Do surprise growth figures hold clues about UK inflation?

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

The UK economy grew 0.2% in the second quarter, a surprise rise that suggests the economy is showing resilience to the sharpest tightening of monetary policy since the late 1980s.

The data published on Friday prompted analysts including J.P.Morgan to upgrade their outlook for growth this year, though many still expect a mild recession to play out over the second half. While better-than-expected growth is generally positive, it does raise the probability that the Bank of England will need to continue hiking to cool inflation. Domestic stock markets closed Friday lower and rate-sensitive real estate stocks were among the top losers, easing 2.2%.

An important number

Inflation figures due out on Wednesday will provide a better gauge of how conditions will evolve over the next few months. Economists polled by Reuters expect the annual rate of inflation to fall to 6.7% in July, slightly lower than the BoE’s 6.8% forecast, and a hefty drop from 7.9% in June.

The details will matter - particularly measures of core prices and services inflation. Wage growth in the services sector has consistently surprised on the upside and holds the most potential to prompt a nasty surprise. A survey from the Chartered Institute of Personnel and Development (CIPD) this morning showed employers are increasingly willing to be drawn into bidding to hold onto staff.

Still, anything that matches or comes in below consensus will pave the way for the further easing of mortgage rates - see Friday's note for more. Tom Bill uses his note this morning to put Wednesday's inflation print in the context of the wider housing market data, and outlines why house price performance during the pandemic has contributed to the prevailing 'expectation gap' we're currently seeing between buyers and sellers.

Supply shortages

Saturday's Times ran a detailed feature on the shortage of suitable university accommodation in cities across the UK. Exeter, for example, has five applicants for every place at its most popular location.

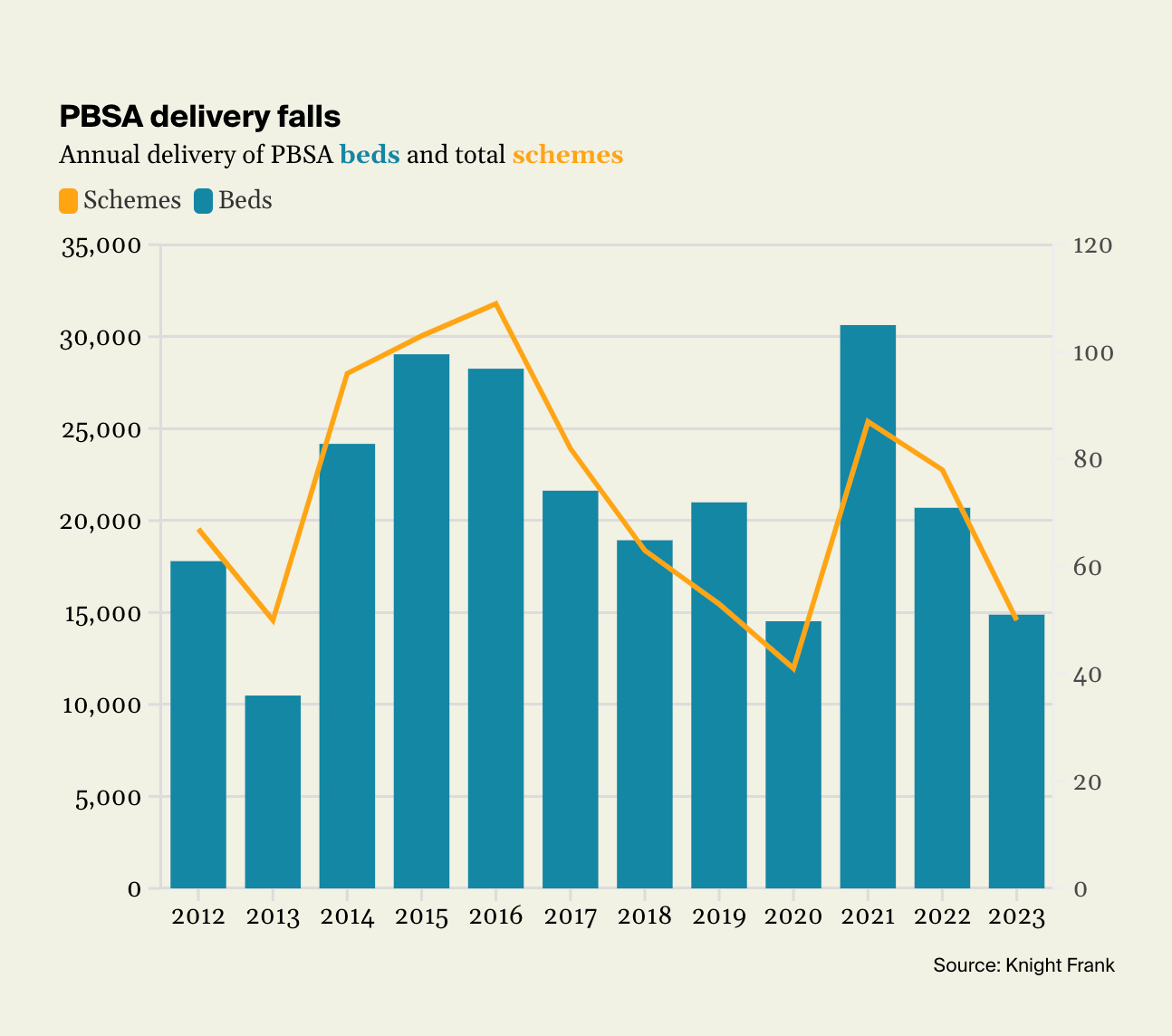

This has been years in the making. Fewer than 15,000 new purpose-built student beds will be added to supply in the 2023/24 academic year, a 28% fall on the previous year’s delivery and well below the five-year pre-pandemic average of nearly 24,000, according to figures compiled by Oliver Knight last month. Just 50 new developments will be completed in 2023/24, less than half the level seen in 2016/17.

Rising build and site costs, skills and labour shortages, higher financing costs, and tricky-to-navigate planning policy all represent headwinds despite continued growth in student numbers. The total pipeline stands at 132,490 beds across the UK, with 22% of this under construction and a further 44% with full planning permission granted.

Our modelling, meanwhile, suggests we'll see an additional 263,000 full-time undergraduate students above the current level by the end of the decade.

A crowded market

Discount retailer Wilko fell into administration on Thursday, putting 400 stores and 12,500 jobs at risk. The collapse says more about the competition at the value end of the retail market than it does about the health of the UK consumer, according to Stephen Springham: -

"The value end of the retail market is an extremely crowded place. Consumers have a multitude of choices. Consumer spend may well be holding up generally and much of it is gravitating towards the value end of the market. But at the end of the day, there is only so much to go around a very broad and diverse retailer base. Wilko is just one of those operators."

Stephen covers the collapse in more detail in his note, and unpacks what it tells us about the state of the wider retail market. You can read it here.

In other news...

China to pause plans to build London embassy (Reuters), China stocks hit after developer Country Garden suspends some bond trading (FT), businesses brace themselves for drop in consumer spending (Times), interest rates and housing hit confidence (Times), tourist tax hits retail spending in London (Times), Goldman Sachs thinks the Fed will start cutting rates by the end of next June (Bloomberg), and finally, the ECB will hike one more time in September and will start rate cuts in March: survey (Bloomberg).

Image by Gerd Altmann from Pixabay