will likely cut its key interest rate by 0.25% to 3.75% when it meets later today, making it one of the first central banks to diverge from the US Federal Reserve.

The Swedish central bank faces pressure from a persistently weak krona, however four quarterly economic contractions and rising unemployment have probably given it enough leeway to begin loosening policy. The annual rate of inflation should ease to just 1% as early as next month, according to Nordea forecasts.

The Bank of England will publish its latest decision tomorrow, which will almost certainly be a hold. Traders are expecting at least two cuts by the end of the year, with about a 50% chance that the first arrives in June. We'll be watching the voting pattern of the Monetary Policy Committee and parsing the meeting minutes for hints of future cuts. Two or more officials voting to ease policy would likely add some stability to the mortgage market, where lenders continue to notch up rates - Natwest said it will increase prices on a batch of its existing customer products this morning.

Trading sideways

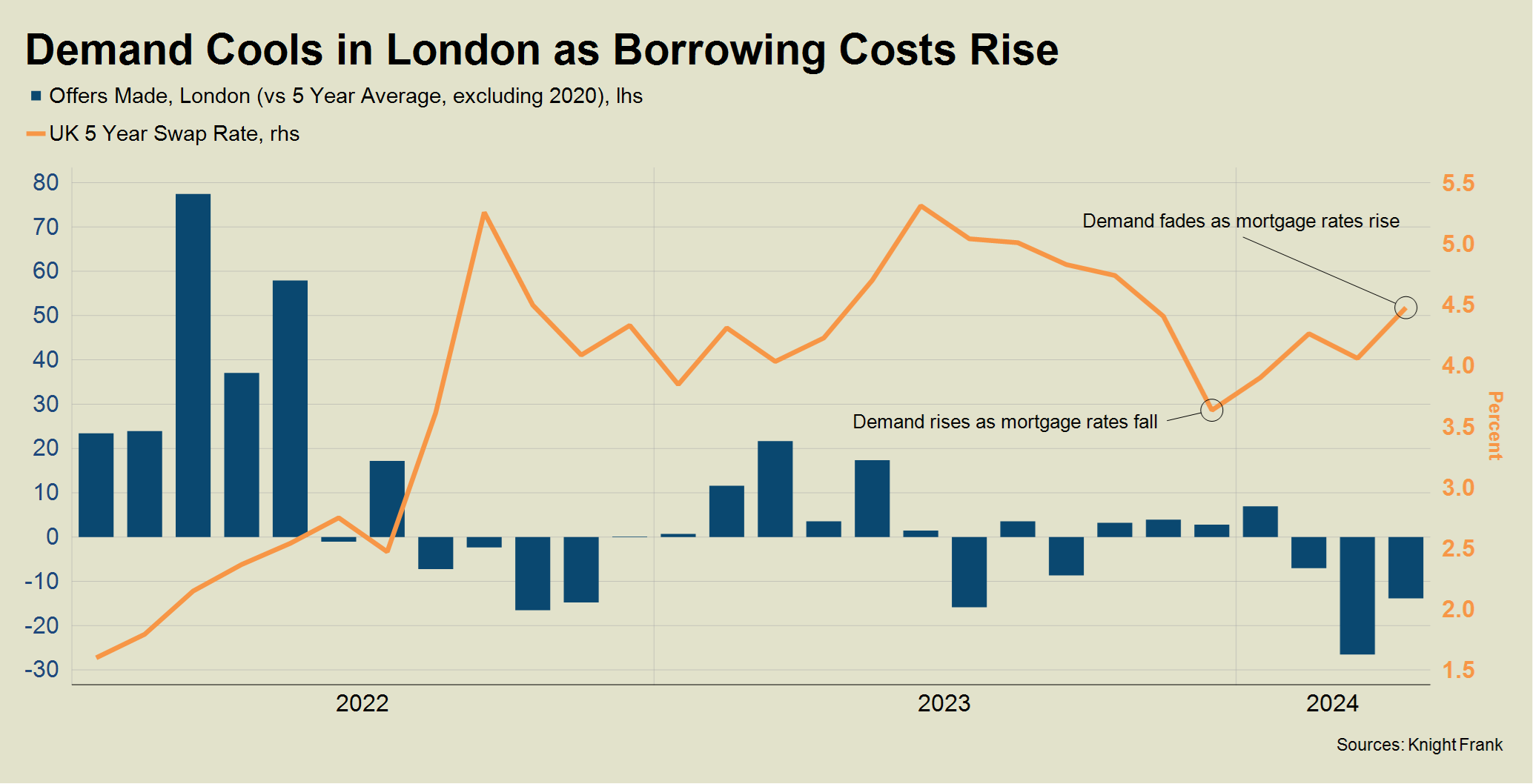

Rising borrowing costs have extinguished the recovery in UK house prices. Average values rose 0.1% in April after a fall of -0.9% in March, Halifax said yesterday - values have been largely flat in 2024 and are up 1.1% year-on-year.

Buyers are adjusting their expectations, with first-time buyers in particular compensating for higher borrowing costs by targeting smaller properties, the lender said. Flats have outperformed, closing the ‘growth gap’ on bigger properties that’s existed for most of the last four years.

Indeed, markets more reliant on buyers that need to move are proving more resilient than higher value locations. Annual price growth in prime central London fell to -2.6% in April, which was the lowest figure in three years, according to our latest index. The annual price decline in prime outer London narrowed to -1.2%.

Rental growth in the prime London lettings markets is easing as supply rises (see chart). New instructions were 11% higher over the first four months of this year compared to the same period two years ago, when rents were climbing at a rate of more than 20%.

The London office market

After three consecutive quarterly rises, London's office leasing market had a quiet start to the year. Take-up fell by 53.4% in Q1 to 1.1m sq ft, which is 30% below the quarterly long-term average of 1.6m sq ft, according to our Q1 London Office Market Report.

"We don’t believe this signal’s anything other than the market pausing for breath after a five year high in lettings transactions was recorded in the last quarter of 2023," says the report's author Shabab Qadar.

Indeed, requirements for space from occupiers, already at a 10-year high, rose by a further 5.7% in Q1 to 12.6m sq ft with demand broadening across sectors. Financial services occupiers maintain the highest level of requirements at 36.4% of the total, followed by professional services at 29.1% and the technology, media, and telecoms sector at 17.3%. Over three quarters of requirements are for offices more than 40,000 sq ft. In addition, deals under offer have risen across all three markets during the quarter – by an average of 14.7% to 3.2m sq ft. All of that is supportive of a rebound in take-up in Q2.

The seniors housing shortage

The UK government wants to increase the delivery of dedicated homes for older people and investors are clamouring for exposure to the sector. As is often the case, the UK's planning system remains one of the biggest barriers to either group getting what it wants.

Our recent survey conducted with the law firm Irwin Mitchell found that a third of local authorities still haven't implemented planning policies to deliver housing for seniors. More than thirty authorities have actually regressed over the past two years.

To find out how we solve this situation, Anna Ward is joined by Irwin Mitchell planning partner Nicola Gooch, and Andrew Sandison, senior research analyst at Knight Frank, for a new edition of Intelligence Talks. Listen here, or wherever you get your podcasts.

In other news...

UK construction growth hits 14-month high in April (Reuters), taxpayers set to fund HS2 tunnel under London despite Sunak pledge (FT), Brexit shows dangers of breaking trade ties, says IMF (Times), and finally, rents will be the last domino to fall in the global battle against inflation (Bloomberg).