Has the Malaysian hotel market turned the corner?

The Malaysian Hotel Investment Intentions Survey reveals a robust sector rebounding well from the impact of the pandemic.

2 minutes to read

The 2022 Knight Frank Malaysian Hotel Investment Intentions Survey analyses the investment perspectives of hotel owners, operators and owner-operators and discusses the impact of the pandemic on the hospitality sector.

The appetite for Malaysian hotel investment remains strong

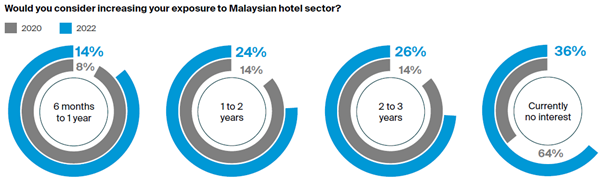

64% of respondents are considering increasing their exposure to the Malaysian hotel sector, a sharp hike compared to 36% back in 2020. 36% of respondents are currently not interested in increasing their exposure in hotels, but this is a significant drop compared to 64% in 2020. This is a positive sign that sentiment towards the sector is returning.

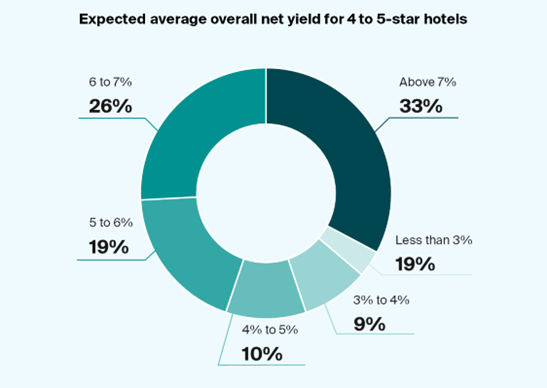

Investors continue to seek high returns to offset the risk of investing in the sector. 33% of respondents are targeting a net yield of above 7% (versus 36% in 2020) when acquiring a four to a five-star hotel in Malaysia. 26% of respondents are targeting net yields of 6-7% (versus 29% in 2020), whilst 19% would accept 5-6% (versus 29% in 2020).

Malaysian hotel owners have conservative levels of debt helping to weather the pandemic storm

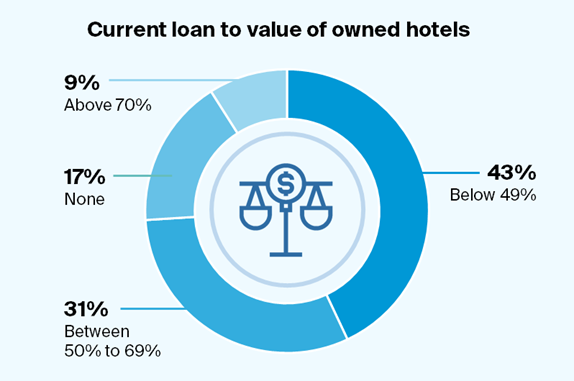

The majority of the hotels have conservative levels of gearing. 43% have less than 49% loan to value ratio, whilst 17% have no debt at all. However, 31% have their loan to value between 50% and 69% and 9% have high gearing of above 70%. On the whole, hotel owners with conservative gearing have managed to weather the pandemic storm and have not had to sell at fire-sale prices.

Turning the Corner

Investors are seeing 2022 as a good time to invest in Malaysian hotels. They can see the economy is recovering, especially now that the borders have opened. Many can see the strong pent-up demand for holiday travel, and in the short term, Singapore tourists, coupled with domestic demand, will drive hotel performance in 2022. We expect hotel transaction volumes to increase in 2022 as the price gap between vendors and purchasers will narrow as investors become more optimistic about the border opening and increasing arrivals. Although bank financing of hotels has been quite difficult during the pandemic, banks will also see the improvements in the sector and begin to lend again.

Historically, Malaysia has attracted a diverse pool of international tourists from all over the world and is particularly well-positioned to capture the growth of Halal Tourism. Malaysia ranked as the top destination out of 140 countries in the MasterCard Crescent Rating Global Muslim Travel Index 2021 for being the most Muslim friendly holiday destination, beating Turkey, Saudi Arabia and Indonesia. Traditionally prime hotels do not come to market regularly, and the next 12 months present a window of opportunity to acquire some unique opportunities.

View the full report here.