Activity wilts as newly-drawn mortgage rates pass 5%

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

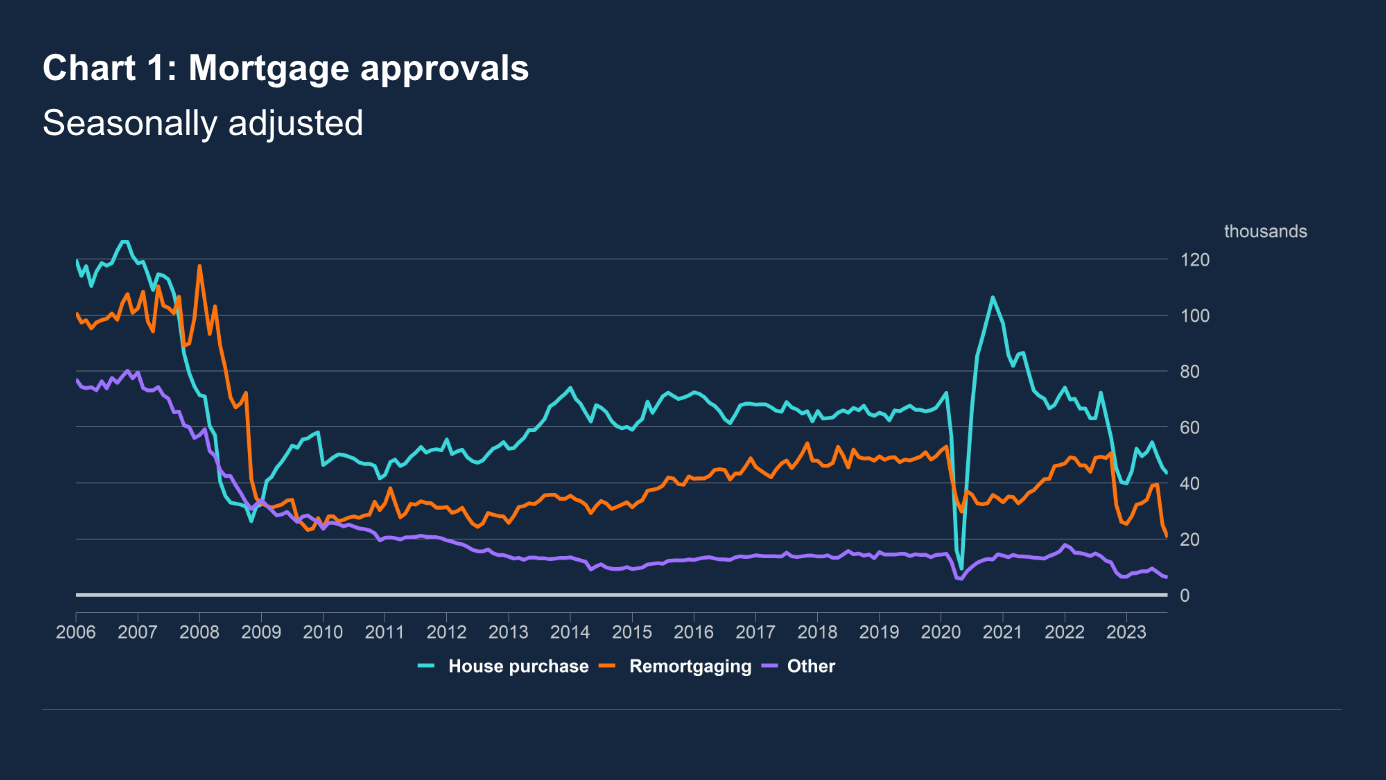

Housing market activity continues to ease. Mortgage approvals for house purchase, a good indication of future borrowing, fell to 43,300 in September, from 45,400 the previous month, the Bank of England said this morning. That's the lowest level since January (see chart).

Mortgage rates have eased to a plateau following a volatile year and it's going to take some time for buyers to get to grips with what they can now afford. The effective interest rate on newly drawn mortgages rose to 5.01% during September, up from just 1,78% two years ago, the Bank said.

"We could see some more marginal cuts to mortgage rates before the end of the year if we see the headline rate of inflation dip into the 4% - 5% range," says Simon Gammon of Knight Frank Finance. "We'd expect five year fixed rate products of around 4.5% in that scenario, down from about 4.8% today. While that's what many borrowers would consider expensive, it's certainly better than the 6.5% five year fixed rates we had a little under a year ago.

"Trackers are the most popular products for now. Most borrowers are willing to risk an uptick in their outgoings if it means they can benefit from any interest rate cuts next year."

Land values

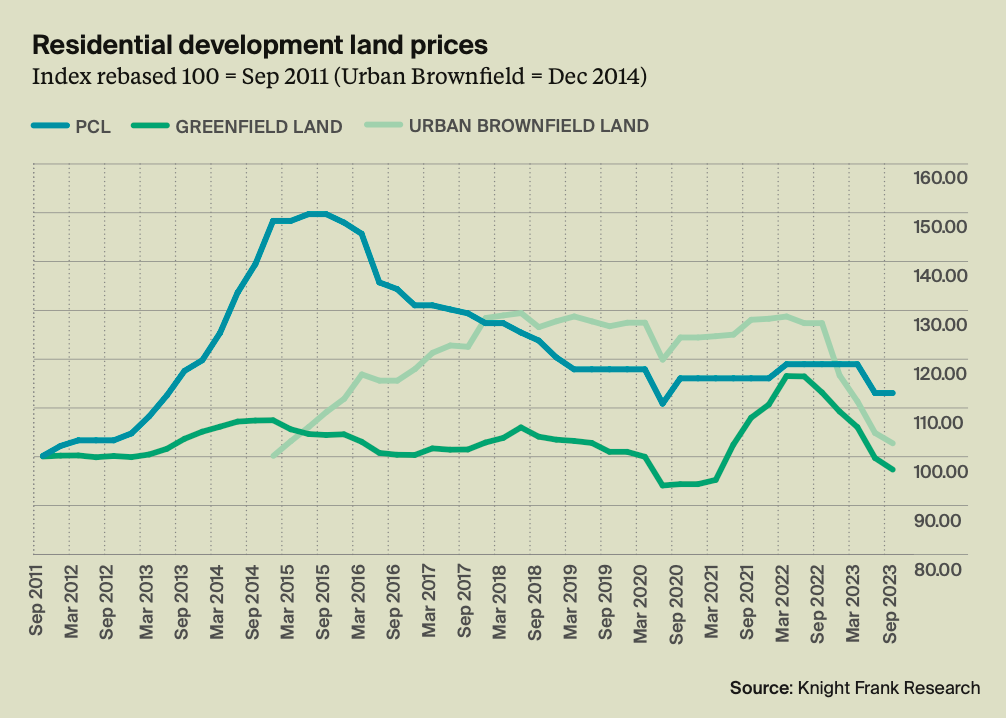

The relative stability of borrowing costs and the likelihood that the Bank of England will opt to hold the base rate at 5.25% on Thursday has added some firmness to UK land values. Greenfield and urban brownfield values fell on average by 2.4% and 2% respectively in Q3 2023. Prices were flat in prime central London, according to our latest Land Index.

Average urban brownfield land values across England have now fallen by 20% since the most recent peak of the market in the first quarter of 2022 up to Q3 this year, with greenfield values down 17% during the same period. Price falls are now moderating in almost every area of the country.

There is a split in our survey of more than 50 volume and SME housebuilders as to the future direction of land prices. Overall, 48% said they expect land values will fall in the fourth quarter compared to Q3, with another 48% predicting they will stay flat.

Given strong demand for student beds and a lack of supply, there has been a rise in planning applications to change the use of some land sites from C3 (Dwelling House) to C4 (HMO) for student accommodation in well- located sites in key university cities.

New Towns

Planning delays remain a key concern for developers. Eight in ten respondents highlighted the system as a challenging factor for their business this quarter.

When it comes to negotiating a 'subject to planning' purchase, the performance of a local authority in processing planning applications is the key consideration for housebuilders. Understaffed planning departments have long been a bug bear for developers. The Labour Party last month pledged to rectify the issue with a recruitment drive for local authority planners.

We've now had some time to digest party conference season and the team has been taking a closer look at some of the proposals. Anna Ward last week unpacked Labour's proposal for a new generation of New Towns. The plan will bring opportunities for developers, but there’s much more that can be done with existing pipeline sites, she writes.

Tom Bill this morning considers the election likely to take place next year, and gets an experts take on the mooted cut to stamp duty in next month's autumn statement.

Paying for HS2

Last month, following the cancellation of the northern leg of HS2, I considered why the UK struggles so much with mega projects. While that's an important issue, there are now rafts of pressing questions that need answering, whether from landowners, developers, contractors or anybody that one day hopes to use the line.

There remains uncertainty as to the outlook for the Old Oak Common to Euston connection, for example. Earlier this month the Prime Minister said the connection would now rely on private funding, and The Department for Transport (DfT) later released a statement citing the success of Battersea Power Station and Nine Elms, "which secured £9bn of private sector investment".

Any proposal to replicate that for the west London section of HS2 is "verging on fantasy", London Mayor Sadiq Khan said on Friday. Mr Khan might say that, but the FT quotes Alexander Jan, former chief economist at engineering group Arup, who explained that TfL had received about £1bn in private finance for the Northern line Tube extension, but HS2 would need at least £4bn: “You would need to build 26m sq ft — the equivalent of 21 Canary Wharf towers — plus 80,000 homes — to come up with that sort of money.” The current plan is for 3m sq ft of commercial space and 3,500 homes.

Many land and property owners along the cancelled part of the route from Handsacre to Manchester remain in the dark as to what's likely to happen next, too. Mark Topliff offers some answers.

In other news...

US thirty-year mortgage rate approaches 8% (Bloomberg).