Why Paris is packing a punch in 2023

The stars are aligning for Paris, the city is emerging as the European Union’s pre-eminent financial hub, it’s gearing up for the 2023 Rugby World Cup and the 2024 Olympic Games and overseas buyers are strengthening in number

4 minutes to read

Post-Brexit, Amsterdam and Frankfurt were due to be the financial winners, but Paris has stolen a march on its European neighbours.

The French capital is attracting a new pool of bankers, with its fintech and investment banking sectors notably strong. A recent article by Bloomberg stated, “If any city can make claim to being the bloc’s new pre-eminent hub, it’s Paris.”

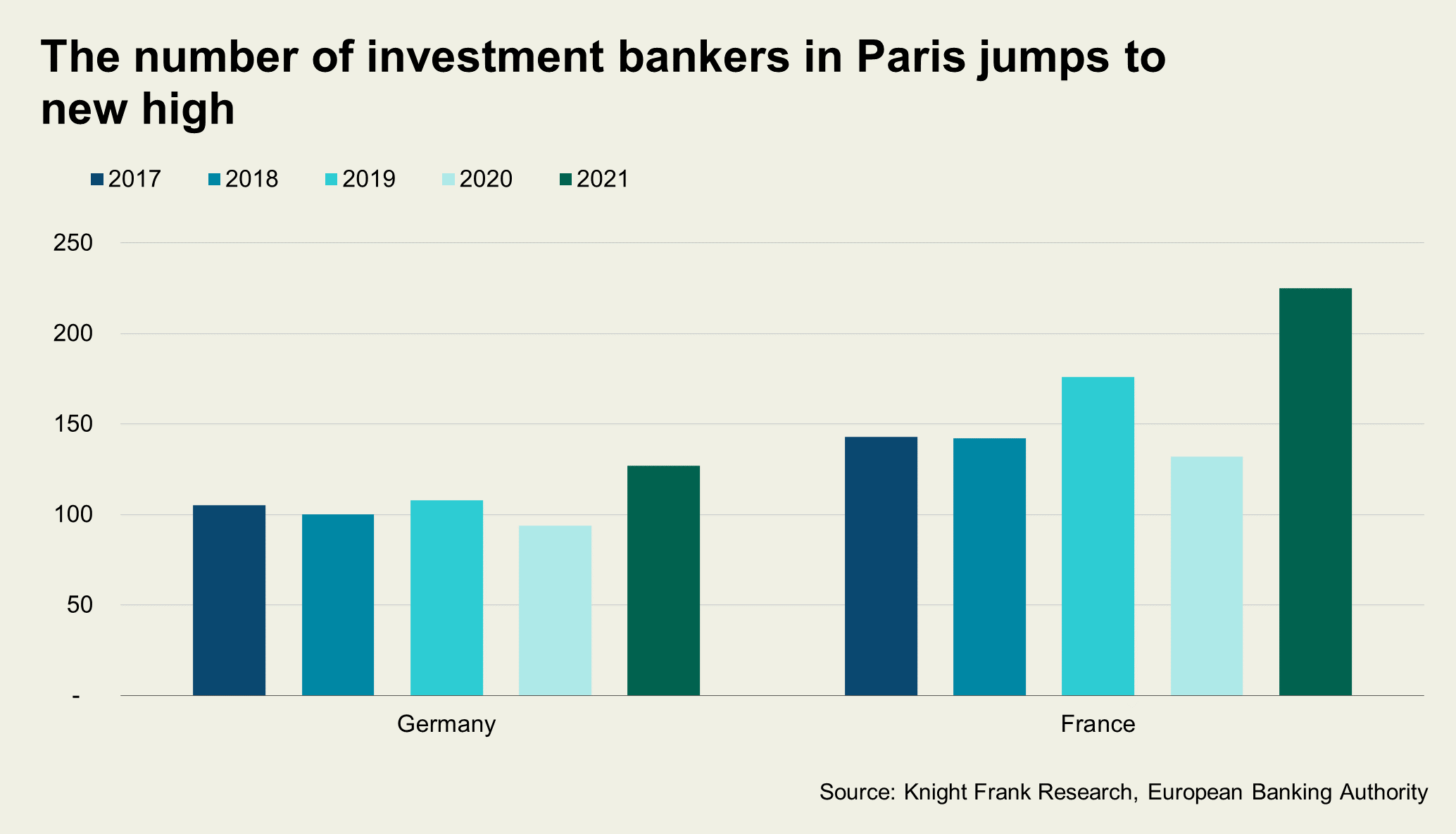

Twelve months after the UK officially left the European Union, the number of investment bankers in France increased 70.5%, Germany’s figure was a paltry 35.1% by comparison, according to The European Banking Authority.

According to Bloomberg, JP Morgan has 550 markets staff in the city, up 22-fold from its total in 2019. Bank of America’s headcount is six times higher than before the Brexit vote, Morgan Stanley is creating a new research centre in the city, and the Goldman Sachs Group Inc. has more than doubled its staff numbers in the past two years.

The French government estimates that over 7,100 new jobs were generated in the Paris region as a direct result of Brexit, with 1,000 more expected by 2025.

Heart of the city

According to Roddy Aris, a Partner in Knight Frank’s International Department, “For the business community, it’s no longer all about La Défense.” Whilst the European Banking Authority may have chosen the financial enclave as its new home, Goldman Sachs’ asset management wing recognised the appeal of central Paris, buying up a €100,000 million office and retail building in the 8th arrondissement.

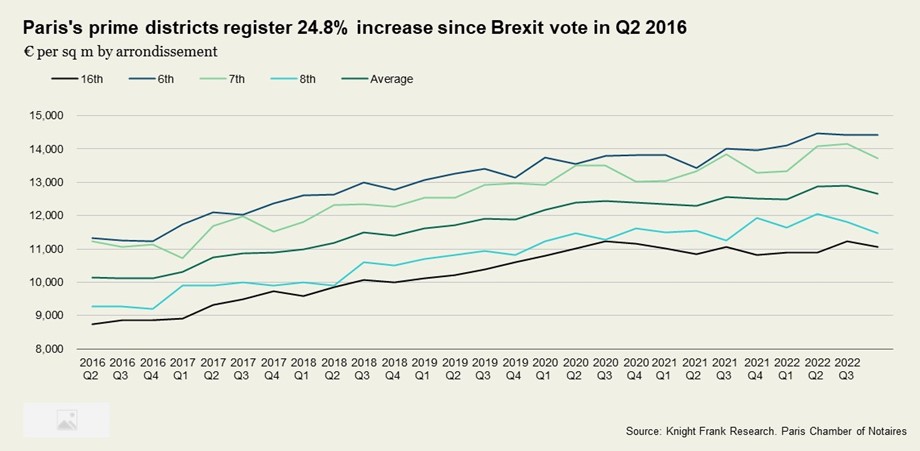

Roddy adds: “This commercial demand is spilling over into the city’s prime residential sector.” Average prices in the most desirable 6th, 7th, 8th and 16th arrondissements are up 24.8% on average since the Brexit vote in June 2016, according to the Paris Chambers of Notaires.

Haute couture

Alison Ashby, director of Junot Fine Properties, Knight Frank’s partners in Paris comments “It’s not just the banking executives making a beeline for Paris, we see the fruits of record earnings in the luxury goods sectors with clients coming from the haute-couture industry looking for an upgrade in Paris.

Alison adds: “Most are looking for iconic but discreet addresses like Rue du Cirque in the 8th or Rue de Grenelle in the 7th, within minutes of the Golden Triangle but tucked away from the hustle and bustle of central Paris.”

Super-prime

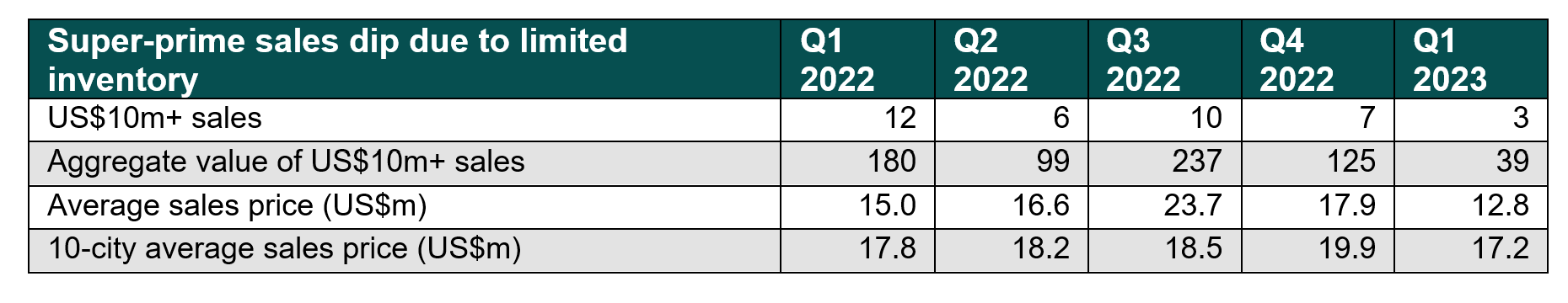

During the pandemic the top end of the luxury residential market (US$ million-plus) detached from the wider prime segment in most major cities. The size and quality of one’s living space became fundamental and trophy homes offering outdoor space and quality amenities were in demand but short supply.

Fast forward three years and the latest data shows a decline in sales above US$10 million. This is due to a lack of stock rather than a lack of appetite. Alison confirms, “The super-prime sector continues to note record deals above €50,000 per sqm, with little sign of prices leveling out,a trend evident in the mainstream market.”

Who’s buying?

US buyers expanded their market share in 2022, according to Junot Fine Properties data. US purchasers accounted for 55% of the team’s overseas buyers in 2022. The strong dollar intensified their interest, although as Alison points out, “Americans have always had a love affair with Paris, drawn by the romanticism of the city’s boulevards, parks and more relaxed pace of life.”

Drilling into the data further shows US buyers spent an average of €5.5m, most targeting the Left bank and Saint-Germain-des-Prés in the 6th arrondissement.

According to Alison, “Paris is also piquing the interest of ultra-high-net-worth Middle East and Taiwanese buyers, who have returned to the capital since January and have their sights set on turn-key properties with a Seine view or close proximity to the Golden Triangle.”

International interest will ramp up further as the buzz around the 2023 Rugby World Cup and the 2024 Olympics Games intensifies and the city gains global exposure.

Green space premium

Seeking a view of a Paris landmark such as the Eiffel Tower, Arc de Triomphe or Notre Dame? Our research shows the average premium for such a property is 26%.

But outdoor space, the addition of a terrace or garden, rather than simply a balcony, still generates the biggest uplift in the post-Covid era, these properties are generating on average a 46% premium.

Need to know:

- Purchase costs for an existing home are c.7-8% of the property price, this figure is closer to 2-3% for a new-build property, in some cases owners can claim a 20% VAT rebate if key conditions are met

- The 2024 Olympic Games will see a 52-hectare site 7km north of the centre developed into the Village that will deliver 2,800 new homes

- The Grand Paris Project, Europe’s largest urban infrastructure project, will deliver 68 new stations and four new rail lines easing the daily commute of over 2.5 million Parisians when completed in 2030

Contact Roddy Aris to learn more about the Paris property market or sign up to our Global Residential Update newsletter.