UK rural property: Nature degradation

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

9 minutes to read

Opinion

The latest report to measure the impact of climate change and nature degradation on the UK’s economy from the Green Finance Institute (discussed below) is well worth a read. If you buy into its methodology and predictions, it only emphasises the need to do more to mitigate carbon emissions and halt the decline in biodiversity. The more cynical will note a lot of the risks originate from overseas and are therefore “beyond our control”. My take is that the findings are an opportunity for rural property owners to make the case that the current market for the nature-based solutions they are ideally placed to deliver is not paying them nearly enough. A potential double-digit hit to GDP should be a fairly powerful bargaining tool.

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update directly to your email here.

Andrew Shirley Head of Rural Research

In this week's update:

• Commodities – Wheat’s weather climb

• Water management – Cooperative cash on offer

• Vineyards – Get the latest insight

• Methane – Action plan released

• Sea eagles – Compensation support continues

• Nature degradation – Economy to take a huge hit

• Politics – Labour’s rural crime pledge

• Border controls – Brexit checks checked

• Out and about – Nature in the boardroom

• New launch – More Exmoor opportunities

• On the market – The heart of Exmoor

• Farmland values – Prices rise in first quarter

• Farmland – 2024 off to a good start

• Country houses – More good news

• Development land – Market stabilises

Commodity markets

Wheat’s weather climb

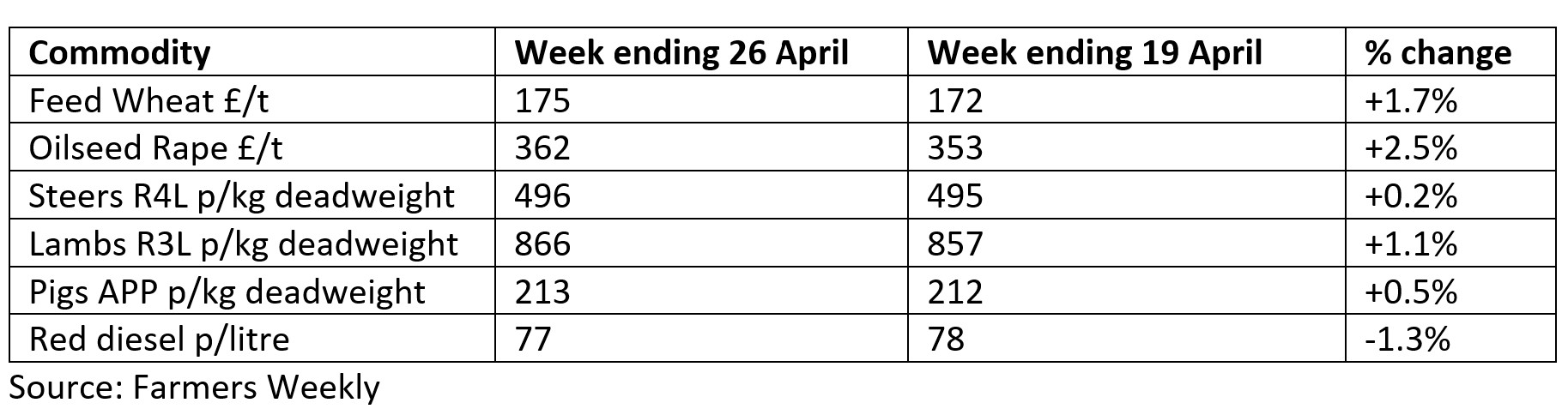

Wheat prices continue to nudge up as dry conditions in Russia, one of the world’s most important producers, prey on the mind of traders and speculators. November prices are now approaching £208/tonne and for anybody with enough storage and an appetite for a bit of risk £215/tonne is on offer for July 2025. If weather conditions remain sub optimal in Russia and climate issues affect more countries, £215 may look a bit cheap, but if the rains do come in time and there are no problems elsewhere, locking in now could prove to be a shrewd move. Some hedging of bets could be a wise idea.

Need to Know

Water management – Cooperative cash on offer

Given the incessant rain so far this year saving water might be the last thing on many farmers’ minds, but summers now invariably bring a period of drought. To help the industry better cope with these drier periods Defra is offering £1.6 million of grant funding to groups of two or more farmers in England interesting in joining a screening study with the Environment Agency. The study will assess and rank water resources options and increase water supply resilience as a group of neighbouring farmers. For details of other grant funding options please contact our specialist team.

Vineyards – Get the latest insight

The UK’s wine sector is burgeoning but getting started and growing a business can still be pretty challenging. To help those keen to take advantage of the growing demand and more conducive climate conditions here, our Head of Viticulture Ed Mansel Lewis is publishing a series of articles that will discuss investment, growth and exit opportunities for existing and future wine business owners. To read the articles sign up to Ed’s newsletter.

Methane – Action plan released

The Environment Agency (EA) has brought together all of the government’s initiatives to cut methane emissions into one handy action plan that covers improved monitoring, reporting and modelling; maximising effectiveness of regulation; and knowledge sharing with external partners. Although UK emissions are already falling, the farming sector still accounts for nearly half of them so will be under increasing scrutiny. As part of its action plan the EA says it will be “publishing a standard-rules permit for methane capture from slurry stores and gas upgrading plant to enable adoption of innovative farm scale methane capture plant”, as well as “engaging with unregulated industries to lower emissions through voluntary schemes, for example industry codes of practice.”

Sea eagles – Compensation support continues

Livestock farmers and crofters affected by the reintroduction of sea eagles in Scotland will still be able to apply for financial support through to 2025. The Scottish Government has made a further £400,000 available under the Sea Eagle Management Scheme to help farmers explore different management techniques and trial new prevention measures. The deadline for applications for support in 2025 is Wednesday, 31 July 2024.

Talking points

Nature degradation – Economy to take a huge hit

A new report from the Green Finance Institute makes for pretty sombre reading if you believe its predictions. The snappily titled Assessing the Materiality of Nature-Related Financial Risks for the UK uses a variety of scenarios to assess the impact of nature degradation and climate change, which it says are inextricably linked, on the UK’s economy. Under the worst-case scenario, which includes an anti-microbial resistant (AMR) pandemic, GDP would take a 12% hit. Even without a major catastrophe the cumulative impact of the deterioration of the natural environment in the UK and around the world could “slow economic growth and lead to major shocks that could result in GDP being 6% lower than it would have been otherwise by the 2030s”. These are greater than the impact on GDP experienced in the global financial crisis, when UK GDP fell by around 4% to 6% and during the Covid-19 pandemic when GDP slumped by 11% in 2020. Unsurprisingly, agriculture is the sector most at risk, but the overall financial security of the country could lie in the balance, the report suggests. Mark Topliff in our Agri-consultancy team says: “The key message from the report for me was that "nature can't wait" but neither can businesses. We have the solutions. We just need to employ them, employ them more widely and employ them more rapidly. Many landowners are in a great position to help implement some of these nature-based solutions for businesses and investors.”

Politics – Labour’s rural crime pledge

With a General Election on the horizon expect plenty of pledges from politicians desperate to woo the public their way. Sensing that Tory hegemony in the countryside could be faltering Labour leader Keir Starmer’s latest initiative is a rural crime strategy. It promises more police patrols in rural areas, tougher measures on theft, drug dealing, fly-tipping and sheep worrying, as well as more joined up thinking across government departments. Crime levels in the countryside have increased by 32% since 2011, 8% more than in urban areas, according to Labour. Rishi Sunak has already made a few promises of his own. Speaking at the NFU conference in February the Prime Minister told farmers “he would be by their side” announcing what he called the largest-ever grant scheme and a Food Security Index.

Border controls – Brexit checks checked

Border checks on goods being imported from the rest of Europe go live today (April 30th), but Defra has denied allegations by some newspapers and farming organisations that it is putting the UK at risk from livestock and plant diseases by not implementing checks on all food imports. A spokesperson said: “As we have always said, the medium and high-risk goods posing the greatest biosecurity risk are being prioritised as we build up to full check rates and high levels of compliance. Taking a pragmatic approach to introducing our new border checks minimises disruption, protects our biosecurity and benefits everyone – especially traders.”

Out and about

Nature in the boardroom

Mark Topliff and James Shepherd from our Agri and Rural Consultancy team attended a crucial discussion about elevating nature's importance in corporate boardrooms last week. Organised by ESG consultant Simply Sustainable and held in the hidden lush oasis of London's Camley Street Natural Park, near Kings Cross station, the panel featured Sarah Beattie, Knight Frank's ESG strategist. “The panellists concluded that to make strides in recognising nature's impact on business, they emphasised education, relevance, and client engagement. With the looming threat of nature's decline impacting GDP, urgency is clear: it's time for businesses to act, for nature can't afford to wait,” reports Mark.

Property News

New launch – More Exmoor opportunities

Our Farms & Estates team now has two new amazing Exmoor options on offer for view-loving buyers to choose between. This week’s offering is the 2,075-acre Lanacre Estate near Withypool, which includes a traditional farmhouse and four other dwellings. The estate has been split into two lots with the houses, farm buildings and 198 acres of pasture and woodland priced at £3.5 million. Almost 1,900 acres of rough grazing and moorland on Withypool Common are available for £1 million. Contact Alice Keith for more information.

On the market – The heart of Exmoor

My colleague Alice Keith in our Farms & Estates team has just launched an 894-acre farming, natural capital, lifestyle and equestrian opportunity at the heart of Exmoor. Emmetts Grange in Simonsbath, includes an attractive nine-bed Georgian House, four cottages, a party barn, 18 stables and a new indoor riding school. In terms of land, the estate includes 360 acres of pasture, 15 acres of woodland and 474 acres of moorland free from commons rights. The guide price is £6.5 million. Contact Alice for more information about the estate and its natural capital opportunities.

Our Latest Property Research

Farmland values – Prices rise in first quarter

The average value of bare agricultural land in England and Wales rose by 1% in the first quarter of 2024, according to the latest results from the Knight Frank Farmland Index. The rise takes annual growth to 6%, outperforming other asset classes like equities and residential property. There is still an imbalance between supply and demand, but competing pressures, including the uncertainty of a general election, will probably keep values in a fairly narrow range for the remainder of 2024. Download the full report for more data and insight.

Country houses – More good news

The latest figures from our prime Country House Index, compiled by my fellow researcher Kate Everett-Allen, show that values have started to rise again for the first time in almost two years. Prices increased 0.3% in the first quarter of the year, the last time the index registered positive quarterly growth was in June 2022. Year-on-year, however, values are still down 5%, but they are almost 12% higher than at the beginning of the Covid-19 pandemic in March 2020. Read Kate’s full report for more numbers and insight.

Development land – Market stabilises

Newly released figures from the Knight Frank Residential Land Index show that England greenfield and urban brownfield values were flat in Q4 2023 compared with the previous quarter. Previously, urban brownfield values had fallen by 20% since the most recent peak of the market in the first quarter of 2022 up to Q3 last year, with greenfield down 17% during the same period. Greater economic confidence and a slowdown in the rise of build costs helped underpin values, says my colleague Anna Ward. Read her full report for more numbers and insight.