Investment capital forecast 2022

Inbound and outbound capital for the Asia-Pacific region is predicted to achieve pre-pandemic figures, with inbound cross-border volumes setting a record in 2022.

4 minutes to read

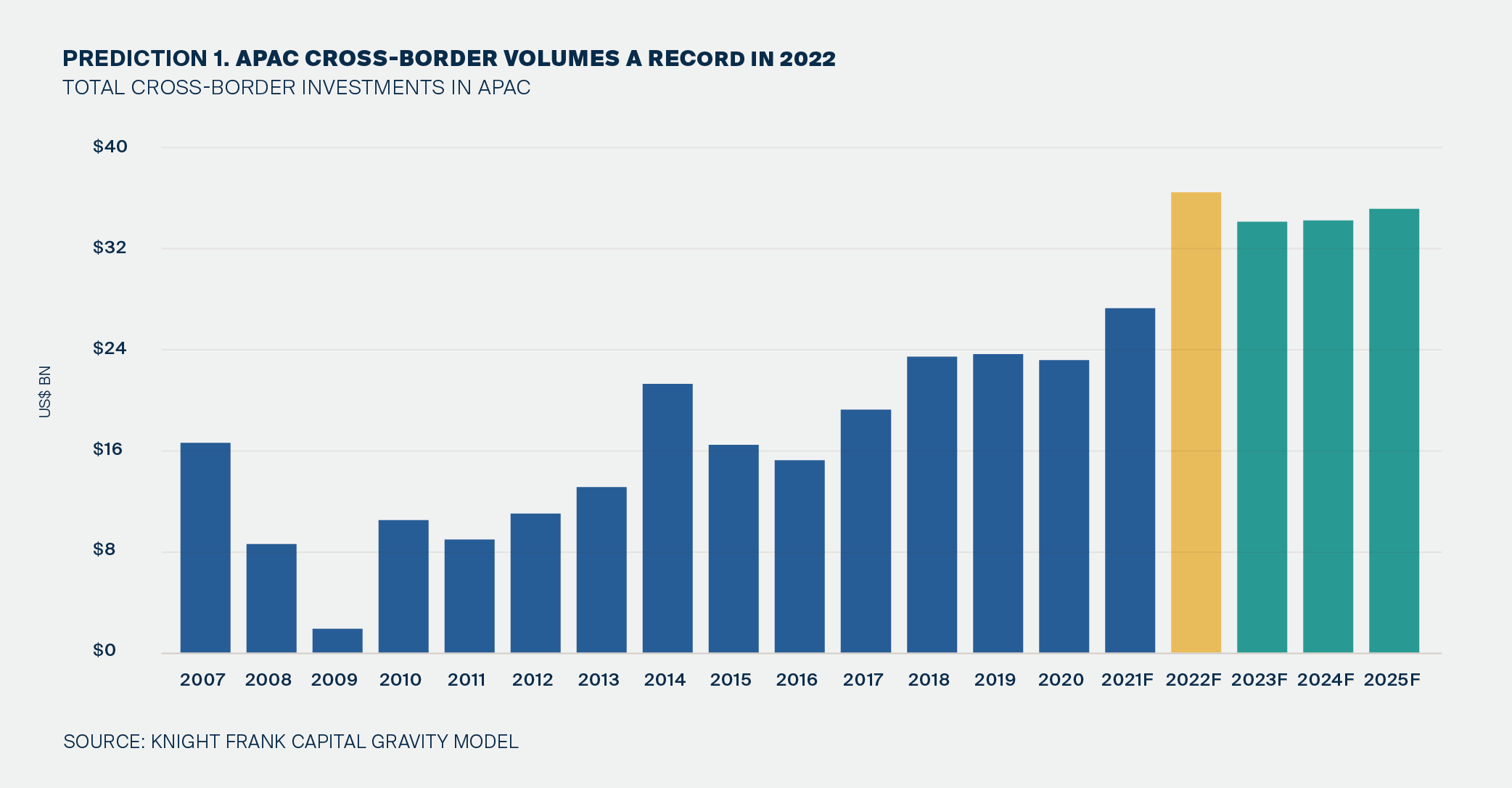

Two years on since the outbreak, the world is looking to finally emerge from the pandemic’s shadow. As economies forge a path towards endemic living, investors will, undoubtedly, retrace the momentum that culminated in 2019’s record investments. Knight Frank’s Capital Gravity model suggests that while the next few years will see a boost in investment volumes, 2022 is likely to see a sharp rise in activity, providing investors the opportunity to rebalance portfolios, execute business plans and further their strategic goals1.

1All projections derived from Knight Frank’s Capital Gravity Model are modelled on major capital flows only and excludes land.

Asia Pacific Inbound Capital Flows

Prediction 1. APAC Cross Border Volumes a Record in 2022

Uncertain times, strong performance

Source: Knight Frank Capital Gravity Model

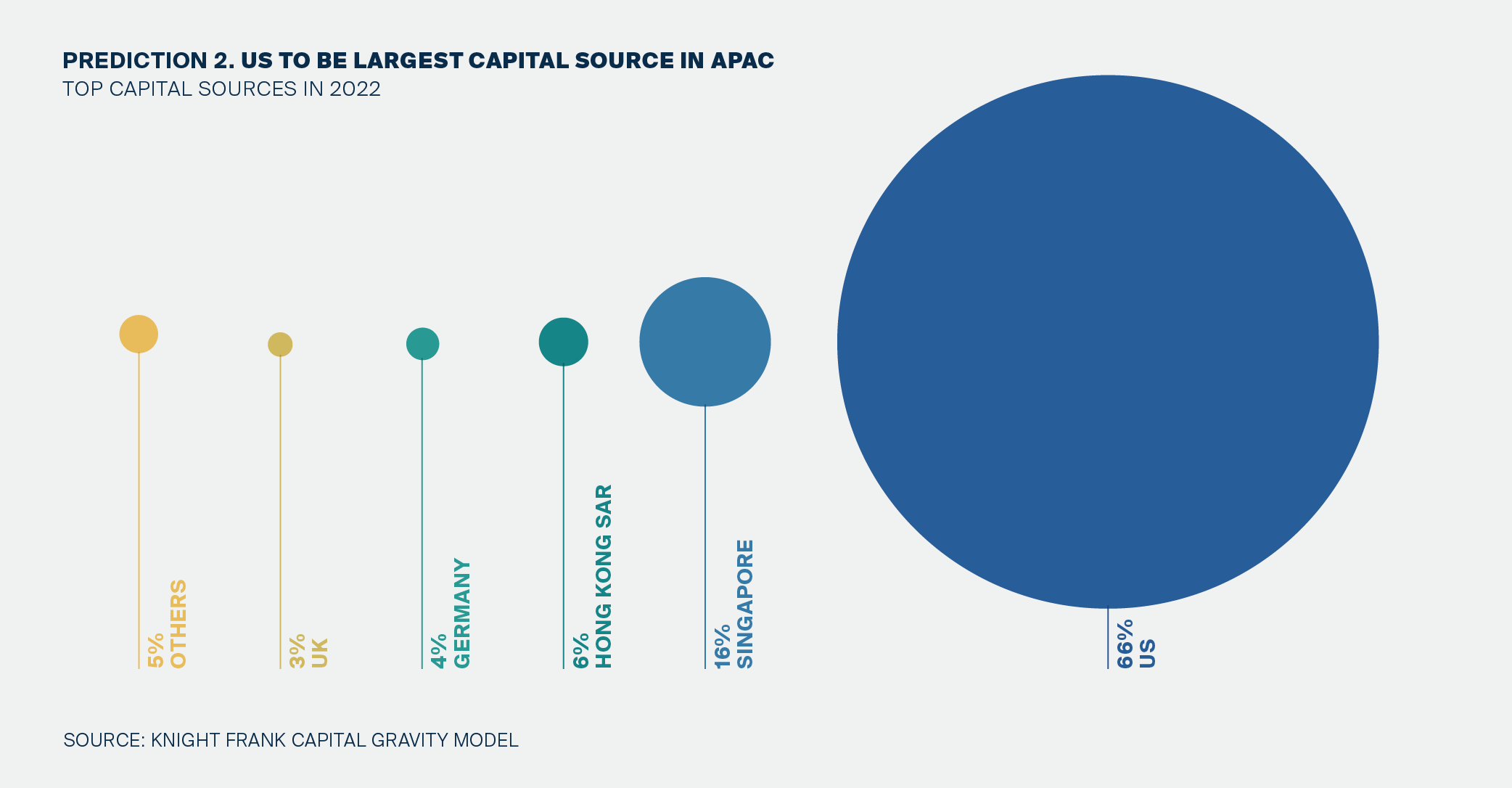

Prediction 2. US to be Largest Capital Source in APAC

Source: Knight Frank Capital Gravity Model

More value for money

While it has been a tumultuous 2022 so far, there remain ample reasons for investors to stay the course in re-discovering the momentum in allocations to the region. The US dollar has gained sharply amid the Fed’s widely anticipated rate hike cycle to trade at two-decade highs. To some investors, this will no doubt be a boon as assets in the region will be cheaper given the strength of the US dollar. Investors from the US has perennially been the region’s largest capital source, which the strength of its currency will reinforce.

Asian Capital remains active

While outbound capital from China Mainland has fallen since 2017 on the back of intense regulatory scrutiny, capital from other sources within the region have rapidly moved in to plug the gap. Capital commitments made by APAC investors in the region in 2021 have breached 2019’s record and we expect intra-regional flows to account for a significant piece of the investment pie in the region in 2022. Singapore and Hong Kong SAR will continue to lead while outbound focus from South Korea will also accelerate. Within the industry, investors scaling up through the recent wave of M&As will result in considerable firepower for acquisitions. Investments from Hong Kong SAR, which boasts a significant base of investors, will also continue to remain strong. Active capital raisings observed will add to capital flows in the region.

Focus on post-pandemic strategies

The pandemic has illustrated the relative resilience of real estate as an asset class, albeit with a bifurcation as investors sought out logistics, multi-family, and data centres as pandemic plays – assets that are consistent with the stay-at-home trend. This has redefined the risk-return spectrum for investors. Logistics are now increasingly viewed as core while retail has turned opportunistic.

However, with economies forging a path towards endemic living, investors will be keen to ride on the region’s recovery. The thematic spotlight in 2022 will be on post-pandemic strategies. We expect investors to focus on the region’s long-term structural fundamentals once again.

With debt cost soaring as the Fed tightens aggressively, yield-seeking investors will also be compelled to move up the risk curve to secure the desired spreads. Investors will have to move fast to secure the best opportunities. We expect portfolio rebalancing and sector rotation to be catalytic to investment activity. Investors will also gravitate to more active asset management strategies, such as repurposing and value-add plays, to generate alpha.

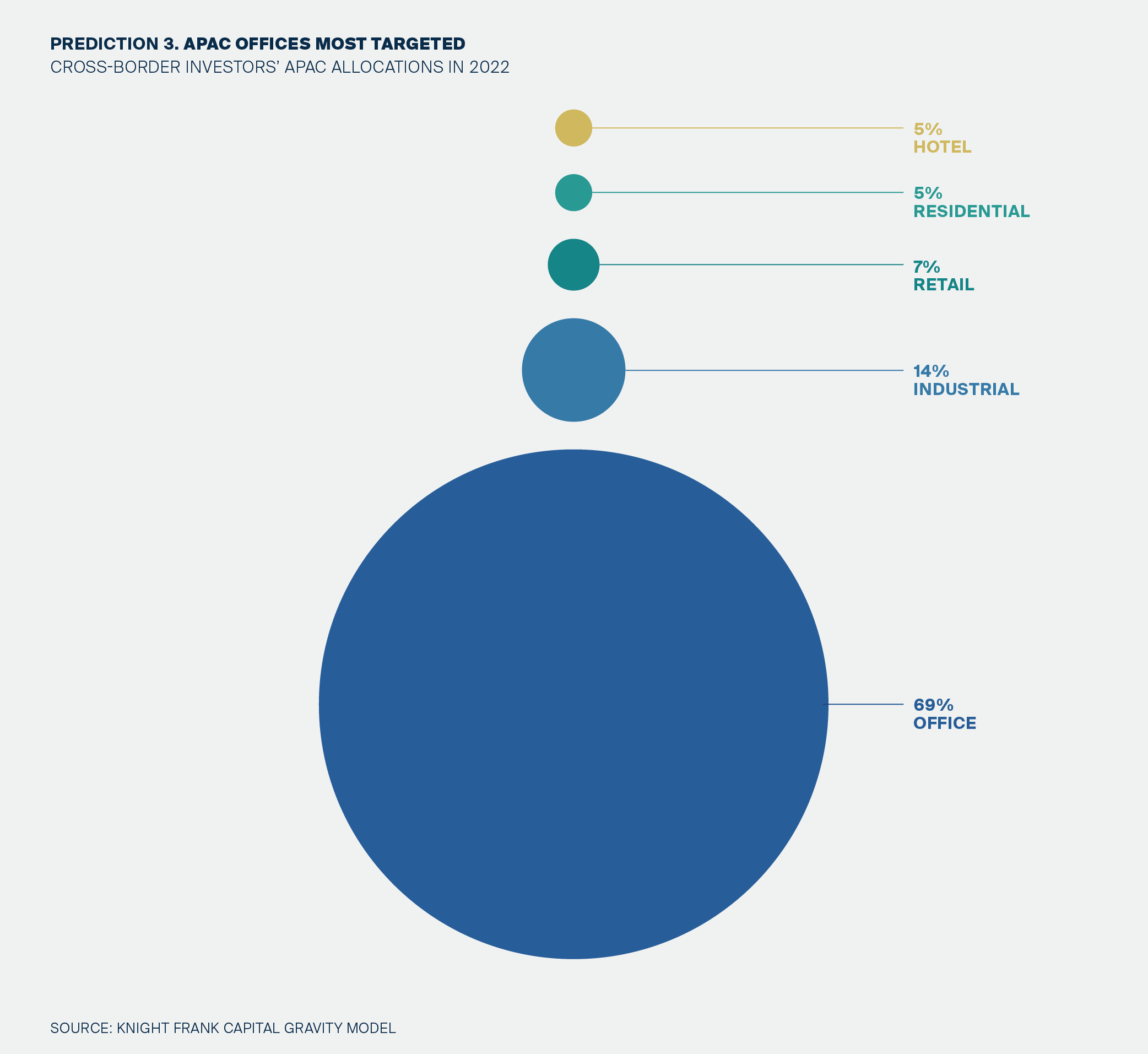

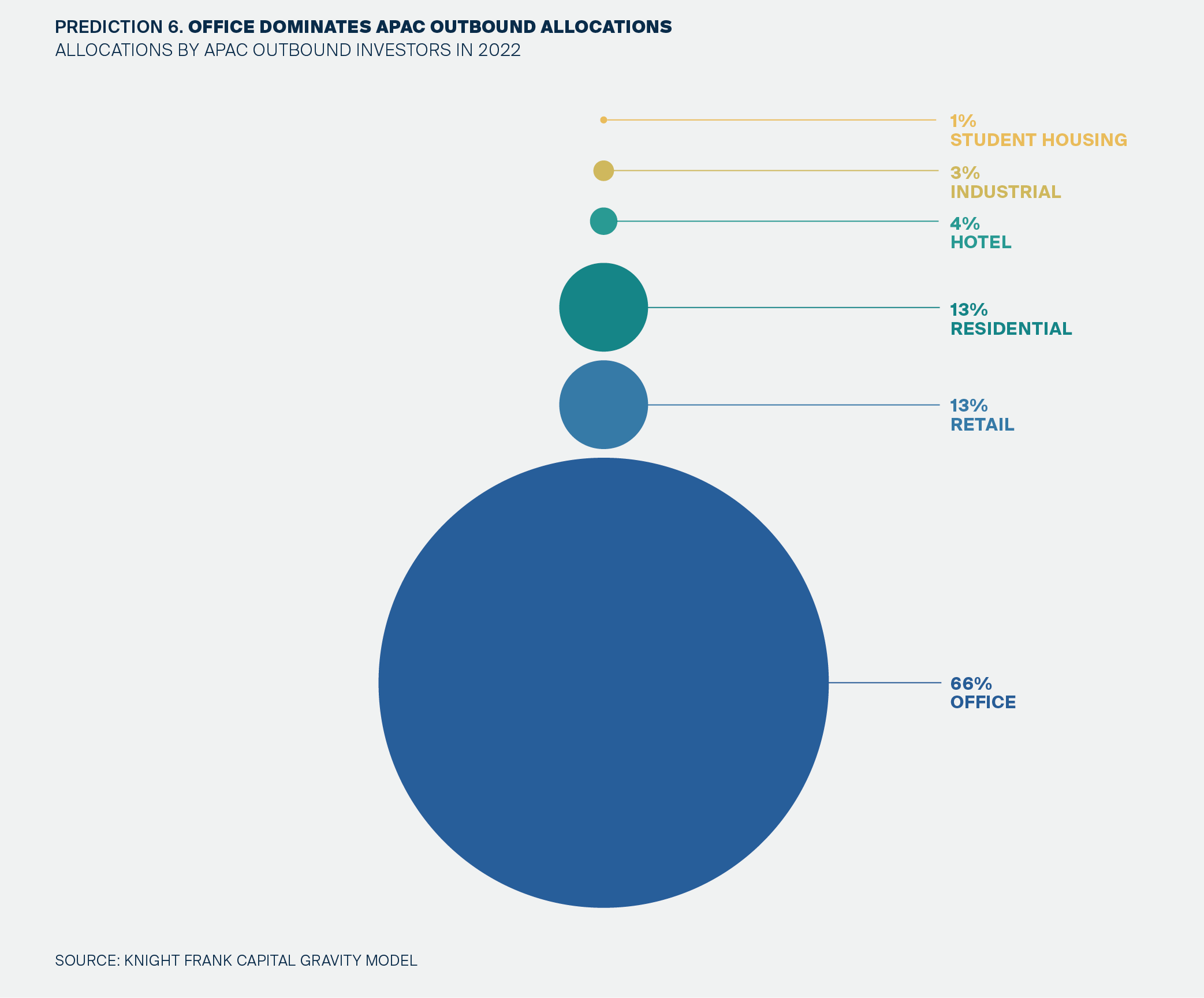

Prime offices favoured

Globally, the office sector is expected to account for over two-thirds of cross-border investment volumes in 2022. As more workers return to the office, higher utilisation rates should translate into a more active leasing market. Still, the pandemic has altered work habits and the future of office could well be hybrid. The pandemic has elevated the importance of the location, amenities, asset quality and wellness attributes of office assets. More will be expected of an organisation’s corporate spaces to serve the needs of a hybrid workforce. The attributes of prime grade buildings in core markets are well place to serve in the ongoing transition.

With macroeconomic headwinds and geopolitical tensions heightening uncertainty, well leased office assets will appeal to the defensive investor. As higher interest rates hold back gains in capital value, investors will also turn to the stability of income streams. With shorter leasing tenures in the region, which give landlords the ability to reset rents, as well as escalation clauses, the sector can serve as an effective hedge against inflation.

Prediction 3. APAC offices most targeted

Source: Knight Frank Capital Gravity Model

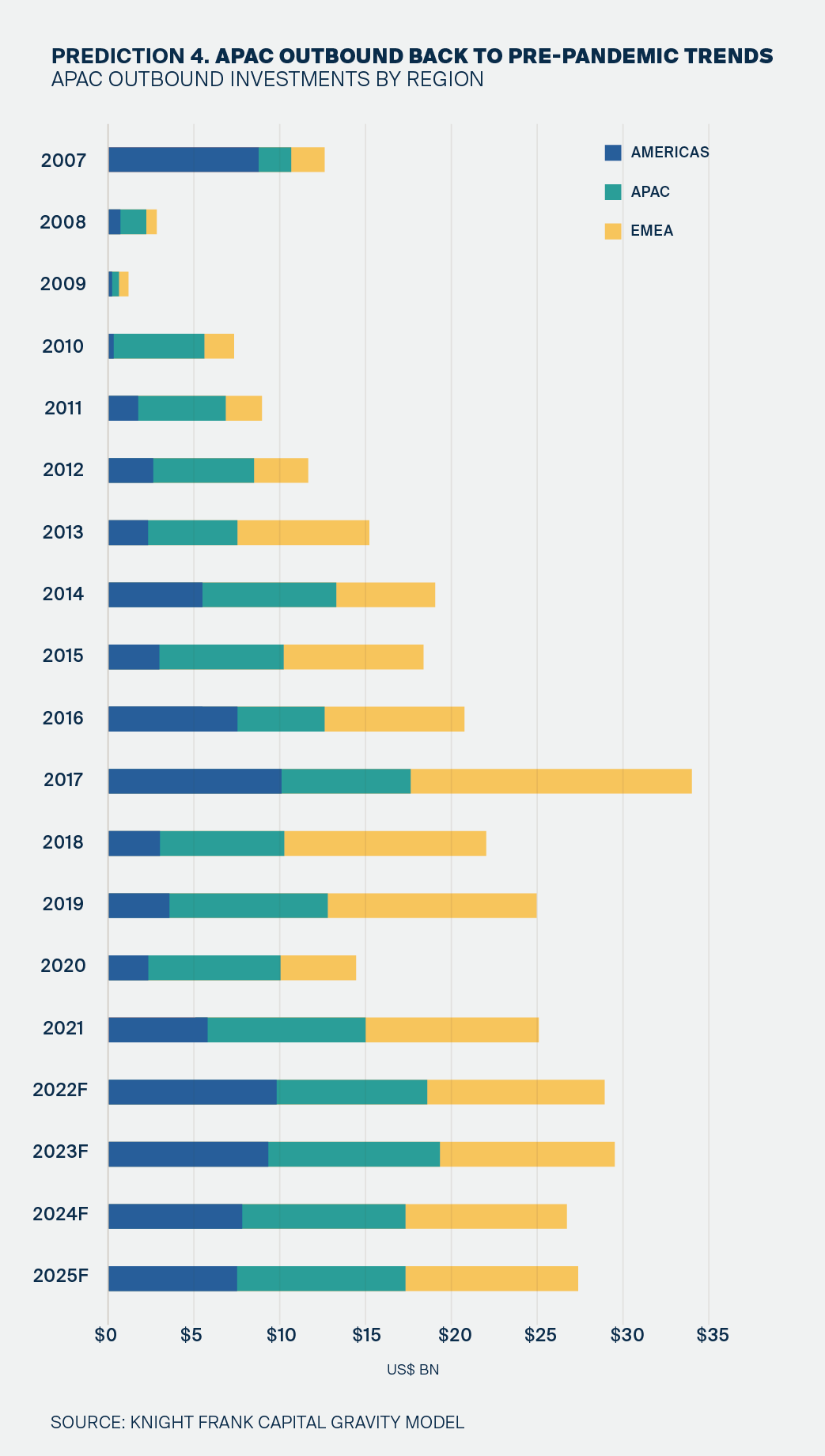

Outbound Capital Flows

Europe top investor target

Europe is emerging to be a top target from Asia Pacific investors. Notably, investment transactions in London offices reached £12.3bn in 2021, a rise of £3bn compared with 2020 – the highest annual change since 2017 – reversing a three-year downward trend following the Brexit referendum. This positive momentum looks set to continue in 2022 with £5.3bn of deals currently under-offer.

Prediction 4. APAC outbound investment back to pre-pandemic trends

Source: Knight Frank Capital Gravity Model

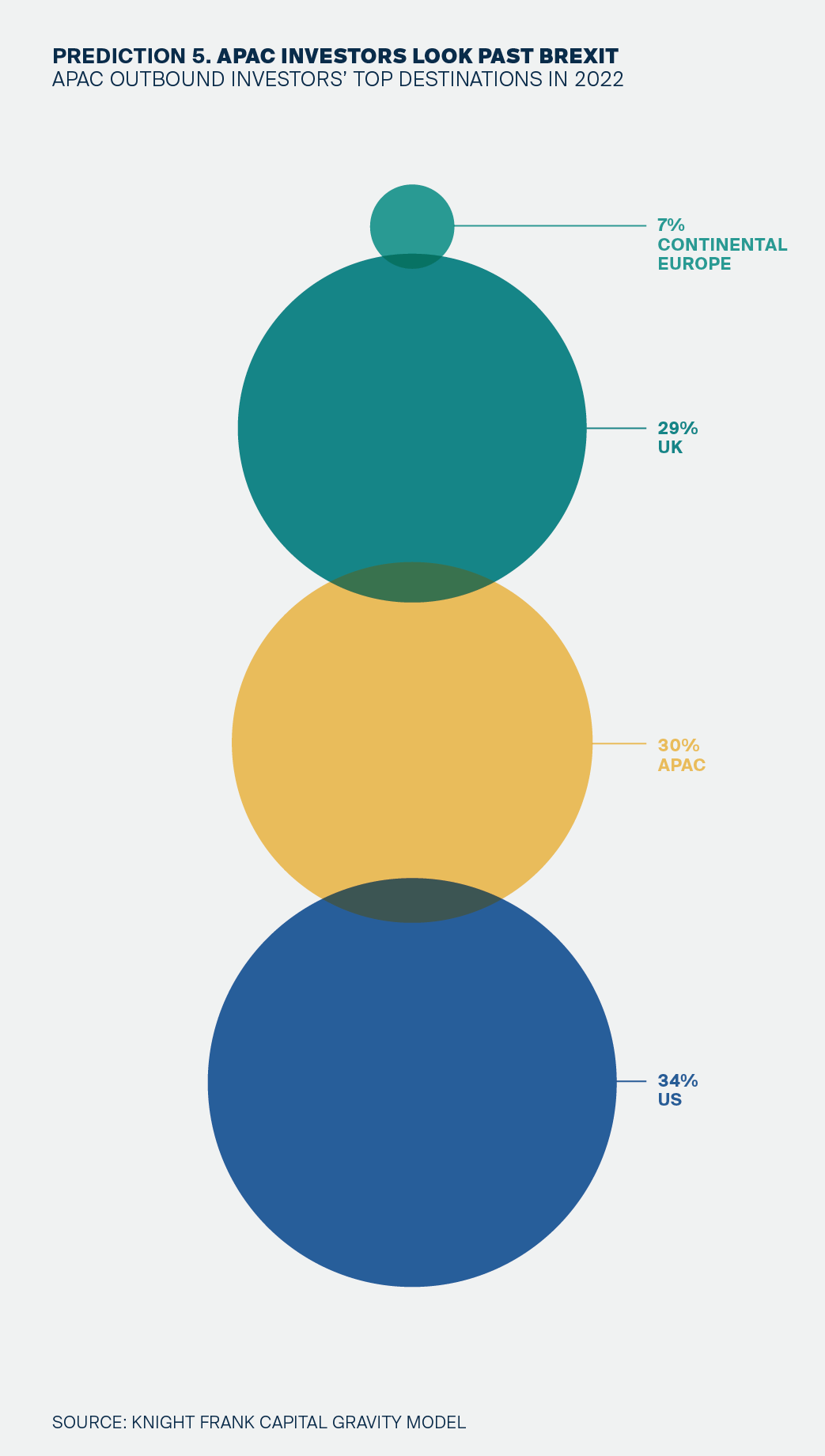

Prediction 5. APAC investors look past Brexit

Source: Knight Frank Capital Gravity Model

Prediction 6. Office dominates APAC Outbound investment allocations

Source: Knight Frank Capital Gravity Model