Knight Frank/UCAS Student Accommodation report: Five trends to watch

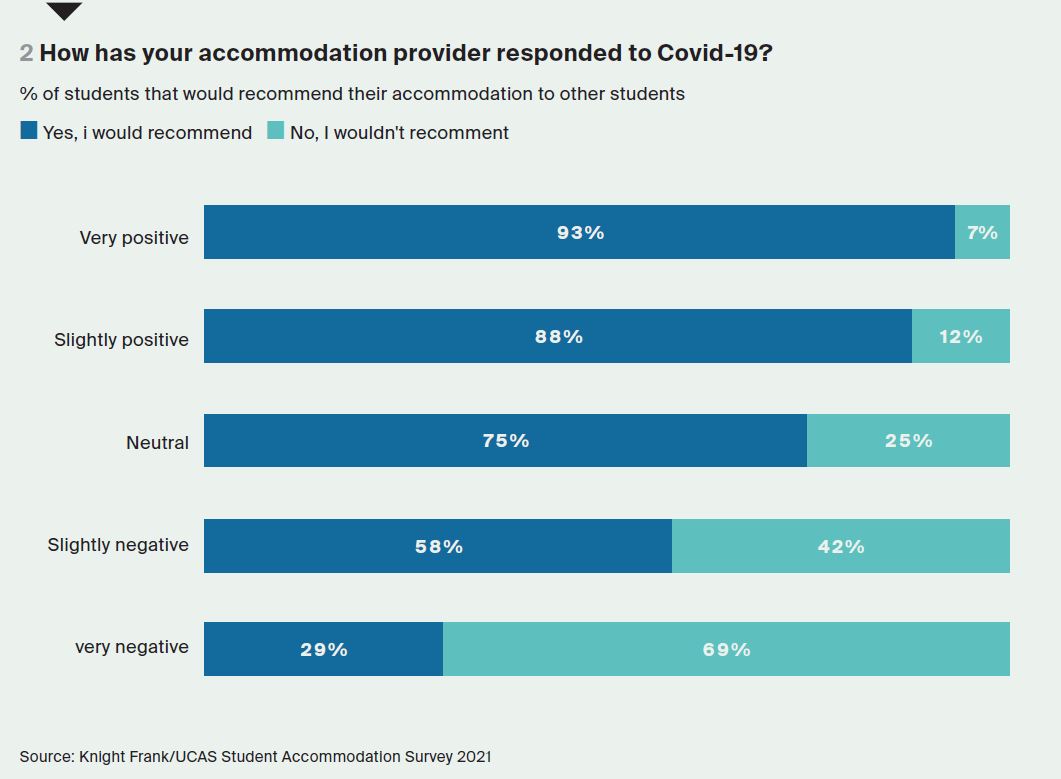

Two thirds of students said they were positive about their PBSA provider’s response to the Covid-19 pandemic.

4 minutes to read

Last year, we suggested the most pressing challenge facing the student market was political. One thing we did not foresee was a global pandemic, and its knock-on impact on the higher education landscape.

The sector has faced unparalleled levels of uncertainty in this year’s academic cycle, including around bookings and occupancy levels, as well as whether international students would be able to travel to the UK.

Despite this, it’s worth noting that a record 516,650 students were accepted at UK universities this year, according to data from UCAS. International student enrolment increased to its highest ever level, testament to the appeal that the UK market has in the global market place.

Our previous survey work - undertaken in partnership with UCAS - has highlighted the important role accommodation plays in the student experience. This year we received more than 70,000 responses from both current and new students across the UK giving us a unique insight into the preferences and concerns they have when it comes to their housing requirements.

Below are five key findings from the report:

1. PBSA is meeting the Covid challenge

Issues relating to wellbeing have been driven to the forefront of the way operators engage with students – not least because of the pressures front line staff have faced in supporting students who were shielding or who were isolated from their friends and families.

It has also brought into stark contrast the differences in quality and experience between professionally managed purpose-built accommodation and the offering available to students within the wider private rented sector.

Encouragingly, our survey suggests that operators of purpose built student accommodation (PBSA) have dealt better with the challenges that the pandemic has created than landlords in the wider rental market. Some 69% of students living in purpose-built student accommodation (PBSA), either privately operated or university operated, were pleased with their provider’s approach and handling of the pandemic. By comparison, just 25% of students living within house-shares rented from landlords in the wider private rented sector said the same.

2. Affordability is key

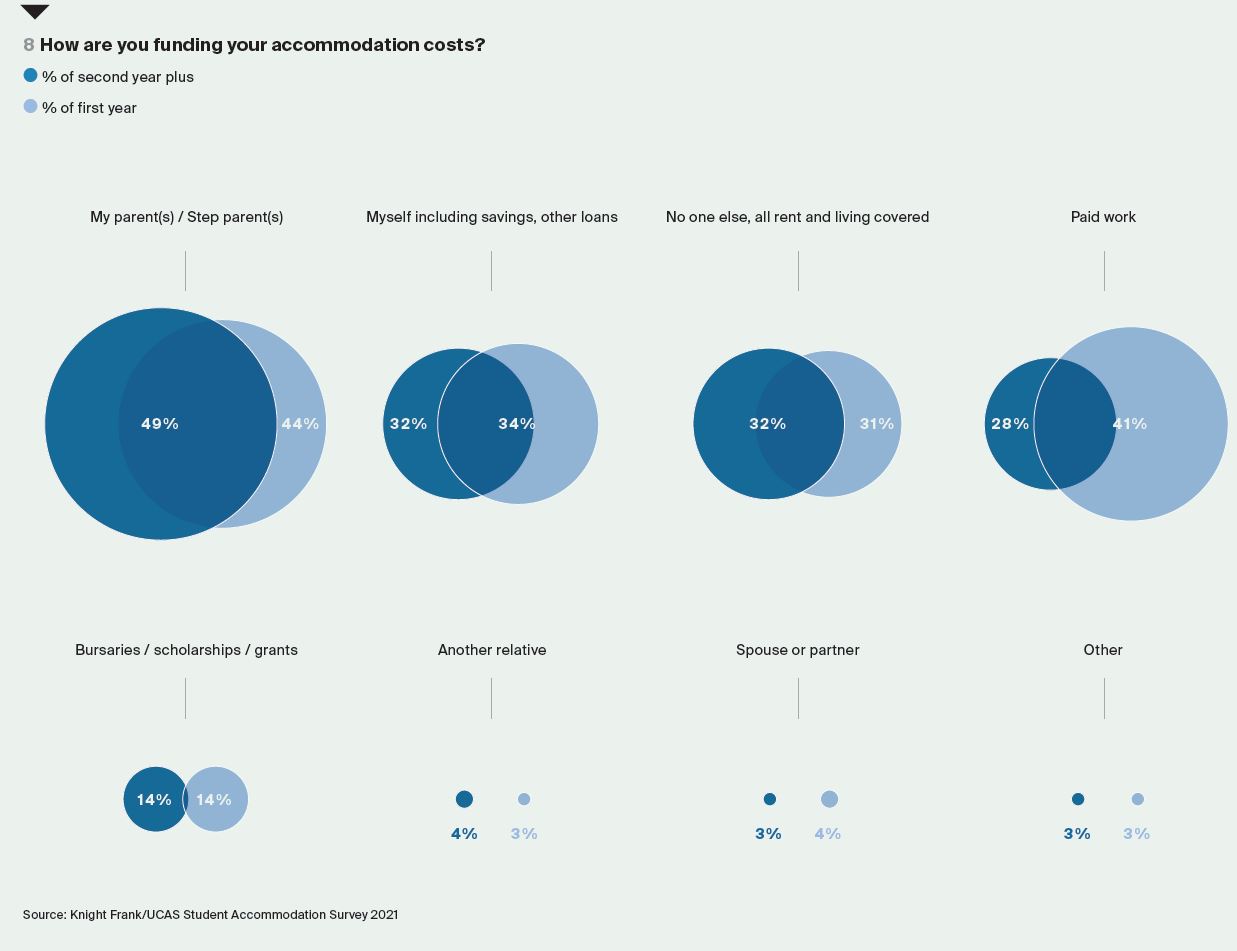

The pressures of meeting living costs are at the forefront of any discussion about student housing. Students living in private PBSA pay, on average, £7,200 per annum for their accommodation. This compares with an average of £6,650 for university-operated accommodation and £5,900 for students in privately rented house shares. Regardless of the type of accommodation, most students (84%) indicated that their accommodation costs were either affordable or just about affordable.

The majority of first-year students (75%) said they pay for their rent directly from their own bank account, rising to 82% for second years. The remainder said their rent was paid at least sometimes by someone else, typically by their parents. Only 32% of respondents indicated that their maintenance loan was covering all of their costs. Nearly half (46%) of students indicated that they needed to work part time to afford the cost of their accommodation.

3. Quality = value

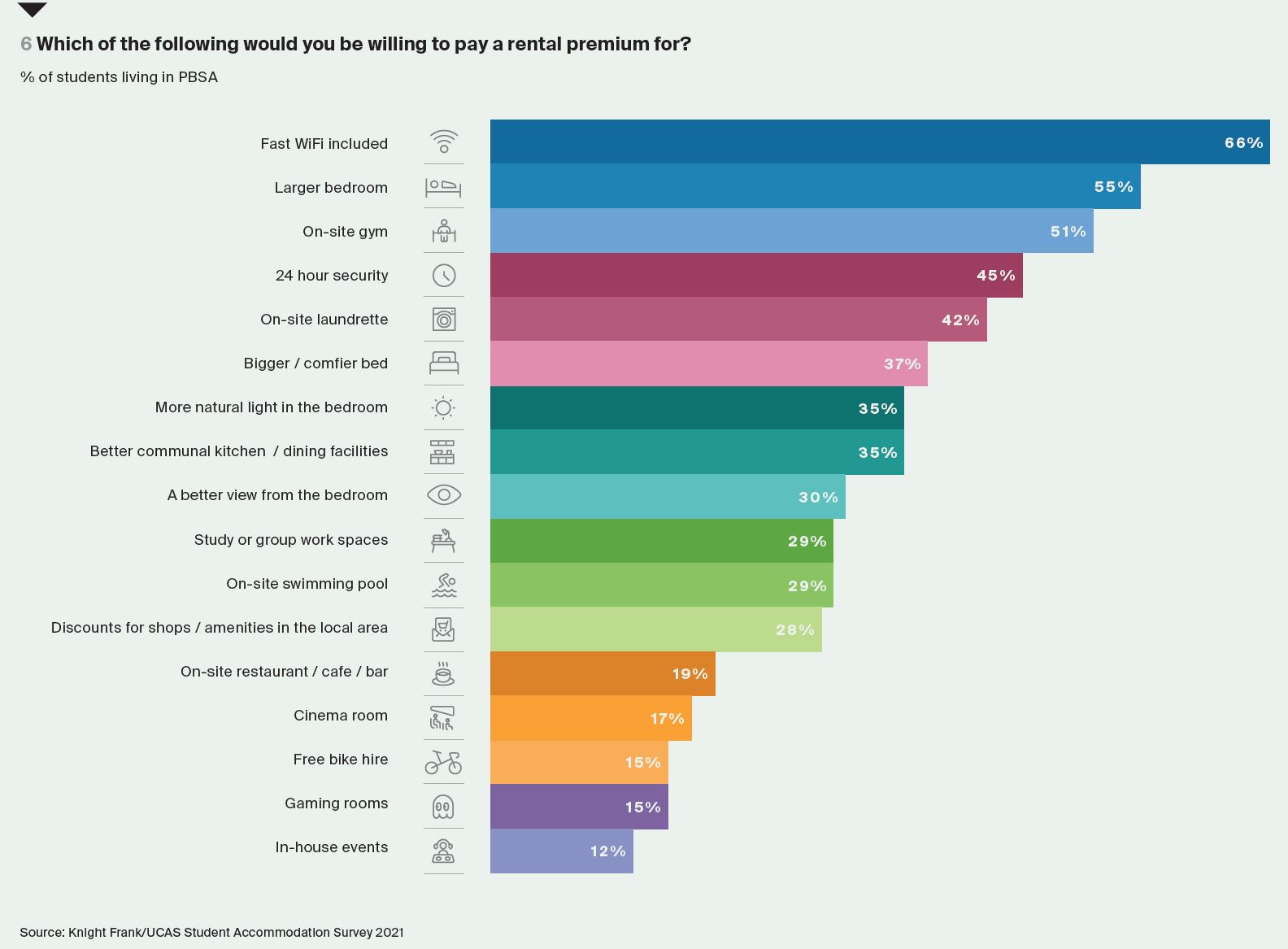

The survey suggests a preference for high-quality accommodation that provides clear and obvious elements that add value. For the right amenities, students are prepared to pay rental premiums. Respondents said that, on top of their existing rent, they would be prepared to pay extra for 24 hour security, a larger bedroom, a bigger or comfier bed and on site facilities such as a gym.

Stronger WiFi remained the number one service that students living in private purpose built accommodation would pay a premium for. The opposite is true for amenities such as on-site swimming pools, cinemas and games rooms.

4. Deals and incentives drive demand

In order to attract new students and retain existing ones, some private PBSA providers offer incentives and deals to students. Indeed, over 50% of first-years living in private PBSA were offered an incentive when looking for somewhere to live. Of those that chose the accommodation offering the incentive, 22% said they would not have chosen the same accommodation had it not been offered.

5. Graduating to BTR

Some 39% of final-year students said they intend to stay in the city in which they study after graduation. Our survey suggests that nearly half (46%) of final year students, equating to some 235,000 individuals, plan to move directly into a property in the private rented sector upon graduation, for example. As a result, delivering homes built specifically for the private rental market, be they co-living or Build to Rent (BTR), will ensure the convenience and quality of housing these households need in locations they want to be.