Investors set aside £8 billion to target single family rental housing

Institutional ownership of purpose-built single family housing (SFH) for the rental market in the UK remains low, but it is on a rapid growth trajectory.

5 minutes to read

Single family housing (SFH) remains in the early stages of its evolution in the UK compared with the more mature multifamily market, but it is growing at pace. Growth is supported by a search from both traditional housebuilders and urban BTR developers for new ways to diversify and to tap into a need to deliver more high-quality, sustainable rental homes.

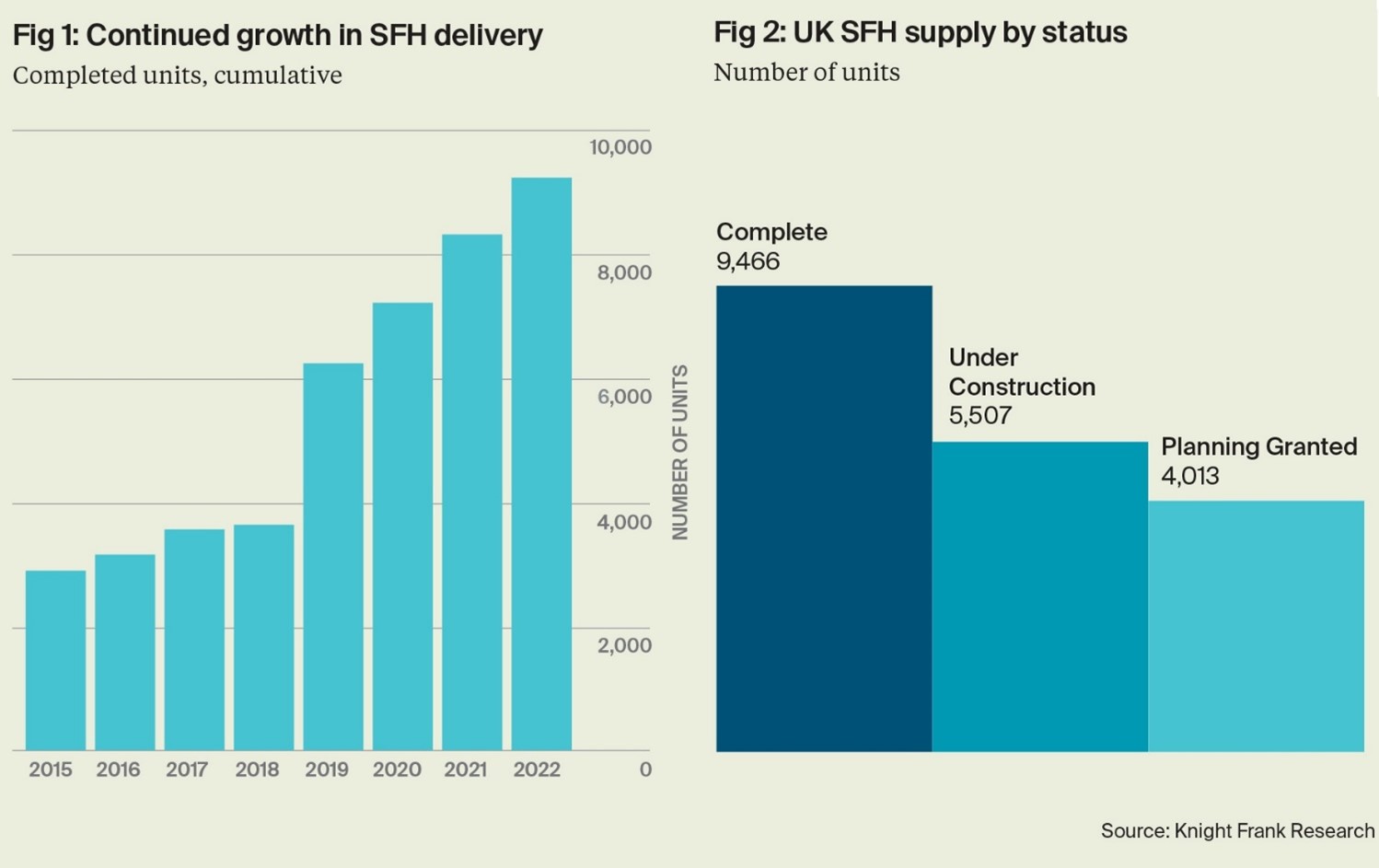

Currently, the number of complete and operational purpose-built rental properties in suburban SFH schemes stands at just shy of 10,000, up 11% since 2021. A further 9,520 SFH units are either under construction or have full planning permission.

We expect that number will increase rapidly, supported by a significant uptick in investment. Already in 2023, more than £450 million in SFH deals have been agreed - surpassing the full-year 2022 figure.

We have identified a further £8 billion of capital set aside to target SFH over the next three to five years either through funds already secured or active fundraises. Our calculations suggest that this translates into the potential for more than 30,000 new homes at today’s values.

More than 60% of privately renting households in the UK live in houses, equating to over three million households. And while SFH delivery is increasing, it accounts for just 11% of overall BTR delivery to date, and only c.0.3% of the total number of privately renting households who live in houses, highlighting the scale of the opportunity.

Yet, this is still likely to fall short of both short and long-term demand.

Supply of rental homes remains constrained

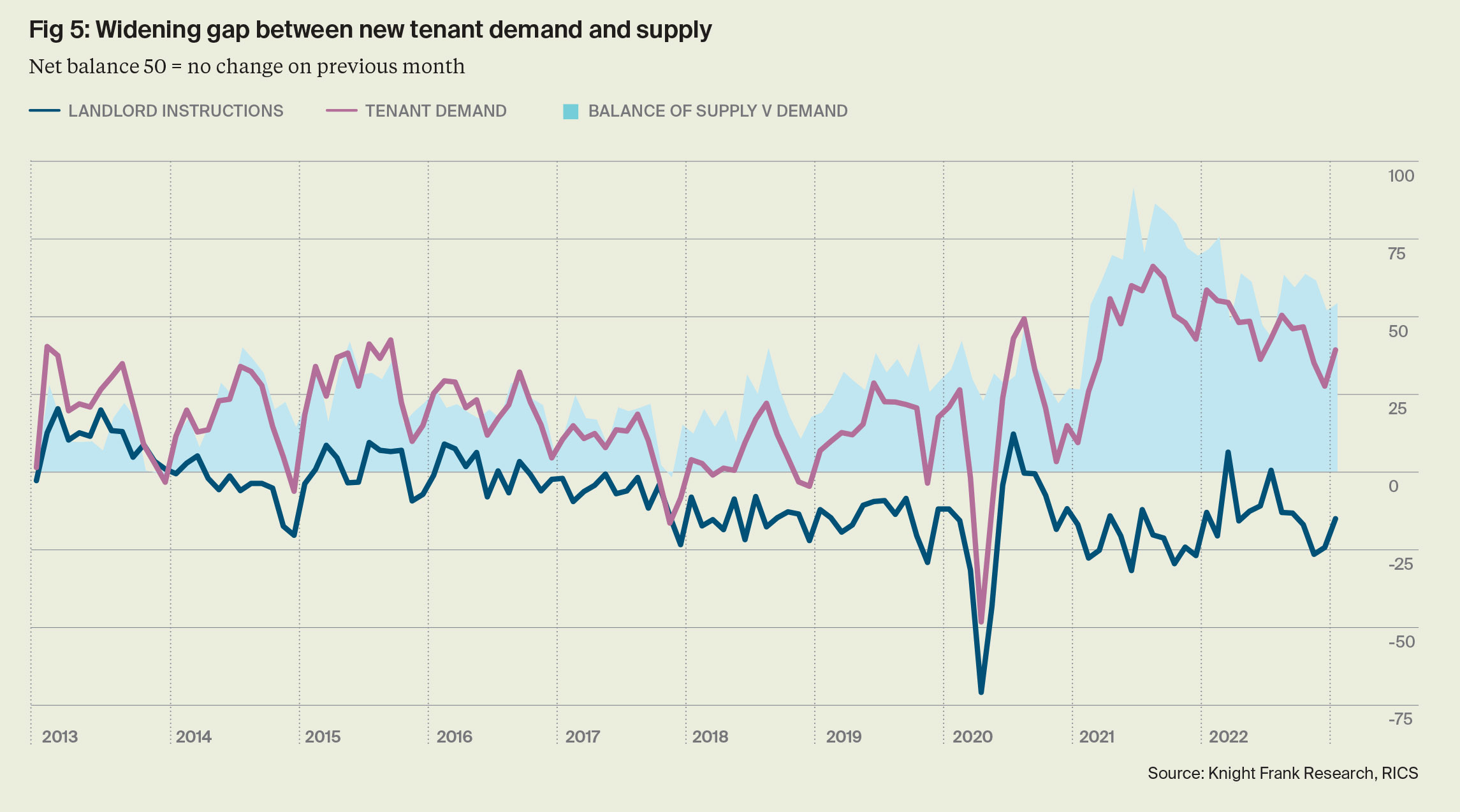

Rising institutional investor interest in the SFH rental market comes at a time when the supply of rental properties across the market is constrained. According to data from Rightmove, the volume of rental listings for houses across the UK in Q4 2022 was 42.6% lower than the 2017-19 pre-pandemic average, while the RICS Market Survey continues to report a fall in landlord instructions.

The rising cost of buy to let (BTL) mortgages, changes to mortgage interest relief and the erosion of capital gains tax allowances are putting individual private landlords under increasing pressure. The net result is that some are looking to rationalise portfolios. Data from the latest English Private Landlord Survey suggests that changes to legislation are the most common reason for landlords choosing to decrease their portfolio size or to leave the sector.

The prospect of further reform impacting the buy-to-let sector, including through potential changes to EPC requirements for rental properties that will require all new tenancies to have a minimum EPC C, could put further pressure on supply. Some 73.8% of houses in the PRS have an EPC rating of D or below. Our analysis of recommended upgrades contained on EPC reports suggests it costs an average of £5,300 per house to make the necessary improvements to bring potentially non-compliant properties up to minimum standards.

Pressure on existing landlords is just one factor contributing to falling supply. Upwards pressure on rental values, particularly for new lets, has meant that existing renters are living in properties for longer which is adding to the supply problem. The English Housing Survey (EHS) shows the average length of time a renter stays in a property has grown to 4.4 years, up from 3.5 years in 2014.

With the supply of homes for private rent shrinking and investor interest growing, the development of more SFH can play a key role in helping to meet demand, particularly for families, and help reduce the significant supply shortages in the rental market.

Will housebuilders seek more deals with SFH investors?

One of the biggest challenges for the SFH market has been gaining access to oven-ready sites and building platforms of a meaningful scale.

Aside from housebuilders who have set up dedicated “partnerships” businesses to strike deals with BTR investors, housing associations and others, widespread housebuilder interest in bulk sales to SFH investors has been limited.

A strong sales market, supported by the presence of Government support for first-time buyers in the form of Help to Buy, and rapidly rising house prices, has supported transaction volumes and viability.

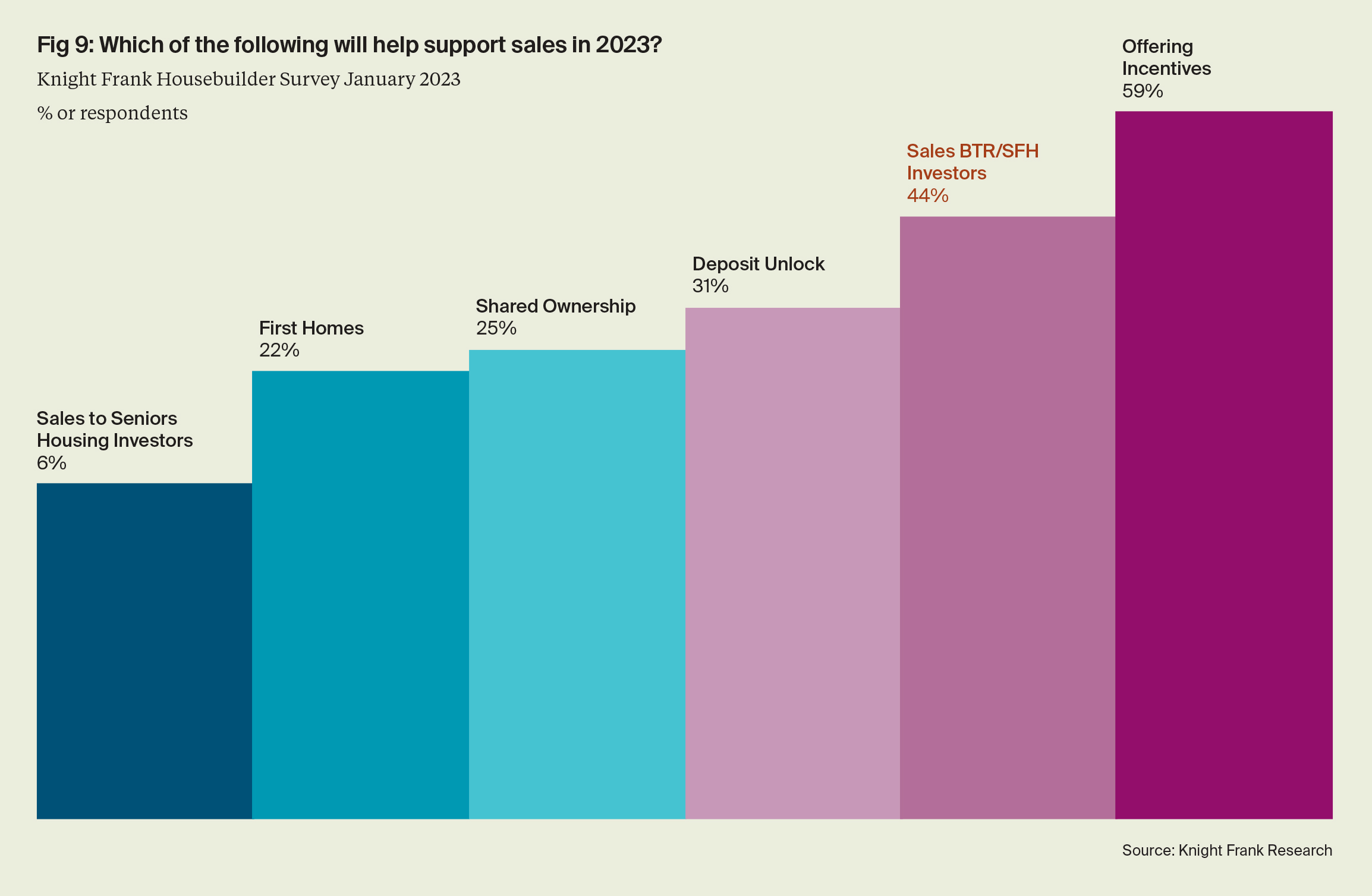

But as the market starts to slow and Help to Buy is withdrawn that is beginning to change. Recent trading updates from the listed housebuilders suggest that while headline pricing has held steady, sales rates have dropped.

In some ways, these current market dynamics could be a win-win for the SFH market and for housebuilders; helping investors grow portfolios and providing an exit route for developers as the market slows.

Our latest quarterly survey of volume and SME housebuilders supports this view, with 44% of survey respondents stating that sales to BTR investors (of both apartments and houses) will play a greater role in the market this year, up from 17% in Q2 2022. Consequently, we expect to see more partnership agreements and bulk sales between housebuilders and SFH investors as they look for new exit routes.

However, getting deals agreed will not be without challenges. Investors will require a discount-to-market value, currently typically in the region of 5-10%, to improve rental returns on investment and to compensate for the more uncertain economic outlook. At the same time, housebuilders will have an eye on maintaining their already squeezed margins.

Market Outlook

Whilst the underlying drivers for investment into SFH remain strong and the weight of capital looking at the sector is substantial, the more challenging economic backdrop and higher financing costs for buyers reliant on debt resulted in a slight softening of yields towards the end of last year.

Strong operational performance, ongoing investor demand and an expectation that rental growth is going to remain robust over

the coming years all support our view that longer-term we will see a return to further yield compression.

On the latter point, across the UK, there is little sign of the supply/demand imbalance ending in the short-term. New housing delivery remains short of expected housing need and population growth, while regulatory pressures on private landlords

continue to mount. Meanwhile, affordability challenges in the sales market are likely to underpin demand for rental properties. This will maintain upwards pressure on rents.

Along with expectations for relatively robust wage growth in the near term, this supports our expectation for cumulative rental growth of 18.2% across the UK over the next five years across the private rented sector.