Don’t read too much into current UK housing market data

Longer-term trends will become more apparent next year once the effects of the mini-Budget fade.

2 minutes to read

Based on the evidence of the last two months, you might conclude the UK property market has entered a period of freefall.

Data from Nationwide, Halifax and Rightmove have all shown notable house price declines.

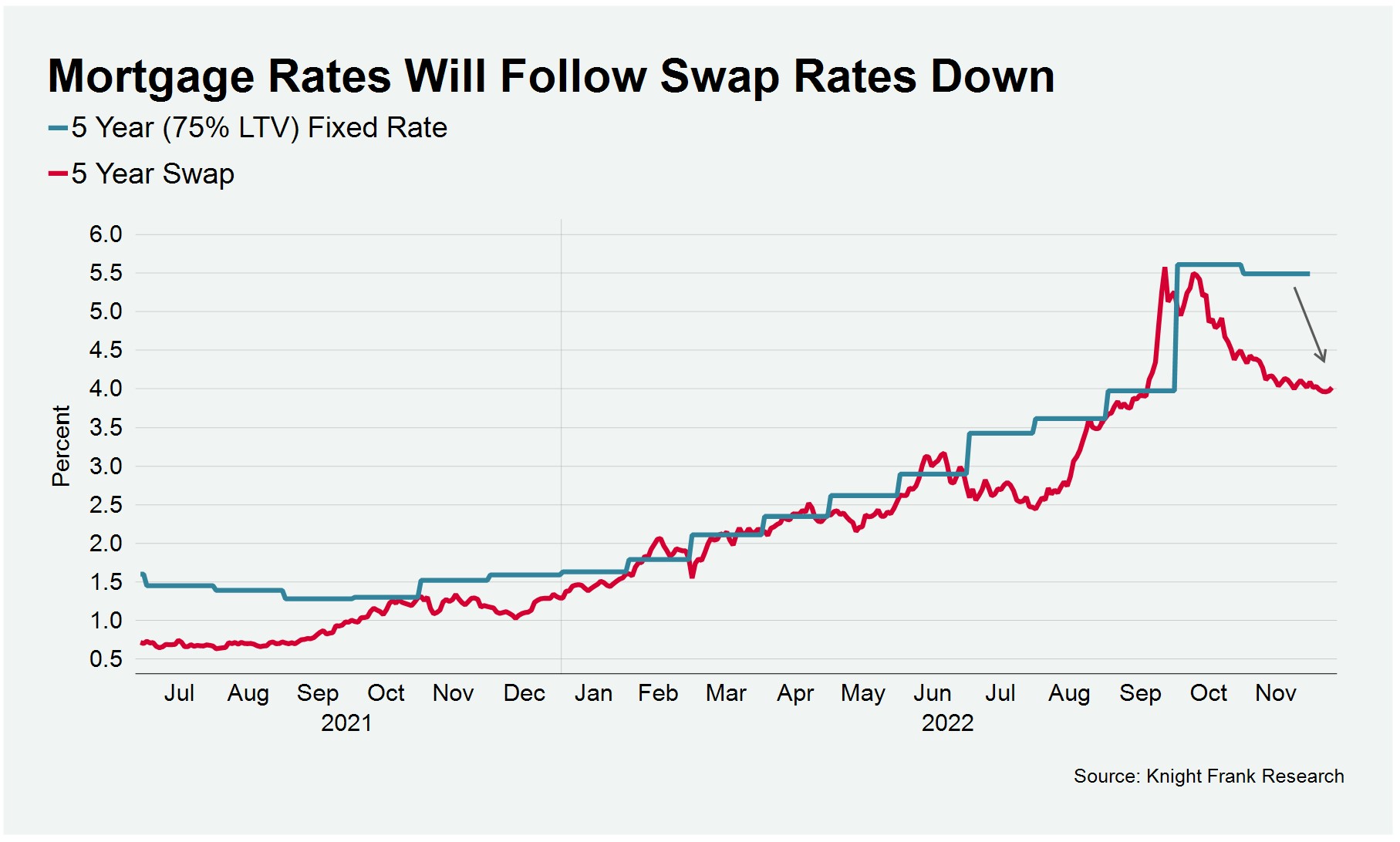

If the five-year swap rate hadn’t fallen so markedly over the same period, it would be concerning.

However, mortgage rates are increasingly following swap rates down as the shock of September’s mini-Budget dissipates (see below).

The latest housing figures show what happens when borrowing costs suddenly spike by more than 150 basis points but are otherwise largely unenlightening.

Two weeks from Christmas, some buyers have pressed the pause button – especially those who don’t have the ticking clock of a mortgage offer that predates the mini-Budget

But buyers are nervous rather than absent.

The number of new UK buyers registering in November was 5% up on the five-year average, Knight Frank data shows (excluding 2020). Meanwhile, the number of offers made fell 17%.

It is a similar story across prime London markets, as we explore here in more detail. However, the higher proportion of cash buyers inside zone 1 should insulate that market to some degree.

I wouldn’t expect more clarity on the longer-term trajectory for house prices until March next year.

Rates will have settled down by then although there won’t be many five-year fixed-rate mortgage offers starting with a “3” still in the system.

The spring selling season is also when trading volumes increase and sellers’ price expectations are properly put to the test.

After 13 years of ultra-low rates, it could be a ‘wake up and smell the coffee’ moment.

One side-effect could be that the lettings market gets some much-needed stock. More accidental landlords will be created if asking prices are not met.

We forecast a 10% price decline in the UK over the next two years, taking prices back to where they were in the summer of 2021.

However, the sort of cliff-edge moment seen during the global financial crisis should be avoided - including low levels of unemployment and a relative lack of financial distress among lenders.

Whatever happens, the double-digit annual price growth seen during the pandemic is over.

That said, the steep monthly declines that have followed the mini-Budget should also become a thing of the past.

Subscribe for more

Subscribe here to get exclusive market analysis, news and data from our research team, straight to your inbox.