Energy prices spiral, volatility returns, UK trade talks progress

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Energy prices continue to rise

The Russia/Ukraine conflict continues to impact commodity prices, with Brent crude reaching $139 per barrel yesterday, its highest level since 2008, while European gas prices increased 79% over the weekend to €345 per megawatt hour. Commercial real estate has the potential to be impacted indirectly via inflation and moderating growth, as well as the need to reorganise some supply chains.

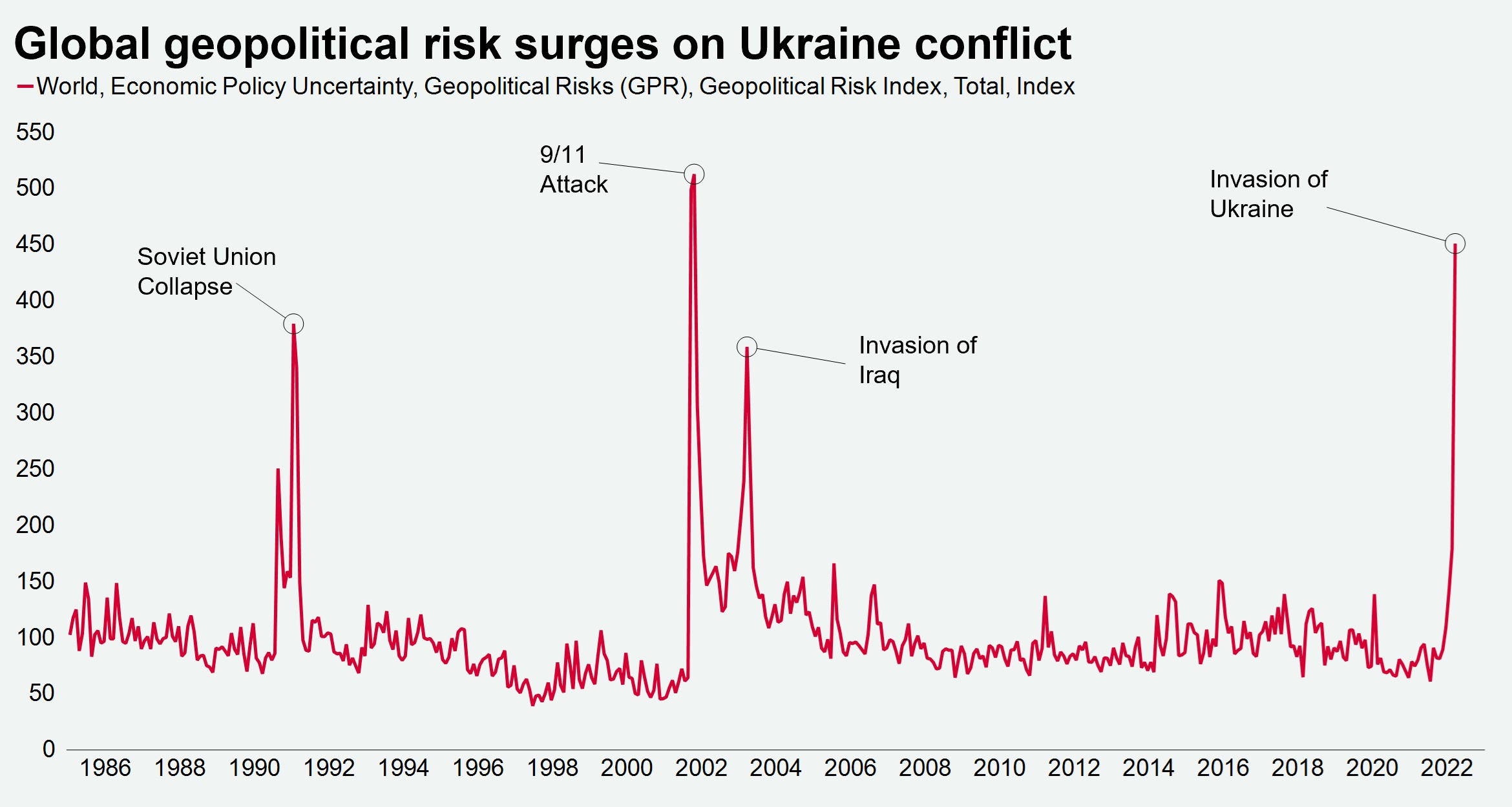

Geopolitical risk hits 20-year high

The outbreak of conflict in Ukraine has seen the global geopolitical risk index rise by 152% in March to its highest level since 9/11. With some economies already contending with decade high inflation and the likelihood of rising interest rates, the conflict in Ukraine has exacerbated uncertainty. Despite this, the Chair of the US Federal Reserve has committed to rising interest rates by 25bps at the next monetary policy meeting on 15th March. Markets expect six more rate hikes this year from the Fed.

UK advances with new trade deals

The UK has signed its second Free Trade Agreement (FTA) post Brexit with New Zealand, following its deal with Australia. This takes the UK one step closer to joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), a free trade area of 11 Pacific nations, including New Zealand, with a total GDP of circa £9 trillion.

Download the latest dashboard