The government walks a tightrope on homeownership

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Economic resilience

We've been tracking various leading indicators suggesting that economic activity should improve through spring. Both consumer and corporate sentiment registered substantial improvements through late March and into April, for example.

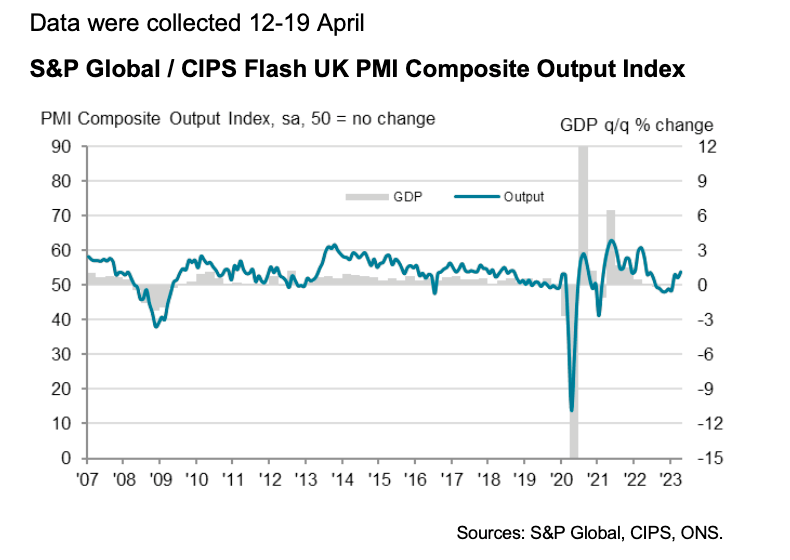

More came on Friday from the S&P Global/CIPS purchasing managers index. UK private sector firms signalled the fastest increase in business activity for a year during April, the release said. That's the third consecutive expansion. New order growth hit a 13-month high in the service economy amid rising spending on travel, leisure and entertainment.

All of this is a double-edged sword for the housing market. The readings suggest that the Bank of England has ample room to keep raising interest rates to make absolutely sure that inflation returns to target. Wage inflation - one of the key indicators guiding the Bank's approach - came in above consensus last week, according to official figures. Respondents to the S&P Global/CIPs survey also noted another month of strong wage inflation, which led to a steep increase in output charges during the month, especially in the service economy.

Rising output

These themes are by no means limited to the UK.

It's earnings season in corporate America and, of the 20% of S&P 500 firms that have posted quarterly figures so far, more than three quarters have come in better than analysts were expecting, according to a Bloomberg tally.

Meanwhile, private sector output rose at the fastest pace in a year in April, according to the US purchasing managers index.

Similarly, the HCOB Flash Eurozone PMI showed growth accelerating to an 11-month high during April. The upturn was driving by reviving demand and was accompanied by the largest increase in employment for nearly a year.

The head of Belgium's central bank Pierre Wunsch, who also sits on the European Central Bank's rate-setting council, told this morning's FT that investors are underestimating how high eurozone borrowing costs will need to rise during the months ahead.

“I would not be surprised if we had to go to 4 per cent at some point,” he said.

A balancing act

The UK's planning system is in dire straits, according to those who interact with it the most. Red tape is now “the worst I can remember in my 30 years of experience", Taylor Wimpey chief executive Jennie Daly tells this morning's Times.

Between nutrient neutrality, water neutrality and recreational impact zones, as many as 45,000 new homes are being rejected each year, according to estimates from the Home Builders Federation (HBF). However, the bigger issue is the government's decision late last year to scrap mandatory housing targets.

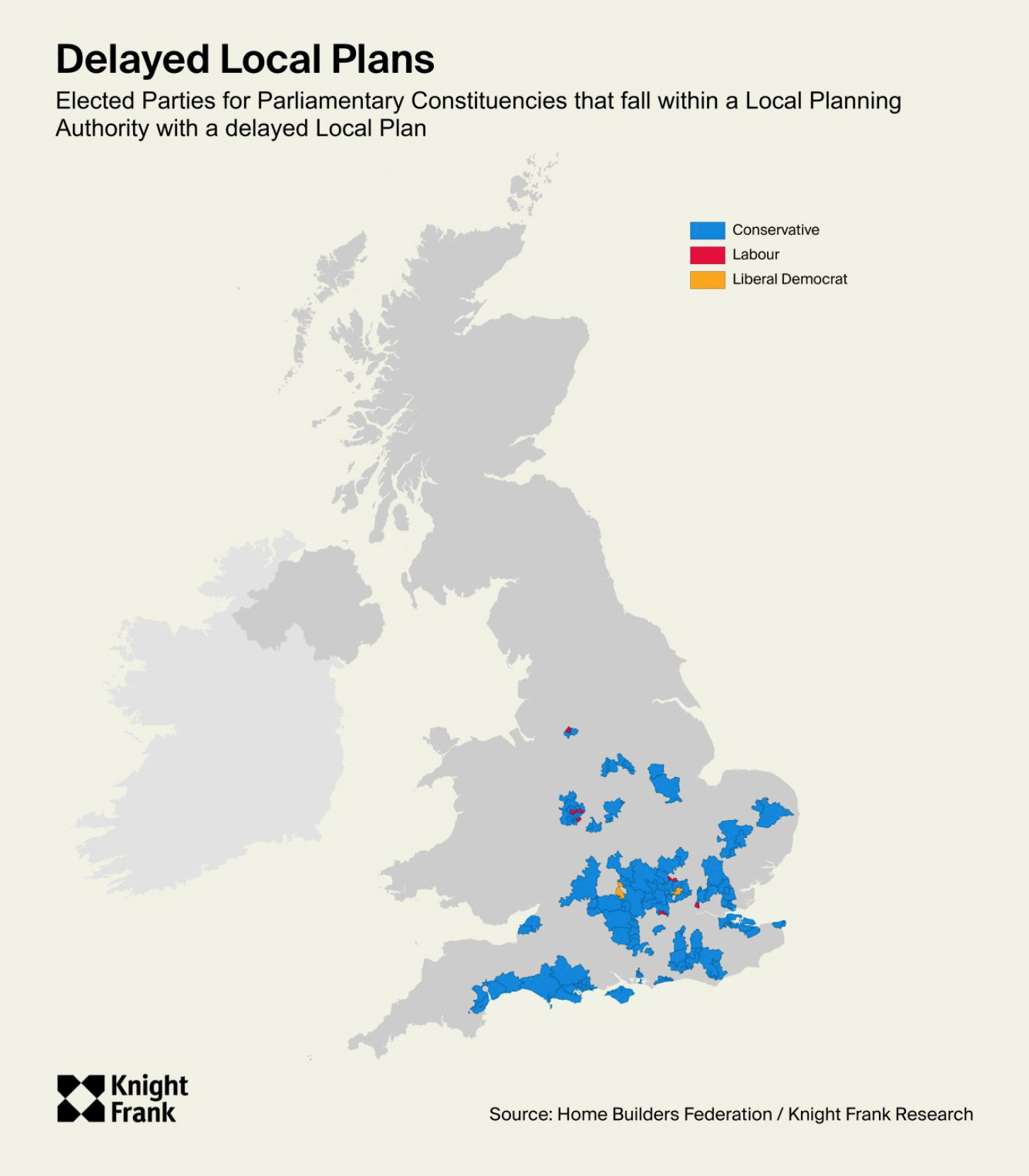

Knight Frank geospatial projects lead Cameron McDonald worked with the HBF to track the number of Local Planning Authorities who have ditched or paused their Local Plans since the government began overhauling the planning system, including 17 since Michael Gove's intervention last year. The analysis, covered in detail by the Telegraph, includes an overview of how those authorities intersect with local political control.

It's a pretty one-sided story: nearly all locations (98%) where local plans have been abandoned are in Conservative parliamentary constituencies, illustrating the delicate balancing act the party must take as it seeks to boost homeownership without alienating constituents that oppose new homes. Both will no doubt play a role in next year's general election.

"From a planning and residential development perspective, the analysis is pretty clear that the removal of firm housing targets and the uncertainty around planning reforms has given local politicians in some areas the perfect excuses to postpone, delay and revisit Development Plans," says our head of residential development research Oliver Knight. "It’s a short termist approach to plan making that is going to have significant longer term implications, particularly given the geographic spread clearly sits in areas where housing demand affordability are most stretched."

Holding up

When mortgage rates were spiking dramatically at the end of last year, the assumption was that lower-value property markets with a high proportion of higher LTV borrowing would suffer disproportionately.

That hasn't been the case, according to new analysis from Tom Bill. There was a 35% decline in the number of sub-£500,000 properties in England and Wales that went under offer in the first quarter of this year compared to the same period last year, OnTheMarket data shows. Above £500,000, the drop was exactly the same. In the £2 million-plus price bracket, there was a 37% decline.

There are various reasons that lower-value markets appear to be holding up better than we expected, from the rising prevalence of longer mortgage terms to a broad acceptance among borrowers that higher rates are here to stay. The fact rents have been rising so quickly due to supply shortages in the lettings market has also prevented buyers from becoming tenants.

Tenants spent an average of 26.8% of their income on rent in March, up from 26.6% a year earlier and 25.0% in March 2019, according to figures released by the Office for National Statistics last week.

In other news...

Bank of England must 'stay the course', deputy governor Ramsden says (Reuters), and finally, London landlords abandon market as mortgage rates erode profits (Telegraph).