Living sectors leading the charge

Plus, fewer permissions and preparing new homes for climate change

3 minutes to read

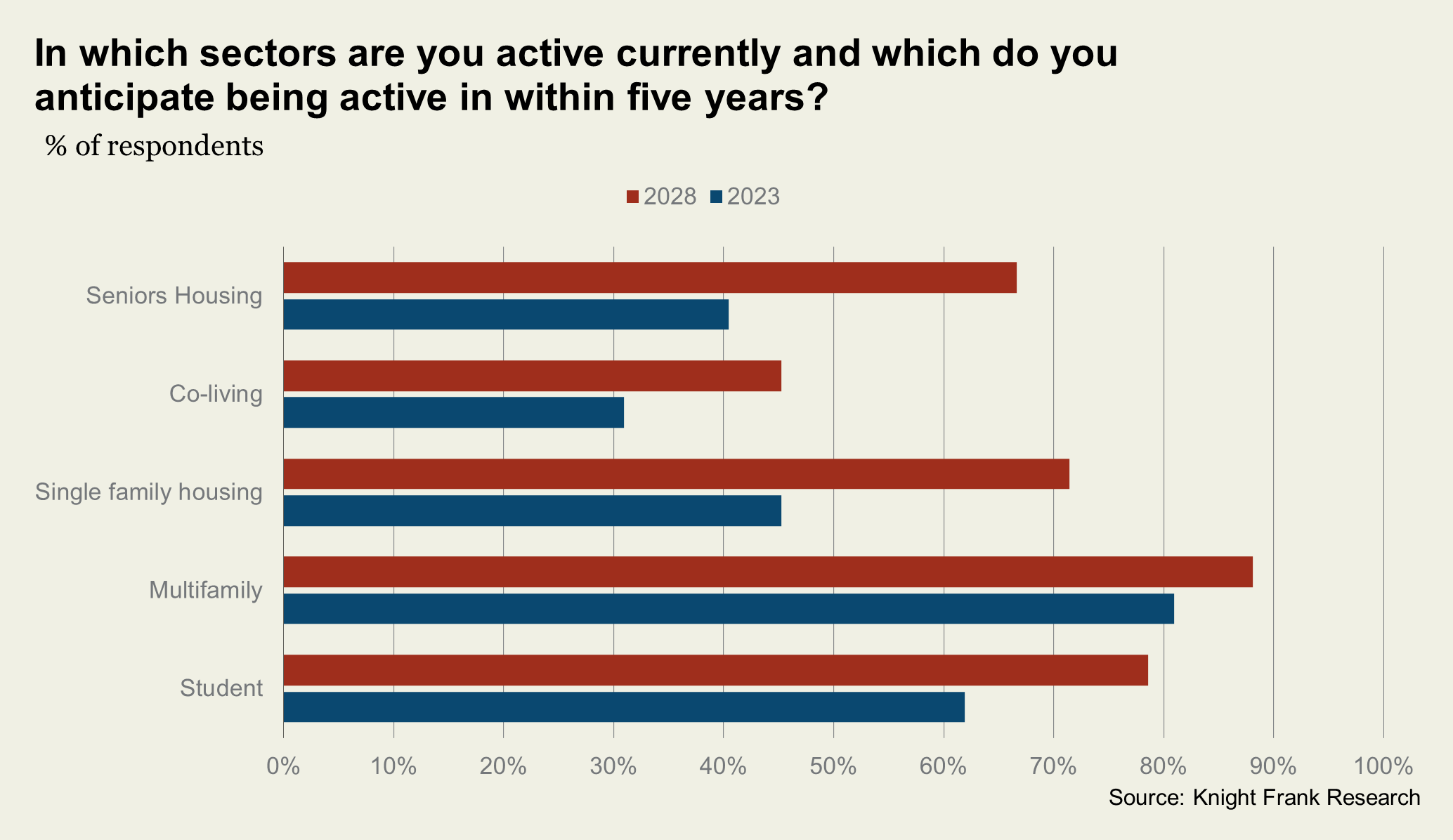

Continued volatility has led to investors doubling down on the asset classes that are doing well, as confirmed by our recent UK Living Sectors Investor Survey.

We’ve talked before about how, in turbulent times, investors are finding confidence in the counter-cyclical nature of the Living sectors, which offer a bright spot for development, given the significant imbalances which exist between supply and demand in the student, rental and seniors housing space.

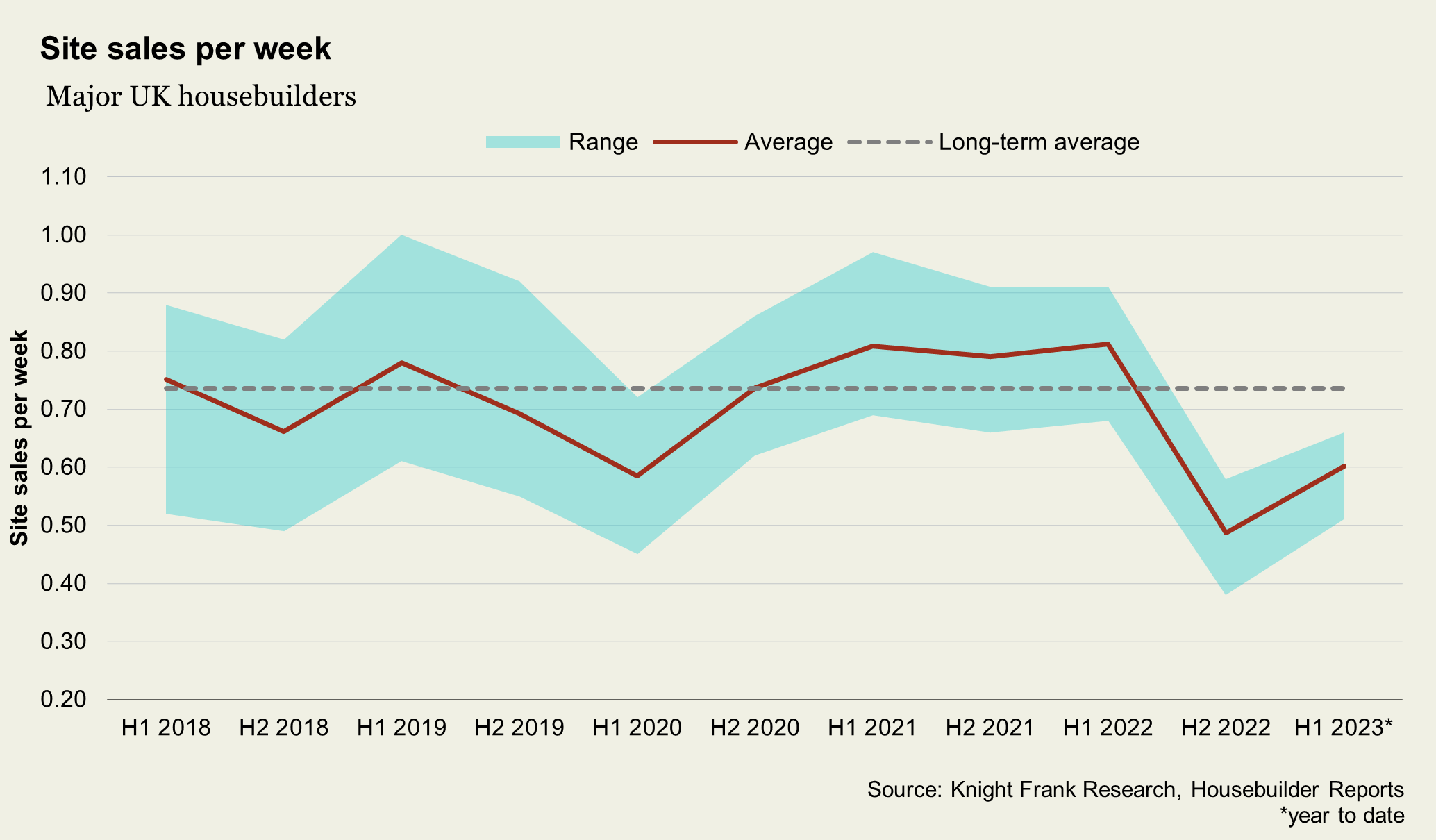

Indeed, in the absence of sales supports such as Help to Buy, which officially closed to new applications in October, some housebuilders have turned to bulk sales to rental and affordable operators to boost numbers. This, in turn, has supported an uptick in sales rates from lows at the end of last year.

A move to diversify revenue streams through bulk deals with institutional investors is also a trend reflected in our most recent survey of SME and volume housebuilders.

Clearly, for some, the wider economic context makes partnering with an investor to fund or part-fund projects attractive, particularly given the untapped equity looking for opportunities. Investors told us they have earmarked £45 billion to spend over the next five years.

Multifamily apartment blocks and student housing are the most favoured asset types but expect to see substantially increased appetite for single family housing for rent, age-targeted seniors housing and co-living over that time.

Growth isn’t without challenges - notably concerning development and acquisition costs. Some 62% of investors cited the cost of finance as a major challenge, reflecting the recent spike in debt costs. Additionally, 50% expressed concerns about the availability of operational stock.

Even so, the future for the living sectors is bright, and we expect they will take up an increasing share of new home sales moving forwards.

Planning (cont.)

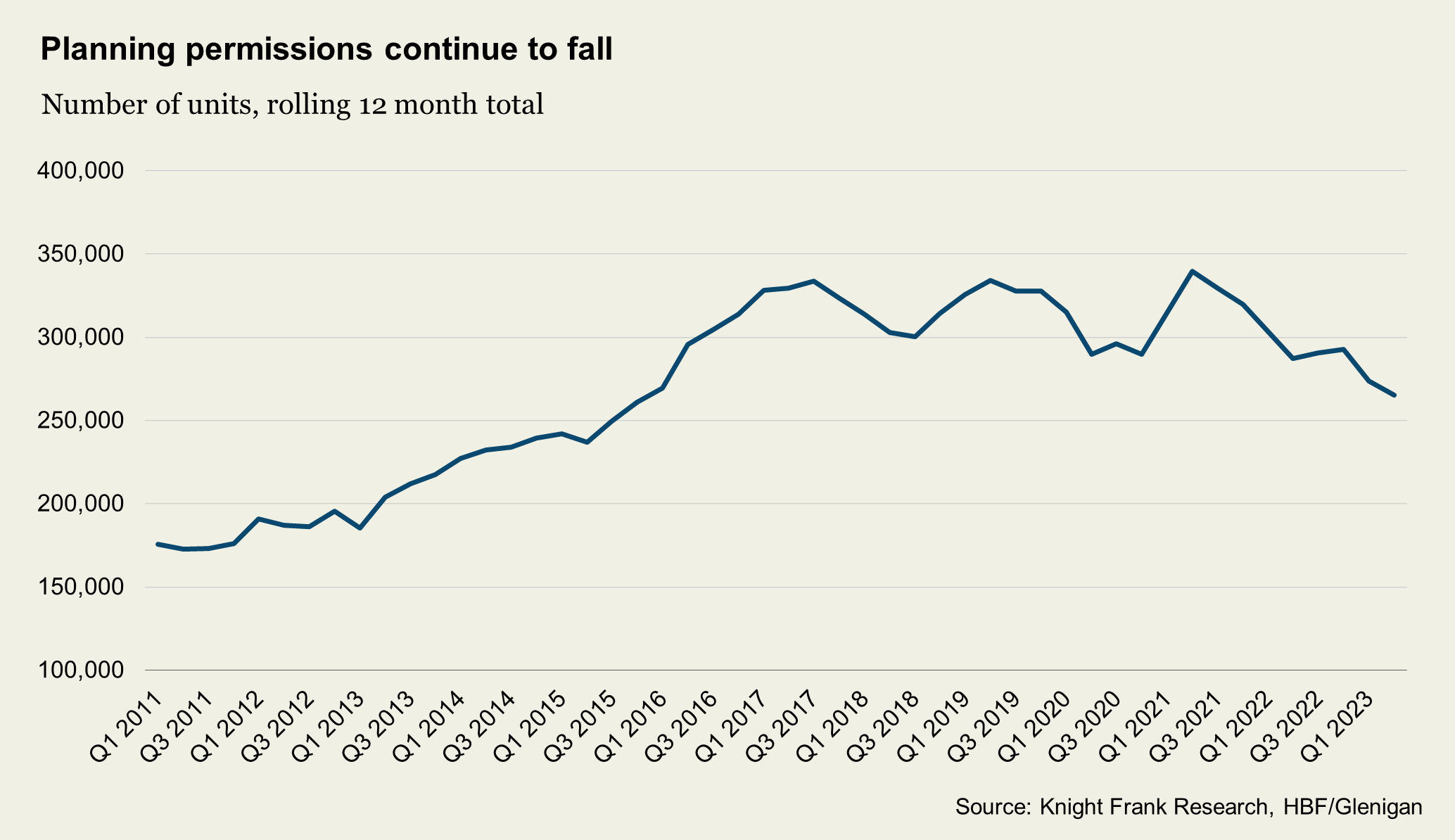

Interestingly (but perhaps unsurprisingly), the second biggest obstacle revealed by our investor survey was the planning regime.

Data released this month by the HBF and Glenigan shows the number of planning permissions being granted across England for new build houses fell sharply during the second quarter of the year, continuing the downward trend of the past two years.

Permissions are a lead indicator of future supply, so the fact that the number of projects granted planning in the second quarter dropped to the lowest since the HBF first published its figures in 2006 is a fairly solid pointer that delivery is going to fall markedly in the coming years.

On an annual basis, permissions were 22% lower than the most recent peak.

Clear evidence of a reduced appetite among housebuilders amidst a riskier planning environment and wider economic circumstances. As a result, developers who can proceed with new schemes are likely to benefit from selling into a market that is likely to be starved of new stock.

Preparing new homes for climate change

In this week’s Intelligence Talks Anna Ward speaks to Barratt’s technical and innovation director, Oliver Novakovic. Oliver is testing new technology at the Energy House 2.0 in Manchester on preparing homes for climate change. Listen here, or wherever you get your podcasts.