UK Housing Market Set for Strong 2024 as Mortgage Rates Fall

The changing mortgage landscape and hints the election will be held in the second half of this year will boost demand in 2024

3 minutes to read

This time last year, as the UK property market stirred from its Christmas slumber, many hoped the final quarter of 2022 had been a bad dream.

Mortgage rates spiked so much following September’s mini-Budget that lenders pulled hundreds of products from the market and the Conservative party was forced to find a new Prime Minister.

This year, buyers and sellers could be forgiven for thinking that the economic news in the final quarter of 2023 was too good to be true.

Sub-4% inflation means speculation has turned to the number of rate cuts in 2024 rather than whether they have peaked. Money markets were pricing in five cuts of 0.25% last week.

As a result, mortgage lenders have sent their own positive message to the property market. The Halifax and Leeds Building Society both made material cuts to their rates last week, which was followed by HSBC announcing a sub-4% five-year fixed rate.

“What is encouraging for the property market is that these cuts are across the board, for all loan-to-values and mortgage types,” said Simon Gammon, head of Knight Frank Finance. “The best rates are currently around 4% but I would expect to see more products starting with a 3 fairly soon. Lenders are trying to stimulate the market after a poor 2023 so the margins will be tight. For context though, we don’t expect considerably lower rates anytime soon.”

The changing landscape means some economists have revised their house price forecasts for 2024 and we will do the same shortly.

House prices rose 1.7% in 2023, the Halifax announced last week, underlining how positive the data has become since last summer, when declines of 5% looked likely to widen.

Demand this year could be further boosted by pre-election giveaways in the Budget on 6 March. There is speculation surrounding tax cuts as well as measures to help first-time buyers including longer fixed-term mortgages, smaller deposits, and a revived help-to-buy scheme.

It also won’t hurt that Rishi Sunak has hinted that the election will come in the second half of this year.

The number of people who will roll off more favourable fixed-rate deals in 2024 should contain more meaningful growth, as well as rising supply and uncertainty ahead of the election itself.

That said, the UK property market is well-placed to build on its strong finish to last year.

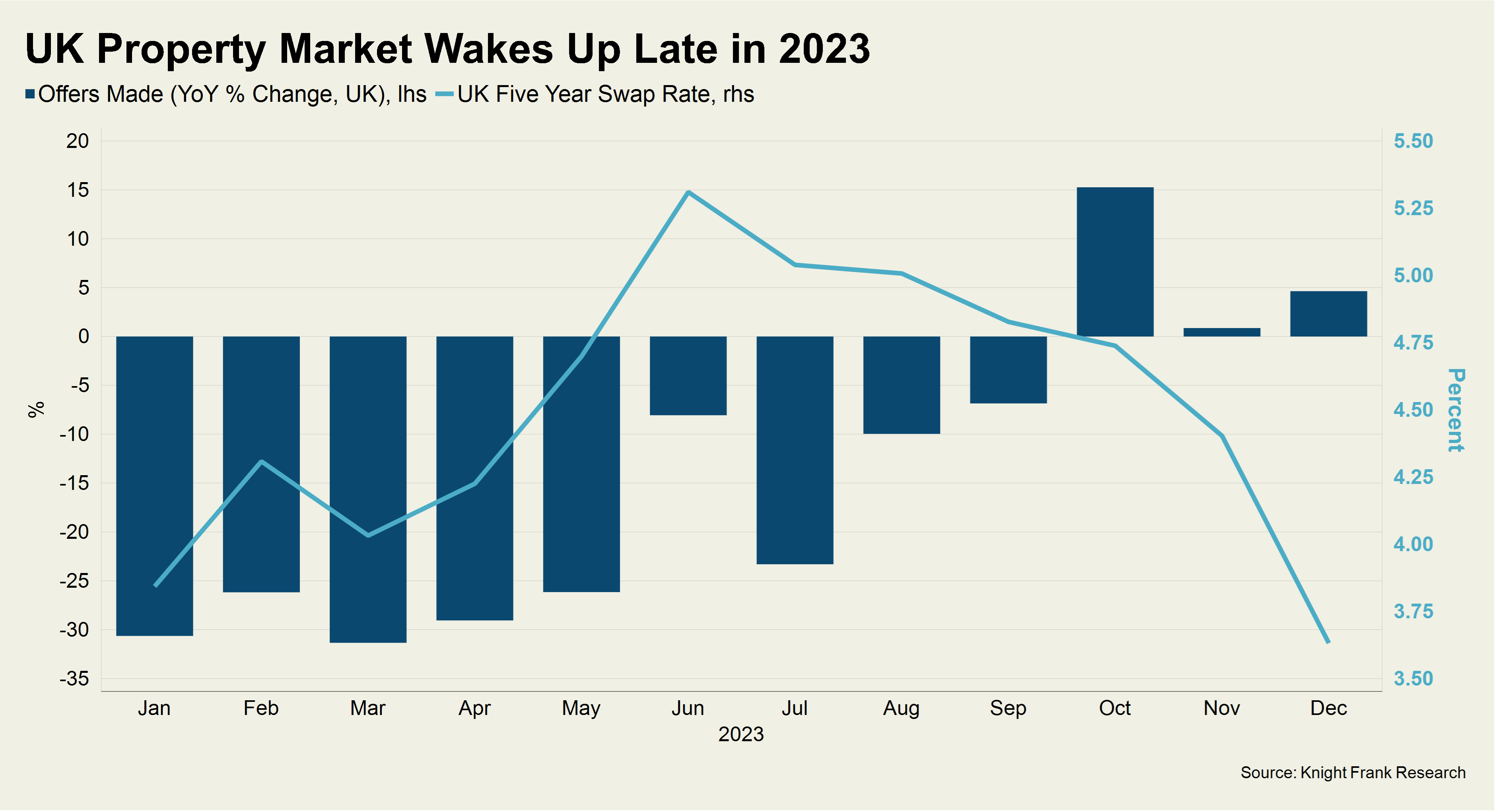

Demand was notably stronger in the final quarter of 2023 than the previous year as borrowing costs fell, as the chart shows. The number of offers made across the UK in October was 15% higher than 2022.

Ideological splits within the Tory party on the issue of immigration may mean that Rishi Sunak does not ultimately have full control of the election timetable, which adds a layer of uncertainty. A backbench Brexit rebellion forced former PM Theresa May to resign in May 2019 and Sunak’s Rwanda bill is proving equally divisive inside his own party.

If anything, the political splits at Westminster and within the traditional voter bases of the two main parties that began with the Brexit vote in 2016 feel like they will get wider this year.

Fortunately for the UK housing market, any impact is likely to be less marked than the fact five-year fixed mortgage rates quadrupled in the two years to July 2023.