Covid unrest spreads, Miami heat and corporate relocations are back

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Covid-19 update

Protests against new Covid-19 restrictions took place across Belgium, Austria, Switzerland and the Netherlands over the weekend. Europe is reporting almost a million new infections every three days, or about 67 infections for every 100 reported globally.

The UK's infection rate has climbed 9.4% during the past seven days, but hospital admissions and deaths continue to fall for the time being. Adults aged between 40 and 49 are due for their booster from Monday and the scheme could be rolled out to all adults soon, according to comments from the health secretary over the weekend.

There are two scenarios for the UK over the coming weeks, according to the Guardian. One which involves a sharp increase in hospitalisations and the reintroduction of some restrictions. The other would be the UK benefitting from the higher immunity that has built up since the summer reopening. It is expected to be several weeks before it is clear which course the virus is taking.

Miami heat

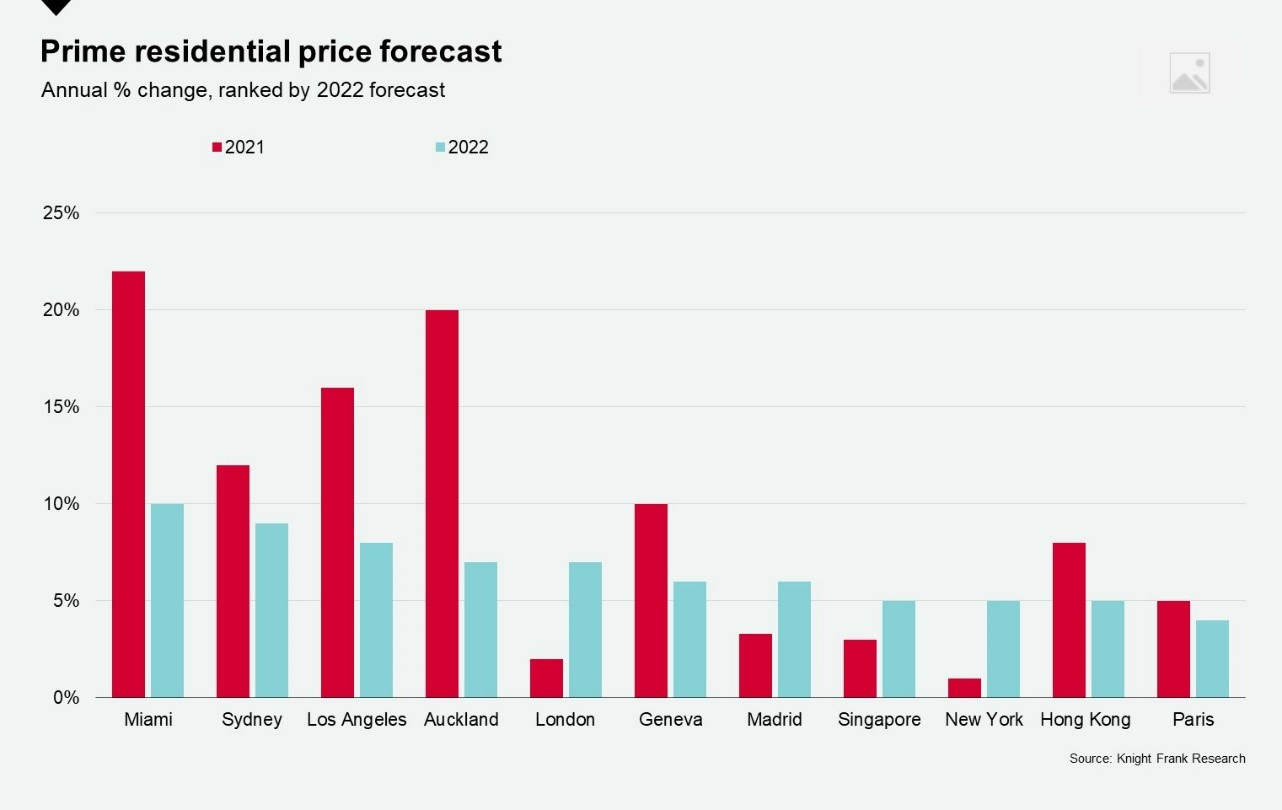

Miami leads Knight Frank’s prime residential price forecast for 2022, with luxury prices expected to rise 10% over the year. Florida’s low tax regime, Miami’s competitive prices and the appeal of coastal living during the pandemic has boosted demand.

Sydney occupies second place, with prime prices forecast to rise 9%. The reopening of borders, the return of investors and a growing appetite amongst domestic buyers for second homes on Australian soil, underlined by recent lockdowns and travel bans, will see prime prices accelerate.

Los Angeles sits in third place. Record low inventory levels, strong demand for large family homes and the continued availability of low mortgage rates are expected to result in growth of around 8% in 2022.

Corporate relocations are back

Last week London's biggest developers reported renewed optimism in the capital's office market.

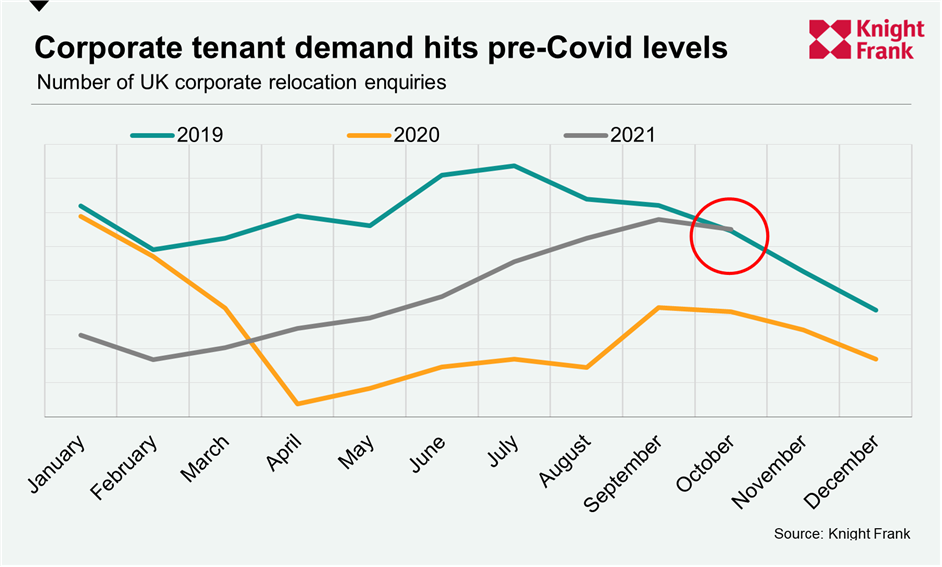

This week we have another indicator suggesting normality is returning to corporate life: October was the month that demand from companies looking to relocate staff to the UK returned to pre-Covid levels.

The relaxation of international travel rules at the beginning of last month helped but, as the chart shows, demand had been steadily building for months. Tight supply of properties is likely to remain an issue for companies, though the availability of higher-value lettings properties has increased marginally. See the full update from Tom Bill for more.

40-year mortgages

Kensington Mortgages will tomorrow launch a fixed rate mortgage of up to 40 years, according to the FT. The move makes it part of a small but growing cohort of lenders offering fixed deals stretching over decades.

For products fixed for 35 years and 40 years at 60% LTV, rates will start at 3.16% and 3.34% respectively. Whether or not that works for you will depend on your view on the path of interest rates over the very long-term. Economists remain divided as to whether historically low interest rates will be with us forever or not.

Interest rates are set to rise imminently, albeit marginally, so there will be an uptick of borrowers seeking to fix their rate. Whether that hike comes in December remains uncertain - Bank of England governor Andrew Bailey's interview with the Sunday Times shed little light on the issue. Mr Bailey did say an expansion of the public sector by a quarter of a million workers was responsible for much of the heat in the jobs market.

Supply chains

Labour shortages will become the most significant source of cost pressures in the construction industry next year, according to research from the Building Cost Information Service.

Competition for staff with other sectors will supplant materials shortages, which recent surveys have suggested may have peaked. Still, the BCIS says supply chain issues will persist until the end of 2022.

The cost of materials in constructing a 3-bedroom semi-detached house has increased by 14% or approximately £7,300 between January and September 2021. It is expected to grow by further 1% or £600 by the end of this year, according to James Fiske, Director of BCIS.

In other news...

Stephen Springham's latest update includes analysis of the October retail sales figures from the ONS, expectations for Black Friday and our projections for retail sales for the festive period.

Andrew Shirley's new Rural Market Update includes analysis of the latest data on farm incomes.

Elsewhere - China's land sales slump for a fourth month (Reuters), the billionaire owners of China's developers are dipping into their own pockets (Bloomberg), China's central bank suggests it could intervene to boost the economy (Bloomberg), Treasury cracks down on councils' risky borrowing (Times), KKR funds 4,000 build-to-rent flats, EY says the economy will grow slower than forecast (Times) and finally, where did all the workers go? (FT)

Photo by Muzammil Soorma on Unsplash